by Calculated Risk on 3/30/2012 05:10:00 PM

Friday, March 30, 2012

Bank Failure #16 in 2012: Fidelity Bank, Dearborn, Michigan

Michigan mega morass

Sixteenth sour shop

by Soylent Green is People

From the FDIC: The Huntington National Bank, Columbus, Ohio, Assumes All of the Deposits of Fidelity Bank, Dearborn, Michigan

As of December 31, 2011, Fidelity Bank had approximately $818.2 million in total assets and $747.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $92.8 million. ... Fidelity Bank is the 16th FDIC-insured institution to fail in the nation this year, and the first in Michigan.It is Friday! And I need one ...

Restaurant Performance Index increases in February

by Calculated Risk on 3/30/2012 03:20:00 PM

From the National Restaurant Association: Restaurant Industry Outlook Improves as Restaurant Performance Index Stood Above 100 for 4th Consecutive Month

Bolstered by positive same-store sales and traffic results and an optimistic outlook among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) remained above 100 for the fourth consecutive month in February. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.9 in February, up 0.6 percent from January’s level of 101.3. In addition, the RPI stood solidly above the 100 threshold in February, which signifies expansion in the index of key industry indicators.

“Buoyed by continued gains in national employment and an extra day in February as a result of Leap Year, a solid majority of restaurant operators reported positive same-store sales and traffic results,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, restaurant operators are bullish about sales growth in the months ahead, while their outlook for the economy remains cautiously optimistic.”

“Perhaps the most positive indicator is the optimistic outlook for staffing levels in the months ahead,” Riehle added. “Only seven percent of restaurant operators expect to reduce staffing levels in the next six months, the lowest level in nearly eight years.”

Click on graph for larger image.

Click on graph for larger image.The index increased to 101.9 in February from 101.3 in January (above 100 indicates expansion). This was boosted by the leap year (the index is not adjusted), but this is still positive.

The comment on employment was especially positive.

State Unemployment Rates "little changed" in February

by Calculated Risk on 3/30/2012 12:50:00 PM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in February. Twenty-nine states recorded unemployment rate decreases, 8 states posted rate increases, and 13 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today. Forty-nine states and the District of Columbia registered unemployment rate decreases from a year earlier, while only one state experienced an increase.

...

Nevada continued to record the highest unemployment rate among the states, 12.3 percent in February. Rhode Island and California posted the next highest rates, 11.0 and 10.9 percent, respectively. North Dakota again registered the lowest jobless rate, 3.1 percent, followed by Nebraska, 4.0 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Every state has some blue - indicating no state is currently at the maximum during the recession.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. This is the fewest since January 2009. In early 2010, 18 states and D.C. had double digit unemployment rates.

Misc: Chicago PMI declines to 62.2, Consumer Sentiment improves

by Calculated Risk on 3/30/2012 09:55:00 AM

• Chicago PMI: The overall index declined to 62.2 in March from 64.0 in February. This was below consensus expectations of 63.0 and indicates slower growth in March. Note: any number above 50 shows expansion. From the Chicago ISM:

The Chicago Purchasing Managers reported the March Chicago Business Barometer paused after February's ten month high. While slowing, the Chicago Business Barometer marked its fifth month above 60, a 2-1/2 year period of expansion and trend data improved. Increases were seen in five of eight Business Activity Indexes, highlighted by significant advances in Prices Paid and Inventories, and a notable lengthening in lead times for Production Material.•

The final Reuters / University of Michigan consumer sentiment index for March increased to 76.2, up from the preliminary reading of 74.3, and up from the February reading of 75.3.

The final Reuters / University of Michigan consumer sentiment index for March increased to 76.2, up from the preliminary reading of 74.3, and up from the February reading of 75.3.Click on graph for larger image.

This was above the consensus forecast of an increase to 74.7. Overall sentiment is still fairly weak, although sentiment has rebounded from the decline last summer and is near the high since collapsing in late 2007 and early 2008.

Personal Income increased 0.2% in February, Spending 0.8%

by Calculated Risk on 3/30/2012 08:30:00 AM

The BEA released the Personal Income and Outlays report for February:

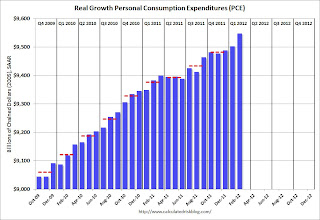

Personal income increased $28.2 billion, or 0.2 percent ... in February, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $86.0 billion, or 0.8 percent.The following graph shows real Personal Consumption Expenditures (PCE) through February (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.5 percent in February, compared with an increase of 0.2 percent in January. ... The price index for PCE increased 0.3 percent in February, compared with an increase of 0.2 percent in January. The PCE price index, excluding food and energy, increased 0.1 percent, compared with an increase of 0.2 percent.

Click on graph for larger image.

Click on graph for larger image.PCE increased 0.8% in February, and real PCE increased 0.5%. January was revised up from unchanged to a 0.2% increase.

Note: The PCE price index, excluding food and energy, increased 0.1 percent.

The personal saving rate was at 3.7% in February.

This was a sharp increase in spending in February (and January spending was revised up). Using the two-month method, it appears real PCE will increase around 2.0% in Q1 (PCE is the largest component of GDP); the mid-month method suggests an increase closer to 2.9%.

Thursday, March 29, 2012

Los Angeles Mayor to "lay off a large number of employees"

by Calculated Risk on 3/29/2012 09:20:00 PM

Just a reminder that the state and local layoffs haven't ended ...

From the LA Daily News: L.A. Mayor Antonio Villaraigosa calls for layoffs of city workers

"We're going to lay off a large number of employees. I'm not going to say how many," [Mayor Antonio Villaraigosa] said ... today.According to the BLS, state and local governments have reduced payrolls by about 650 thousand over the last four years. The pace of layoffs has slowed recently, but there are still more to come.

...

City Administrative Officer Miguel Santana said this week the city's budget deficit for the next fiscal year is close to $220 million.

...

The mayor said he will push to raise the retirement age for city workers to 67, vowing to put it before voters if not approved by the City Council.

Q4 GDP and GDI

by Calculated Risk on 3/29/2012 07:19:00 PM

Early this morning the BEA released the third estimate of Q4 GDP. The BEA reported that Real gross domestic product "increased at an annual rate of 3.0 percent in the fourth quarter of 2011", the same as the previous estimate.

Also in the release, the BEA reported the real gross domestic income (GDI) increased at a 4.4% annualized rate in Q4.

There are really two measures of GDP: 1) real GDP, and 2) real Gross Domestic Income (GDI). A research paper in 2010 suggested that GDI is often more accurate than GDP. For a discussion on GDI, see from Fed economist Jeremy Nalewaik, “Income and Product Side Estimates of US Output Growth,” Brookings Papers on Economic Activity. An excerpt:

The U.S. produces two conceptually identical official measures of its economic output, currently called Gross Domestic Product (GDP) and Gross Domestic Income (GDI). These two measures have shown markedly different business cycle fluctuations over the past twenty five years, with GDI showing a more-pronounced cycle than GDP. These differences have become particularly glaring over the latest cyclical downturn, which appears considerably worse along several dimensions when looking at GDI. ...During the worst period of the recession, GDI fell more than GDP as Nalewaik noted. In subsequent revisions, GDP was revised down showing the economy contracted more than originally reported - and closer to the original GDI reports.

In discussing the information content of these two sets of estimates, the confusion often starts with the nomenclature. GDP can mean either the true output variable of interest, or an estimate of that output variable based on the expenditure approach. Since these are two very different things, using “GDP” for both is confusing. Furthermore, since GDI has a different name than GDP, it may not be initially clear that GDI measures the same concept as GDP, using the equally valid income approach.

The opposite has happened over the last two quarters - GDI is showing stronger growth than GDP - and this suggests that 2nd half 2011 GDP might be revised up with the next annual revision that will be released on July 27th (Revised Estimates will be provided for years 2009 through 2011).

David Wessell wrote about this at the WSJ Real Time Economics this morning GDI: An Alternate Measure Showing Stronger U.S. Growth

With its third revision of fourth-quarter GDP, issued Thursday, the agency also released its GDI estimates. Here’s what they show:Of course this is all history and the focus will be on Q1.

GDP Q4 up 3.0% GDI Q4 up 4.4%

GDP Q3 up 1.8% GDI Q3 up 2.6%

FULL YEAR 2011 GDP: up 1.7% FULL YEAR 2011 GDI: up 2.1%

As our colleague Jon Hilsenrath notes: “The clues in these numbers are especially important now because of the Okun’s Law conundrum: The economy doesn’t seem to be growing fast enough to account for the recent sharp declines in the unemployment rate. It might be the case that GDP numbers are understating growth.” (Read more about the disconnect between growth and labor-market improvement.)

Reacting to the latest numbers (on Twitter), economist Justin Wolfers of the University of Pennsylvania said: “GDI growth was fast enough to explain rapid jobs growth. Historically, GDP revises toward GDI.”

Note: Personal income and outlays for February will be released tomorrow.

Bernanke: "The Federal Reserve and the Financial Crisis" Part 4

by Calculated Risk on 3/29/2012 04:12:00 PM

This is part 4 of 4 of a lecture series on the Federal Reserve.

From the WSJ: Fed Chief Bernanke Defends Bond Buys

In the period after World War II, "many central banks began to view financial stability as kind of a junior partner to monetary policy—it was not as important," Mr. Bernanke said. "It's now clear that maintaining financial stability is just as important a responsibility as monetary and economic stability, and indeed this is very much a return to where the Fed came from in the beginning."My comment: One of the key reason for the financial crisis was the lack of proper oversight during the bubble. Usually I'm pretty optimistic, but as time passes, and memories fade, the oversight will probably be ignored again.

Here is a link to the lecture series including links to videos.

Here are the slides for the lectures:

Lecture 1: Origins and Mission of the Federal Reserve

Lecture 2: The Federal Reserve after World War II

Lecture 3: The Federal Reserve’s Response to the Financial Crisis

Lecture 4: The Aftermath of the Crisis

CoreLogic: Almost 65,000 completed foreclosures in February 2012

by Calculated Risk on 3/29/2012 01:03:00 PM

From CoreLogic: CoreLogic® Reports Almost 65,000 Completed Foreclosures Nationally in February

CoreLogic ... today released its National Foreclosure Report for January, which provides monthly data on completed foreclosures, foreclosure inventory and 90+ delinquency rates. There were approximately 65,000 completed foreclosures in February 2012, compared to 66,000 in February 2011, and 71,000 in January 2012. The number of completed foreclosures for the 12 months ending in February was 862,000. From the start of the financial crisis in September 2008, there have been approximately 3.4 million completed foreclosures.This is a new monthly report and will help track the number of completed foreclosures, and to see if the lenders are starting to clear the foreclosure inventory backlog following the mortgage settlement.

Approximately 1.4 million homes, or 3.4 percent of all homes with a mortgage, were in the foreclosure inventory as of February 2012 compared to 1.5 million, or 3.6 percent, in February 2011 and 1.4 million, or 3.4 percent, in January 2012. Nationally, the number of borrowers in the foreclosure inventory decreased by 115,000, a decline of 7.6 percent, in February 2012 compared to February 2011.

"The pace of completed foreclosures is down slightly compared to January, running at an annualized pace of 670,000, but compares favorably to the pace of completed foreclosures in February a year ago. Even though the pace of completed foreclosures has slowed, the overall foreclosure inventory is decreasing because REO sales were up in February,” said Mark Fleming, chief economist for CoreLogic. “With the spring buying season upon us, the inventory may decline further as the pace of distressed-asset sales rises along with the rest of the housing market.”

Notes: The sequence is 1) a loan goes delinquent, 2) if it doesn't cure, after several months, the foreclosure process begins (this is called the "foreclosure inventory"), 3) then the foreclosure is completed and becomes REO (lender Real Estate Owned), and then 4) the REO is sold. Sometimes, during this process, the loan will cure or a short sale approved, so not all loans in the foreclosure inventory are future "completed foreclosures".

When CoreLogic reports "completed foreclosures", they are discussing the number of homes moving from the foreclosure process to REO.

Another vendor, LPS, reported 91,086 completed foreclosures in January (significantly above the revised 71,000 reported by CoreLogic). I've heard that the LPS February numbers will probably be higher than CoreLogic too (LPS will release next week).

Kansas City Fed: Growth in Manufacturing Activity Moderated Slightly in March

by Calculated Risk on 3/29/2012 11:00:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Moderated Slightly but Remained Solid Overall

Growth in Tenth District manufacturing activity moderated slightly but remained generally solid overall, with a continued positive outlook for future months. ... The month-over-month composite index was 9 in March, down from 13 in February but up from 7 in January ...The index for number of employees increased from 11 to 12, and the average workweek index increase to +2 from -3 in February.

The production index dropped from 20 to 13, and the order backlog index also fell after rising last month. In contrast, the shipments and new order indexes both increased from 8 to 17, and employment index also edged higher.

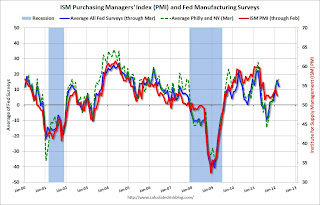

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through March), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

The ISM index for March will be released Monday April 2nd, and these surveys suggest some increase from the 52.4 reading in February.