by Calculated Risk on 5/12/2012 08:01:00 AM

Saturday, May 12, 2012

Summary for Week of May 11th

The key stories for the week were the elections in France and Greece, and JPMorgan’s $2 billion trading loss on a synthetic credit position. JPMorgan CEO Jamie Dimon said the losses were due to “egregious mistakes”, “sloppiness" and that the "portfolio still has risk”. This doesn’t appear to be a systemic risk, just poor risk management at JPMorgan.

The Greek political situation is unsettled, and the Europeans have said they support Greece through the next election on June 17th. After that … who knows? There is a strong possibility that Greece will leave the euro not long after the next election.

This was a light week for US economic data. The trade deficit was a little higher than expected, but most of the data improved slightly. The 4-week average of initial weekly unemployment claims declined, small business confidence improved, and consumer sentiment improved, and there were more job openings in March.

In an under reported story, both Fannie and Freddie reported improved performance due to “stabilization of house prices” in certain areas. The sharp decline in "for sale" inventory appears to be supporting house prices, and inventory and house prices continue to be key stories for 2012.

Here is a summary in graphs:

• Trade Deficit increased in March to $51.8 Billion

The trade deficit was above the consensus forecast of $49.5 billion.

The trade deficit was above the consensus forecast of $49.5 billion.

The first graph shows the monthly U.S. exports and imports in dollars through March 2012.

Exports increased in March, and are at record levels. Imports increased even more. Exports are 13% above the pre-recession peak and up 7% compared to March 2011; imports are 3% above the pre-recession peak, and up about 8% compared to March 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through March.

The second graph shows the U.S. trade deficit, with and without petroleum, through March.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

Oil averaged $107.95 per barrel in March, up from $103.63 in February. Import oil prices were probably a little higher in April too, but will probably decline in May. The increase in imports was a combination of more petroleum imports and more imports from China.

• BLS: Job Openings increased in March

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in March to 3.737 million, up from 3.565 million in February. The number of job openings (yellow) has generally been trending up, and openings are up about 17% year-over-year compared to March 2011. This is the highest level for job openings since July 2008.

Quits increased in March, and quits are now up about 8.5% year-over-year and quits are now at the highest level since 2008. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

• REO Inventory for Fannie, Freddie and the FHA

This graph shows the combined REO inventory for Fannie, Freddie and the FHA (FHA through Feb 2012).

This graph shows the combined REO inventory for Fannie, Freddie and the FHA (FHA through Feb 2012).The combined REO inventory is down to 203 thousand in Q1 2012, down about 18% from Q1 2011.

The pace of REO acquisitions will probably increase following the mortgage servicer settlement (signed off on April 5th); and dispositions will probably increase too.

• CoreLogic: House Price Index increases in March, Down 0.6% Year-over-year

From CoreLogic: CoreLogic® March Home Price Index Shows Slight Year-Over-Year Decrease of Less Than One Percent

From CoreLogic: CoreLogic® March Home Price Index Shows Slight Year-Over-Year Decrease of Less Than One Percent[CoreLogic March Home Price Index (HPI®) report] shows that nationally home prices, including distressed sales, declined on a year-over-year basis by 0.6 percent in March 2012 compared to March 2011. On a month-over-month basis, home prices, including distressed sales, increased by 0.6 percent in March 2012 compared to February 2012, the first month-over-month increase since July 2011.This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.6% in March, and is down 0.6% over the last year.

The index is off 34% from the peak - and is just above the post-bubble low set last month.

• Weekly Initial Unemployment Claims at 367,000

Here is a long term graph of weekly claims:

Here is a long term graph of weekly claims:The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 379,000.

This decline in the 4-week moving average followed for four consecutive increases.

This was close to the consensus of 366,000. This is two consecutive weeks with initial unemployment claims in the 360s, after averaging close to 390,000 over the previous 3 weeks.

• NFIB: Small Business Optimism Index increases in April

This graph shows the small business optimism index since 1986. The index increased to 94.5 in April from 92.5 in March. This ties February 2011 as the highest level since December 2007.

This graph shows the small business optimism index since 1986. The index increased to 94.5 in April from 92.5 in March. This ties February 2011 as the highest level since December 2007.Another positive sign is that the "single most important problem" was not "poor sales" in April - for the first time in years. In the best of times, small business owners complain about taxes and regulations, and that is starting to happen again.

This index remains low, but as housing continues to recover, I expect this index to increase (there is a high concentration of real estate related companies in this index).

• Consumer Sentiment increases in May to 77.8

The preliminary Reuters / University of Michigan consumer sentiment index for May increased to 77.8, up from the April reading of 76.4.

The preliminary Reuters / University of Michigan consumer sentiment index for May increased to 77.8, up from the April reading of 76.4.This was above the consensus forecast of 76.2 and the highest level since January 2008. Overall sentiment is still fairly weak - probably due to a combination of the high unemployment rate, high gasoline prices and the sluggish economy.

• Other Economic Stories ...

• LPS: House Price Index increased 0.2% in February

• Lawler: Table of Short Sales and Foreclosures for Selected Cities

• Sacramento: Percentage of Distressed House Sales increases slightly in April

• Lawler: REO inventory of "the F's" and PLS

• Fannie Mae reports $2.7 billion in income, REO inventory declines in Q1 2012

• The economic impact of stabilizing house prices?

• The Declining Participation Rate

• Housing: Inventory declines 21% year-over-year in early May

Friday, May 11, 2012

Bookies stop taking bets on Greece leaving the euro

by Calculated Risk on 5/11/2012 07:38:00 PM

Something for a Friday evening ...

From the Athens News: No more bets for Greek euro exit

Want a flutter on Greece leaving the euro zone? It may already be too late. A surge in bets has forced Britain's biggest bookmakers William Hill Plc and Ladbrokes Plc to suspend betting on the odds of Greece dropping out.Maybe they could take bets on when Greece will leave the euro. The Europeans have said they support Greece through the next election (June 17th) ... after that ... who knows?

...

William Hill said the level of betting on Greece quitting first was such that it had become too risky to continue taking bets ...

"We've had Greece as hot favourites for some time but increasingly it was becoming the only one that people wanted to bet on," said a spokesman for William Hill, Britain's largest betting firm.

"It wasn't a healthy situation for bookmakers. We found it was virtually impossible to make a book."

Britain's second-biggest betting firm Ladbrokes said it had suspended betting on Greece dropping out of the euro zone by the end of the year, after repeatedly slashing the odds.

"It is safer for us to suspend betting than to keep cutting the odds," a spokesman for Ladbrokes said. "We have been slashing the odds repeatedly over the last few days."

Lawler: Fannie SF REO Inventory: Total vs. “Listed/Available for Sale”

by Calculated Risk on 5/11/2012 02:03:00 PM

From economist Tom Lawler:

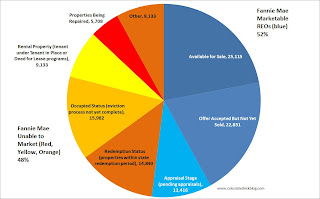

In its latest 10-Q filing Fannie Mae showed the distribution of the “status” of its SF REO inventory, including the % it was unable to “market” for various reasons. (Fannie’s SF REO inventory as of 3/31/2012 totaled 114,157 properties, down 25.5% from last March).

Of Fannie’s 114,157 SF REO properties, almost half – 54,795 – were characterized as being “unable to market” (meaning can’t be listed for sale). Another 11,416 were not yet “listed” or “available” for sale because the properties were still being appraised (so that a list price can be determined). That left just 47,946 properties that were available for sale (listed), of which 22,831 already had a purchase offer accepted but which had not yet closed escrow.

Every so often some “quack” writes a piece saying that “lots” of GSE REOs aren’t listed for sale, “proving” that the GSEs are “holding properties off the market.”

Hopefully disclosure such as these will make such quacks “duck” for cover.

Click on graph for larger image.

Click on graph for larger image.

CR Note: The Fannie table is below. Here is a pie chart showing the distribution of REO.

The "blue" categories are "marketable" (and many are in escrow).

The "orange, yellow, red" categories are not currently marketable. Some are within the state redemption period, some are rented, some are in the eviction process, some are being repaired ...

NOTE: Table below has a sub-total for "unable to market" that includes the categories below it:

| Fannie Mae SF REO Inventory by "Status," March 31, 2012 | ||

|---|---|---|

| Percent | Number (derived for categories) | |

| Available for Sale | 22% | 25,115 |

| Offer Accepted But Not Yet Sold | 20% | 22,831 |

| Appraisal Stage (pending appraisals) | 10% | 11,416 |

| Unable to Market: | 48% | 54,795 |

| Redemption Status (properties within state redemption period) | 13% | 14,840 |

| Occupied Status (eviction process not yet complete) | 14% | 15,982 |

| Rental Property (tenant under Tenant in Place or Deed for Lease programs) | 8% | 9,133 |

| Properties Being Repaired | 5% | 5,708 |

| Other | 8% | 9,133 |

| Total | 100% | 114,157 |

Las Vegas: Visitor Traffic at New High, Convention Attendance Lags

by Calculated Risk on 5/11/2012 01:01:00 PM

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic has recovered.

From the Las Vegas Sun: Visitor volume continues steady climb, latest numbers show

Las Vegas visitor volume continued to climb in March despite a drop in convention attendance, the Las Vegas Convention and Visitors Authority reported Thursday.

The LVCVA said 3.5 million tourists visited the city in March, a 3.7 percent increase over March 2011. For the first quarter, visitor volume is up 3.6 percent over last year to 9.8 million, just under the pace needed to record an unprecedented 40 million visitors.

Convention attendance was down 3.9 percent to 513,010 ... Convention attendance was down despite a 34.6 percent increase in the number of conferences and meetings held (2,302).

Click on graph for larger image.

Click on graph for larger image. It looks like visitor traffic will set a record this year, but convention attendance is still way below the pre-recession levels. This is probably giving a boost to the hotel and gambling industry.

Consumer Sentiment increases in May to 77.8

by Calculated Risk on 5/11/2012 10:00:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for May increased to 77.8, up from the April reading of 76.4.

This was above the consensus forecast of 76.2 and the highest level since January 2008. Overall sentiment is still fairly weak - probably due to a combination of the high unemployment rate, high gasoline prices and the sluggish economy.

PPI declines 0.2% in April, Core PPI increased 0.2%

by Calculated Risk on 5/11/2012 08:42:00 AM

From the BLS: The Producer Price Index for finished goods falls 0.2% in April; finished core rises 0.2%

The decline in the headline number was mostly due to falling energy prices.

The index for crude energy materials fell 6.8 percent in April. From January to April, prices for crude energy materials dropped 15.1 percent subsequent to a 6.6-percent advance for the 3 months ended in January. Almost three-fourths of the April monthly decline can be traced to the index for crude petroleum, which decreased 7.9 percentHowever, excluding food and energy, core PPI increased 0.2%. We will probably see a slowdown in April CPI too due to declining oil and gasoline prices in April (to be released next week).

Thursday, May 10, 2012

Look Ahead: PPI, Consumer Sentiment

by Calculated Risk on 5/10/2012 09:55:00 PM

There are two minor economic indicators scheduled for release tomorrow.

• The Producer Price Index for April at 8:30 AM ET. The consensus is for no change in producer prices (0.2% increase in core).

• And at 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index is scheduled (preliminary for May). The consensus is for sentiment to decline to 76.2 from 76.4 in April.

Here are a couple of other sources for consumer confidence, with opposite readings. First from Gallup: U.S. Economic Confidence Steady at Relatively Improved Level

U.S. economic confidence for the week ending May 6 is at -18, up slightly from the previous week and slightly better than the -20 average for the month of April.And from IBD: U.S. Consumer Confidence Weakens in May

The IBD/TIPP Economic Optimism Index declined by 0.8 points, or 1.6%, in May posting 48.5 vs. 49.3 in April.• Of course the big stories tomorrow will be JPMorgan's $2 billion blunder, and the ongoing tragedy in Greece and Europe. It seems very likely that there will be another election in Greece on June 17th, from the Athens News:

Euro zone countries are prepared to keep financing Greece until the country forms a new government, whether one emerges from Sunday's election or if new elections have to be held next month, euro zone officials said on Thursday. "I expect an announcement of new elections in Greece by Sunday at the latest," one euro zone official said. "My understanding is that a second election in Greece could be by mid-June. We have the means to support Greece through the end of June," a second euro zone official said.

"We will provide enough funds for Greece to stay afloat for as long as the political decision is clarified," the first euro zone official said.

"There is no use letting them default in the middle of things. That is what yesterday was all about - giving them enough money to stay afloat and not induce new chaos if people are not paid, but not giving them more than the bare minimum to discourage parties which say that 'we can do whatever we want and they will still save us because it is in the EU's interest.'"

LPS: House Price Index increased 0.2% in February

by Calculated Risk on 5/10/2012 08:21:00 PM

Note: The timing of different house prices indexes can be a little confusing. LPS uses February closings only (not an average) and this tends to be closer to what other indexes report for March. The LPS index is seasonally adjusted.

From LPS: LPS Home Price Index Shows U.S. Home Price Increase of 0.2 Percent in February; Early Data Suggests Further Increase of 0.3 Percent is Likely During March

The updated LPS HPI national home price for transactions during February 2012 increased 0.2 percent to a level on par with those seen in June 2003 ...

"Our HPI shows an increase in seasonally adjusted prices this month for the first time since March 2010, and for only the third time in five years,” said Raj Dosaj, vice president of LPS Applied Analytics. “There have been signs of price declines slowing for a few months now, and our estimates for next month are flat to slightly positive. Without a pickup in sales volumes from their current anemic levels, it’s hard to be more optimistic that the market may be nearing the end of its fall.

“Reasons for caution are clear, as we’ve been here before. Non-seasonally adjusted prices increased for a few months in early 2009, 2010 and 2011 – trends that all ended by summer, after which all the gains – and then some – were lost. As is true this month, those temporary increases were on low sales volumes – about 30 percent lower than at any point since 1998. Furthermore, the inventory of distressed homes remains high, which will continue to put a drag on prices.”

Click on graph for larger image.

Click on graph for larger image. From LPS:

During the period of most rapid price declines, from April 2007 through April 2009, the LPS HPI national home price fell at an average annual rate of 9.3 percent. ... The slowest declining trend lasted from about April 2009 to April 2010, dates which are marked in Figure 1. ... The expiration of the first-time buyers’ tax incentive in April 2010 marks the start of a steadier decline in house prices. Figure 1 shows the trends for the three different post-bubble intervals.

JPM: $2 billion trading loss on synthetic credit position

by Calculated Risk on 5/10/2012 05:19:00 PM

At a special conference call, from the WSJ: J.P. Morgan To Host Surprise Conference Call. A few excerpts:

J.P. Morgan is now forecasting an $800 million loss in the corporate segment in the second quarter.

Dimon says the strategy was "Flawed complex poorly reviewed poorly executed and poorly monitored."

These were egregious mistakes, they were self-inflicted."- Dimon

Other headlines: "Obviously there was sloppiness" "Portofolio still has risk"

Lawler: Table of Short Sales and Foreclosures for Selected Cities

by Calculated Risk on 5/10/2012 04:44:00 PM

CR Note: Earlier I posted some distressed sales data for Sacramento. I'm following the Sacramento market to see the change in mix over time (short sales, foreclosure, conventional). Economist Tom Lawler sent me the following table for several other distressed areas. For all of the areas, the share of distressed sales is down from April 2011, the share of short sales has increased and the share of foreclosure sales are down - and down significantly in some areas.

Economist Tom Lawler wrote today: "Note that there are BIG declines in the foreclosure share of resales this April vs. last April, reflecting sharply lower REO inventories."

Tom has been looking at the incoming data from various areas of the country, and wrote today: "There seems little doubt that the NAR’s median existing SF home sales price for April will show a good-sized YOY increase, probably over 5%." In March, the NAR reported median prices were up 2.5% year-over-year.

Of course the median price is impacted by the mix, and some of the increase in the median price is probably due to fewer foreclosure sales at the low end.

Note: The table is as a percentage of total sales. Note that the percent of short sales has been increasing, and the percent of foreclosure sales has been declining - and the percent of total distressed sales has been declining too (but is still very high).

In four of the six cities, there are now more short sales than foreclosure sales!

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Apr | 11-Apr | 12-Apr | 11-Apr | 12-Apr | 11-Apr | |

| Las Vegas | 29.9% | 23.8% | 36.9% | 46.3% | 66.8% | 70.1% |

| Reno | 32.0% | 31.0% | 26.0% | 38.0% | 58.0% | 69.0% |

| Phoenix | 25.2% | 19.7% | 18.8% | 44.5% | 44.0% | 64.2% |

| Minneapolis | 10.9% | 10.0% | 32.0% | 43.3% | 42.9% | 53.3% |

| Sacramento | 30.4% | 22.2% | 30.3% | 44.6% | 60.7% | 66.8% |

| Mid-Atlantic (MRIS) | 12.2% | 11.8% | 11.0% | 20.9% | 23.2% | 32.7% |