by Calculated Risk on 5/16/2012 10:02:00 AM

Wednesday, May 16, 2012

MBA: Mortgage Delinquencies decline in Q1

The MBA reported that 11.79 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q1 2012 (delinquencies seasonally adjusted). This is down from 11.96 percent in Q4 2011 and is the lowest level since 2008.

From the MBA: Delinquencies Decline in Latest MBA Mortgage Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 7.40 percent of all loans outstanding as of the end of the first quarter of 2012, a decrease of 18 basis points from the fourth quarter of 2011, and a decrease of 92 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate decreased 121 basis points to 6.94 percent this quarter from 8.15 percent last quarter.Note: 7.40% (SA) and 4.39% equals 11.79%.

The percentage of loans on which foreclosure actions were started during the fourth quarter was 0.96 percent, down three basis points from last quarter and down 12 basis points from one year ago. The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 4.39 percent, up one basis point from the fourth quarter and 13 basis points lower than one year ago. The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 7.44 percent, a decrease of 29 basis points from last quarter, and a decrease of 66 basis points from the first quarter of last year.

...

“Mortgage delinquencies normally fall during the first quarter of the year, but the declines we saw were even greater than the normal seasonal adjustments would predict, so delinquencies are clearly continuing to improve. Newer delinquencies, loans one payment past due as of March 31, are down to the lowest level since the middle of 2007, indicating fewer new problems we will need to deal with in the future. The percentage of loans three payments or more past due, the loans that represent the backlog of problems that still need to be handled, is down to the lowest level since the end of 2008. Foreclosure starts are at their lowest level since the end of 2007,” said Michael Fratantoni, MBA's Vice President of Research and Economics.

...

"The problem continues to be the slow-moving judicial foreclosure systems in some of the largest states. While the rate of foreclosure starts is essentially the same in judicial and non-judicial foreclosure states, the percent of loans in the foreclosure process has reached another all-time high in the judicial states, 6.9 percent. In contrast, that rate has fallen to 2.8 percent in non-judicial states, the lowest since early 2009. As the foreclosure starts rate is essentially the same in both groups of states, that difference is due entirely to the systems some states have in place that effectively block timely resolution of non-performing loans and is not an indicator of the fundamental health of the housing market or the economy. In fact, hard-hit markets like Arizona that have moved through their foreclosure backlog quickly are seeing home price gains this spring."

I'll have more later after the conference call this morning.

Industrial Production up in April, Capacity Utilization increases

by Calculated Risk on 5/16/2012 09:33:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 1.1 percent in April. Output is now reported to have fallen 0.6 percent in March and to have moved up 0.4 percent in February; previously, industrial production was estimated to have been unchanged in both months. Manufacturing output increased 0.6 percent in April after having decreased 0.5 percent in March. Excluding motor vehicles and parts, which increased nearly 4 percent, manufacturing output moved up 0.3 percent, and output for all but a few major industries increased. Production at mines rose 1.6 percent, and the output of utilities gained 4.5 percent after unseasonably warm weather in the first quarter held down demand for heating. At 97.4 percent of its 2007 average, total industrial production for April was 5.2 percent above its year-earlier level. The rate of capacity utilization for total industry moved up to 79.2 percent, a rate 3.1 percentage points above its level from a year earlier but 1.1 percentage points below its long-run (1972--2011) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.2% is still 1.1 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

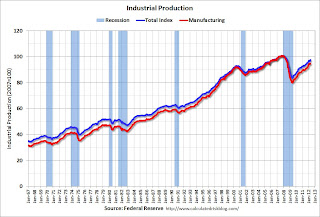

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in April to 97.4. March was revised down (so the month-to-month increase was greater than expected), and February was revised up.

The consensus was for a 0.5% increase in Industrial Production in April, and for an increase to 79.0% (from 78.7%) for Capacity Utilization. This was above expectations.

Housing Starts increase to 717,000 in April

by Calculated Risk on 5/16/2012 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 717,000. This is 2.6 percent (±14.8%)* above the revised March estimate of 699,000 and is 29.9 percent (±15.2%) above the revised April 2011 rate of 552,000.

Single-family housing starts in April were at a rate of 492,000; this is 2.3 percent (±11.9%)* above the revised March figure of 481,000. The April rate for units in buildings with five units or more was 217,000.

Building Permits:

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 715,000. This is 7.0 percent (±1.0%) below the revised March rate of 769,000, but is 23.7 percent (±1.9%) above the revised April 2011 estimate of 578,000.

Single-family authorizations in April were at a rate of 475,000; this is 1.9 percent (±1.1%) above the revised March figure of 466,000. Authorizations of units in buildings with five units or more were at a rate of 217,000 in April.

Click on graph for larger image.

Click on graph for larger image.Total housing starts were at 717 thousand (SAAR) in April, up 2.6% from the revised March rate of 699 thousand (SAAR). Note that March was revised up sharply from 654 thousand.

Single-family starts increased 2.3% to 492 thousand in April. March was revised up to 481 thousand from 462 thousand.

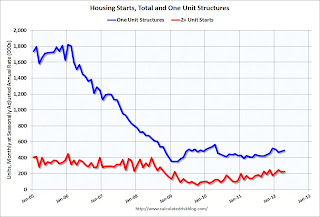

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years. Total starts are up 50% from the bottom, and single family starts are up 39% from the low.

This was above expectations of 690 thousand starts in April, and was especially strong given the upward revisions to prior months.

The housing recovery continues.

Tuesday, May 15, 2012

Look Ahead: Housing Starts, Industrial Production, Mortgage Delinquencies, FOMC Minutes

by Calculated Risk on 5/15/2012 09:16:00 PM

Wednesday will be another busy day:

• Housing starts for April will be released at 8:30 AM. Total housing starts were at 654,000 in March, on a seasonally adjusted annual rate basis (SAAR), and single-family starts were at 462,000. This was a decline from the February rate, but most of the decline was related to the volatile multi-family sector. Based on housing permits, starts probably rebounded in April. The consensus is for total housing starts to increase to 690,000 (SAAR) in April.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for April. The consensus is for a 0.5% increase in Industrial Production in April, and for Capacity Utilization to increase to 79.0% (from 78.6%).

• At 10:00 AM, the Mortgage Bankers Association (MBA) is scheduled to release the 1st Quarter 2012 National Delinquency Survey (NDS). This provides a breakdown of mortgage delinquencies by number of days delinquent, type of loan, and by state. Since the mortgage settlement was signed off on April 5th, there probably wasn't any impact on Q1 delinquencies. I'll be on the conference call at 10:30 AM and pass along any comments about the settlement, HARP, house prices, etc.

• At 2 PM, the FOMC Minutes for the meeting of April 24-25 will be released. From Goldman Sachs on things to look for:

We expect that the April FOMC minutes ... will include a discussion of possible easing options. ... The first set of options center around the Fed's balance sheet, and we think that the discussion might include the benefits of mortgage purchases, the potential for more “twisting,” and the pros and cons of sterilized asset purchases.• Also on Wednesday, the MBA will release the weekly mortgage applications survey, and the AIA will release the Architecture Billings Index for April (a leading indicator for commercial real estate).

For the monthly economic question contest:

Misc: NY Fed Manufacturing Survey, Remodeling Index

by Calculated Risk on 5/15/2012 05:49:00 PM

A couple of releases earlier this morning ...

• From the NY Fed: May Empire State Manufacturing Survey indicates manufacturing activity expanded at a moderate pace

The May Empire State Manufacturing Survey indicates that manufacturing activity expanded in New York State at a moderate pace. The general business conditions index rose eleven points to 17.1. The new orders index inched up to 8.3, and the shipments index shot up eighteen points to 24.1. ... Employment index readings remained relatively healthy, suggesting that employment levels and hours worked continued to expand. ... The index for number of employees was little changed at 20.5, and the average workweek index rose six points to 12.1.This was above the consensus forecast of 10.0, up from 6.6 in April (above zero is expansion).

• From BuildFax:

Residential remodels authorized by building permits in the United States in March were at a seasonally-adjusted annual rate of 2,781,000. This is 1 percent below the revised February rate of 2,811,000 and is 10 percent above the March 2011 estimate of 2,522,000.Even with the decline in March, the remodeling in is up 10% year-over-year.

"Overall, March 2012 had lower remodeling activity than February, which saw significantly greater-than-expected activity, likely due to the unseasonably warm winter weather," said Joe Emison, Vice President of Research and Development at BuildFax.

The BuildFax Remodeling Index (BFRI) is based on construction permits for residential remodeling projects filed with local building departments across the country. The index estimates the number of properties permitted. The national and regional indexes are based upon a subset of representative building departments in the U.S. and population estimates from the U.S. Census. The BFRI is seasonally-adjusted using the X12 procedure.

Lawler: Update Table of Short Sales and Foreclosures for Selected Cities

by Calculated Risk on 5/15/2012 03:12:00 PM

CR Note: Last week I posted some distressed sales data for Sacramento. I'm following the Sacramento market to see the change in mix over time (short sales, foreclosure, conventional). Economist Tom Lawler sent me the updated table below for several other distressed areas. For all of these areas, the share of distressed sales is down from April 2011 - and for the areas that break out short sales, the share of short sales has increased and the share of foreclosure sales are down - and down significantly in some areas.

In five of the seven cities that break out short sales, there are now more short sales than foreclosure sales!

Economist Tom Lawler also wrote today: Plunge in Foreclosures Pushes Up REO Prices/Down REO Price Discounts

ForeclosureRadar released its April Foreclosure Report, which covers foreclosure activity in Arizona, California, Nevada, Oregon, and Washington. According to the report, foreclosure starts fell sharply in April in all five states, and completed foreclosure sales declined in all five states, with sizable drops from March in all states save for Washington. And in Arizona, California, and Nevada, record high percentages (44.6%, 41,1%, and 50.7%) of completed foreclosure sales were sold to third parties, rather than becoming bank REO. In its write-up, FR lamented that “we are seeing unprecedented government intervention into the foreclosure process leaving underwater homeowners in limbo, while stealing opportunity from investors and first time buyers." In discussing the “stolen opportunities,” FR noted that “In both Arizona and Nevada winning bids on the courthouse steps on average equal the current estimated value of those properties,” and that “(i)n California the discount between market value and winning bid have on average declined to 12.3 percent” – substantially lower than a year ago. According to FR, “(t)his leaves investors who intend to resell their purchases with record low profits after eviction, repairs, and closing costs.”

An increasing number of investors, of course, are buying REO with plans to rent the properties out, which has not only intensified demand but has reduced the supply of homes offered for sale.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Apr | 11-Apr | 12-Apr | 11-Apr | 12-Apr | 11-Apr | |

| Las Vegas | 29.9% | 23.8% | 36.9% | 46.3% | 66.8% | 70.1% |

| Reno | 32.0% | 31.0% | 26.0% | 38.0% | 58.0% | 69.0% |

| Phoenix | 25.2% | 19.7% | 18.8% | 44.5% | 44.0% | 64.2% |

| Sacramento | 30.4% | 22.2% | 30.3% | 44.6% | 60.7% | 66.8% |

| Minneapolis | 10.9% | 10.0% | 32.0% | 43.3% | 42.9% | 53.3% |

| Mid-Atlantic (MRIS) | 12.2% | 11.8% | 11.0% | 20.9% | 23.2% | 32.7% |

| Orlando | 29.4% | 25.4% | 25.5% | 40.2% | 54.9% | 65.6% |

| Northeast Florida | 38.1% | 50.3% | ||||

| Hampton Roads | 31.0% | 35.0% | ||||

Key Measures of Inflation in April

by Calculated Risk on 5/15/2012 11:52:00 AM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in April on a seasonally adjusted basis ... The gasoline index fell 2.6 percent in April and accounted for most of the decline in energy, though the indexes for natural gas and fuel oil decreased as well. ... The index for all items less food and energy rose 0.2 percent in April, the same increase as in March.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in April. The 16% trimmed-mean Consumer Price Index increased 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for April here.

...

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was flat at 0.0% (0.4% annualized rate) in April. The CPI less food and energy increased 0.2% (2.9% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.3%, and core CPI rose 2.3%. Core PCE is for March and increased 2.0% year-over-year.

These measures show inflation on a year-over-year basis is mostly still above the Fed's 2% target.

NAHB Builder Confidence increases in May, Highest since May 2007

by Calculated Risk on 5/15/2012 10:05:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased 5 points in May to 29. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Rises Five Points in May

Builder confidence in the market for newly built, single-family homes gained five points in May from a downwardly revised reading in the previous month to reach a level of 29 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. This is the index’s strongest reading since May of 2007.

“Builders in many markets are reporting that buyer traffic and sales have picked back up after a pause this April,” said Barry Rutenberg, chairman of the National Association of Home Builders (NAHB) and a home builder from Gainesville, Fla. “It seems we have resumed the gradual upward trend in confidence that started at the beginning of this year, as stabilizing prices and excellent affordability encourage more people to pursue a new-home purchase.”

“While home building still has quite a way to go toward a fully healthy market, the fact that the HMI has returned to trend is an excellent sign that firming home values, improving employment and low mortgage rates are drawing consumers back,” said NAHB Chief Economist David Crowe.

...

Each of the index’s components rebounded from declines in the previous month. The component gauging current sales conditions and the component gauging traffic of prospective buyers each rose five points in May to 30 and 23, respectively, with the traffic component hitting its highest level since April of 2007. The component gauging sales expectations in the next six months rose three points to 34.

Three out of four regions registered improving builder sentiment in May. This included a six-point gain to 32 in the Northeast, and five-point gains to 27 and 28 in the Midwest and South, respectively. The West posted a two-point decline, to 29.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the May release for the HMI and the March data for starts (April housing starts will be released tomorrow).

Retail Sales increased 0.1% in April

by Calculated Risk on 5/15/2012 08:47:00 AM

On a monthly basis, retail sales were up 0.1% from March to April (seasonally adjusted), and sales were up 6.4% from April 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for April, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $408.0 billion, an increase of 0.1 percent from the previous month and 6.4 percent above April 2011.Ex-autos, retail sales also increased 0.1% in April.

Click on graph for larger image.

Click on graph for larger image.Sales for March was revised down to a 0.7% increase from 0.8%, and February was revised down to 1.0% from 1.1%.

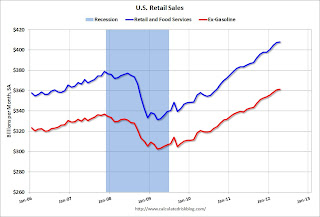

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 23.1% from the bottom, and now 7.7% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 19.4% from the bottom, and now 7.3% above the pre-recession peak (not inflation adjusted).

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 19.4% from the bottom, and now 7.3% above the pre-recession peak (not inflation adjusted).The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.4% on a YoY basis (6.4% for all retail sales). Retail sales ex-gasoline increased 0.2% in April.

This was at the consensus forecast for retail sales of a 0.1% increase in April, and below the consensus for a 0.2% increase ex-auto.

This was at the consensus forecast for retail sales of a 0.1% increase in April, and below the consensus for a 0.2% increase ex-auto. Monday, May 14, 2012

Look Ahead: Retail sales, CPI, Home Builder Confidence, NY Fed Manufacturing Survey

by Calculated Risk on 5/14/2012 09:37:00 PM

Tuesday will be a busy day with the release of several key economic indicators including retail sales, CPI, home builder confidence, and the NY Fed manufacturing survey:

• Retail sales for April will be released at 8:30 AM ET. Retail sales were very strong in February and March, increasing 1.1% and 0.8%, respectively. The consensus is for retail sales to increase 0.1% in April, and for retail sales ex-autos to increase 0.2%. This report could be weak. Note: The annual revision for retail sales was released on April 30th including new seasonal adjustments using the Census Bureau’s X-13ARIMA-SEATS (yes, a new model).

• Also at 8:30 AM, the Consumer Price Index for April will be released. The consensus is for no change in headline CPI (with the decline in energy prices) and for core CPI to increase 0.2%. From Merrill:

With gasoline prices peaking in early April, we expect headline CPI to soften, dropping 0.1% monthly, after a 0.3% rise in March. ... Overall, the annual headline CPI inflation rate is likely to decelerate in April to 2.2%, its slowest year-on-year rise since the rapid run-up in global oil prices in February 2011.• Also at 8:30 am, the NY Fed Empire Manufacturing Survey for May will be released. The consensus is for a reading of 10.0, up from 6.6 in April (above zero is expansion).

• At 10 AM, the May NAHB home builder confidence survey will be released. The consensus is for a reading of 26, up slightly from 25 in April. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

• The Manufacturing and Trade: Inventories and Sales report for March will be released at 10 AM, and Fed Governor Elizabeth Duke speaks at 9.30 AM: "Prescriptions for Housing Recovery".

For the monthly economic question contest: