by Calculated Risk on 9/30/2010 06:00:00 PM

Thursday, September 30, 2010

Existing Home Inventory declines slightly in September, Up year-over-year

Tom Lawler reports that at the end of September, listings on Realtor.com totaled 3,960,417, down 1.2% from 4,007,860 at the end of August. This is 1.7% higher than in September 2009.

The NAR reported inventory at 3.98 million at the end of August, and at 3.71 million in September 2009. So they will probably report inventory at around 3.85 million for September 2010. (NAR does not seasonally adjust inventory and this appears to be a normal seasonal decline. The months-of-supply metric uses seasonally adjusted sales, but NSA inventory.).

Since sales probably only increased slightly in September, the months-of-supply metric will probably still be well into double digits again.

Note: there is a seasonal pattern for existing home inventory. Usually inventory peaks in July and declines slightly through October - and then declines sharply at the end of the year as sellers take their homes off the market for the holidays.

Restaurant Index shows contraction in August

by Calculated Risk on 9/30/2010 03:31:00 PM

This is one of several industry specific indexes I track each month.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Same store sales and customer traffic both declined again in August (on a year-over-year basis). Unfortunately the data for this index only goes back to 2002.

Note: Any reading above 100 shows expansion for this index.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Remained Cautious as Restaurant Performance Index Was Essentially Flat in August

As a result of continued soft sales and traffic levels, the National Restaurant Association’s comprehensive index of restaurant activity remained below 100 for the fourth consecutive month in August. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 99.5 in August, essentially unchanged from the previous three months. In addition, the RPI stood below 100 for the fourth consecutive month, which signifies contraction in the index of key industry indicators.Restaurants are a discretionary expense, and this contraction could be because of the sluggish recovery or might suggest further weakness in consumer spending in the months ahead.

...

Restaurant operators reported a net decline in same-store sales for the fifth consecutive month in August ... Restaurant operators also continued to report a net decline in customer traffic levels in August..

emphasis added

The Economist: Expanding household Size

by Calculated Risk on 9/30/2010 01:34:00 PM

From The Economist: Cramped quarters: As children postpone their departure, households get larger

Image credit: The Economist

Image credit: The Economist

[A]fter shrinking for decades, households have started to grow. Last year the average household had 2.59 people, up from 2.56 two years earlier, marking the first increase since 1993.Note: This data comes from the 2009 American Community Survey, and many caveats apply.

...

Much of this is almost certainly a response to the recession and the surge in unemployment. For young people who have lost their job or cannot find their first one, living with their parents becomes more attractive.

As Greg Ip noted, the overall U.S. population is still growing, and at the current growth rate that would usually mean the demand for over 1 million additional housing units per year. However since many people are doubling up (or as we always joke - have moved into their parent's basement), this keeps the demand for housing units down.

This might seem like a small increase in the number of people per household (from 2.56 to 2.59), however that has a significant impact on the number of housing units needed.

Some rough numbers: If we assume a population of 300 million, the slight increase in household size would suggest about 1.3 million fewer housing units were needed. (300 million divided 2.56) minus (300 million divided by 2.59) equals about 1.3 million. This is more than offset by the growing population over this two year period, but this shows why the excess inventory has remained very high even with a series low number of new housing units being completed.

We all expected this during the recession, but it will be important to watch if the household size starts to decline again.

Kansas City Fed: Regional Manufacturing Activity rebounded in September

by Calculated Risk on 9/30/2010 11:13:00 AM

Usually I don't post all the regional manufacturing surveys, but it appears manufacturing is slowing right now - and the regional surveys provide early clues ...

From the Kansas City Fed:

Tenth District manufacturing activity rebounded in September, and producers’ expectations for future activity also improved.Here is an update to the graph comparing the regional Fed surveys with the ISM manufacturing survey, including the Kansas City survey released this morning:

...

The net percentage of firms reporting month-over-month increases in production in September was 14, up from 0 in August and equal to 14 in July ... The shipments, new orders, and order backlog indexes jumped back into positive territory.

...

The employment index was unchanged [at -2].

Click on graph for larger image in new window.

Click on graph for larger image in new window.For this graph I averaged the New York and Philly Fed surveys (dashed green, through September), and averaged five surveys including New York, Philly, Richmond, Dallas and Kansas City (blue).

The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

The ISM Manufacturing index will be released tomorrow and the consensus is for a decline to 54.5 in September from 56.3 in August.

Chicago PMI increases in September

by Calculated Risk on 9/30/2010 09:45:00 AM

From the Institute for Supply Management – Chicago:

The Chicago Purchasing Managers reported the CHICAGO BUSINESS BAROMETER improved in September to chalk up a full twelve months of expansion.The overall index increased to 60.4 vs. 56.7. Note: any number above 50 shows expansion.

Employment index declined to 53.4 from 55.5 in August.

The new orders index increased to 61.4 from 55.0.

Overall this was a positive report. The national ISM manufacturing index will be released tomorrow.

Weekly Initial Unemployment Claims decrease

by Calculated Risk on 9/30/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Sept. 25, the advance figure for seasonally adjusted initial claims was 453,000, a decrease of 16,000 from the previous week's revised figure of 469,000. The 4-week moving average was 458,000, a decrease of 6,250 from the previous week's revised average of 464,250.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 6,250 to 458,000.

The 4-week moving average has been moving sideways at an elevated level for about 10 months - and that suggests a weak job market.

Wednesday, September 29, 2010

Two Stories: JPMorgan halts some foreclosures, Fed to release crisis transaction details

by Calculated Risk on 9/29/2010 09:26:00 PM

Here are two stories we've been discussing in the comments ...

From David Streitfeld at the NY Times: JPMorgan Suspending Foreclosures

JPMorgan Chase, said it was halting 56,000 foreclosures because some of its employees might have improperly signed court documents. All of the suspensions are in the 23 states where foreclosures must be approved by a court, including New York, New Jersey, Connecticut, Florida and Illinois.It is amazing that the servicers haven't reviewed all their procedures already ...

And from Fed Chairman Ben Bernanke: Regulatory Reform Implementation

A final element of the Federal Reserve's efforts to implement the Dodd-Frank Act relates to the transparency of our balance sheet and liquidity programs. Well before enactment, we were providing a great deal of relevant information on our website, in statistical releases, and in regular reports to the Congress. Under a framework established by the act, the Federal Reserve will, by December 1, provide detailed information regarding individual transactions conducted across a range of credit and liquidity programs over the period from December 1, 2007, to July 20, 2010. This information will include the names of counterparties, the date and dollar value of individual transactions, the terms of repayment, and other relevant information. On an ongoing basis, subject to lags specified by the Congress to protect the efficacy of the programs, the Federal Reserve also will routinely provide information regarding the identities of counterparties, amounts financed or purchased and collateral pledged for transactions under the discount window, open market operations, and emergency lending facilities.Apparently disclosure isn't a problem now.

Fannie Mae and Freddie Mac: Serious Delinquent Rates decline

by Calculated Risk on 9/29/2010 05:01:00 PM

Click on graph for larger image in new window.

Fannie Mae reported today that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business decreased to 4.82% in July, down from 4.99% in June - and up from 4.17% in July 2009.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

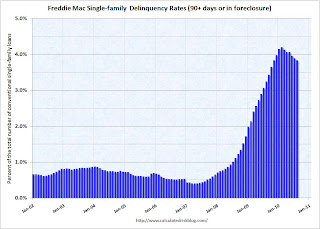

The second graph is for the delinquency rate for Freddie Mac. The rate declined to 3.83% in August (Freddie reports a month quicker than Fannie), from 3.89% in July.

The second graph is for the delinquency rate for Freddie Mac. The rate declined to 3.83% in August (Freddie reports a month quicker than Fannie), from 3.89% in July.

Some of the rapid increase last year was probably because of foreclosure moratoriums, and distortions from modification programs because loans in trial mods were considered delinquent until the modifications were made permanent.

More modifications have become permanent and no longer counted as delinquent, and Fannie Mae and Freddie Mac are foreclosing again (they have a record number of REOs) - so there has been a decline in the delinquency rate.

Fed's Rosengren: Fed must respond "vigorously, creatively, thoughtfully, and persistently"

by Calculated Risk on 9/29/2010 01:31:00 PM

I cautioned that today was Fed speech day! Boston Fed president Eric Rosengren is currently a voting member of the FOMC ...

From Rosengren: How Should Monetary Policy Respond to a Slow Recovery?

I’ve called this talk “How Should Monetary Policy Respond to a Slow Recovery?” My answer to that question is: vigorously, creatively, thoughtfully, and persistently, as long as we have options at our disposal. And we do have options, despite having pushed short-term rates to the zero lower bound.On unemployment:

[T]he most recent recession is far less a reflection of dislocation in a few industries but rather reflects a general decline in almost all industries. ... in this recession there has been a peak to trough loss of employment of 5 percent or greater in construction, manufacturing, retail trade, wholesale trade, transportation, information technology, financial activities, and professional and business services. To me, this does not suggest that the driver is structural change in the economy increasing job mismatches – although no doubt some of that exists – but instead I see here a widespread decline in demand across most industries.And on QE2:

Now I’d like to make a few observations on Fed purchases of Treasury securities.And his conclusion:

First, the positives: Purchases of long-term Treasury securities are likely to push down long-term interest rates on Treasury bonds, but also are likely to reduce rates on other long-term securities. Some have argued that it would be difficult to reduce Treasury rates further, but Figure 13 highlights, importantly, that U.S. Treasury rates are still well above the zero bound, roughly equivalent to rates in Germany, and well above long-term rates in Japan.

Now some concerns: While purchases of Treasury securities have the advantage of not directly “allocating credit” to a particular industry, they have the disadvantage of only indirectly affecting the private borrowing rates that more directly affect private investment spending. In addition, Treasury purchases raise for some a concern that the Fed intends to monetize the federal debt, using monetary policy to accommodate the financing of fiscal policy. I can assure you that we have no desire or intention whatsoever to do so.

While lower long-term rates are likely the primary channel through which asset purchases would influence the economy, purchases of Treasury or mortgage-backed securities also expand the Federal Reserve’s balance sheet and increase the amount of reserves in the financial system. This expansion of reserves might serve as an effective signal that highlights the determination of the Federal Reserve to reduce disinflationary pressures.

Certainly, views on securities purchases differ within the ranks of policymakers and all manner of observers. I would just reiterate that it is important to keep firmly in mind the goal of such purchases: to stimulate the economy by reducing long-term interest rates to a level that is more consistent with where they would be, were we able to further reduce the federal funds rate.

While the economy is growing, it is currently growing too slowly to significantly reduce the unemployment rate or stem disinflationary pressures created by the high degree of slack in the economy. While fiscal policies may be the most effective way to stimulate the economy when short-term interest rates approach the zero bound, unconventional monetary policies provide additional policy options. Of course, policymakers need to carefully weigh the benefits and costs of unconventional monetary policy – some of which I have tried to share with you today. Yet all in all, my firm view is that it is important that policymakers be open to implementing policies consistent with achieving full employment, and an appropriate level of inflation, within a reasonable time frame.There is much more in this speech.

Fed's Plosser opposes QE2

by Calculated Risk on 9/29/2010 12:49:00 PM

With QE2 arriving on November 3rd - barring an upside surprise in the economic data - it is interesting to hear the views of the Fed presidents.

From Philadelphia Fed President Charles Plosser: Economic Outlook. On QE2:

[I]t is difficult, in my view, to see how additional asset purchases by the Fed, even if they move interest rates on long-term bonds down by 10 or 20 basis points, will have much impact on the near-term outlook for employment. Sending a signal that monetary policymakers are taking actions in an attempt to directly affect the near-term path of the unemployment rate, and then for those actions to have no demonstrable effects, would hurt the Fed’s credibility and possibly erode the effectiveness of our future actions to ensure price stability. It also risks leading the public to believe that the Fed is seeking to monetize the deficit and make it more difficult to return to normal policy when the time comes.And on the outlook:

While the near-term outlook has softened a bit, I expect growth in the national economy to be around 3 to 3½ percent over the next two years, with stronger business spending on equipment and software, moderate growth of consumer spending, and gradual improvement in household balance sheets.Although I agree that there will be some geographic and skill mismatches going forward because of the housing bubble - I don't think that is the main problem impacting the labor markets right now. There are many highly skilled people currently unemployed in many sectors - so Plosser's view appears incorrect.

The unemployment rate continues to be one of the biggest challenges our economy faces. Although unemployment will begin to decline gradually, it will take some time for it to return to its long-run level. As the economy strengthens and firms become convinced that the recovery is sustainable, hiring will pick up over the rest of this year and in 2011. But it may take even longer to address the sectoral, geographic, and skill imbalances that seem to plague the labor markets.

I expect inflation to remain subdued. As long as inflation expectations remain well anchored, I see little risk of a period of sustained deflation.

I'm surprised that Plosser is sticking with his optimistic (so far wrong) economic outlook. Right now Plosser is an alternate member of the FOMC and next year he will be a voting member (along with several other Fed presidents with similar views).