by Calculated Risk on 5/14/2012 07:09:00 PM

Monday, May 14, 2012

Update on Gasoline Prices: West Coast Refinery Problems

Earlier I noted that gasoline prices will probably follow the price of Brent oil down, but that there were some refinery issues.

Here is a story from the Mercury News last Friday: Rising California gas prices expected to increase even more

Prices could rise an additional 20 cents in the next few days, as refinery problems continue to choke supplies for California's special blend of clean burning gas. On Thursday, many Bay Area stations saw jumps of several cents to a dime.Gasoline prices on the west coast are up about 20 cents this month, and about 10 cents over the last several days. Hopefully this is a short term problem.

"Prepare to get clobbered," said Patrick DeHaan, the senior petroleum analyst with GasBuddy.com.

West Coast gas inventories are at their lowest level in 20 years, he said, and the blame is with production on the West Coast.

"Refineries have been having a lousy spring with not just one massive facility outage," DeHaan said, "but smaller, more widespread issues."

Housing: The Return of Multiple Offers

by Calculated Risk on 5/14/2012 04:34:00 PM

I've mentioned this before, but here are a couple more excerpts from articles ...

From Susan Straight at the WaPo: How to buy a house in D.C.’s sellers’ market

If you’ve dipped a toe into the Washington-area real estate market these days, you know it’s returned to an era of multiple offers, escalation clauses and competitive bidding. According to RealEstate Business Intelligence, the active inventory of homes in March was down more than 25 percent from March 2011.From the Jon Lansner at the O.C. Register: O.C. homes draw multiple-offer ‘avalanche’ (an excerpt from Steve Thomas' report)

...

Sellers are in heaven; buyers are feeling the stress. These days you can go to any open house of a home in good condition in a desirable neighborhood, and you’ll find you’re one of a steady stream of potential buyers.

Below $500,000 range is NUTS. Homes priced at or near their market value are generating an avalanche of multiple offers. A home in this range is placed on the market and, within moments, cars filled with buyers are touring the home. ...The local economies in these two areas are probably better than most of the country, and anything priced right is selling pretty quickly. The key reason for the multiple offers is the sharp decline in inventory.

Upon writing an offer, buyers quickly find that they are one of many, sometimes over ten, offers on the home. Suddenly ... In the end, the seller factors the highest price with the largest down payment. I know, you are thinking, “What about the appraisal?” In many instances, shrewd sellers and Realtors are leveraging the competition to drop the appraisal contingency and require the buyer to make up the difference between the appraisal price and the purchase price, IF there is an appraisal problem. ...

Supply has dropped to levels not seen since June 2005. ... The expected market time for all of Orange County is 1.5 months, or six weeks.

Although this might remind some people of 2005, I think the dynamics are very different. This is only happening in a few parts of the country, the buyers are usually making substantial down payments, and I suspect any clear increase in prices would be met with more supply ("sellers waiting for a better market").

Oil and Gasoline Prices, and the Reversal of Seaway Pipeline

by Calculated Risk on 5/14/2012 12:15:00 PM

Oil prices have fallen sharply, and once again gasoline prices are lagging. But if oil prices stay at this level - or fall further - then gasoline prices should decline further too (there are always some refinery issues).

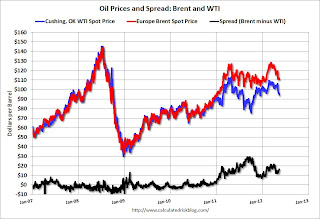

First, gasoline prices tend to track international oil prices, so we need to compare gasoline to Brent oil prices, and not WTI (West Texas Intermediate). A "glut" of oil at Cushing pushed down WTI prices relative to Brent over the last few years, but the spread has narrowed some now that a key pipeline is being reversed.

From Bloomberg: Sweet Crude From Seaway Pipeline Offered in the U.S. Gulf

Low-sulfur oil delivered from the soon-to-be reversed Seaway pipeline is being offered in the U.S. Gulf Coast for June delivery.This following graph shows the prices for Brent and WTI over the last few years.

Enterprise Product Partners LP (EPD) and Enbridge Inc. (ENB) are reversing the pipeline and on May 17 will begin shipping oil from the storage hub at Cushing, Oklahoma, to the Gulf. It is expected to narrow the discount of inland U.S. grades to imports and Gulf Coast production.

The first phase will carry 150,000 barrels a day on the 500-mile (800-kilometer) line, with subsequent phases expanding capacity to 850,000 barrels a day by mid-2014.

Click on graph for larger image.

Click on graph for larger image.The spread narrowed last year with the announcement of the partial reversal of the Seaway pipeline. The spread will probably narrow further as the capacity is expanded.

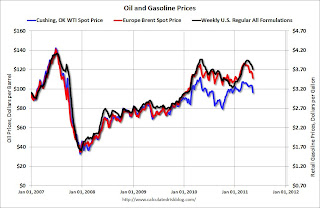

The second graphs shows that gasoline prices track Brent more than WTI.

Before the spread emerged, WTI and Brent tracked closely - and retail gasoline prices tracked pretty closely too.

Before the spread emerged, WTI and Brent tracked closely - and retail gasoline prices tracked pretty closely too.Once the "glut" emerged, gasoline prices tracked Brent oil prices. Brent was as high as $128 per barrel in March, and gasoline prices peaked at $3.94 (weekly basis) in early April.

We will probably see a similar lag this time, with gasoline prices falling to below $3.50 per gallon by early June (if oil prices stay at this level). It wouldn't be a surprise if most of the decline in gasoline prices happened after Memorial Day (May 28th).

And below is a graph of gasoline prices. Gasoline prices have been slowly moving down since peaking in early April. Note: The graph below shows oil prices for WTI; as noted above, gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Spanish and Italian Bond Yields Increase

by Calculated Risk on 5/14/2012 08:54:00 AM

From the WSJ: Global Stocks Hit by Greece Worries

Worries about what a Greek exit would mean for other euro-zone nations with hefty deficits pushed yields on 10-year Spanish government bonds above 6% to the highest levels seen since December.Here are the Spanish and Italian 10-year yields from Bloomberg.

The Spanish yields are at 6.3%, the highest level since last November. Compared to the German yield, Spanish borrowing costs at euro-era high:

Spreads on Spanish 10-year bonds over German Bunds hit a euro-era high of 486 basis points, surpassing the record hit last November. Yields on Spanish benchmark debt reached 6.30 per cent while German 10-year Bunds were at an all-time low of 1.44 per cent.The Italian yields are at 5.74%, the highest level since January.

excerpt with permission

The US 10-year yield is down to 1.78%, close to the record low of 1.7% last September.

Sunday, May 13, 2012

Look Ahead: Sunday Night Futures

by Calculated Risk on 5/13/2012 09:52:00 PM

This will be a busy week, but there are no economic indicators scheduled for release on Monday. The spotlight tomorrow will be on Greece and the Eurogroup meeting.

The Asian markets are mostly green tonight. The Nikkei is up about 0.6%, and the Shanghai Composite is up 0.3% after the People's Bank of China cut reserve requirements on Saturday.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are down slightly, and Dow futures are down 5.

Oil: WTI futures are down to $95.47 (this is down from $109.77 in February) and Brent is down to $111.78 per barrel.

Yesterday:

• Summary for Week Ending May 11th

• Schedule for Week of May 13th

For the monthly economic question contest (for data to be released on Tuesday and Wednesday):

Greek Exit: Looking more likely

by Calculated Risk on 5/13/2012 07:26:00 PM

The Financial Times has an overview of some things that might happen when Greece exits the euro: Eurozone: If Greece goes ...

In any exit scenario, the new drachma would depreciate rapidly. ... Goldman Sachs has estimated ... a devaluation of 30 per cent is needed compared with the rest of the eurozone, and more than 50 per cent with Germany.The price for imports would soar (like oil prices), and living standards would fall - and Greece would have to immediately bring their primary budget into balance. The hope would be that competitiveness would be restored, and the economy could start growing again.

...

Even if all interest payments were stopped [Greece defaults again], additional austerity would still be needed for a period because Greece’s tax revenues still fall short of its public spending – a primary deficit.

excerpt with permission

A key question is spillover to other countries.

Professor Krugman has some thoughts on timing: Eurodämmerung

Some of us have been talking it over, and here’s what we think the end game looks like:Yesterday:

1. Greek euro exit, very possibly next month.

2. Huge withdrawals from Spanish and Italian banks, as depositors try to move their money to Germany.

3a. Maybe, just possibly, de facto controls, with banks forbidden to transfer deposits out of country and limits on cash withdrawals.

3b. Alternatively, or maybe in tandem, huge draws on ECB credit to keep the banks from collapsing.

4a. Germany has a choice. Accept huge indirect public claims on Italy and Spain, plus a drastic revision of strategy — basically, to give Spain in particular any hope you need both guarantees on its debt to hold borrowing costs down and a higher eurozone inflation target to make relative price adjustment possible; or:

4b. End of the euro.

And we’re talking about months, not years, for this to play out.

• Summary for Week Ending May 11th

• Schedule for Week of May 13th

Europe Update: Next Greek Election, Euro-area GDP expected to show recession

by Calculated Risk on 5/13/2012 11:44:00 AM

Greece: It is very unlikely that a coalition government will be formed. This means there will be another election on June 17th. The Europeans have said they will fund Greece through the next election, but it is not clear what will happen next. An exit from the euro is very possible.

From the Financial Times: Greek exit from eurozone ‘possible’

Greece’s exit from the eurozone “would be possible,” even if not in Europe’s interest, and countries should have a democratic right to quit, according to ... Luc Coene, the central bank governor of Belgium, in a Financial Times interview ...And it is appears data this week will confirm the European recession. From Nomura:

Mr Coene’s remarks – echoing similar comments by other eurozone central bankers – hinted at swirling debate within the ECB’s 23-strong council and suggested the ECB now realises such an outcome has become distinctly possible.

Excerpt with permission

An important state election in Germany and a Eurogroup meeting will take center stage amid heightened political uncertainty and GDP data likely to confirm the euro area is in recession. ... Euro-area Q1 GDP first release (Tuesday & Wednesday): The euro area seems to have entered into a technical recession in Q1, albeit with a shallower contraction than in Q4. We expect GDP growth to come in at -0.2% q-o-q in Q1 from -0.3% previously. By country, we think the core should hold up well, while the rest see a less sharp decline in economic output. In Germany and France, we forecast GDP growth of +0.1% q-o-q (vs Q4‟s -0.2%) and 0% q-o-q (vs Q4‟s +0.2%) respectively. ... In Italy, we think GDP growth is likely to print at -0.5% q-o-q in Q4 (vs -0.7% in Q4).Yesterday:

• Summary for Week Ending May 11th

• Schedule for Week of May 13th

Unofficial Problem Bank list declines to 924 Institutions

by Calculated Risk on 5/13/2012 08:03:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 11, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Only one change to report this week to the Unofficial Problem Bank List.Yesterday:

A reader pointed out an action termination against First Missouri National Bank back in August 2011 that was not captured. First Missouri National Bank underwent a name change to First Missouri Bank and charter flip to state member in December 2011. While the name change and charter flip were properly identified, the action termination prior to the charter conversion was not as the OCC did not include the termination within a press release nor can it be found via the OCC's enforcement action search tool. Perhaps the reader has direct access into the OCC's database or a strong interest in this bank to discover such a needle in the haystack. We can only hope they find any other remaining needles.

With the removal, the Unofficial Problem Bank list stands at 924 institutions with assets of $361.1 billion. A year ago, the list held 983 institutions with assets of $425.4 billion. We thought there was an outside chance for the OCC to release its actions through mid-April, but they will keep us waiting until next week. Also, we will be on watch for the FDIC to release the Official Problem Bank List as of March 31, 2012.

Until then, do something kind this weekend for all of the mothers in your life.

• Summary for Week Ending May 11th

• Schedule for Week of May 13th

Saturday, May 12, 2012

Gov. Brown: California Deficit increases to $16 Billion

by Calculated Risk on 5/12/2012 06:31:00 PM

From the LA Times: California deficit has soared to $16 billion, Gov. Jerry Brown says

Gov. Jerry Brown announced on Saturday that the state's deficit has ballooned to $16 billion, a huge increase over his $9.2-billion estimate in January.In addition to more budget cuts, Governor Brown is asking for a temporary 3% income tax hike for the highest income bracket, and an increase in the state sales tax (but still below a year ago).

The bigger deficit is a significant setback for California, which has struggled to turn the page on a devastating budget crisis. Brown, who announced the deficit on YouTube, is expected to outline his full budget proposal on Monday in Sacramento.

"This means we will have to go much further, and make cuts far greater, than I asked for at the beginning of the year," Brown said in the video.

In the aggregate, it appears state and local cuts might end mid-year, but some states - like California - will see further budget cuts.

Earlier:

• Summary for Week Ending May 11th

• Schedule for Week of May 13th

Schedule for Week of May 13th

by Calculated Risk on 5/12/2012 01:00:00 PM

Earlier:

• Summary for Week Ending May 11th

This will be a busy week. There are two key housing reports to be released this week: May homebuilder confidence on Tuesday, and April housing starts on Wednesday.

Another key report is April retail sales. For manufacturing, the May NY Fed (Empire state) and Philly Fed surveys, and the April Industrial Production and Capacity Utilization report will be released this week.

Also, the Mortgage Bankers Association (MBA) 1st Quarter National Delinquency Survey, and the AIA's Architecture Billings Index for April will be released on Wednesday.

Europe will remain in the spotlight with a Eurogroup meeting on Monday, and euro area Q1 GDP being released in Tuesday.

No economic releases scheduled.

8:30 AM ET: Retail Sales for April.

8:30 AM ET: Retail Sales for April. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales were up 0.8% in March and 1.0% in February. There will probably be some payback in April for the strong retail reports over the previous two months.

The consensus is for retail sales to increase 0.1% in April, and for retail sales ex-autos to increase 0.2%.

8:30 AM: Consumer Price Index for April. The consensus is for no change in headline CPI (with the decline in energy prices). The consensus is for core CPI to increase 0.2%.

8:30 AM ET: NY Fed Empire Manufacturing Survey for May. The consensus is for a reading of 10.0, up from 6.6 in April (above zero is expansion).

9:30 AM: Speech by Fed Governor Elizabeth Duke, "Prescriptions for Housing Recovery", At the National Association of Realtors Midyear Legislative Meetings and Trade Expo, Washington, D.C.

10:00 AM: Manufacturing and Trade: Inventories and Sales for March (Business inventories). The consensus is for 0.4% increase in inventories.

10:00 AM: The May NAHB homebuilder survey. The consensus is for a reading of 26, up slightly from 25 in April. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

8:30 AM: Housing Starts for April.

8:30 AM: Housing Starts for April. Total housing starts were at 654 thousand (SAAR) in March and single-family starts at 462 thousand in March. This was a decline from the February rate, but most of the decline was related to the volatile multi-family sector. Based on permits, starts probably rebounded in April.

The consensus is for total housing starts to increase to 690,000 (SAAR) in April from 654,000 in March.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for April.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for April. This shows industrial production since 1967.

The consensus is for a 0.5% increase in Industrial Production in April, and for Capacity Utilization to increase to 79.0% (from 78.6%).

10:00 AM: Mortgage Bankers Association (MBA) 1st Quarter 2012 National Delinquency Survey (NDS).

10:00 AM: Mortgage Bankers Association (MBA) 1st Quarter 2012 National Delinquency Survey (NDS). This graph shows the percent of loans delinquent by days past due through Q4 2011. Based on other data, the seasonally adjusted delinquency rate probably declined slightly in Q1.

The key problem remains the large number of seriously delinquent loans (90+ days and in the foreclosure process), especially in judicial foreclosure states like Florida, New Jersey, New York, and Illinois. With the mortgage servicer settlement signed off on April 5th, the delinquency rate will probably start falling faster by mid-2012 through a combination of more modifications and more foreclosures.

2:00 PM: FOMC Minutes, Meeting of April 24-25, 2012.

During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to be essentially unchanged at 365 thousand compared to 367 thousand last week.

10:00 AM: Philly Fed Survey for May. The consensus is for a reading of 10.0, up from 8.5 last month (above zero indicates expansion).

10:00 AM: Conference Board Leading Indicators for April. The consensus is for a 0.1% increase in this index.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for April 2012