by Calculated Risk on 4/21/2012 09:06:00 PM

Saturday, April 21, 2012

Unofficial Problem Bank list declines to 939 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for April 20, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As expected, the OCC released its enforcement action activity through mid-March this week, which contributed to many changes to the Unofficial Problem Bank List. In all, there were 12 removals and seven additions that result in the list having 939 institutions with assets of $365.6 billion. A year ago, the list held 976 institutions with assets of $422.2 billion.

The removals, which are centered in Texas, Michigan, and Minnesota, include 10 action terminations, one failure, and one unassisted merger. Action terminations include Citizens Bank, Flint MI ($9.2 billion Ticker: CRBC); Sterling Bank and Trust, FSB, Southfield, MI ($762 million); The Central National Bank of Alva, Alva, OK ($276 million); First National Bank of Jasper, Jasper, TX ($222 million); First National Bank Minnesota, St. Peter, MN ($190 million); Northwestern Bank, National Association, Dilworth, MN ($138 million); Texas Heritage National Bank, Daingerfield, TX ($109 million); Peoples National Bank Leadville, Leadville, CO ($50 million); Uvalde National Bank, Uvalde, TX ($30 million); and Flint River National Bank, Camilla, GA ($27 million). The failure removal was Fort Lee Federal Savings Bank, FSB, Fort Lee, NJ ($52 million) and the other removal was American Bank of Texas, National Association, Marble Falls, TX ($775 million), which merged on unassisted basis.

The seven additions were Tulsa National Bank, Tulsa, OK ($175 million); Choice Bank, Oshkosh, WI ($175 million Ticker: CBKW); The First National Bank of Absecon, Absecon, NJ ($160 million Ticker: ASCN); Flatbush Federal Savings and Loan Association, Brooklyn, NY ($143 million Ticker: FLTB); Atlas Bank, Brooklyn, NY ($108 million); Mojave Desert Bank, National Association, Mojave, CA ($105 million Ticker: MOJA); and Auburn Savings Bank, FSB, Auburn, ME ($78 million Ticker: ABBB).

Other changes include Prompt Corrective Action orders issued against Citizens First National Bank, Princeton, IL ($1.0 billion Ticker: PNBC) and Security Bank, National Association, North Lauderdale, FL ($95 million). Next week, we anticipate the FDIC will release its enforcement action activity through March 2012.

Click on graph for larger image.

Click on graph for larger image.This graph shows the cumulative bank failures for each year starting in 2008. There have been 431 bank failures since the beginning of 2008, and so far closings this year are on pace for around 50 failures compared to 140 in 2009, 157 in 2010, and 92 in 2011.

Earlier:

• Summary for Week Ending April 20th

• Schedule for Week of April 22nd

Schedule for Week of April 22nd

by Calculated Risk on 4/21/2012 01:05:00 PM

Earlier:

• Summary for Week Ending April 20th

The key U.S. economic report for the coming week is the Q1 advance GDP report to be released on Friday. Also New Home sales and the Case-Shiller house price index will be released on Tuesday.

The Fed's FOMC holds a two day meeting on Tuesday and Wednesday, and Fed Chairman Ben Bernanke will hold a press conference following the FOMC announcement on Wednesday. The FOMC will release participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

No economic releases scheduled.

9:00 AM: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February.

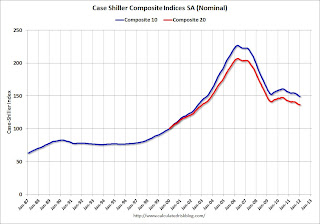

9:00 AM: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through January 2012 (the Composite 20 was started in January 2000).

The consensus is for a 3.3% decrease year-over-year in prices (NSA) in February. I expect these indexes to be at new post-bubble lows, not seasonally adjusted. The CoreLogic index declined 0.8% in February (NSA).

10:00 AM ET: New Home Sales for March from the Census Bureau.

10:00 AM ET: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

The consensus is for an increase in sales to 318 thousand Seasonally Adjusted Annual Rate (SAAR) in March from 313 thousand in February. This might be a little low based on recent comments and the homebuilder confidence survey.

10:00 AM: Conference Board's consumer confidence index for April. The consensus is for a decrease to 69.7 from 70.2 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for April. The consensus is for an increase to 8 for this survey from 7 in March (above zero is expansion).

10:00 AM: FHFA House Price Index for February 2011. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 1.5% decrease in durable goods orders.

12:30 PM: FOMC Meeting Announcement. No changes are expected to interest rates or to "operation twist".

2:00 PM: FOMC Forecasts The will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:15 PM: Fed Chairman Ben Bernanke holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 375,000 from 386,000 last week.

8:30 AM: Chicago Fed National Activity Index (March). This is a composite index of other data.

10:00 AM ET: Pending Home Sales Index for March. The consensus is for a 1.0% increase in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for April. The index was at 9 in March (above zero is expansion).

8:30 AM: Q1 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 2.5% annualized in Q1.

8:30 AM: Q1 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 2.5% annualized in Q1.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column is the forecast for Q1 GDP.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for April). The consensus is for no change from the preliminary reading of 75.7.

Summary for Week ending April 20th

by Calculated Risk on 4/21/2012 08:27:00 AM

For a few months the incoming data was above expectations. This was a combination of somewhat stronger reports and very low expectations. Since then expectations have increased, and the data has been a little weaker - so the data has been mostly below expectations for several weeks now. This doesn't suggest a sharp slowdown, just more sluggish growth as the economy continues to recover from the financial crisis, and as household continue to deleverage.

This was another week of somewhat disappointing data, a key exception being very strong retail sales in March. Housing starts declined in March, although the decline was mostly due to the volatile multi-family sector (and permits were up suggesting a bounce back next month). Existing home sales were below expectations, but inventory was down again – and is now down 21.8% year-over-year. Weekly initial unemployment claims declined, but the overall level is still fairly high.

Here is a summary in graphs:

• Housing Starts declined in March

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 654 thousand (SAAR) in March, down 5.8% from the revised February rate of 694 thousand (SAAR). Note that February was revised down from 698 thousand.

Single-family starts declined 0.2% to 462 thousand in March. February was revised up to 463 thousand from 457 thousand.

Total starts are up 37% from the bottom, and single family starts are up 31% from the low.

This was well below expectations of 700 thousand starts in March, but mostly because of multi-family starts.

• Retail Sales increased 0.8% in March

On a monthly basis, retail sales were up 0.8% from February to March (seasonally adjusted), and sales were up 6.5% from March 2011. Ex-autos, retail sales increased 0.8% in March.

On a monthly basis, retail sales were up 0.8% from February to March (seasonally adjusted), and sales were up 6.5% from March 2011. Ex-autos, retail sales increased 0.8% in March. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 23.6% from the bottom, and now 8.6% above the pre-recession peak (not inflation adjusted)

This was above the consensus forecast for retail sales of a 0.3% increase in March, and above the consensus for a 0.6% increase ex-auto.

• Existing Home Sales in March: 4.48 million SAAR, 6.3 months of supply

The NAR reports: Existing-Home Sales Decline in March but Inventory Down, Prices Stabilizing

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in March 2012 (4.48 million SAAR) were 2.6% lower than last month, and were 5.2% above the March 2011 rate.

According to the NAR, inventory decreased to 2.37 million in March from 2.40 million in February. Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.

This graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory

This graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventoryInventory decreased 21.8% year-over-year in March from March 2011. This is the thirteenth consecutive month with a YoY decrease in inventory.

Months of supply was unchanged at 6.3 months in March.

This was below to expectations of sales of 4.62 million.

• Weekly Initial Unemployment Claims at 386,000

The DOL reports: "In the week ending April 14, the advance figure for seasonally adjusted initial claims was 386,000, a decrease of 2,000 from the previous week's revised figure of 388,000. The 4-week moving average was 374,750, an increase of 5,500 from the previous week's revised average of 369,250."

The DOL reports: "In the week ending April 14, the advance figure for seasonally adjusted initial claims was 386,000, a decrease of 2,000 from the previous week's revised figure of 388,000. The 4-week moving average was 374,750, an increase of 5,500 from the previous week's revised average of 369,250."The previous week was revised up to 388,000 from 380,000. Claims for two weeks ago were revised down.

This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 374,750. This is the highest level for the 4-week moving average since January.

• AIA: Architecture Billings Index indicates expansion in March

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Positive Conditions Persist for Architecture Billings Index

This graph shows the Architecture Billings Index since 1996. The index was at 50.4 in March (slight expansion). Anything above 50 indicates expansion in demand for architects' services.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in early 2012, but perhaps stabilizing mid-year.

• Industrial Production unchanged in March, Capacity Utilization declines

This graph shows Capacity Utilization. This series is up 11.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.6% is still 1.7 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production was unchanged in March at 96.6; however February was revised up from 96.2.

The consensus was for a 0.3% increase in Industrial Production in March, and for a decrease to 78.6% (from 78.7%) for Capacity Utilization. Although below consensus, with the February revisions, this was close to expectations.

• Other Economic Stories ...

• NAHB Builder Confidence declines in April

• Residential Remodeling Index increases 3% in February

• NY Fed: Manufacturing Activity "improved modestly" in April

• Philly Fed: "Regional manufacturing activity expanded modestly" in April Survey

• State Unemployment Rates decline in 30 states in March

Friday, April 20, 2012

FT Alphaville: FOMC pre-preview

by Calculated Risk on 4/20/2012 09:27:00 PM

From Cardiff Garcia at FT Alphaville: Flies in the Fed’s ointment

Yep, nearly time to start talking about the next FOMC meeting, a two-day affair that begins this Tuesday.Garcia quotes Neal Soss at Credit Suisse regarding the FOMC participants' projections of the appropriate target federal funds rate:

Any big decisions regarding further quantitative easing are more likely to be taken later, closer to when Operation Twist is scheduled to end in mid-June. (Expect to see more stories using the “wait-and-see mode” formulation.) But on the schedule is the second iteration of the individual participants’ federal funds rate projections, and that could be interesting.

"While we expect that 2014 guidance to be reaffirmed at the April meeting, we also think it likely that the distribution as a whole would shift slightly inward in time."So the distribution of projections will be closely scrutinized (this allows the "hawks" to argue for raising rate sooner, even though the 2014 guidance will almost certainly be reiteritated.) Garcia concludes:

It’s true that the US economy is on surer footing now than six months ago, but recently we’ve also had a payroll report that was weak relative to prior months; home prices have continued to fall; and the downward trend in jobless claims was revealed to be less impressive than we thought and even might have stalled (yeah, we know, the last one could just be seasonality issues). European debt markets have again become a focal point and there’s no way to know how fiscal-cliff-mageddon will turn out.CR: I'll have another preview in the next few days, but I don't expect any significant changes announced next week.

Bank Failure #17 in 2012: Fort Lee Federal Savings Bank, FSB, Fort Lee, NJ

by Calculated Risk on 4/20/2012 06:14:00 PM

Near the George Washington Bridge

Lies a Fort Lee Bank

by Soylent Green is People

From the FDIC: Alma Bank, Astoria, New York, Assumes All of the Deposits of Fort Lee Federal Savings Bank, FSB, Fort Lee, New Jersey

As of December 31, 2011, Fort Lee Federal Savings Bank, FSB had approximately $51.9 million in total assets and $50.7 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $14.0 million. ... Fort Lee Federal Savings Bank, FSB is the seventeenth FDIC-insured institution to fail in the nation this year, and the first in New Jersey.I was wondering if the FDIC was taking April off ...

Zillow's forecast for Case-Shiller House Price index in February

by Calculated Risk on 4/20/2012 02:47:00 PM

Note: Remember the Case-Shiller report is for February (really an average of prices in December, January and February). This data is released with a significant lag, see: House Prices and Lagged Data

Zillow Forecast: February Case-Shiller Composite-20 Expected to Show 3.4% Decline from One Year Ago

On Tuesday, April 24th, the Case-Shiller Composite Home Price Indices for February will be released. Zillow predicts that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) will decline by 3.4 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will decline by 3.5 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from January to February will be -0.1 percent and -0.2 percent for the 20 and 10-City Composite Home Price Index (SA), respectively.Zillow's forecasts for Case-Shiller have been pretty close, and I expect Case-Shiller will report house prices at a new post-bubble low in February.

One of the keys this year will be to watch the year-over-year change in the various house price indexes. The composite 10 and 20 indexes declined 3.9% and 3.8% respectively in January, after declining 4.1% in December. Zillow is forecasting a smaller year-over-year decline in February.

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

|---|---|---|---|---|---|

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | February 2011 | 152.38 | 154.86 | 139.06 | 141.57 |

| Case-Shiller (last month) | January 2012 | 148.4 | 149.43 | 135.46 | 136.6 |

| Zillow February Forecast | YoY | -3.5% | -3.5% | -3.4% | -3.4% |

| MoM | -0.9% | -0.2% | -0.8% | -0.1% | |

| Zillow Forecasts1 | 147.1 | 149.3 | 134.4 | 136.6 | |

| Post Bubble Lows | 148.4 | 149.43 | 135.46 | 136.6 | |

| Date of Post Bubble Low | January 2012 | January 2012 | January 2012 | January 2012 | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Residential Investment and the Housing Industry Recovery

by Calculated Risk on 4/20/2012 01:11:00 PM

Earlier this week I wrote:

"There is no question that housing starts and residential investment have bottomed. And it appears new home sales have also bottomed. For the housing industry, the recovery has started. The debate is about the strength of the recovery, not whether there is a recovery (I think housing will remain sluggish for some time, and I expect 2012 to be another weak year, but better than 2011)."I've received several questions about this. We could look at several measures: construction employment is up about 100 thousand payroll jobs from the bottom, housing starts are up 36% from the bottom (thanks to multi-family), and residential investment has been adding to GDP for three consecutive quarters (probably four consecutive quarters once Q1 2012 GDP is released next week).

What is residential investment? According to the Bureau of Economic Analysis residential investment (RI) is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales.

Here is a graph of the contribution of RI to the percent change in GDP since 2004:

Note that RI made a large negative contribution in every quarter in 2006, 2007 and 2008. In 2009 and 2010, RI was impacted by the housing tax credit, but otherwise RI was still mostly negative.

Starting in Q2 2011, RI started making a small positive contribution to the change in GDP. This was an important change (something I mentioned at the beginning of 2011.)

I expect RI to make further positive contributions to GDP growth in 2012, and not just from multi-family and home improvement. I also expect single family investment to increase from the very low rate in 2011.

Here is an article that mentions a little new single family construction, from Diana Olick at CNBC: Phoenix's Hard-Hit Housing Starts to Rise From Ashes

Mike Ripson hasn't built a home in three years, but he is about to. He has been sitting on one hundred sixty acres of land just outside Phoenix, Arizona, which he intends to divide into 121 one-acre lots.This is just a few homes and doesn't suggest a surge in new home sales. But I expect some increase this year from 2011, and yes, the housing recovery has started (note: this isn't a comment about home builders, just about the turn in residential investment - a positive for the economy).

"Now's the time because we've been studying the marketplace, and we noticed beginning late last summer, early fall, that for homes priced less than $100,000, the market was becoming very tight," says Ripson, whose company is celebrating its ten year anniversary this week.

"Over the last several months that price point has increased such that today, homes priced less than 300,000 dollars, there's less than a thirty-day supply in the marketplace," Ripson adds.

"To give you an example, within a five mile radius of where we sit here at Sonoran Acres, two months ago there were 18 homes on the market. Today there's only one," says Ripson.

That's why he re-opened his model home two weeks ago, and immediately saw high buyer traffic. He filed permits for two new homes, which he expects to sell in the next few weeks, thanks to his low, $200,000 price point.

State Unemployment Rates decline in 30 states in March

by Calculated Risk on 4/20/2012 10:30:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in March. Thirty states recorded unemployment rate decreases, 8 states posted rate increases, and 12 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today. Forty-nine states and the District of Columbia registered unemployment rate decreases from a year earlier, while New York experienced an increase.

...

Nevada continued to record the highest unemployment rate among the states, 12.0 percent in March. Rhode Island and California posted the next highest rates, 11.1 and 11.0 percent, respectively. North Dakota again registered the lowest jobless rate, 3.0 percent, followed by Nebraska, 4.0 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Every state has some blue - indicating no state is currently at the maximum during the recession.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. This is the fewest since January 2009. In early 2010, 18 states and D.C. had double digit unemployment rates.

Spanish 10 year bond yields near 6%

by Calculated Risk on 4/20/2012 08:53:00 AM

From Dow Jones: Italian, Spanish Bonds Suffer As Crisis Fears Mount

Italian and Spanish government bond prices continued to fall early Friday after Thursday's Spanish bond auction failed to inspire renewed confidence in peripheral markets, while French bonds also suffered ahead of Sunday's presidential election. ... Italian 10-year bond yields climbed 10 basis points to 5.68%, while Spanish yields were up 10 basis points at 5.97%, according to Tradeweb. German 10-year bund yields were at 1.61%, having briefly hit a record low of just below 1.6%, while French 10-year yields climbed four basis points to 3.11%.Here are the Spanish and Italian 10-year yields from Bloomberg. Both are still well below the highs of last November. Both the election in France, and the election in Greece scheduled for May 6th, are making investors uneasy. Sarkozy will probably lose in a runoff, and the smaller parties in Greece will probably do very well. At some point current policies will not survive at the ballot box.

Thursday, April 19, 2012

State and Local Government Payroll Employment Stabilizing?

by Calculated Risk on 4/19/2012 08:50:00 PM

A few months ago I wrote:

It is looking like there will be less drag from state and local governments in 2012, and that most of the drag will be over by the end of Q2 (end of FY 2012). This doesn't mean state and local government will add to GDP in the 2nd half of 2012, just that the drag on GDP and employment will probably end. Just getting rid of the drag will help.It is time for an update - it is early in the year, but it is possible the employment drag from state and local governments has already ended. In fact, state and local government have added 14 thousand jobs since December.

Click on graph for larger image.

Click on graph for larger image.This graph shows total state and government payroll employment since January 2007. Note: Some of the stimulus spending from the American Recovery and Reinvestment Act probably kept state and local employment from declining faster in 2009.

Of course the Federal government is still losing workers (53,000 over the last year), but it looks like state and local government employment is stabilizing.