by Calculated Risk on 5/23/2012 05:16:00 PM

Wednesday, May 23, 2012

Kolko: Dissecting the House Price Indices

CR Note: This is from Trulia chief economist Jed Kolko:

Dissecting the House Price Indices

Each month, several data releases track house price changes. Case-Shiller, CoreLogic, the Federal Housing Finance Agency (FHFA), the National Association of Realtors (NAR) and others report monthly sales-price trends, and the Trulia Price Monitor reports trends in asking prices, a leading indicator of sales prices. These indices often show different trends even for the same time period.

Some of the differences among these indices are well-known, such as the fact that FHFA’s traditional index is based on transactions involving conforming, conventional Fannie Mae & Freddie Mac mortgages, while other indices (including the newer FHFA expanded-data index) cover a broader set of homes. But other, more technical differences help account for why some indices go up while others go down, including how they handle:

• The mix of homes listed and sold.

• Seasonal patterns in home prices.

• Weighting of homes and metros.

How much do these issues really matter for price trends? A lot, it turns out. In constructing the Trulia Price Monitor, we (1) adjust for the mix of homes listed, (2) adjust for seasonality, and (3) “weight” homes equally so that our national trend best represents what’s going on with the typical home in the largest 100 metros. Using this approach, we found that asking prices nationally rose 0.2% year-over-year and 1.9% quarter-over-quarter in April. Other price indices take different approaches, and mix-adjustment, seasonal adjustment, and value-weighting all have pros and cons. To see how much these issues matter, we used our data to see what the price trends would look like using different technical approaches.

Mix of homes listed and sold.

The price of a home depends on its size, location, and many other factors. For example, if larger homes or homes in more expensive neighborhoods happen to be listed or sold, the average (or median) listing or sales price will rise. That doesn’t mean that the typical home has increased in value – which is what most owners, buyers, sellers, and investors really care about. To know how the typical home’s value has changed, most price indices adjust for the mix of homes that are listed or sold, either by factoring in specific attributes of the home like its size and location (hedonic models, which the Trulia Price Monitor and FNC use) or by looking only at how prices have changed for the same home over time (repeat-sales models, which Case-Shiller, FHFA, and CoreLogic use).

How much does the changing the mix of homes matter? The Trulia Price Monitor for April 2012 showed that prices nationally increased 0.2% year-over-year; this adjusts for the mix of homes. But without adjusting for home size, neighborhood, and other factors, the median listing price increased by 8.1% year-over-year. That’s a huge difference and that can partly be attributed to the fact that homes listed today are, on average, 6.2% larger than a year ago. They also tend to be located in slightly more expensive neighborhoods.

The shift toward larger homes on the market means that price indices that don’t adjust for the mix of homes are showing much larger price increases than what the typical home is experiencing. So why look at any price trends that don’t adjust for the mix of homes? Unadjusted price trends do reflect how typical transaction amounts are changing, which affects real estate commissions and the health of the real estate industry.

Seasonal patterns in home prices.

Home prices – both asking and sales – follow predictable seasonal patterns, dipping in winter and rising in spring and summer. (Other housing activities, like sales volume and construction starts, swing even more with the seasons than prices do.) Comparing home prices at the same time of the year takes out any seasonal effect, but quarter-over-quarter or month-over-month changes can be strongly affected by seasonal patterns.

The Trulia Price Monitor for April 2012 showed that prices increased nationally quarter-over-quarter by 1.9%, seasonally adjusted, but by 4.8% without adjusting for seasonality since the adjustment removes the regular springtime price jump.

Seasonal adjustment has its challenges. If the seasonal pattern changes over time – like if winters get warmer and cause housing activity to drop off less in winter – seasonal adjustment methods need to reflect those changes. Not-seasonally-adjusted trends are still useful because they show what buyers and sellers are actually experiencing in the market right now and can help them time when in the year to buy or sell. But to detect if and when housing prices are finally reaching a sustained turnaround, seasonal adjustment is needed to distinguish the underlying trend from regular seasonal patterns.

The Trulia Price Monitor, Case-Shiller and FHFA report seasonally adjusted price changes, even though Case-Shiller emphasizes the non-seasonally-adjusted trends. Most other indices only report non-seasonally-adjusted trends.

Weighting of homes and metros.

In the Case-Shiller and CoreLogic indices, higher-priced homes count more – they are “value-weighted”; in contrast, the Trulia Price Monitor, the FHFA index, and most other indices don’t put extra weight on higher-priced homes. Why give more weight to pricier homes? Higher-priced homes should get more weight if the purpose of an index is to assess movements in the value of a real-estate portfolio. If, for instance, a $1,000,000 real estate portfolio consists of two homes, one initially worth $900,000 and one initially worth $100,000, the change in the overall value of the portfolio depends a lot more on the percentage change in the value of the $900,000 house than the $100,000 house. In other words, weighting by home price yields an index that shows how the value of a dollar invested in real estate changes. The Trulia Price Monitor weights homes equally, regardless of price, in order to show how the value of a typical home is changing – rather than the value of a dollar invested in real estate. (FHFA doesn’t use value-weighting, either.)

Value-weighting potentially matters a lot for price trends if high-priced and low-priced homes in a market are trending differently. We tested the potential impact of value-weighting by comparing the year-over-year price change in several metro areas from the Trulia Price Monitor with the price change we would have reported for those same metros over the same time period but with value-weighting. The Trulia Price Monitor for April 2012 showed that prices in New York decreased 2.6% year-over-year, but with value-weighting prices decreased just 0.3%. In Los Angeles, the Trulia Price Monitor showed that prices decreased 2.8% without value-weighting but increased 0.7% value-weighted. In Phoenix, the Trulia Price Monitor showed that prices increased 15.8% without value-weighting, but increased only 11.1% value-weighted. In short, value-weighting can change the price trend either up or down by several percentage points – a big difference for what sounds like an obscure technical issue.

Finally, value-weighting can lead to expensive metro areas counting heavily in a broad home price index. The New York and Los Angeles metros together account for 48% of the Case-Shiller Composite 10 index and 35% of the Composite 20 index (based on weights in the published methodology) -- not only because those metros are large but also because they are expensive. At the same time, Houston and Philadelphia, which are among the ten largest metros in the US, are not included in the Case-Shiller Composite 20 – even though much smaller metros, like Charlotte, NC, and Portland, OR, are.

To sum up: home-price indices can disagree with each other by several percentage points depending on whether they adjust for the mix of homes, whether they adjust for seasonal patterns, and how they weight homes and local markets in the index. These technical issues help explain why different indices looking at the same market at the same time can tell very different stories.

FHFA: Quarterly House Price Index shows first year-over-year gain since 2007

by Calculated Risk on 5/23/2012 01:55:00 PM

The Federal Housing Finance Agency (FHFA) releases several house prices indexes. The most followed are the Purchase Only repeat sales index, both monthly and quarterly, based on Fannie and Freddie loans only, and the quarterly "expanded data series" that includes data from FHA endorsed mortgages and county recorder data licensed from DataQuick.

Here are the key results released today:

1) The quarterly Q1 seasonally adjusted purchase-only house price index showed the first year-over-year (YoY) increase since 2007.

2) The monthly (March) purchase only house price index showed a larger YoY increase of 2.7% in March compared to a 0.3% YoY increase in February. This is the largest YoY increase since 2006.

3) The expanded data series showed a smaller YoY decline of 1.3% in Q1 (smaller than the 3.0% YoY decline in Q4).

From the FHFA: HPI Shows Quarterly Increase and First Annual Increase Since 2007

U.S. house prices rose modestly in the first quarter of 2012 according to the Federal Housing Finance Agency’s (FHFA) seasonally adjusted purchase-only house price index (HPI). The FHFA HPI was up 0.6 percent on a seasonally adjusted basis since the fourth quarter of 2011. The HPI is calculated using home sales price information from Fannie Mae and Freddie Mac mortgages. ... FHFA’s seasonally adjusted monthly index for March was up 1.8 percent from February.

FHFA’s expanded-data house price index, a metric introduced in August 2011 that adds transactions information from county recorder offices and the Federal Housing Administration to the HPI data sample, rose 0.2 percent over the latest quarter. Over the latest four quarters, the index is down 1.3 percent.

New Home Sales Comments

by Calculated Risk on 5/23/2012 11:22:00 AM

Clearly new home sales have bottomed. Although sales are still historically very weak, sales are up 25% from the low, and up about 15% from the May 2010 through September 2011 average.

Update: Some people think housing will recover rapidly to the 1.2+ million rate we saw in 2004 and 2005. I think that is incorrect for two reasons. First, I think the recovery will be sluggish - 2012 will probably be the third worst year ever. Second, the 1.2 million in annual sales was due to an increasing homeownership rate and speculative buying. With a stable homeownerhip rate, and little speculative buying, sales will probably only rise to around 800 thousand at full recovery.

There were more upward revisions this month too. Sales were revised up for January, February and March.

And inventory of completed homes is at a new record low

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

Click on graph for larger image.

Click on graph for larger image.This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale was at a record low 46,000 units in April. The combined total of completed and under construction is at the lowest level since this series started.

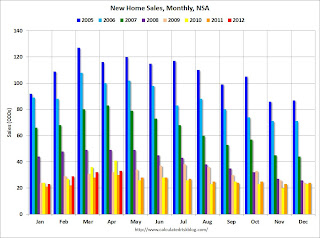

The second graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In April 2012 (red column), 33 thousand new homes were sold (NSA). Last year only 30 thousand homes were sold in March. This was the fourth weakest April since this data has been tracked. The high for April was 116 thousand in 2005.

The debate is now about the strength of the recovery, not whether there is a recovery. My view is housing will remain sluggish for some time, and I expect 2012 to be another historically weak year, but clearly better than 2011.

The debate is now about the strength of the recovery, not whether there is a recovery. My view is housing will remain sluggish for some time, and I expect 2012 to be another historically weak year, but clearly better than 2011.Below is an update to the "distressing gap" graph that shows existing home sales (left axis) and new home sales (right axis) through April. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders haven't been able to compete with the low prices of all the foreclosed properties.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders haven't been able to compete with the low prices of all the foreclosed properties. I expect this gap to eventually close, but it will probably take a number of years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase in April to 343,000 Annual Rate

by Calculated Risk on 5/23/2012 10:00:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 343 thousand.

This was up from a revised 332 thousand SAAR in March (revised up from 328 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The second graph shows New Home Months of Supply.

Months of supply decreased to 5.1 in April from 5.2 in March.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal).

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 340 thousand SAAR over the last 5 months, after averaging under 300 thousand for the previous 18 months. All of the recent revisions have been up too.

This was a solid report and above the consensus forecast of 335 thousand.

More graphs soon ...

MBA: Mortgage Refinance activity increases, Mortgage Rates at Record Low

by Calculated Risk on 5/23/2012 08:30:00 AM

From the MBA: Record Low Mortgage Rates Fuel Third Consecutive Increase In Refinance Applications In Latest MBA Weekly Survey

The Refinance Index increased 5.6 percent from the previous week. This is the third consecutive weekly increase in the Refinance Index which is at its highest level since February 10, 2012. The seasonally adjusted Purchase Index decreased 3.0 percent from one week earlier to its lowest level since April 20, 2012.The purchase index is still very weak.

"Mortgage rates again dipped to new record lows in the survey, which spurred more borrowers back into the refinance market. As a result, applications for refinance loans have increased for the third straight week and are at the highest level since February of this year. The HARP share of refinance applications was essentially unchanged over the week at 28 percent, so it was not the primary driver of the increase over the previous week." [said] Michael Fratantoni, MBA's Vice President of Research and Economics.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.93 percent, the lowest rate in the history of the survey, from 3.96 percent,with points increasing to 0.39 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Tuesday, May 22, 2012

Look Ahead: New Home Sales

by Calculated Risk on 5/22/2012 09:05:00 PM

• At 10:00 AM ET, the Census Bureau is scheduled to release the New home sales report for April. The consensus is for an increase in sales to 335,000 on a Seasonally Adjusted Annual Rate basis (SAAR) in April from 328,000 in March. Based on recent builder comments, and the homebuilder confidence survey, new home sales probably increased in April. Also, watch for upward revisions to prior reports.

• Also at 10:00 AM, the FHFA House Price Index for March 2012 will be released. This is based on GSE repeat sales and is not as closely followed as Case-Shiller or CoreLogic. Last month this index turned positive on a year-over-year basis: "For the 12 months ending in February, U.S. prices rose 0.4 percent, the first 12-month increase since the July 2006 - July 2007 interval." Look for a larger year-over-year increase in March.

For the monthly economic question contest:

Earlier on existing home sales:

• Existing Home Sales in April: 4.62 million SAAR, 6.6 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

ATA Trucking index declined 1.1% in April

by Calculated Risk on 5/22/2012 05:31:00 PM

From ATA: ATA Truck Tonnage Fell 1.1% in April

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 1.1% in April after increasing 0.6% in March. (March’s gain was more than the preliminary 0.2% increase ATA reported on April 24.) The latest drop put the SA index at 118.7 (2000=100), down from March’s level of 120. Compared with April 2011, the SA index was up 3.5%, better than March’s 3.1% increase. Year-to-date, compared with the same period last year, tonnage was up 3.8%.

...

“While April’s decrease was a little disappointing, the March gain turned out to be stronger than originally thought,” ATA Chief Economist Bob Costello said. “The ups and downs so far this year are similar to other economic indicators.”

“While just one month, the April’s decrease also matches with an economy that is likely to grow slightly slower in the second quarter than in the first quarter,” he said. Costello reiterated last month’s noting that the industry should not expect the rate of growth seen over the last couple of years, when tonnage grew 5.8% in both 2010 and 2011. “I continue to expect tonnage to moderate from the pace over the last two years. Annualized growth in the 3% to 3.9% seems more likely.”

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. The index is above the pre-recession level and up 3.5% year-over-year.

From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.

Lawler: Comments on Existing home sales and FHA REO

by Calculated Risk on 5/22/2012 02:32:00 PM

Some comments from housing economist Tom Lawler:

The National Association of Realtors estimated that US existing home sales ran at a seasonally adjusted annual rate of 4.62 million in April, up 3.4% from March’s downwardly revised (to 4.47 million from 4.48 million) pace and up 10.0% from last April’s pace. The NAR’s estimate exceeded my estimate based on regional tracking, though almost all of my “miss” was related to the NAR’s seasonal adjustment factor: while seasonally adjusted sales were up 10.0% YOY, unadjusted sales showed just a 6.7% YOY gain (I guess the timing of Easter was the reason; my bad).

The NAR also estimated that the inventory of existing homes for sale at the end of April totaled 2.540 million, up 9.5% from March’s downwardly revised (to 2.32 million from 2.37 million) level and down 20.6% from last April. This was pretty close to my “guess” for a 21% YOY decline, and today’s report continued the trend for the NAR’s inventory estimates to show significantly lower monthly gains (or larger declines) in March and significantly larger monthly gains in April than that suggested by actual listings data.

Finally, the NAR estimated that the median existing home sales price in April was $177,400, up a whopping 10.1% from last April. The median existing SF sales price last month was $178,000, up 10.4% from last April. According to the NAR, the median existing SF sales price in the Northeast showed a YOY gain of 10.9%; in the Midwest, 8.1%; in the South, 8.5%; and in the West, 14.7%. While I was looking for a YOY increase exceeding 5%, this gain was obviously a boatload larger. Based on regional data I’ve seen the gain in the Northeast that the NAR reported seemed particularly “whacky,” though other regions – including the West – seemed high as well (Phoenix had a YOY gain of around 24%, but that was an outlier!).

CR Note: Remember the median price is impacted by the change in mix, and there are fewer low end foreclosures for sale this year and that pushes up the median price.

Lawler on FHA REO:

HUD finally got around to releasing the Monthly Report to the FHA Commissioner for March, and one “stand-out” stat was the sharp rise in SF property conveyances in March. Here are some historical stats (from the current and past monthly commissioner reports).

The number of SF properties “conveyed” to FHA has been surprising low over the last year given the number of properties in the foreclosure process, and FHA had noted that servicing “issues” were artificially depressing conveyances. Obviously, that was not the case in March!

| Monthly Report to FHA Commissioner | ||||

|---|---|---|---|---|

| SF REO Inventory (EOM) | Conveyances | Sales | Adjustments | |

| 10-Jun | 44,850 | 8,487 | 8,893 | 41 |

| 10-Jul | 44,944 | 8,341 | 8,508 | 261 |

| 10-Aug | 47,007 | 9,810 | 7,686 | -61 |

| 10-Sep | 51,487 | 11,411 | 7,439 | 508 |

| 10-Oct | 54,609 | 9,908 | 7,289 | 503 |

| 10-Nov | 55,488 | 6,752 | 5,817 | -56 |

| 10-Dec | 60,739 | 7,728 | 2,749 | 272 |

| 11-Jan | 65,639 | 7,709 | 2,632 | -177 |

| 11-Feb | 68,801 | 7,383 | 4,221 | 0 |

| 11-Mar | 68,997 | 8,647 | 8,728 | 277 |

| 11-Apr | 65,063 | 7,410 | 11,375 | 31 |

| 11-May | 59,465 | 7,032 | 12,659 | 29 |

| 11-Jun | 53,164 | 7,240 | 13,600 | 59 |

| 11-Jul | 48,507 | 6,509 | 11,379 | 213 |

| 11-Aug | 44,749 | 8,005 | 11,701 | -62 |

| 11-Sep | 40,719 | 6,567 | 10,554 | -43 |

| 11-Oct | 37,922 | 6,541 | 9,883 | 545 |

| 11-Nov | 35,192 | 6,212 | 9,178 | 236 |

| 11-Dec | 32,170 | 5,997 | 8,800 | -219 |

| 12-Jan | 31,046 | 6,771 | 7,670 | -225 |

| 12-Feb | 30,005 | 7,132 | 7,637 | -536 |

| 12-Mar | 35,613 | 14,007 | 8,219 | -180 |

CR Note: This probably means FHA REO sales will increase in May and June.

Click on graph for larger image.

Click on graph for larger image.This graph shows the combined REO inventory for Fannie, Freddie and the FHA.

The combined REO inventory is down to 209 thousand in Q1 2012, down about 16% from Q1 2011.

CR Note: Even though REO inventories are down, there are still more distressed sales coming because of all the loans 90+ days delinquent and in the foreclosure process.

Earlier on existing home sales:

• Existing Home Sales in April: 4.62 million SAAR, 6.6 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

Existing Home Sales: Inventory and NSA Sales Graph

by Calculated Risk on 5/22/2012 12:08:00 PM

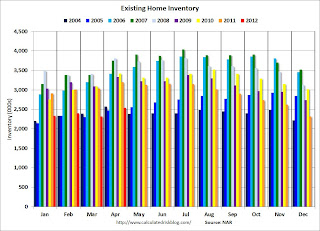

The NAR reported inventory increased to 2.54 million units in April, up 9.5% from the downwardly revised 2.32 million in March (revised down from 2.40 million). This is down 20.6% from April 2011, and up 2.7% from the inventory level in April 2005 (mid-2005 was when inventory started increasing sharply). Inventory was down slightly compared to April 2004 (see first graph below). This decline in inventory remains a significant story.

There is a seasonal pattern for inventory - usually inventory is the lowest in the winter months, and inventory usually peaks mid-summer. However most of the seasonal increase typically happens by April - so we could be close to the peak for this year.

Earlier this year, there were several analysts projecting that inventory would increase to 3 million by mid-summer. I thought that was too high, and it now looks like inventory will peak in the 2.6+ million range. That would be well below the inventory peak in 2005 of 2.9 million units.

At the current sales rate, 2.6 million units of inventory this would push the months-of-supply measure up to 6.7 to 6.8 months from the current 6.6 months. Note: Months-of-supply uses the seasonally adjusted sales rate, and the not seasonally adjusted inventory (even though there is a seasonal pattern for inventory). That would be the lowest seasonal peak for months-of-supply since 2005.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we comparing inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. However, in the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

The following graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

Click on graph for larger image.

Click on graph for larger image.

This year (dark red for 2012) inventory is at the lowest level for the month of April since 2005, and inventory is slightly below the level in April 2004 (not counting contingent sales). Sometime this summer, I expect inventory to be below the same month in 2005. However inventory is still elevated - especially with the much lower sales rate.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA (red column) are above the sales for the 2008, 2009 and 2011 (2010 was higher because of the tax credit). Sales are well below the bubble years of 2005 and 2006.

Sales NSA (red column) are above the sales for the 2008, 2009 and 2011 (2010 was higher because of the tax credit). Sales are well below the bubble years of 2005 and 2006.

Also it appears distressed sales were down in April. From the NAR:

Distressed homes – foreclosures and short sales sold at deep discounts – accounted for 28 percent of April sales (17 percent were foreclosures and 11 percent were short sales), down from 29 percent in March and 37 percent in April 2011.The increase in existing home sales, combined with fewer distressed sales, is a positive sign for the housing market.

Earlier:

• Existing Home Sales in April: 4.62 million SAAR, 6.6 months of supply

• Existing Home Sales graphs

Existing Home Sales in April: 4.62 million SAAR, 6.6 months of supply

by Calculated Risk on 5/22/2012 10:00:00 AM

The NAR reports: April Existing-Home Sales Up, Prices Rise Again

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 3.4 percent to a seasonally adjusted annual rate of 4.62 million in April from a downwardly revised 4.47 million in March, and are 10.0 percent higher than the 4.20 million-unit level in April 2011.

...

Total housing inventory at the end of April rose 9.5 percent to 2.54 million existing homes available for sale, a seasonal increase which represents a 6.6-month supply at the current sales pace, up from a 6.2-month supply in March. Listed inventory is 20.6 percent below a year ago when there was a 9.1-month supply; the record for unsold inventory was 4.04 million in July 2007.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April 2012 (4.62 million SAAR) were 3.4% higher than last month, and were 10.00% above the April 2011 rate.

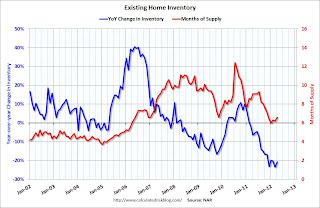

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.54 million in April from the downwardly revised 2.32 million in March (revised down from 2.40 million). Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.

According to the NAR, inventory increased to 2.54 million in April from the downwardly revised 2.32 million in March (revised down from 2.40 million). Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 20.6% year-over-year in April from April 2011. This is the fourteenth consecutive month with a YoY decrease in inventory.

Inventory decreased 20.6% year-over-year in April from April 2011. This is the fourteenth consecutive month with a YoY decrease in inventory.Months of supply was increased to 6.6 months in April.

This was slightly below expectations of sales of 4.66 million. I'll have more soon ...