by Calculated Risk on 6/04/2012 06:31:00 PM

Monday, June 04, 2012

The Misfiring Engine of Recovery

Gad Levanon at the Conference Board makes some interesting points: Why is Employment Growth Still Disappointing and When Will it be “Normal” Again?

In a typical recovery, rapid economic growth is driven by pent-up demand for consumer durable goods, housing, and business equipment. Also, in a typical recovery the government moderately adds jobs, and economies outside of the U.S. are enjoying robust growth, which helps boost American exports and raises the revenues of American multinationals. So what’s different this time? There are several combined factors that are dragging down the U.S. economy and labor market:Usually housing is an engine of recovery following a recession, but this time, due to the excess supply of vacant homes, housing has lagged the economy.

1) Government spending is shrinking. The hope was that the federal stimulus would create jobs while the private sector was in recession, and that this federal stimulus would eventually wind down while the private sector would pick up. This wind-down has occurred, but the private sector is not generating enough jobs by itself yet. At the same time, state and local governments... have been cutting back for several years now ... In the past year, state and local governments have slowed down their layoffs, but the number of employees in the federal government is still rapidly shrinking -- down by 1.8%. Overall, the public sector has reduced its workforce for three years in a row, cutting a total of about 700,000 workers.

2) The housing market has barely started recovering, and employers in related industries are barely adding jobs. This typically strong driver of growth during expansions is missing in this economy.

3) The global economy is weak. Many countries in Europe are in recession, and the main emerging countries’ economies are significantly slowing down. As a result, U.S. exports and revenues of multinationals and overall consumer and business confidence are suffering.

4) Commodity prices are now at a much higher level than two-to-three years ago. This has caused large price increases in food, energy, and other commodity related products. In the past 2 years, as a result of the price hikes and weakness in housing, the consumption of food, gasoline, public transportation, housing, and utilities have increased by just 0.5% of their annual rate.

And usually government hiring contributes moderately to a recovery, but this time we've seen a significant decline in government employment. This decline has been mostly from state and local cutbacks, but the Federal government has been cutting back too.

And of course, as Levanon notes, the global economy is weak with several key countries in recession.

The little bit of good news is housing is finally starting to slowly recover, and perhaps state and local government layoffs might end mid-year. So far GDP growth has been heavily car driven, and that growth might slow - and, of course, the global economy is a drag.

It seems like one or two cylinders of the growth engine are always misfiring. This is why sluggish and choppy growth has been my general forecast for almost 3 years now.

G7 Emergency Talks on Tuesday

by Calculated Risk on 6/04/2012 03:26:00 PM

From Reuters: G7 to hold emergency euro zone talks, Spain top concern

Finance chiefs of the Group of Seven leading industrialized powers will hold emergency talks on the euro zone debt crisis on Tuesday ...Over the weekend, I put together a short list of key dates this month for Europe. There will probably be plenty of "emergency" discussions too.

Canadian Finance Minister Jim Flaherty said ministers and central bankers of the United States, Canada, Japan, Britain, Germany, France and Italy would hold a special conference call, raising pressure on the Europeans to act.

"The real concern right now is Europe of course - the weakness in some of the banks in Europe, the fact they're undercapitalized, the fact the other European countries in the euro zone have not taken sufficient action yet to address those issues of undercapitalization of banks and building an adequate firewall," Flaherty told reporters.

BIS Quarterly Review: Global Banks Cut Lending

by Calculated Risk on 6/04/2012 01:30:00 PM

From the Bank for International Settlements (BIS): Quarterly Review(ht mp)

And from Mark Scott at the NY Times DealBook: Global Banks Cut Lending in Response to Economic Slowdown

International lending by global banks in the fourth quarter last year fell by the largest amount since the collapse of Lehman Brothers in 2008, according to the Bank for International Settlements, an association of the world’s central banks.This pullback in lending is global, but it is concentrated in Europe. However there appears to be some tightening in the U.S. too. In a research note on Friday, Goldman Sachs noted this:

In total, financial firms cut overseas lending by $799 billion in the last three months of 2011, the latest figures available. Around 80 percent of the reduction came from the so-called interbank market where institutions lend money to one another.

...

As the ripple effects of the European debt crisis have been felt across the United States and emerging economies in Asia and Latin America, banks in both developed and emerging economies have been looking to pullback on credit to risky borrowers.

Attention has focused on Europe and its beleaguered banking system. In its quarterly review published on Monday, the Bank for International Settlements, based in Basel, Switzerland, said international banks had cut lending to financial firms in the so-called euro zone region by $364 billion in the fourth quarter last year. The reduction represents almost half of the global pullback in lending over the period.

US financial conditions have tightened by about 40bp since April, according to our GSFCI. If the current stress were sustained, the tightening would mechanically imply a 0.6% hit to real GDP. Our analysis suggests that perhaps half of this can be explained by the European crisis.

Gasoline prices declining

by Calculated Risk on 6/04/2012 09:09:00 AM

Oil prices have fallen sharply. West Texas Intermediate (WTI) futures are down to $82.36, and Brent is down to $96.93 per barrel.

Note on Europe: There are two main channels that could impact the U.S. economy: trade, and financial spillover / credit tightening. The impact on trade will probably be minimal, even as the euro falls sharply against the dollar, because a small percentage of U.S. GDP is from exports to Europe - and some of decline in trade will be offset by lower oil prices (and lower US interest rates). The financial channel is much more of an unknown, and that is the significant downside risk.

From the Indystar.com: Gasoline prices expected to continue to fall in Indiana, analyst says

“With significant downward pressure on oil last week, motorists will continue to see prices sliding east of the Rockies, and even the West Coast will start to get in on the action, thanks to a supply situation that appears to be turning around.”The following graph shows the decline in gasoline prices. Gasoline prices are down significantly from the peak in early April, and should fall further following the steep decline in oil prices last week. Gasoline prices in the west have been impacted by refinery issues, but prices are now falling there too.

Average retail gas prices in Indianapolis have dropped by 17 cents a gallon last week, averaging $3.53 Sunday and $3.52 this morning. That’s about 40 cents lower than last month and about half a dollar cheaper than last year, according to Gasbuddy.com.

Note: The graph shows oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Sunday, June 03, 2012

Sunday Night Futures

by Calculated Risk on 6/03/2012 10:06:00 PM

The only release on Monday is Factory Orders at 10:00 AM. The consensus is for a 0.1% increase in orders.

The focus will probably be on Europe again, although the FTSE 100 is closed for the Queen's Diamond Jubilee. The ECB meets on Wednesday (see Europe: A few Key Dates this Month )

The Asian markets are all red tonight. The Nikkei is down about 2.2%, and the Shanghai Composite is down 1.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are down about 10, and Dow futures are down 100.

Oil: WTI futures are at $82.30 (this is down from $109.77 in February) and Brent is at $97.73 per barrel. Both are down about 10% over the last week.

Saturday:

• Summary for Week Ending June 1st

• Schedule for Week of June 3rd

For the monthly economic question contest (two more questions for June):

Sluggish Growth and Payroll Employment: An Update

by Calculated Risk on 6/03/2012 04:15:00 PM

Last November I posted a graph showing two possible paths for payroll employment if sluggish growth continued. I've received several requests to update that graph.

The two rates were 125,000 jobs added per month, and 200,000 jobs added per month.

Since I posted that graph, payroll growth has averaged 172,000 jobs per month. Also, with the annual benchmark revision, the previous year was revised up - so at 125,000 per month from November 2011, it would have taken 48 months just to get back to the pre-recession level of payroll employment. From the current level, at 125,000 per month, it will take an additional 40 months (Sept 2015).

At 200,000 payroll jobs per month, it will take an additional 25 months (June 2014) to get back to the pre-recession level from the current level. (The graph shows April 2014 at 200,000 per month, but that is from November 2011, and we are behind that pace).

The following two graphs show these projections from last November.

The dashed red line is 125,000 payroll jobs added per month. The dashed blue line is 200,000 payroll jobs per month.

Click on graph for larger image.

Click on graph for larger image.

If we followed the red line path from last year, payroll jobs would return to the pre-recession level in November 2015. The dashed blue line returns to the pre-recession level in April 2014.

And this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow).

The second graph shows the same data but aligned at peak job losses.

The second graph shows the same data but aligned at peak job losses.

Last November the debate was been between another recession and sluggish growth - and I correctly took sluggish growth. But as I noted last year, even sluggish growth is a disaster for payroll employment.

Europe: A few Key Dates this Month

by Calculated Risk on 6/03/2012 12:46:00 PM

Just a few dates ... the last two weeks will be very busy.

• Wednesday, June 6th: ECB Governing Council meeting. Here are a few comments from analysts at Nomura:

We expect the ECB to keep its policy rate unchanged at 1%, keeping the powder dry until there is more clarity on Greece's euro-area membership. ... We think the tone of the press conference and the statement will be significantly more dovish than last month given that the ECB's assumption of a mid-summer recovery is currently at risk. We also expect the June quarterly forecast update to show downward revisions to both the inflation and the output outlook. In our view, such a dovish signal would firm expectations that the ECB will cut rates as soon as at the July meeting. ... At the moment, we see a 30% probability of a 25bp rate cut next week.• Thursday, June 7th: BoE rate decision. From the Telegraph: Bank of England to consider £50bn stimulus for economy

Worsening economic prospects could force the hand of the Bank’s Monetary Policy Committee, which last month voted to pause its purchase of government bonds after pumping £325bn into the market through quantitative easing. ... The International Monetary Fund has recommended that the MPC consider a further reduction in interest rates, which have been at an all-time low of 0.5pc since March 2009, to help the UK weather the eurozone debt crisis.• Monday, June 11th: IMF Report on Spanish Banks

• Sunday, June 17th: Greek Election.

Monday, June 18th: Independent Spanish Bank Stress Tests. This is the preliminary results of the tests by Oliver Wyman Ltd. and Roland Berger Strategy Consultants. From Reuters: "Big Four" to audit Spain's banking sector

Spain has picked the "Big Four" accounting firms KPMG KPMG.UL, PwC PWC.UL, Deloitte DLTE.UL and Ernst & Young ERNY.UL to carry a full, individual audit of its ailing banks, a source with knowledge of the decision told Reuters on Saturday.Monday, June 18th: Start of two day G20 summit meeting in Los Cabos, Mexico

The review, which should take a few months, will complement an ongoing exercise to stress test Spain's banking sector by consultors Oliver Wyman and Roland Berger, whose first results are expected around mid-June.

Thursday, June 21st: Meeting of euro zone finance ministers

Thursday, June 28th: Start of two day European summit in Brussels

Saturday, June 30th: Greece required to enact new austerity measures as part of the bailout agreement. Greece is currently funded until the end of June.

Yesterday:

• Summary for Week Ending June 1st

• Schedule for Week of June 3rd

Employment posts:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

• May Employment Summary and Discussion

• Employment Report Graphs: Construction, Duration of Unemployment and Diffusion Indexes

• Employment Graphs

Unofficial Problem Bank list declines to 927 Institutions

by Calculated Risk on 6/03/2012 09:17:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 1, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As anticipated, most changes to the Unofficial Problem Bank List were removals. In all, there were four removals that include one unassisted merger --Bank of Anderson, National Association, Anderson, SC ($139 million) -- and three action terminations -- Preferred Bank, Los Angeles, CA ($1.4 billion Ticker: PFBC); Castle Rock Bank, Castle Rock, CO ($106 million); and Battle Creek State Bank, Battle Creek, NE ($26 million). After the removals, the list holds 927 institutions with assets of $356.4 billion. A year ago, the list held 997 institutions with assets of $416.7 billion. The other change this week is the Federal Reserve issuing a Prompt Corrective Action order against Premier Bank, Denver, CO ($53 million).Yesterday:

• Summary for Week Ending June 1st

• Schedule for Week of June 3rd

Employment posts:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

• May Employment Summary and Discussion

• Employment Report Graphs: Construction, Duration of Unemployment and Diffusion Indexes

• Employment Graphs

Saturday, June 02, 2012

Schedule for Week of June 3rd

by Calculated Risk on 6/02/2012 08:59:00 PM

Earlier:

• Summary for Week Ending June 1st

Employment posts:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

• May Employment Summary and Discussion

• Employment Report Graphs: Construction, Duration of Unemployment and Diffusion Indexes

• Employment Graphs

The key report this week is the April Trade Balance report.

Also the ISM non-manufacturing (service) index will be released on Tuesday.

Fed Chairman Ben Bernanke will provide Senate testimony on Thursday. There are several Fed speeches scheduled this week, and the Fed Beige Book will be released on Wednesday.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for April. The consensus is for a 0.1% increase in orders.

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for May (a measure of transportation).

10:00 AM: ISM non-Manufacturing Index for May. The consensus is for the index to be unchanged at 53.5. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: ISM non-Manufacturing Index for May. The consensus is for the index to be unchanged at 53.5. Note: Above 50 indicates expansion, below 50 contraction.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index. The index declined sharply in April.

10:00 AM: Trulia Price & Rent Monitors for May. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Expect record low mortgage rates and probably an increase in refinance activity.

8:30 AM: Productivity and Costs for Q1 (Final). The consensus is for a 2.1% increase in unit labor costs.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This will receive extra attention this month as investors look for signs of a slowdown.

7:00 PM: Speech by Fed Vice Chair Janet Yellen, "The Economic Outlook and Monetary Policy", At the Boston Economic Club Dinner, Boston, Massachusetts

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decline to 379 thousand from 383 thousand last week.

10:00 AM: Testimony, Fed Chairman Ben Bernanke, "Economic Outlook and Policy", before the Joint Economic Committee, U.S. Senate.

3:00 PM: Consumer Credit for April. The consensus is for a $12.0 billion increase in consumer credit.

12:00 PM: Q1 Flow of Funds Accounts from the Federal Reserve.

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. Exports increased in March, and were at record levels. Imports increased even more. Exports are 13% above the pre-recession peak and up 7% compared to March 2011; imports are 3% above the pre-recession peak, and up about 8% compared to March 2011.

The consensus is for the U.S. trade deficit to decrease to $49.3 billion in April, down from from $51.8 billion in March. Export activity to Europe will be closely watched due to economic weakness. Also oil prices started to decline in April, but that probably won't reduce imports until May.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for April. The consensus is for a 0.5% increase in inventories.

Summary for Week Ending June 1st

by Calculated Risk on 6/02/2012 04:50:00 PM

This was a banner week for economic observers who scream "Miss!" every time an economic report is weaker than expected. The list of disappointing reports is long: a weak employment report, a downward revision to Q1 GDP growth, a disappointing ISM manufacturing index, weaker than expected auto sales, an increase in weekly unemployment claims, house prices at new post-bubble lows, pending home sales were down, and the Chicago PMI was weaker than expected.

Meanwhile the European crisis is grabbing headlines again, and June is another "kick-the-can or break" month for Europe (Usually the saying is "make or break", but there is no "make" on the horizon in Europe).

The weak data is a reminder: Every time the data is better than expected, some observers start predicting robust growth. And every time the data is weak, like last week, other observers start predicting another recession. Both groups have consistently been wrong; this is more of the sluggish and choppy growth that is typical following a financial crisis.

I'll have more on the economic outlook this week (the negatives and a few positives).

Here is a summary of last week in graphs:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

Click on graph for larger image.

Click on graph for larger image.

This was a weak month with only 69,000 payroll jobs added. Also the previous two months were revised down.

There appeared to be some additional weather related "payback" in May offsetting the relatively solid job growth during the winter months. As an example, construction employment was down 28,000 (seasonally adjusted), and "leisure and hospitality" declined by 9,000 jobs. Both were up solidly Not Seasonally Adjusted (NSA) in May. Construction was up 169,000 jobs, and leisure and leisure and hospitality increased 312,000 jobs NSA, but this is less than usual in May - probably because of the hiring during the winter - and the seasonally adjusted numbers were down. This weather "payback" is probably over now.

However weather payback probably only accounts for some of the recent slowdown in hiring.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 8.2% (red line).

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 8.2% (red line).

The household survey showed a strong increase in employment (422,000 jobs added), but the participation rate increased too from 63.6% to 63.8% (blue line) so that pushed up the unemployment rate. The household survey job gains - and increase in the participation rate - are small positives.

The Employment-Population ratio increased to 58.6% in May from 58.4% in April (black line).

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was weaker payroll growth than expected (expected was 150,000).

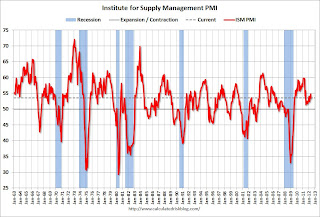

• ISM Manufacturing index declines in May to 53.5

PMI was at 53.5% in May, down from 54.8% in April. The employment index was at 56.9%, down from 57.3%, and new orders index was at 60.1%, up from 58.2%.

PMI was at 53.5% in May, down from 54.8% in April. The employment index was at 56.9%, down from 57.3%, and new orders index was at 60.1%, up from 58.2%.From the Institute for Supply Management: May 2012 Manufacturing ISM Report On Business®

Here is a long term graph of the ISM manufacturing index.

This was below expectations of 54.0%. This suggests manufacturing expanded at a slower rate in May than in April.

Although this was slightly weaker than expected, new orders were up and prices were down. Not all bad.

• U.S. Light Vehicle Sales at 13.8 million annual rate in May

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.78 million SAAR in May. That is up 17.9% from May 2011, and down 4.1% from the sales rate last month (14.37 million SAAR in April 2012).

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.78 million SAAR in May. That is up 17.9% from May 2011, and down 4.1% from the sales rate last month (14.37 million SAAR in April 2012).This was the weakest month this year. The year-over-year increase was large because of the impact of the tsunami and related supply chain issues in May 2011. This was below the consensus forecast of 14.5 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for May (red, light vehicle sales of 13.78 million SAAR from Autodata Corp).

• Case Shiller: House Prices fall to new post-bubble lows in March

S&P/Case-Shiller released the monthly Home Price Indices for March (a 3 month average of January, February and March).

S&P/Case-Shiller released the monthly Home Price Indices for March (a 3 month average of January, February and March).The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 34.1% from the peak, and up 0.2% in March (SA). The Composite 10 is at a new post bubble low Not Seasonally Adjusted.

The Composite 20 index is off 33.8% from the peak, and up 0.2% (SA) from March. The Composite 20 is also at a new post-bubble low NSA.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 2.8% compared to March 2011.

The Composite 20 SA is down 2.6% compared to March 2011. This was a smaller year-over-year decline for both indexes than in February.

• Real House Prices and Price-to-Rent Ratio at late '90s Levels

Another Update: Case-Shiller, CoreLogic and others report nominal house prices. It is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

This graph shows the quarterly Case-Shiller National Index SA (through Q1 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through March) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

This graph shows the quarterly Case-Shiller National Index SA (through Q1 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through March) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to Q4 1998 levels, the Composite 20 index is back to January 2000, and the CoreLogic index back to May 1999.

In real terms, all appreciation in the '00s is gone.

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 1998 levels, the Composite 20 index is back to March 2000 levels, and the CoreLogic index is back to August 1999.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels.

• Weekly Initial Unemployment Claims increase to 383,000

The DOL reports:

The DOL reports:In the week ending May 26, the advance figure for seasonally adjusted initial claims was 383,000, an increase of 10,000 from the previous week's revised figure of 373,000. The 4-week moving average was 374,500, an increase of 3,750 from the previous week's revised average of 370,750.This was above the consensus forecast of 370,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 374,500.

The average has been between 363,000 and 384,000 all year.

Private residential spending is 62% below the peak in early 2006, and up 14% from the recent low. Non-residential spending is 29% below the peak in January 2008, and up about 20% from the recent low.

Public construction spending is now 17% below the peak in March 2009 and at a new post-bubble low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down on a year-over-year basis. The year-over-year improvements in private non-residential is mostly related to energy spending (power and electric).

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit).

• Other Economic Stories ...

• Personal Income increased 0.2% in April, Spending 0.3%

• Fannie Mae Serious Delinquency rate declined in April, Freddie Mac unchanged

• LPS: Foreclosures Sales declined in April, FHA foreclosure starts increased sharply

• Chicago PMI declines to 52.7

• ADP: Private Employment increased 133,000 in May

• NAR: Pending home sales index declined 5.5% in April