by Calculated Risk on 4/24/2012 09:00:00 AM

Tuesday, April 24, 2012

Case Shiller: House Prices fall to new post-bubble lows in February NSA

S&P/Case-Shiller released the monthly Home Price Indices for February (a 3 month average of December, January and February).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Nine Cities and Both Composites Hit New Lows in February 2012 According to the S&P/Case-Shiller Home Price Indices

Data through February 2012, released today by S&P Indices for its S&P/Case-Shiller Home Price Indices ... showed annual declines of 3.6% and 3.5% for the 10- and 20-City Composites, respectively. This is an improvement over the annual rates posted for the month of January, -4.1% and -3.9%, respectively. ... Nine MSAs and both Composites posted new cycle lows as of February 2012.

...

“While there might be pieces of good news in this report, such as some improvement in many annual rates of return, February 2012 data confirm that, broadly-speaking, home prices continued to decline in the early months of the year,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “Nine MSAs -- Atlanta, Charlotte, Chicago, Cleveland, Las Vegas, New York, Portland, Seattle and Tampa -- and both Composites hit new post-crisis lows. Atlanta continued its downward spiral, posting its lowest annual rate of decline in the 20-year history of the index at -17.3%. The 10-City Composite declined 3.6% and the 20-City was down 3.5% compared to February 2011.

Click on graph for larger image.

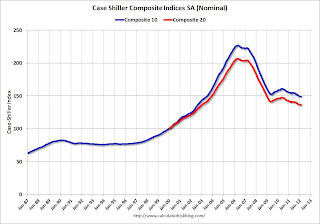

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 34.2% from the peak, and up 0.2% in February (SA). The Composite 10 is at a new post bubble low Not Seasonally Adjusted.

The Composite 20 index is off 33.9% from the peak, and up 0.1% (SA) from January. The Composite 20 is also at a new post-bubble low NSA.

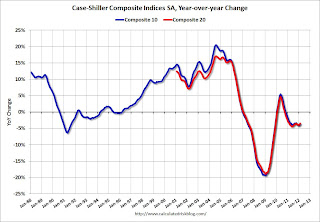

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.6% compared to February 2011.

The Composite 20 SA is down 3.4% compared to February 2011. This was a smaller year-over-year decline for both indexes than in January.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 12 of the 20 Case-Shiller cities in February seasonally adjusted (only 3 cities increased NSA). Prices in Las Vegas are off 61.7% from the peak, and prices in Dallas only off 8.2% from the peak.

Prices increased (SA) in 12 of the 20 Case-Shiller cities in February seasonally adjusted (only 3 cities increased NSA). Prices in Las Vegas are off 61.7% from the peak, and prices in Dallas only off 8.2% from the peak.The NSA indexes are at new post-bubble lows - and the NSA indexes will continue to decline in March (this report was for the three months ending in February). I'll have more on prices later

Monday, April 23, 2012

Two Convicted of Mortgage Fraud in San Diego

by Calculated Risk on 4/23/2012 07:53:00 PM

These people didn't think they'd get caught? And how did they earn $350,000 in fees on $8 million in loans? That sure seems excessive.

From Eric Wolff at the North County Times: Carlsbad mother and Orange County son convicted in $8 million mortgage fraud

A jury convicted a Carlsbad mother and her Orange County son of an $8 million mortgage fraud scheme, the U.S. Attorney for Southern California said Wednesday.Now they will get free rent at the Big House.

Stephen Chrysler, an Orange County attorney and loan broker, and his mother, Aida Agusti Castro, a Carlsbad real estate agent living in Cardiff, inflated clients incomes on loan mortgages to buy 16 properties in Escondido, Oceanside, San Marcos, Lakeside and Menifee over 25 months from 2005 to 2007 to create false loans, which in turn netted the pair $350,000 in fees.

...

Castro and Chrysler located their clients through advertising in Spanish-language publications. They then inflated their clients' incomes so the clients could purchase more expensive houses, which in turn inflated Castro and Chrysler's fees. In order to persuade lenders, the pair had to fake businesses, management companies, tenants and rental histories.

...

The pair then told clients to sign the loan documents without reading them, and they often refused to translate the documents from English to Spanish.

Lawler: Early Builder Reports Point to “Pretty Decent” Spring Selling Season, Contest Questions

by Calculated Risk on 4/23/2012 02:47:00 PM

From economist Tom Lawler:

NVR Inc, the fourth largest US home builder in 2010, reported last week that net home orders in the quarter ended March 31, 2012 totaled 3,157, up 31.4% from the comparable quarter of 2011. The company’s sales cancellation rate, expressed as a % of gross orders, was 10.3% last quarter, down form 12.3% a year ago. Home closings totaled 1,924 last quarter, up 17.7% from the comparable quarter of last year, while the company’s order backlog on 3/31/12 was 4,909, up 33.2% from last March.

D.R. Horton, the largest home builder in the US, reported today that net home orders in the quarter ended March 31, 2012 totaled 5,899, up 19.3% from the comparable quarter of 2011. The company’s sales cancellation rate, expressed as a % of gross orders, was 22% last quarter, down from 25% a year ago. Home closings totaled 4,240, up 20.6% from the comparable quarter of last year, while the company’s order backlog on 3/31/12 was 6,189, up 17.2% from a year ago.

Chairman of the Board Don Horton noted that the company’s strong sales pace had “continued through the first of April.”

There are been few scattered reports from other, smaller home builders that the current spring selling season has been significantly better than last year, The Ryland Group, PulteGroup, Meritage Homes, and M/I Homes report earnings and operating results for the quarter ended 3/31/12 on April 26.

The Commerce Department’s February report on new SF homes showed YTD new SF home sales (not seasonally adjusted) up by just 8.2% from the comparable period of 2011. The March new SF home sales report is due out tomorrow. While correlations between builder reports and Census new SF sales are not that strong, right now I’d guess that there is significant “upside surprise” to tomorrow.

| Settlements | Net Orders | Backlog | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 3/2012 | 3/2011 | 3/2010 | 3/2012 | 3/2011 | 3/2010 | 3/2012 | 3/2011 | 3/2010 | |

| D.R. Horton | 4,240 | 3,516 | 4,260 | 5,899 | 4,943 | 6,438 | 6,189 | 5,281 | 6,314 |

| NVR | 1,924 | 1,634 | 1,919 | 3,157 | 2,403 | 2,940 | 4,909 | 3,685 | 4,552 |

| Combined | 6,164 | 5,150 | 6,179 | 9,056 | 7,346 | 9,378 | 11,098 | 8,966 | 10,866 |

| YOY % Chg | 19.7% | -16.7% | 23.3% | -21.7% | 23.8% | -17.5% | |||

CR Note: There has probably been some shift to the larger builders, and that would suggest the Census reported increase in new home sales would be lower than the large builders report. The March New Home sales reported is scheduled to be released at 10 AM tomorrow, and the consensus is for an increase in sales to 318 thousand Seasonally Adjusted Annual Rate (SAAR) in March from 313 thousand in February.

For those playing the prediction contest:

DOT: Vehicle Miles Driven increased 1.8% in February

by Calculated Risk on 4/23/2012 01:50:00 PM

The Department of Transportation (DOT) reported:

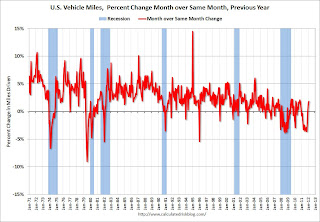

Travel on all roads and streets changed by +1.8% (3.9 billion vehicle miles) for February 2012 as compared with February 2011. Travel for the month is estimated to be 216.1 billion vehicle miles..The following graph shows the rolling 12 month total vehicle miles driven.

Even with the year-over-year increase in February, the rolling 12 month total is mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 51 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

This is the third consecutive month with a year-over-year increase in miles driven - for the first time since 2010.

This is the third consecutive month with a year-over-year increase in miles driven - for the first time since 2010.Even though gasoline prices are up sharply over the last few of months, prices also increased quickly last year in March and April - so we might not see a year-over-year decline in miles driven in the coming months.

The lack of growth in miles driven over the last 4+ years is probably due to a combination of factors: the great recession and the lingering effects, the high price of gasoline - and the aging of the overall population. HS Dent has a graph of gasoline demand by age (see page 13 of Age of Consumer demand curves based on Census Bureau data) (ht Doug Short) - so this is probably, at least partially, another impact from the aging of the baby boomers (ht Brian).

FNC: February Residential Property Values Down 0.8%

by Calculated Risk on 4/23/2012 11:08:00 AM

In addition to Case-Shiller, CoreLogic, and LPS, I'm also watching the FNC, Zillow and RadarLogic indexes.

From FNC: February Residential Property Values Down 0.8%

FNC’s latest Residential Price Index™ (RPI), released Friday, indicates that U.S. residential property values continued to show signs of persistent weakening - ending in February with a seventh consecutive month-to-month decline. Despite sharply rising activities in existing home sales and new housing starts from a year ago, prices on non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales) continue to slide, down 0.8% from February or 3.0% from a year ago.

...

All three RPI composites (the National, 30-MSA, and 10-MSA indices) show similar month-to-month declines in February, down about a percentage point from January. ... The indices’ year-to-year trends continue to show signs of improvement. According to the national RPI, home prices nationwide declined at a seasonally adjusted rate of 3.0% in February, the slowest pace in the last 20 months. The year-to-year declines at the nation’s top housing markets, as indicated by the 30- and 10-MSA composites, have also decelerated to below 4.0% -- their slowest pace since May 2010.

Click on graph for larger image.

Click on graph for larger image.This graph is based on the FNC index (four composites) through February 2012. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

The indexes are generally showing less of a year-over-year decline in February (I think prices will fall seasonally through the March report). This is the smallest year-over-year decline in the FNC index since the housing tax credit expired.

The February Case-Shiller index will be released tomorrow, and the consensus is for a 3.3% decrease in year-over-year prices (NSA) in February. (Zillow is forecasting that Case-Shiller will report a 3.5% decline for the Composite 10 index, and a 3.4% decline for the Composite 20).

Eurozone Worries Again

by Calculated Risk on 4/23/2012 08:54:00 AM

A few stories:

From the Financial Times: Eurozone angst spooks investors

Markets reacted nervously on Monday to the socialists’ first-round victory in France’s presidential election, as the eurozone crisis claimed another victim on Monday with the collapse of the Dutch government.From the WSJ: Euro-Zone's Private Sector Shrinking Fast

excerpt with permission

The euro zone's private sector contracted in April at the sharpest pace since November, damaged by a steep decline in the manufacturing sector, suggesting the region won't rebound quickly from the recession recent data are pointing to.From the WSJ: Spain's Economy Dwindling

The preliminary composite PMI for the euro zone slumped to 47.4 in April from March's 49.1, Markit's preliminary purchasing managers' index showed Monday. The April manufacturing PMI slipped to 46 from March's 47.7 while the services PMI also declined to 47.9 from 49.2 over the same period ...

Spain's central bank said Monday that the country's economy contracted 0.4% in the first quarter from the fourth, evidence that a worsening downturn is making it tougher for Madrid to reach ambitious austerity targets.

On an annual basis, the economy contracted 0.5%, the first negative reading after seven-consecutive quarters of modest growth, the Bank of Spain said in its monthly economic report. This marks the official end of a mild recovery between late 2010 and late 2011 ...

Sunday, April 22, 2012

Sunday Night Futures

by Calculated Risk on 4/22/2012 11:30:00 PM

From the NY Times: Hollande and Sarkozy Head to Runoff in French Race

The Socialist candidate, François Hollande, won a narrow victory in Sunday’s first round of France’s presidential elections, riding promises of economic growth and a general dislike for the incumbent, Nicolas Sarkozy, into a favorable position before a runoff with Mr. Sarkozy on May 6.It sounds link Hollande is leading right now. The election in Greece is also scheduled for May 6th.

The strong showing by the left and anger on the political extremes seemed to reflect a desire for change in France after 17 years of centrist, conservative presidents. And it could continue an anti-incumbency trend that began with the economic crisis in Western Europe, where center-right governments dominate from Britain to Spain to Germany.

It may also represent the first stirrings of a challenge to the German-dominated narrative of the euro crisis, which holds that public debt and runaway spending are the main culprits and that austerity must precede growth.

The Asian markets are mostly red tonight. The Nikkei is down about 0.3%, but the Shanghai Composite is up 0.5%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are down slightly, and Dow futures are down 20.

Oil: WTI futures are down to $103.81 (this is down from $109.77 in February) and Brent is up to $118.79 per barrel.

Earlier:

• Summary for Week Ending April 20th

• Schedule for Week of April 22nd

• FOMC Meeting Preview

From the WSJ: Hilsenrath's FOMC Preview

by Calculated Risk on 4/22/2012 07:58:00 PM

This is very similar to my FOMC Meeting Preview this morning.

From Jon Hilsenrath at the WSJ: A Forecast of What the Fed Will Do: Stand Pat

The changing forecast will be one of the most important topics of discussion at the central bank's policy meeting Tuesday and Wednesday, when officials will update their quarterly economic projections.Also on "QE", Paul Krugman has two short comments: What We Talk About When We Talk About QE and QE Or Not QE, That Is The Question. I frequently point out in the comments that the Fed is buying agency MBS, not private label garbage. Apparently there is widespread misunderstanding on this point. Krugman writes:

...

The new forecasts could project a little more inflation in 2012 than the Fed forecast in January, thanks in part to a recent rise in gasoline prices. It could also project a little less unemployment for 2012, thanks to recent declines in the jobless rate.

...

But the overall growth outlook for 2012 doesn't seem to have changed much from a few months ago.

...

Against the backdrop of a little more inflation and a little less unemployment than expected in the short-run, a scattering of officials might say that short-term interest rates should go up sooner than they projected in January to forestall a run-up in consumer prices.

...

But with many officials still doubtful about the durability of the recovery and expecting inflation to recede, the broader view at the Fed seems likely to favor sticking to their plan to keep rates low until late 2014.

Reading a few comments, I think it’s really important to emphasize that the Fed is only buying agency mortgage-backed securities — that is, the stuff that already has an implicit Federal guarantee. A lot of readers seem to think that the Fed is buying subprime MBS or something like that, handing over money for worthless paper. Not so.Earlier:

• Summary for Week Ending April 20th

• Schedule for Week of April 22nd

Housing Survey: Fewer "low ball" Offers in 2012

by Calculated Risk on 4/22/2012 03:23:00 PM

From Kenneth Harney at the WaPo: Low-ball bidders in many markets learn they can no longer get a steal on a house

A year ago, according to researchers at the National Association of Realtors, one out of 10 members surveyed in a monthly poll complained about low-ball offers on houses listed for sale. In the latest survey — conducted in March among 4,500 agents and brokers across the country but not yet released — there were hardly any. Instead, the focus of volunteered comments has shifted to declining inventory levels — fewer houses available to sell — and multiple offers on well-priced listings.Harney concludes that low ball offers might have worked in 2008 through 2011, but this is 2012.

A low-ball offer typically involves a contract submitted to a seller where the price proposed by the purchaser is 25 percent or more below list. ...

... in local markets where inventories are tight and competition for homes rising, realty agents say that buyers looking to steal houses by low-balling their offers are ending up at the back of the line, their contracts either rejected out of hand or countered close to the original asking price.

Earlier:

• Summary for Week Ending April 20th

• Schedule for Week of April 22nd

• FOMC Meeting Preview

FOMC Meeting Preview

by Calculated Risk on 4/22/2012 11:36:00 AM

There will be a two day meeting of the Federal Open Market Committee (FOMC) this coming Tuesday and Wednesday. I expect no changes to the Fed Funds rate, or to the program to "extend the average maturity of its holdings of securities" (scheduled to end in June), or to the program to "reinvest principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities". I don't expect further accommodation (aka "QE3") to be announced at this meeting.

On Wednesday the FOMC statement will be released around 12:30 PM ET, the FOMC projections will be released at 2:00 PM, and Fed Chairman Ben Bernanke will hold a quarterly press briefing at 2:15 PM.

A few things to look for:

1) FOMC participants' projections of the appropriate target federal funds rate. This will be the second quarterly release of the participants' view of the appropriate path for the Fed funds rate. I've included the charts from the January FOMC meeting below. It is unlikely that there will be any significant change in views, but there might be some slight shift in when some participants think the Fed should start raising the Fed funds rate.

"The shaded bars represent the number of FOMC participants who project that the initial increase in the target federal funds rate (from its current range of 0 to ¼ percent) would appropriately occur in the specified calendar year."

The April chart will be compared to the January chart for any shift in views, but the changes will probably be minor.

Most participants will probably still think the Fed Funds rate will be in the current range into 2014.

2) Fed Chairman Press Briefing. At the press briefing, Chairman Bernanke will discuss the new FOMC forecasts including the two charts on the Fed funds rate. Growth forecasts were routinely revised down last year, but it appears that GDP forecasts will remain mostly unchanged this quarter. However the unemployment rate for 2012 will probably be revised down given that the March unemployment rate was already at the lower range of the FOMC's Q4 2012 forecast. The inflation forecast might be revised up slightly.

One again Bernanke will be asked about the possibility of a large scale MBS purchase program (QE3), and I expect he will leave the door open for further accomodation based on incoming data.

Here are the updated forecasts from the January meeting (including the November forecasts to show the change). The GDP projection for 2012 will probably be mostly unchanged.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| January 2012 Projections | 2.2 to 2.7 | 2.8 to 3.2 | 3.3 to 4.0 |

| November 2011 Projections | 2.5 to 2.9 | 3.0 to 3.5 | 3.0 to 3.9 |

The unemployment rate declined to 8.2% in March, and the projection for 2012 will probably be revised down.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| January 2012 Projections | 8.2 to 8.5 | 7.4 to 8.1 | 6.7 to 7.6 |

| November 2011 Projections | 8.5 to 8.7 | 7.8 to 8.2 | 6.8 to 7.7 |

The forecasts for overall and core inflation will probably be revised up slightly or left unchanged.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2012 | 2013 | 2014 |

| January 2012 Projections | 1.4 to 1.8 | 1.4 to 2.0 | 1.6 to 2.0 |

| November 2011 Projections | 1.4 to 2.0 | 1.5 to 2.0 | 1.5 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2012 | 2013 | 2014 |

| January 2012 Projections | 1.5 to 1.8 | 1.5 to 2.0 | 1.6 to 2.0 |

| November 2011 Projections | 1.5 to 2.0 | 1.4 to 1.9 | 1.5 to 2.0 |

3) Possible Statement Changes. The FOMC met last month, and the economic data has been a little weaker since the March meeting - so the statement will probably be slightly more downbeat than the March statement.

As an example, the first two sentences in March might be changed slightly. From the March statement:

Information received since the Federal Open Market Committee met in January suggests that the economy has been expanding moderately. Labor market conditions have improved further; the unemployment rate has declined notably in recent months but remains elevated.Perhaps "moderately" will be changed to "at a modest to moderate pace" as described in the recent Beige Book. And improvements in labor conditions have slowed. The phrase "prices of crude oil and gasoline have increased lately" could be removed, or altered to reflect that prices have been mostly stable since the March meeting.

Given the recent developments in Europe, investors will probably focus on any change to this sentence in the second paragraph: "Strains in global financial markets have eased, though they continue to pose significant downside risks to the economic outlook."

The sentence "The Committee ... currently anticipates that economic conditions ... are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014" seems redundant given the FOMC Fed Funds rate projections, but might remain in the statement to make it clear there is no change to policy.

I expect the focus will once again be on the press briefing and the FOMC forecasts.

Yesterday:

• Summary for Week Ending April 20th

• Schedule for Week of April 22nd