by Calculated Risk on 9/29/2010 10:31:00 AM

Wednesday, September 29, 2010

Fed's Kocherlakota revises down forecast

Minneapolis Federal Reserve President Narayana Kocherlakota spoke in London today. He has been one of more optimistic Fed presidents, and he revised down his forecast today ...

From Kocherlakota: Economic Outlook and the Current Tools of Monetary Policy

Our September estimates are distinctly lower than our August estimates. I now expect GDP growth to be around 2.4 percent in the second half of 2010 and around 2.5 percent in 2011.This still seems too optimistic, but he is moving in the right direction.

...

From the fourth quarter of 2009 through the second quarter of 2010, the change in the PCE price level was just over 0.5 percent, which works out to an annual rate of just over 1 percent. ... I expect inflation to remain at about this level during the rest of this year. However, our Minneapolis forecasting model predicts that it will rise back into the more desirable 1.5-2 percent range in 2011.

...

To summarize: GDP is growing, but more slowly than I expected or than we would like. Inflation is a little low, but only temporarily. The behavior of unemployment is deeply troubling.

And on the coming QE2:

My own guess is that further uses of QE would have a more muted effect on Treasury term premia. Financial markets are functioning much better in late 2010 than they were in early 2009. As a result, the relevant spreads are lower, and I suspect that it will be somewhat more challenging for the Fed to impact them.Kocherlakota is currently an alternate member of the FOMC and will be a voting member next year. It is interesting that certain Fed presidents are now revising down their overly optimistic forecasts - all but guaranteeing QE2 (even if he thinks it will have little impact).

Estimate of Decennial Census impact on September payroll employment: minus 78,000

by Calculated Risk on 9/29/2010 10:02:00 AM

The Census Bureau released the weekly payroll data for the week ending September 18th today (ht Bob_in_MA).

If we subtract the number of temporary 2010 Census workers in the week containing the 12th of the month, from the same week for the previous month - this provides a close estimate for the impact of the Census hiring on payroll employment.

The Census Bureau releases the actual number with the employment report.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of Census workers paid each week. The red labels are the weeks of the BLS payroll survey.

The Census payroll decreased from 83,955 for the week ending August 14th to 6,038 for the week ending September 18th.

So my estimate for the impact of the Census on September payroll employment is minus 78 thousand (this will probably be close). The employment report will be released on October 8th, and the headline number for September - including Census numbers - will probably be close to zero. But a key number will be the hiring ex-Census (so we will add back the Census workers again this month).

The following table compares the weekly payroll report estimate to the monthly BLS report on Census hiring - this shows the estimate is usually very close:

| Payroll, Weekly Pay Period | Payroll, Monthly BLS | Change based on weekly report | Actual Change (monthly) | |

|---|---|---|---|---|

| Jan | 25 | 24 | ||

| Feb | 41 | 39 | 16 | 15 |

| Mar | 96 | 87 | 55 | 48 |

| Apr | 156 | 154 | 61 | 67 |

| May | 574 | 564 | 418 | 410 |

| Jun | 344 | 339 | -230 | -225 |

| Jul | 200 | 196 | -144 | -143 |

| Aug | 84 | 82 | -116 | -114 |

| Sep | 6 | -78 | ||

| All thousands | ||||

There are very few temporary decennial workers left on the payroll, and this month marks the end of the weekly payroll report from the Census Bureau: "These data will continue through the end of September with the last release of data being the week of Sept. 26-Oct. 2."

I'll have more on the September employment report (due Oct 8th) this Sunday in the weekly schedule.

MBA: Mortgage Applications Purchase Index increases slightly

by Calculated Risk on 9/29/2010 07:34:00 AM

The MBA reports: Mortgage Refinance Applications Decrease Despite Decline in Rates in Latest MBA Weekly Survey

The Refinance Index decreased 1.6 percent from the previous week, which is the fourth straight weekly decrease. The seasonally adjusted Purchase Index increased 2.4 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.38 percent from 4.44 percent, with points increasing to 1.01 from 0.81 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The 30-year contract rate is a new low for this survey. The previous low was 4.43 percent for the week ending August 27, 2010.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Purchase applications have increased slightly from the lows in July and are at about the same level is in 1996 or 1997. This suggests existing home sales (closed transactions) in September, October, and even November will not be much above the August sales rate.

Tuesday, September 28, 2010

ATA: Truck Tonnage Index "Plunged" 2.7 Percent in August

by Calculated Risk on 9/28/2010 07:56:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Plunged 2.7 Percent in August

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index fell 2.7 percent in August, which was the largest month-to-month decrease since March 2009. The latest drop lowered the SA index from 110 (2000=100) in July to 106.9 in August.

...

Compared with August 2009, SA tonnage climbed 2.9 percent, which was well below July’s 7.4 percent year-over-year gain. Year-to-date, tonnage is up 6.2 percent compared with the same period in 2009.

ATA Chief Economist Bob Costello said that August’s data highlights that the economy, while still growing, is slowing. “We fully anticipate sluggish economic growth for the remainder of this year and the latest tonnage numbers are reflecting that slowdown.”

Fed's Lockhart: The Approaching Monetary Policy Decision Dilemma

by Calculated Risk on 9/28/2010 05:44:00 PM

From Atlanta Fed President Dennis Lockhart: The Approaching Monetary Policy Decision Dilemma

In the coming weeks monetary policymakers must come to grips with the question of whether there is anything they can do to improve the situation in the economy and, if so, what that action should be. The circumstances of weak recovery, persistent unemployment, dangerously low inflation, and the policy interest rate (the primary tool of modern monetary policy) at the zero lower bound present a tough analytical challenge.Lockhart is not a voting member of the FOMC this year, but I think a consensus is building for QE2 in early November.

...

If action is taken by the Fed, a clear option is to grow the size of the balance sheet since the policy interest rate, for all practical purposes, cannot go any lower. Growth of the balance sheet would be accomplished by a second round of asset purchases (probably Treasury bills and notes) paid for by newly created money. The technical term for this policy is "quantitative easing," and the prospect of more of this approach is being referred to as QE2.

Will it work? And, how much would be needed to make a difference? In my view, a consensus on these pivotal questions remains to come together, and I will not take a position here today. In the weeks ahead my staff and I will be tackling these and related questions to prepare for the important decisions coming.

...

I cannot tell you how the economic policy story will play out. I can assure you, however, that the Fed has scope for further action to influence the course of recovery. And, importantly, I believe the Fed and the committee have the will to act—or not—as demanded by economic conditions in the near term.

Meredith Whitney on state budget crisis

by Calculated Risk on 9/28/2010 04:22:00 PM

From Jeff Cox at CNBC: States Are Poised to Be Next Credit Crisis for US: Whitney

"The similarities between the states and the banks are extreme to the extent that states have been spending dramatically and are leveraged dramatically," [Meredith Whitney] said. "Municipal debt has doubled since 2000, spending has grown way faster than revenues."Many states have serious budget and debt issues, but I doubt it will result in a "near-trillion-dollar bailout" (note that Whitney is saying an "attempt" at a bailout). More likely the states will raise some taxes and cut more services - and this will be a drag on growth for some time.

...

"You have to look at the states and the risk that the states pose, because the crisis with the states will result in an attempt at least for the third near-trillion-dollar bailout."

...

[On banks] "We think October, after the banks report, you'll see a really ugly Case-Shiller number, which means the fourth quarter is going to be very tough for banks."

I think Whitney is correct on the timing of the Case-Shiller numbers, but I don't think the numbers will be anywhere near as "ugly" as earlier price declines.

Misc: Case-Shiller, Manufacturing Surveys, QE2 and Europe

by Calculated Risk on 9/28/2010 12:26:00 PM

The headlines on Case-Shiller seemed contradictory this morning. Here are a few examples:

From the Financial Times: US home prices slip in July

From the WSJ: Home Prices Rose in July

From CNBC: US Home Prices Slipped In July And May Stabilize Near Lows

From MarketWatch: Home price growth slows in July

From HousingWire: S&P/Case-Shiller 20-city composite index rose 0.6% for July

The reason for the confusion is S&P Case-Shiller reports both seasonally adjusted (SA), and not seasonally adjusted (NSA) data. Because of concerns about the impact of foreclosures and government programs on prices, S&P switched to reporting NSA numbers in their press release, but many analysts are still using the SA numbers (I reported the SA numbers - see this post for the SA graphs from earlier this morning).

The important points are:

1) this is a three month average of May, June, and July. Seasonally this is the strongest time of the year for house prices.

2) sales collapsed in July, so the next report (for June, July and August) will probably show falling prices.

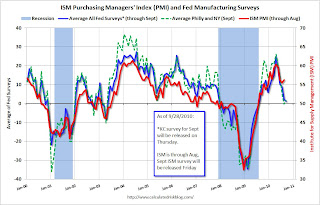

Here is an update to the graph comparing the regional Fed surveys with the ISM manufacturing survey, including the Richmond survey released this morning (Kansas City will be released Thursday):

Click on graph for larger image in new window.

Click on graph for larger image in new window.For this graph I averaged the New York and Philly Fed surveys (dashed green, through September), and averaged five surveys including New York, Philly, Richmond, Dallas and Kansas City (blue, through September - KC through August).

The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

Last month, when the ISM survey came in slightly better than expected, I wrote: "Based on this graph, I'd expect either the Fed surveys to bounce back in September - or the ISM to decline." So far there has been little "bounce back" in the Fed surveys - so I expect a decline in the ISM survey.

The consensus is for a decline in ISM Manufacturing Index to 54.5 in September from 56.3 in August.

There was a very important article from Jon Hilsenrath at the WSJ yesterday: Fed Weighs New Tactics to Bolster Recovery (note: many people think that Hilsenrath has taken over Greg Ip's role (now at the Economist) and leaks to Hilsenrath might be part of the Fed's communication strategy).

I reviewed the article here, but the key points are the Fed is debating between announcing "massive bond purchases with a finite end" and a "smaller-scale program that they could adjust" over time. Based on the article, it appears the Fed is leaning towards the latter (small-scale program).

Although QE2 isn't a done deal, the odds are very high that the next round will be announced on November 3rd at 2:15 PM ET.

The crisis is not over in Europe.

From Reuters: Ireland Faces Threat of New Downgrades

Two more credit rating agencies warned Ireland on Tuesday that its debt was at risk of being downgraded further, setting off another leap in borrowing costs and heaping pressure on the government to accelerate the planned late-October release of a budget preview.The Ireland and Portugal to Germany bond spreads have hit new highs again today.

Richmond Fed: Regional manufacturing activity contracted after seven months of expansion

by Calculated Risk on 9/28/2010 10:00:00 AM

Note: Usually I don't post all the regional manufacturing surveys, however with the inventory adjustment over, export growth slowing, and domestic consumer demand sluggish, these surveys provide an early look at weakness in the manufacturing sector.

From the Richmond Fed: Manufacturing Activity Pulled Back in September, But Expectations Upbeat

Manufacturing activity in the central Atlantic region pulled back in September after expanding during the previous seven months, according to the Richmond Fed's latest survey. The index of overall activity was pushed lower as shipments and employment edged into negative territory. Other indicators also suggested softer activity. District contacts reported that the volume of new orders flattened, order backlogs turned negative, and delivery times held steady. Furthermore, manufacturers reported growth in capacity utilization flat lined, while inventories grew at a slightly quicker pace.This is further evidence of the slowdown in manufacturing.

...

In September, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — turned negative, losing thirteen points to −2 from August's reading of 11. Among the index's components, shipments fell fifteen points to −4, new orders lost ten points to finish at 0, and the jobs index declined fifteen points to −3.

Other indicators also suggested weaker activity. The backlogs of orders measure turned negative losing eleven points to −11, and the index for capacity utilization flattened declining fourteen points to 0. The delivery times index held steady at 8, while our gauges for inventories were somewhat higher in September.

...

Labor market activity also weakened in September. The manufacturing employment index registered a −3 versus August's reading of 12, and the average workweek measure lost fourteen points to 0. In addition, wage growth posted a five-point loss to 8.

Also, from CNBC: Consumer Confidence Falls to Lowest Level Since February

The Conference Board, an industry group, said its index of consumer attitudes fell to 48.5 in September from a revised 53.2 in August.

Case-Shiller: "Home Prices Stable in July"

by Calculated Risk on 9/28/2010 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July (actually a 3 month average of May, June and July).

This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Home Prices Remain Stable Around Recent Lows According to the S&P/Case-Shiller Home Price Indices

Data through July 2010, released today by Standard & Poor’s for its S&P/Case-Shiller Home Price Indices, the leading measure of U.S. home prices, show that the annual growth rates in 16 of the 20 MSAs and the 10- and 20-City Composites slowed in July compared to June 2010. The 10-City Composite is up 4.1% and the 20-City Composite is up 3.2% from where they were in July 2009. For June they were reported as +5.0% and +4.2%, respectively. Although home prices increased in most markets in July versus June, 15 MSAs and both Composites saw these monthly rates moderate in July.

Click on graph for larger image in new window.

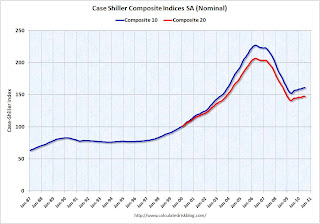

Click on graph for larger image in new window. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 29.0% from the peak, and flat in July (SA).

The Composite 20 index is off 28.6% from the peak, and down 0.1% in July (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 is up 4.0% compared to July 2009.

The Composite 20 is up 3.1% compared to July 2009.

The year-over-year changes appear to be rolling over - and will probably be negative later this year.

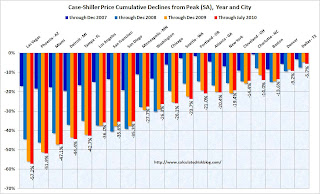

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in only 4 of the 20 Case-Shiller cities in July seasonally adjusted.

Prices increased (SA) in only 4 of the 20 Case-Shiller cities in July seasonally adjusted.Prices in Las Vegas are off 57.2% from the peak, and prices in Dallas only off 5.7% from the peak.

Prices probably declined just about everywhere in July, but this will not be evident in the Case-Shiller index until next month since the Case-Shiller index is an average of three months.

Monday, September 27, 2010

Bank of England official to savers: 'Start spending'

by Calculated Risk on 9/27/2010 10:28:00 PM

From the Telegraph: Savers told to stop moaning and start spending

[Bank of England deputy governor Charles Bean said] "Savers shouldn't necessarily expect to be able to live just off their income in times when interest rates are low. It may make sense for them to eat into their capital a bit."In the U.K., savers are receiving about £18 billion a year less in interest. In the U.S., using the monthly personal interest income data from the BEA, interest income is off about $143 billion from the peak - and falling ...

...

Mr Bean said that encouraging Britons to spend was one reason why the Bank had cut interest rates.