by Calculated Risk on 4/07/2012 08:17:00 PM

Saturday, April 07, 2012

HUD Secretary on Principal Reductions

HUD Secretary Shaun Donovan will be on C-SPAN Sunday morning (see here).

Here are some comments on Fannie and Freddie principal reductions:

Q: Why should Fannie and Freddie be forced to do write-downs?A few days ago, FHFA acting director Edward DeMarco said:

DONOVAN: This isn’t about force. This is about making the right decision for homeowners and for the taxpayer. We believe and there is a lot of agreement, many economists, those who have looked closely at this data who believe where you have someone who is deeply underwater, where you’re in a situation where there is really no light at the end of the tunnel, no sense that even if you’re paying your mortgage for three, four, five years or even a decade, that you’ll get back to building equity again. Families will give up at some point. We think the data shows that. Really the issue here is about the numbers and the analysis and whether this is not only good for homeowners but also good for the taxpayer. And we believe with the changes that we’ve made over the last few months that the case is compelling. And my experience with Ed DeMarco is whatever his personal feelings are, he is dedicated to making sure that he follows the law and what the conservator is required to do. And we believe based on the analysis that we’ve done that the evidence is that principal write-downs should happen in cases where it’s not only good for the homeowner but also good for the taxpayer.

Q: Three out of four deeply underwater borrowers with loans backed by Fannie and Freddie are paying. How concerned are you that some of those borrowers may stop paying if you offer debt reduction to borrowers who are delinquent?

DONOVAN: The vast majority of homeowners don’t operate that way. They know that their home is where they’re going to raise their kids. They’re part of a community there. The home is much more than an investment. And so we really know this from studies we’ve done, that the vast majority of folks, these families, aren’t going to just put all of that at risk to default on purpose on their homes.

And so what we’re really talking about is a small group of folks, maybe demographically single folks who aren’t giving up those same things, who see that there may be from defaulting that you know they could move across the street or other things. So there is a small group. But we shouldn’t punish the vast majority of folks where strategic default isn’t really a risk, just to fix what may be really a risk with a small percentage.

This isn’t that hard a problem to design around. Take the mortgage-servicing settlement that we recently reached. In that case what we’re doing is putting in place protections so that we avoid some of the risks of strategic default. For example, in that case many of the servicers are simply going to set a date at which you’re eligible based on delinquency and what that means is there’s nothing you can do. You can’t make yourself eligible. You can’t start to default on your mortgage and all of a sudden start to get a windfall from that by getting a principal reduction. And so while I understand the concerns about this, I think one the vast majority of homeowners are not at risk for strategic default. And two, even for those where there is some risk, there is a way to design it so that … it avoids those risks.

[W]e are currently evaluating the recent Treasury Department proposal to HAMP regarding principal forgiveness and expect a decision this month.So a decision will probably be made very soon.

Earlier:

• Summary for Week Ending April 6th

• Schedule for Week of April 8th

Unofficial Problem Bank List and Quarterly Transition Matrix

by Calculated Risk on 4/07/2012 05:25:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for April 6, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Quiet week for the Unofficial Problem Bank List as there were only two removals. The changes leave the list with 946 institutions with assets of $376.5 billion. A year ago, the list 982 institutions with assets of $433.2 billion. The action against First Savings Bank Northwest, Renton, WA ($1.0 billion Ticker: FFNW) was replaced by an informal action and Pilsen State Bank, Lincolnville, KS ($11 million) was dissolved through an unassisted merger.

With the passage of the first quarter of 2012, it is time to update the Unofficial Problem Bank List transition matrix. The list debuted on August 7, 2009 with 389 institutions with assets of $276.3 billion (see table). Over the past 32 months, 230 institutions or about 59 percent of the institutions on the original list have been removed with 137 from failure, 71 from action termination, 20 from unassisted merger, and two from voluntary liquidation. About 35 percent of the 389 institutions on the original list have failed, which is substantially higher than the 12 percent figure usually cited by the media as the failure rate for institutions on the FDIC Problem Bank List.

Since the publication of the original list, another 1,122 institutions have been added. However, only 789 of those additions remain on the current list as 333 institutions have been removed in the interim. Of the 333 inter-period removals, 178 were from failure, 72 were from an unassisted merger, 78 from action termination, and five from voluntary liquidation.

In total, 1,511 institutions have made an appearance on the Unofficial Problem Bank List and 315 or 20.8 percent have failed. Of the 563 total removals, the primary way of exit from the list is failure at 315 institutions or 56 percent. Only 149 or around 27 percent have been able to rehabilitate themselves to see their respective action terminated. Alternatively, another 92 or nearly 16 percent found merger partners most likely to avoid failure. Total assets that have appeared on the list amount to $789.8 billion and $282.3 billion have been removed due to failure. The average asset size of removals from failure is $896 million.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 71 | (19,039,409) | |

| Unassisted Merger | 20 | (3,401,337) | |

| Voluntary Liquidation | 2 | (4,855,164) | |

| Failures | 137 | (178,872,611) | |

| Asset Change | (14,066,292) | ||

| Still on List at 3/31/2012 | 167 | 56,078,616 | |

| Additions | 789 | 321,473,577 | |

| End (3/31/2012) | 948 | 377,552,193 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 78 | 44,376,836 | |

| Unassisted Merger | 72 | 42,937,646 | |

| Voluntary Liquidation | 5 | 1,259,188 | |

| Failures | 178 | 103,460,185 | |

| Total | 333 | 192,033,855 | |

| 1Institutions not on 8/7/2009 or 3/31/2012 list but appeared on a list between these dates. | |||

Schedule for Week of April 8th

by Calculated Risk on 4/07/2012 01:28:00 PM

Earlier:

• Summary for Week Ending April 6th

The key reports for this week are the February Trade Balance report, to be released on Thursday, and the March Consumer Price Index (CPI), to be released on Friday.

FHFA acting director Edward DeMarco is speaking on Tuesday: "Addressing the Weak Housing Market: Is Principal Reduction the Answer?"

There will be several speeches by Fed officials, including both Fed Chairman Ben Berananke, and Fed Vice Chairman Janet Yellen.

Morning: LPS House Price Index for January.

7:15 PM ET: Speech by Fed Chairman Ben Bernanke, "Fostering Financial Stability", At the 2012 Federal Reserve Bank of Atlanta Financial Markets Conference, Stone Mountain, Georgia

7:30 AM: NFIB Small Business Optimism Index for March.

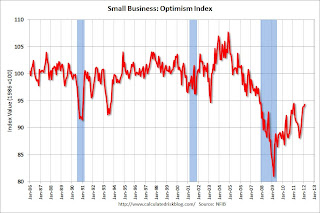

7:30 AM: NFIB Small Business Optimism Index for March. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index increased to 94.3 in February from 93.9 in January. This is the sixth increase in a row after for the index, and the index is now at second highest level since December 2007. The consensus is for an increase to 94.8.

9:30 AM ET: Speech by FHFA acting director Edward DeMarco: "Addressing the Weak Housing Market: Is Principal Reduction the Answer?" at the The Brookings Institution, 1775 Massachusetts Ave., NW Washington, DC.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings were unchanged in January, and the number of job openings (yellow) has generally been trending up, and are up about 21% year-over-year compared to January 2011.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for February. The consensus is for a 0.6% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

8:30 AM: Import and Export Prices for February. The consensus is a for a 0.9% increase in import prices.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

6:15 PM: Speech by Fed Vice Chair Janet Yellen, "The Economic Outlook and Monetary Policy", At the Money Marketeers of New York University Dinner Meeting, New York, New York

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase slightly to 359,000.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. Both exports and imports increased in January. Imports stalled in the middle of 2011, but increased towards the end of the year (seasonally adjusted). Exports are well above the pre-recession peak and up 8% compared to January 2011; imports just passed the pre-recession high and imports are up about 8% compared to January 2011.

The consensus is for the U.S. trade deficit to decrease to $51.7 billion in February, up from from $52.6 billion in January. Export activity to Europe will be closely watched due to economic weakness.

8:30 AM: Producer Price Index for March. The consensus is for a 0.3% increase in producer prices (0.2% increase in core).

8:30 AM: Consumer Price Index for March. The consensus is a 0.3% increase in prices. The consensus for core CPI to increase 0.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (perliminary for April). The consensus is for sentiment to be unchanged at 76.2.

1:00 PM: Speech by Fed Chairman Ben Bernanke, "Reflections on the Crisis and the Policy Response", At the Russell Sage Foundation and The Century Foundation Conference on "Rethinking Finance," New York, New York

Summary for Week ending April 6th

by Calculated Risk on 4/07/2012 07:43:00 AM

The March employment report was below expectations with only 120,000 payroll jobs added. The unemployment rate declined slightly to 8.2%. U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 14.5% from 14.9% in February.

Is this the beginning of even slower employment growth, or was this just noise? That is a key question and will put additional pressure on the April report.

In 2011, the economy added 1.84 million payroll jobs (2.1 million private sector), and, even after the weak March report, the economy is on pace to add over 2.5 million payroll jobs this year. That is still sluggish growth given the slack in the system, but better than 2011.

Other reports below expectations included March auto sales, February construction spending, and the March ISM service survey. The ISM manufacturing survey was slightly above expectations.

A couple of other positives: initial weekly unemployment claims continued to decline, and, for commercial real estate, the office and mall vacancy rates are now declining.

Overall it was a disappointing week and suggests sluggish growth.

Here is a summary in graphs:

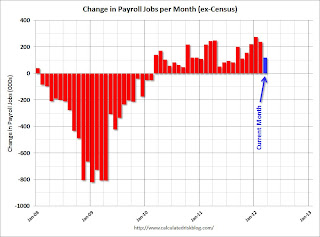

• March Employment Report: 120,000 Jobs, 8.2% Unemployment Rate

Click on graph for larger image.

Click on graph for larger image.

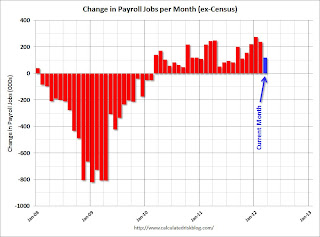

This graph shows the jobs added or lost per month (excluding temporary Census jobs) since the beginning of 2008.

From the BLS: "Nonfarm payroll employment rose by 120,000 in March, and the unemployment rate was little changed at 8.2 percent, the U.S. Bureau of Labor Statistics reported today."

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate was declined to 8.2% (red line).

The Labor Force Participation Rate decreased to 63.8% in March (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the decline is due to demographics.

The Labor Force Participation Rate decreased to 63.8% in March (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the decline is due to demographics.

The Employment-Population ratio decreased slightly to 58.5% in March (black line).

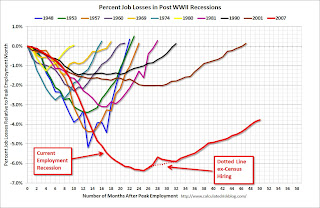

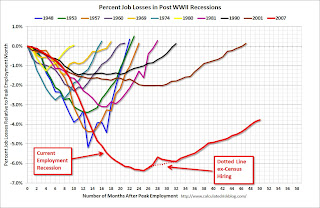

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - much worst than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was weaker payroll growth than expected (expected was 201,000).

• ISM Manufacturing index indicates slightly faster expansion in March

PMI was at 53.4% in March, up from 52.4% in February. The employment index was at 56.1%, up from 53.2%, and new orders index was at 54.5%, down from 54.9%.

PMI was at 53.4% in March, up from 52.4% in February. The employment index was at 56.1%, up from 53.2%, and new orders index was at 54.5%, down from 54.9%. Here is a long term graph of the ISM manufacturing index.

This was slightly above expectations of 53.0%. This suggests manufacturing expanded at a faster rate in March than in February. It appears manufacturing employment expanded in March with the employment index at 56.1%.

• ISM Non-Manufacturing Index indicates slower expansion in March

The March ISM Non-manufacturing index was at 56.0%, down from 57.3% in February. The employment index increased in March to 56.7%, up from 55.7% in February. Note: Above 50 indicates expansion, below 50 contraction.

The March ISM Non-manufacturing index was at 56.0%, down from 57.3% in February. The employment index increased in March to 56.7%, up from 55.7% in February. Note: Above 50 indicates expansion, below 50 contraction. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 56.7% and indicates slightly slower expansion in March than in February.

• U.S. Light Vehicle Sales at 14.4 million annual rate in March

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.37 million SAAR in March. That is up 10.4% from March 2011, but down 4.4% from the sales rate last month (15.03 million SAAR in Feb 2012).

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.37 million SAAR in March. That is up 10.4% from March 2011, but down 4.4% from the sales rate last month (15.03 million SAAR in Feb 2012).This graph shows light vehicle sales since the BEA started keeping data in 1967.

March was above the August 2009 rate with the spike in sales from "cash-for-clunkers". Only February had a higher sales rates since early 2008. This was below the consensus forecast of 14.7 million SAAR.

Even though this was below expectations, growth in auto sales will make another strong positive contribution to GDP in Q1 2012.

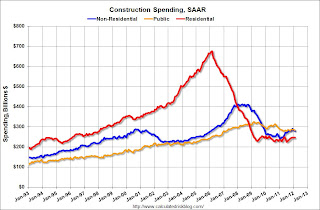

• Construction Spending declined in February

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.Private residential spending is 63.5% below the peak in early 2006, and up 10% from the recent low. Non-residential spending is 32% below the peak in January 2008, and up about 15% from the recent low.

Public construction spending is now 13% below the peak in March 2009.

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit), and this suggest the bottom is in for residential investment.

• Reis: Office, Mall and Apartment Vacancy Rates

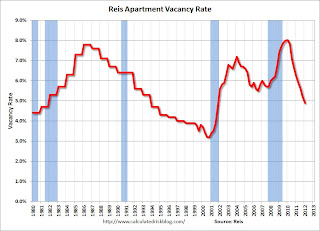

Reis reported the apartment vacancy rate (82 markets) fell to 4.9% in Q1 from 5.2% in Q4 2011. The vacancy rate was at 6.1% in Q1 2010 and peaked at 8.0% at the end of 2009.

Reis reported the apartment vacancy rate (82 markets) fell to 4.9% in Q1 from 5.2% in Q4 2011. The vacancy rate was at 6.1% in Q1 2010 and peaked at 8.0% at the end of 2009.This graph shows the apartment vacancy rate starting in 1980 (prior to 1999 the data is annual). Back in the early '80s, there was overbuilding in the apartment sector (just like for offices) with the very loose lending that led to the S&L crisis. Once the lending stopped, starts of built-for-rent units slowed, and the vacancy rate started to decline.

Following the financial crisis, starts and completions of multi-family units fell to record lows (there were a record low number of completions last year). Builders have increased construction, but it usually takes over a year to complete a multi-family building, so this new supply hasn't reached the market yet. As Reis noted, the number of completions will increase this year, but the vacancy rate will probably decline further.

This will also impact on house prices. The upward pressure on rents will make the price-to-rent ratio a little more favorable for buying.

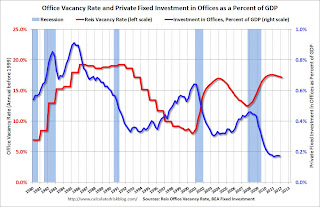

Reis reported the office vacancy rate declined slightly to 17.2% in Q1 from 17.3% in Q4 2011. The vacancy rate was at 17.6% in Q1 2011.

Reis reported the office vacancy rate declined slightly to 17.2% in Q1 from 17.3% in Q4 2011. The vacancy rate was at 17.6% in Q1 2011.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual). Back in the early '80s, there was overbuilding in the office sector even as the vacancy rate was rising. This was due to the very loose lending that led to the S&L crisis.

In the '90s, office investment picked up as the vacancy rate fell. Following the bursting of the stock bubble, the vacancy rate increased sharply and office investment declined.

During the housing bubble, office investment started to increase even before the vacancy rate had fallen below 14%. This was due to loose lending - again. Investment essentially stopped following the financial crisis.

The good news is there is very little new office construction right now and the vacancy rate will probably continue to decline.

Ries reported the regional mall vacancy rate declined to 9.0% in Q1, and the strip mall vacancy rate declined to 10.9% from 11.0%.

Ries reported the regional mall vacancy rate declined to 9.0% in Q1, and the strip mall vacancy rate declined to 10.9% from 11.0%.This graph shows the vacancy rate for regional and strip malls since Q1 2000.

It appears the vacancy rate is starting to decline, but very slowly. Just like for office space, there is almost no new supply of malls being built.

• Weekly Initial Unemployment Claims decline to 357,000

The DOL reports:

The DOL reports:In the week ending March 31, the advance figure for seasonally adjusted initial claims was 357,000, a decrease of 6,000 from the previous week's revised figure of 363,000. The 4-week moving average was 361,750, a decrease of 4,250 from the previous week's revised average of 366,000.The previous week was revised up to 363,000 from 359,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 361,750.

The 4-week moving average is at the lowest level since early 2008.

• Other Economic Stories ...

• FOMC Minutes: No Push for QE3

• Federal Reserve Issues Statement on Rental of REOs

• Trulia announces new "mix adjusted" House Asking Price Monitor, Prices up 1.4% from Q4

• Ceridian-UCLA: Diesel Fuel index increased 0.3% in March

• ADP: Private Employment increased 209,000 in March

• LPS: February Foreclosure Starts and Sales Reversed Prior Month’s Increases

Friday, April 06, 2012

Stand-up economist Yoram Bauman: S*** happens: the economics version

by Calculated Risk on 4/06/2012 10:32:00 PM

Language warning on video below ...

Earlier Employment posts:

• March Employment Report: 120,000 Jobs, 8.2% Unemployment Rate

• Employment Summary and Discussion

• Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• All Employment Graphs

AAR: Rail Traffic "mixed" in March

by Calculated Risk on 4/06/2012 04:01:00 PM

From the Association of American Railroads (AAR): AAR Reports Mixed Rail Traffic for March

The Association of American Railroads (AAR) today reported reported U.S. rail carloads originated in March 2012 totaled 1,123,298, down 69,190 carloads or 5.8 percent, compared with March 2011. Intermodal volume in March 2012 was 928,350 containers and trailers, up 31,348 units or 3.5 percent compared with March 2011.

...

Commodities with carload declines in March were led by coal, down 84,854 carloads or 15.8 percent from March 2011. Other commodities with declines included grain, down 9,088 carloads or 9.7 percent; chemicals, down 4,278 carloads or 3.4 percent; nonmetallic minerals, down 1,863 carloads or 9.7 percent; and farm products excluding grain, down 479 carloads or 13.3 percent. Carloads excluding coal and grain were up 4.4 percent or 24,752 carloads in March 2012 over March 2011.

...

“There is no denying that coal is a crucial commodity for railroads, and there’s also no denying that recent declines in coal traffic are presenting significant challenges to railroads right now,” said AAR Senior Vice President John T. Gray. “That said, it’s encouraging that many commodities that are better indicators of the state of the economy than coal is — things like motor vehicles, lumber and wood products, and crushed stone — saw higher rail carloadings in March.”

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

U.S. railroads originated 1,123,298 total carloads in March 2012, down 5.8% (69,190 carloads) from the same period in 2011. Total carloads averaged 280,825 per week in March 2012, down from 298,122 in March 2011. Coal and, to a lesser extent, grain were the main reasons for the decline. Excluding coal and grain, U.S. rail carloads were up 4.4% (24,752 carloads) in March 2012 over March 2011, though the 4.4% gain is the smallest gain for this category of rail traffic in six monthsAccording to the AAR, the decline in coal is because coal is being used less for electricity generation.

The second graph is for intermodal traffic (using intermodal or shipping containers):

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is now above the peak year in 2006.

Intermodal continued to impress in March. U.S. railroads originated 928,350 containers and trailers in March 2012, up 3.5% (31,348 units) over March 2011 and the 28th straight year-over-year monthly increase. Average weekly U.S. intermodal loadings in March 2012 were the highest of any March in history.

Earlier Employment posts:

• March Employment Report: 120,000 Jobs, 8.2% Unemployment Rate

• Employment Summary and Discussion

• Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• All Employment Graphs

Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 4/06/2012 01:09:00 PM

The first graph below shows the number of total construction payroll jobs in the U.S. including both residential and non-residential since 1969.

Construction employment decreased by 7 thousand jobs in March, giving back some of the gains from January. Last year was the first year with an increase in construction employment since 2006, and the first with an increase in residential construction employment since 2005.

Unfortunately this graph is a combination of both residential and non-residential construction employment. The BLS only started breaking out residential construction employment fairly recently (residential specialty trade contractors in 2001).

Usually residential investment (and residential construction) leads the economy out of recession, and non-residential construction usually lags the economy. Because this graph is a blend, it masks the usual pickup in residential construction following previous recessions. Of course there was no pickup for residential construction this time because of the large excess supply of vacant homes - although that appears to be changing and residential construction employment will probably increase this year.

Click on graph for larger image.

Click on graph for larger image.

Construction employment is now generally increasing, and construction will add to both GDP and employment growth in 2012.

As I've noted for years, there are usually two bottoms for housing following a bubble: 1) when housing starts, new home sales, and residential construction bottoms, and 2) when house prices bottom. The bottom is in for construction and construction employment.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.All categories are generally moving down (the less than 5 week category is back to normal levels). The other categories are still high.

The the long term unemployed declined to 3.4% of the labor force - this is still very high, but the lowest since September 2009.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This is a little more technical. The BLS diffusion index for total private employment was at 59.6 in March, down slightly from 60.7 in January. For manufacturing, the diffusion index increased to 67.9, up from 59.9 in February.

This is a little more technical. The BLS diffusion index for total private employment was at 59.6 in March, down slightly from 60.7 in January. For manufacturing, the diffusion index increased to 67.9, up from 59.9 in February. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.It appears job growth was still fairly widespread in March.

We'd like to see the diffusion indexes consistently above 60 - and even in the 70s like in the '1990s.

Earlier Employment posts:

• March Employment Report: 120,000 Jobs, 8.2% Unemployment Rate

• Employment Summary and Discussion

• All Employment Graphs

Employment Summary and Discussion

by Calculated Risk on 4/06/2012 10:17:00 AM

The number of payroll jobs added in March was disappointing, and this is reminding many observers of the slowdown in 2011.

But we also have to remember that this is just one month, and that there were clear reasons for the slowdown last year. In 2011, the economy was negatively impacted by the tsunami, bad weather, high oil prices and the debt ceiling debate. Of course oil prices are high again, but hopefully there will be no natural disasters, and also no threats of defaulting on the debt.

The report wasn't all bad news. It looks like the drag from state and local layoffs is nearing the end, the unemployment rate declined (although partially because of workers leaving the labor force), the number of people working part time for economic reasons declined, and the number of people unemployed for more than 6 months declined - and hourly wages increased a little faster.

Some numbers: There were 120,000 payroll jobs added in March, with 121,000 private sector jobs added, and 1,000 government jobs lost. The unemployment rate declined to 8.2%. U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 14.5% from 14.9% in February. This remains very high - U-6 was in the 8% range in 2007 - but this is the lowest level of U-6 since early 2009.

The participation rate decreased slightly to 63.8% (from 63.9%) and the employment population ratio also decreased slightly to 58.5%.

The change in January payroll employment was revised down from +284,000 to +275,000, and February was revised up from +227,000 to +240,000.

The average workweek declined 0.1 hours to 34.5 hours, and average hourly earnings increased 0.2%. "The average workweek for all employees on private nonfarm payrolls edged down by 0.1 hour to 34.5 hours in March. ... In March, average hourly earnings for all employees on private nonfarm payrolls rose by 5 cents, or 0.2 percent, to $23.39." This is sluggish earnings growth, and earnings are still being impacted by the large number of unemployed and marginally employed workers.

There are a total of 12.67 million Americans unemployed and 5.3 million have been unemployed for more than 6 months. These numbers are declining, but still very high.

Overall this report was disappointing, and this report will make the April report even more important as analysts try to determine if this is the beginning of slower growth - or if this was just a one month slowdown in hiring.

Percent Job Losses During Recessions

Click on graph for larger image.

Click on graph for larger image.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the previous post, the graph showed the job losses aligned at the start of the employment recession.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) fell from 8.1 to 7.7 million over the month. These individuals were working part time because theirThe number of part time workers decreased sharply in March - and is back to 2008 levels - but this is still very high.

hours had been cut back or because they were unable to find a full-time

job.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 14.5% in March from 14.9% in February - the lowest level since early 2009.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.308 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 5.426 million in February. This is very high, but this is the lowest number since 2009.

More graphs coming ...

March Employment Report: 120,000 Jobs, 8.2% Unemployment Rate

by Calculated Risk on 4/06/2012 08:30:00 AM

From the BLS:

Nonfarm payroll employment rose by 120,000 in March, and the unemployment rate was little changed at 8.2 percent, the U.S. Bureau of Labor Statistics reported today.This graph shows the jobs added or lost per month (excluding temporary Census jobs) since the beginning of 2008.

...

The civilian labor force participation rate (63.8 percent) and the employment-population ratio (58.5 percent) were little changed in March.

...

The change in total nonfarm payroll employment for January was revised from

+284,000 to +275,000, and the change for February was revised from +227,000

to +240,000.

Click on graph for larger image.

Click on graph for larger image.Job growth started picking up early last year, but then the economy was hit by a series of shocks (oil price increase, tsunami in Japan, debt ceiling debate) - and then growth started picking up again. This is only one month, but the concern is job growth will slow again.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate was declined to 8.2% (red line).

The Labor Force Participation Rate decreased to 63.8% in March (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the decline is due to demographics.

The Labor Force Participation Rate decreased to 63.8% in March (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the decline is due to demographics.The Employment-Population ratio decreased slightly to 58.5% in March (black line).

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - much worst than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was weaker payroll growth than expected (expected was 201,000). More later ...

Reis: Strip Mall Vacancy Rate declines slightly in Q1

by Calculated Risk on 4/06/2012 12:44:00 AM

From Reuters: US strip-mall vacancy falls 1st time in 7 yrs

The average vacancy rate at U.S. strip malls fell for the first time in nearly seven years in the first quarter and rents inched up, but it is too early to call a rebound for a sector battered by the housing bust and recession, a report by Reis Inc showed.

During the first quarter, the national vacancy rate for strip malls fell to 10.9 percent from 11 percent the prior quarter, according to preliminary figures from Reis. ... "This is really only the first quarter where the vacancy rate declined. We need to see something a little bit more sustained than just a quarter or two before it really signals the beginning of a trend," Severino said.

...

At regional malls, the first-quarter vacancy rate fell to 9 percent from 9.2 percent the prior quarter. It was the second consecutive quarterly decline for the big malls.

Click on graph for larger image.

Click on graph for larger image.This graph shows the vacancy rate for regional and strip malls since Q1 2000.

It appears the vacancy rate is starting to decline, but very slowly. Just like for office space, there is almost no new supply of malls being built.