by Calculated Risk on 6/02/2012 11:53:00 AM

Saturday, June 02, 2012

Employment Report Graphs: Construction, Duration of Unemployment and Diffusion Indexes

The first graph below shows the number of total construction payroll jobs in the U.S. including both residential and non-residential since 1969.

Construction employment decreased by 28,000 thousand jobs in May, seasonally adjusted. Not seasonally adjusted, construction employment increased 169,000 in May. This suggests some weather related "payback" in May, as opposed to a new round of job losses in construction.

Last year was the first year with an increase in construction employment since 2006, and the first with an increase in residential construction employment since 2005.

Unfortunately this graph is a combination of both residential and non-residential construction employment. The BLS only started breaking out residential construction employment fairly recently (residential specialty trade contractors in 2001).

Click on graph for larger image.

Click on graph for larger image.

Construction employment appears to have bottomed, and should add to both GDP and employment growth in 2012.

Other construction indicators - housing starts, new home sales, construction spending - are all increasing (public construction spending is decreasing), and construction employment should also increase this year.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.All categories are generally moving down. The less than 5 week category is back to normal levels, but the other categories remain elevated.

Unfortunately the long term unemployed increased to 3.5% of the labor force in May. This was offset by a decline in the '15 to 26 weeks' category. Apparently a number of people just moved from the '15 to 26 weeks' category to the '27 week or more' category.

Diffusion indexes are a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. If there are employment gains, the more widespread, the better - even if job growth is slow. From the BLS:

Diffusion indexes are a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. If there are employment gains, the more widespread, the better - even if job growth is slow. From the BLS: Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The BLS diffusion index for total private employment was at 59.4 in May, up from 55.6 in April. For manufacturing, the diffusion index increased to 54.3, up from 53.7 in April.

So job growth was a little more widespread in May than in April. A small positive.

Yesterday employment posts:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

• May Employment Summary and Discussion

• Employment Graphs

Update: State and Local Government Job Losses

by Calculated Risk on 6/02/2012 08:49:00 AM

Back in January I wrote:

It is looking like there will be less drag from state and local governments in 2012, and that most of the drag will be over by the end of Q2 (end of FY 2012). This doesn't mean state and local government will add to GDP in the 2nd half of 2012, just that the drag on GDP and employment will probably end. Just getting rid of the drag will help.It is time for an update since we are almost halfway through the year.

So far in 2012 - through May - state and local government have lost 7,000 jobs (8,000 jobs were lost in May alone though). In the first five months of 2011, state and local governments lost 126,000 payroll jobs - and 230,000 for the year.

Click on graph for larger image.

Click on graph for larger image.This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.

Note: Some of the stimulus spending from the American Recovery and Reinvestment Act probably kept state and local employment from declining faster in 2009.

Of course the Federal government is still losing workers (50,000 over the last 12 months), but it looks like state and local government employment losses might be ending (or at least slowing sharply).

Yesterday employment posts:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

• May Employment Summary and Discussion

• Employment Graphs

Friday, June 01, 2012

Fannie Mae Serious Delinquency rate declined in April, Freddie Mac unchanged

by Calculated Risk on 6/01/2012 10:13:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in April to 3.63%, down from 3.67% in March. The serious delinquency rate is down from 4.19% in April last year, and is at the lowest level since April 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate was unchanged at 3.51% in April. Freddie's rate is only down from 3.67% in April 2011. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

With the mortgage servicer settlement, I'd expect the delinquency rate to start to decline faster over the next year or so. I don't know why Fannie's delinquency rate is falling faster than for Freddie.

The "normal" serious delinquency rate is under 1%, so there is a long way to go.

Note: HUD also released the quarterly FHA Single-Family Mutual Mortgage Insurance Fund Programs report. This showed the FHA serious delinquency rate declined in Q1 to 9.4% from 9.6%, but this was probably just a seasonal decline.

Earlier employment posts:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

• May Employment Summary and Discussion

• Employment Graphs

Personal Income increased 0.2% in April, Spending 0.3%

by Calculated Risk on 6/01/2012 07:02:00 PM

This is worth mentioning, from earlier today: The BEA released the Personal Income and Outlays report for April:

Personal income increased $31.7 billion, or 0.2 percent ... in April, according to the Bureau of Economic Analysis. Personal Personal consumption expenditures (PCE) increased $31.8 billion, or 0.3 percent.The following graph shows real Personal Consumption Expenditures (PCE) through April (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in April, compared with an increase of less than 0.1 percent in March. ... PCE price index -- The price index for PCE increased less than 0.1 percent in April, compared with an increase of 0.2 percent in March. The PCE price index, excluding food and energy, increased 0.1 percent, compared with an increase of 0.2 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE. You can really see the slow down in Q2 of last year. Even if May and June are flat compared to April this year, real PCE would increase around 2% in Q2.

Another key point is the PCE price index has only increased 1.8% over the last year, and core PCE is up 1.9%. And it looks like the year-over-year increases will decline further in May.

Also the personal saving rate declined to 3.4% in April.

Earlier employment posts:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

• May Employment Summary and Discussion

• Employment Graphs

U.S. Light Vehicle Sales at 13.8 million annual rate in May

by Calculated Risk on 6/01/2012 03:28:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.78 million SAAR in May. That is up 17.9% from May 2011, and down 4.1% from the sales rate last month (14.37 million SAAR in April 2012).

This was below the consensus forecast of 14.5 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for May (red, light vehicle sales of 13.78 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

This was the weakest month this year. The year-over-year increase was large because of the impact of the tsuanmi and related supply chain issues in May 2011.

Sales have averaged a 14.43 million annual sales rate through the first five months of 2012, up sharply from the same period of 2011.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

This shows the huge collapse in sales in the 2007 recession.

Earlier employment posts:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

• May Employment Summary and Discussion

• Employment Graphs

Construction Spending in April: Private spending increases, Public Spending declines

by Calculated Risk on 6/01/2012 01:50:00 PM

Catching up ... This morning the Census Bureau reported that overall construction spending increased in April:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during April 2012 was estimated at a seasonally adjusted annual rate of $820.7 billion, 0.3 percent above the revised March estimate of $818.1 billion. The April figure is 6.8 percent above the April 2011 estimate of $768.2 billion.Private construction spending increased while public spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $549.7 billion, 1.2 percent above the revised March estimate of $543.4 billion. ... In April, the estimated seasonally adjusted annual rate of public construction spending was $271.0 billion, 1.4 percent below the revised March estimate of $274.7 billion..

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 62% below the peak in early 2006, and up 14% from the recent low. Non-residential spending is 29% below the peak in January 2008, and up about 20% from the recent low.

Public construction spending is now 17% below the peak in March 2009 and at a new post-bubble low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down on a year-over-year basis. The year-over-year improvements in private non-residential is mostly related to energy spending (power and electric).

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit).

May Employment Summary and Discussion

by Calculated Risk on 6/01/2012 11:50:00 AM

Another month, another disappointing employment report.

There appeared to be some additional weather related "payback" in May offsetting the relatively solid job growth during the winter months. As an example, construction employment was down 28,000 (seasonally adjusted), and "leisure and hospitality" declined by 9,000 jobs. Both were up solidly Not Seasonally Adjusted (NSA) in May. Construction was up 169,000 jobs, and leisure and leisure and hospitality increased 312,000 jobs NSA, but this is less than usual in May - probably because of the hiring during the winter - and the seasonally adjusted numbers were down. This weather "payback" is probably over now.

If we average over the first five months of the year, the economy has added 164,600 jobs per month (169,400 private sector per month). At this pace, the economy would add around 2 million private sector jobs in 2012; about the same as in 2011.

However weather payback probably only accounts for some of the recent slowdown in hiring.

Some numbers: There were 69,000 payroll jobs added in May, with 82,000 private sector jobs added, and 13,000 government jobs lost. The unemployment rate increased to 8.2%. The household survey showed a strong increase in employment (422,000 jobs added), but the participation rate increased too (from 63.6% to 63.8%) so that pushed up the unemployment rate. The household survey job gains - and increase in the participation rate - are small positives.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, increased so 14.8%.

The change in March payroll employment was revised down from +154,000 to +143,000, and April was revised down from +115,000 to +77,000.

The average workweek declined to 34.4 hours, and average hourly earnings increased slightly. "The average workweek for all employees on private nonfarm payrolls edged down by 0.1 hour to 34.4 hours in May. ... In May, average hourly earnings for all employees on private nonfarm payrolls edged up by 2 cents to $23.41. Over the past 12 months, average hourly earnings have increased by 1.7 percent.

There are a total of 12.7 million Americans unemployed and 5.4 million have been unemployed for more than 6 months.

The bottom line is this was another disappointing employment report.

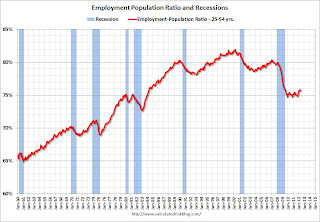

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate has declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move back to or above 80% as the economy recovers. So far the ratio has only increased slightly from a low of 74.7% to 75.7% in May (this was unchanged in May from April.)

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) edged up to 8.1 million over the month. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers increased in May to 8.1 millon.

These workers are included in the alternate measure of labor underutilization (U-6) that increased in May to 14.8%, up from 14.5% in April.

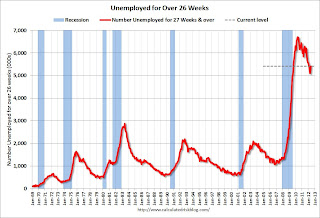

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.4 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 5.1 million in April. This reversed the decline over the previous two months, although the number is still down since the beginning of the year. Long term unemployment remains one of the key labor problems in the US.

ISM Manufacturing index declines in May to 53.5

by Calculated Risk on 6/01/2012 10:00:00 AM

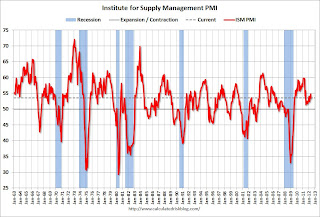

I'll have more on the employment report soon. PMI was at 53.5% in May, down from 54.8% in April. The employment index was at 56.9%, down from 57.3%, and new orders index was at 60.1%, up from 58.2%.

From the Institute for Supply Management: May 2012 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in May for the 34th consecutive month, and the overall economy grew for the 36th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 53.5 percent, a modest decrease of 1.3 percentage points from April's reading of 54.8 percent, indicating expansion in the manufacturing sector for the 34th consecutive month. The New Orders Index continued its growth trend for the 37th consecutive month, registering 60.1 percent in May. This represents an increase of 1.9 percentage points from April and also the highest level recorded by the index since April 2011. The Prices Index for raw materials fell to 47.5 percent in May, dropping 13.5 percentage points from April, indicating lower prices for the first time since December 2011. Comments from the panel generally reflect stable-to-strong orders, with sales showing steady improvement over the first five months of 2012."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 54.0%. This suggests manufacturing expanded at a slower rate in May than in April.

Although this was slightly weaker than expected, new orders were up and prices were down. Not all bad.

May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

by Calculated Risk on 6/01/2012 08:30:00 AM

From the BLS:

Nonfarm payroll employment changed little in May (+69,000), and the unemployment rate was essentially unchanged at 8.2 percent, the U.S. Bureau of Labor Statistics reported today.

...

The civilian labor force participation rate increased in May by 0.2 percentage point to 63.8 percent, offsetting a decline of the same amount in April. The employment-population ratio edged up to 58.6 percent in May.

...

The change in total nonfarm payroll employment for March was revised from +154,000 to +143,000, and the change for April was revised from +115,000 to +77,000.

Click on graph for larger image.

Click on graph for larger image.This was a weak month, and the previous two months were revised down.

This was below expectations of 150,000 payroll jobs added.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 8.2% (red line).

The Labor Force Participation Rate increased to 63.8% in May (blue line). This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 63.8% in May (blue line). This is the percentage of the working age population in the labor force.The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the recent decline is due to demographics.

The Employment-Population ratio increased to 58.6% in May from 58.4% in April (black line).

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was weaker payroll growth than expected (expected was 150,000). More later ...

Thursday, May 31, 2012

May Contest Winners and Look Ahead

by Calculated Risk on 5/31/2012 09:09:00 PM

The June contest starts on Friday with four questions (see below). For the economic question contest in May, the leaders were (Congratulations all!):

1) Bill Dawers

2) Bill (Calculated Risk)

3) (2 way tie) Liye Ma

3) Jon Fader

5) (3 way tie) David Fiene

5) Joey Cordero

5) Andrew Marrinson

Friday will be another busy day:

• At 8:30 AM ET, the BLS is scheduled to release the employment situation report for May. The consensus is for an increase of 150,000 non-farm payroll jobs in May, up from the 115,000 jobs added in April. Earlier I posted an employment preview.

• Also at 8:30 AM the Personal Income and Outlays report for April will be released. The consensus is for a 0.3% increase in personal income in April, and a 0.3% increase in personal spending, and for the Core PCE price index to increase 0.1%.

• At 10:00 AM ET, the ISM Manufacturing Index for May is scheduled for release. The consensus is for a slight decrease to 54.0 from 54.8 in April. The regional Fed surveys were mixed this month. Also the Chicago PMI released this morning was weaker than expected, and Markit has introduced a new "Flash PMI" for the US showing "the seasonally adjusted PMI falling from 56.0 in April to 53.9". This would suggest a larger decrease in the ISM index.

• Also at 10:00 AM, the Census Bureau will release Construction Spending for April. The consensus is for a 0.4% increase in construction spending.

• And during the day, the auto manufacturers will report light vehicle sales for May. Light vehicle sales are expected to increase to 14.5 million from 14.4 million in April (Seasonally Adjusted Annual Rate).