by Calculated Risk on 6/09/2012 02:09:00 PM

Saturday, June 09, 2012

Spain to ask EU for Bank Bailout

From the Financial Times: Spain to ask EU for bail out

The Spanish government agreed to seek EU bailout aid for its struggling financial sector on a conference call of eurozone finance ministers Saturday evening.It sounds like the maximum will be €100 billion. Apparently policymakers wanted to get something in place before the Greek election on June 17th.

In exchange, the ministers agreed not to attach any new conditions on Madrid other than its current commitments ...

Excerpt with permission

Earlier:

• Summary for Week Ending June 8th

• Schedule for Week of June 10th

Schedule for Week of June 10th

by Calculated Risk on 6/09/2012 01:05:00 PM

Earlier:

• Summary for Week Ending June 8th

The key report this week is the May retail sales report. For manufacturing, the May NY Fed (Empire state) survey, and the May Industrial Production and Capacity Utilization report will be released this week.

For prices, the May Producer Price Index and Consumer Price Index will be released on Wednesday and Thursday, respectively.

No economic releases scheduled.

7:30 AM: NFIB Small Business Optimism Index for May.

7:30 AM: NFIB Small Business Optimism Index for May. Click on graph for larger image in graph gallery.

The index increased to 94.5 in April from 92.5 in March. This tied February 2011 as the highest level since December 2007

The consensus is for a slight decrease to 94.2 in May.

8:30 AM: Import and Export Prices for April. The consensus is a for a 1.1% decrease in import prices.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Expect record low mortgage rates and probably an increase in refinance activity.

8:30 AM: Producer Price Index for May. The consensus is for a 0.6% decrease in producer prices (0.2% increase in core).

8:30 AM ET: Retail Sales for May.

8:30 AM ET: Retail Sales for May. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 23.1% from the bottom, and now 7.7% above the pre-recession peak.

The consensus is for retail sales to decrease 0.2% in May, and for retail sales ex-autos to decrease 0.1%.

10:00 AM: Manufacturing and Trade: Inventories and Sales for April (Business inventories). The consensus is for 0.3% increase in inventories.

8:30 AM: Consumer Price Index for May. The consensus is for headline CPI to decline 0.2% (with the decline in energy prices). The consensus is for core CPI to increase 0.2%.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decline to 375 thousand from 377 thousand last week.

8:30 AM ET: NY Fed Empire Manufacturing Survey for June. The consensus is for a reading of 13.8, down from 17.1 in May (above zero is expansion).

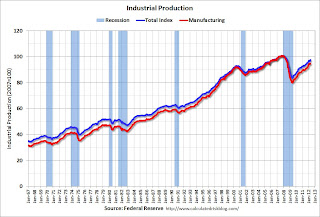

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for May.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for May. This shows industrial production since 1967.

The consensus is for no change in Industrial Production in May, and for Capacity Utilization to be unchanged at 79.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for June). The consensus is for sentiment to decline to 77.5 from 79.3 in May.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for May 2012

Report: Euro zone discussing €100 billion aid for Spanish Banks

by Calculated Risk on 6/09/2012 10:16:00 AM

From the WSJ: Ministers to Discuss $125 Billion in Spain Bank Support

Euro-zone finance ministers will discuss a commitment to provide as much as €100 billion ($125 billion) in support for Spain's ailing banking sector on Saturday afternoon, an official from a euro-zone country said Saturday.

Summary for Week Ending June 8th

by Calculated Risk on 6/09/2012 08:01:00 AM

Most of the news last week was about either Europe or the Fed, especially comments from Fed Chairman Bernanke. The Fed debate is on the possibility and timing of "QE3". The next FOMC meeting is on June 19th and 20th, just after the election in Greece.

This was a light week for US economic data. The trade deficit declined slightly - and will probably decline further in May with falling oil prices. However the weakness in the euro zone is showing up in the trade data as US exports to the euro area declined from $17.1 billion in April 2011 to $16.3 billion in April 2012.

Other data was a little more positive. Initial weekly unemployment claims declined slightly, and the ISM non-manufacturing index increased in May.

Also CoreLogic reported house prices were up year-over-year in April. This is the first year-over-year increase in prices since the bubble burst - except for a brief increase related to the tax credit.

Here is a summary of last week in graphs:

• Trade Deficit declines in April to $50.1 Billion

The first graph shows the monthly U.S. exports and imports in dollars through April 2012.

Click on graph for larger image.

Click on graph for larger image.

Exports decreased in April. Imports decreased even more. Exports are 11% above the pre-recession peak and up 4% compared to April 2011; imports are 2% above the pre-recession peak, and up about 6% compared to April 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through April.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

Oil averaged $109.94 per barrel in April, up from $107.95 in March. Import oil prices will probably start to decline in May. The trade deficit with China increased to $24.6 billion in April, up from $21.6 billion in April 2011. Once again most of the trade deficit is due to oil and China.

Exports to the euro area were $16.3 billion in April, down from $17.1 billion in April 2011, so the euro area recession appears to be a drag on US exports.

• ISM Non-Manufacturing Index indicates slightly faster expansion in May

The May ISM Non-manufacturing index was at 53.7%, up from 53.5% in April. The employment index decreased in May to 50.8%, down from 54.2% in April - the lowest level since November 2011. Note: Above 50 indicates expansion, below 50 contraction.

The May ISM Non-manufacturing index was at 53.7%, up from 53.5% in April. The employment index decreased in May to 50.8%, down from 54.2% in April - the lowest level since November 2011. Note: Above 50 indicates expansion, below 50 contraction.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was slightly above the consensus forecast of 53.5% and indicates faster expansion in May than in April.

• CoreLogic: House Price Index increases in April, Up 1.1% Year-over-year

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 2.2% in April, and is up 1.1% over the last year.

The index is off 32% from the peak - and is just above the post-bubble low set two months ago.

Excluding the tax credit period, this is the first year-over-year increase since 2006 (March was revised up to a year-over-year increase too). This "stabilization" of house prices is a significant story.

• Fed's Q1 Flow of Funds: Household Real Estate Value increased in Q1

The Federal Reserve released the Q1 2012 Flow of Funds report this week: Flow of Funds.

The Fed estimated that the value of household real estate increased $372 billion to $16.05 trillion in Q1 2012. The value of household real estate has fallen $6.3 trillion from the peak.

This graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $85 billion in Q1. Mortgage debt has now declined by $885 billion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, is near the lows of the last 30 years, however household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

• Weekly Initial Unemployment Claims decline to 377,000

This graph shows the 4-week moving average of weekly claims since January 2000.

This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 377,750.

The average has been between 363,000 and 384,000 all year, and this is the highest level since early May.

This was close to the consensus forecast of 379,000.

• Other Economic Stories ...

• Testimony by Chairman Bernanke on economic outlook and policy

• Fed's Beige Book: Economic activity increased at "moderate" pace, Residential real estate "activity improved"

• Comparing Housing Recoveries

• Housing: Dude, Where's my inventory?

• Trulia Reports Flat Asking Prices in May After Three Straight Months of Increases, as Foreclosure Prices Decline

Friday, June 08, 2012

IMF reports Spanish Banks need €37 billion; China CPI up 3.0%

by Calculated Risk on 6/08/2012 10:05:00 PM

Earlier today there were reports that Spain could request a bank bailout this weekend. From the Financial Times: Spain poised to seek bailout and from Reuters: Exclusive: Spain poised to request EU bank aid Saturday

Spain is expected to ask the euro zone for help with recapitalizing its banks this weekend, sources in Brussels and Berlin said on Friday, becoming the fourth country to seek assistance since Europe's debt crisis began.However, later in the day, from MarketWatch:

Five senior EU and German officials said deputy finance ministers from the single currency area would hold a conference call on Saturday morning to discuss a Spanish request for aid, although no figure for the assistance has yet been fixed.

Later the Eurogroup, which consists of the euro zone's 17 finance ministers, will hold a separate call to discuss approving the request, the sources said.

"The announcement is expected for Saturday afternoon," one of the EU officials said.

Deputy Prime Minister Soraya Saenz de Santamaria told reporters Friday that the government would make no decisions on any aid request before the results of various reports on Spanish banks were known.However the IMF released the report today, from the WSJ: Pressure Mounts on Spain to Request a Bailout

“The government has to respect the process before taking any decisions about the data of the banks,” said Sáenz de Santamaría, in the televised press conference. She also said there were no plans for any meetings in the coming days, but sidestepped questions about whether a teleconference call would be held.

The Economics Ministry said Friday that the results of the independent audit and stress-testing of Spanish banks will publish June 21. The government has also hired a second set of independent auditors to value the banks, with results expected July 31. As well, said Sáenz de Santamaría, the government was waiting on results expected next Monday, June 11, from the International Monetary Fund report on the banking sector.

In conference calls Saturday, euro-zone finance officials are expected to press Spain's government to request aid before the June 17 Greek elections, according to European officials familiar with the negotiations.And on China from MarketWatch: China data deluge

On the eve of those calls, the International Monetary Fund rushed out a report late Friday saying the banks need at least €37 billion ($46 billion); the report had been expected Monday.

Chinese data will be closely watched for signs that country’s economy is slowing more dramatically than previously projected. Over the weekend, China is scheduled to release its latest data on inflation, industrial production and retail sales for May, as well as monthly trade results.From the WSJ headline: "China's consumer price index rose 3.0% in May from the same month a year earlier, slower than April's 3.4% rise."

Bank Failures #26 to #28 in 2012

by Calculated Risk on 6/08/2012 06:08:00 PM

What the hell’s a Waccamaw?

Carolina too?

by Soylent Green is People

From the FDIC: Bank of North Carolina, Thomasville, North Carolina, Assumes All of the Deposits of Carolina Federal Savings Bank, Charleston, South Carolina

As of March 31, 2012, Carolina Federal Savings Bank had approximately $54.4 million in total assets and $53.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $15.2 million. ... Carolina Federal Savings Bank is the 26th FDIC-insured institution to fail in the nation this year, and the second in South Carolina.From the FDIC: First State Bank, Mendota, Illinois, Assumes All of the Deposits of Farmers and Traders State Bank, Shabbona, Illinois

As of March 31, 2012, Farmers and Traders State Bank had approximately $43.1 million in total assets and $42.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $8.9 million. ... Farmers and Traders State Bank is the 27th FDIC-insured institution to fail in the nation this year, and the second in Illinois.From the FDIC: First Community Bank, Bluefield, Virginia, Assumes All of the Deposits of Waccamaw Bank, Whiteville, North Carolina

As of March 31, 2012, Waccamaw Bank had approximately $533.1 million in total assets and $472.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $51.1 million. ... Waccamaw Bank is the 28th FDIC-insured institution to fail in the nation this year, and the first in North Carolina.That makes four so far today.

Bank Failure #25 in 2012: First Capital Bank, Kingfisher, Oklahoma

by Calculated Risk on 6/08/2012 05:11:00 PM

Capital base denuded

Bank apprehended.

by Soylent Green is People

From the FDIC: F & M Bank, Edmond, Oklahoma, Assumes All of the Deposits of First Capital Bank, Kingfisher, Oklahoma

As of March 31, 2012, First Capital Bank had approximately $46.1 million in total assets and $44.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $5.6 million. ... First Capital Bank is the 25th FDIC-insured institution to fail in the nation this year, and the first in Oklahoma.The FDIC gets back to work ...

Las Vegas House sales up YoY in May, Inventory down sharply

by Calculated Risk on 6/08/2012 03:41:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities. Prices, as of the March Case-Shiller report, were off 61.5% from the peak, and off 7.5% over the last year.

Sales in 2011 were at record levels - even more than during the bubble - and it looks like 2012 will be an even stronger year, even with some new rules that slow the foreclosure process.

From the GLVAR: GLVAR reports local home prices and sales are rising, as local housing inventory shrinks

“Basically, we’re seeing a classic case of supply and demand,” said GLVAR President Kolleen Kelley, a longtime local REALTOR®. “Our local housing supply is going down, primarily because banks are putting fewer homes on the market. As a result, prices are going up.”Inventory continues to decline (down 66.3% year-over-year for single family homes) and sales are on a record pace. Still over 2/3s of all sales are distressed (short and REO), as the shift from foreclosure to short sales continues.

The local housing inventory was already tightening throughout 2011. But Kelley said it has been shrinking at a more rapid rate in 2012. Based on the current sales pace, she said “our local housing supply is down to about a month’s worth of inventory.”

Even with fewer homes listed for sale, Kelley said existing home sales remain ahead of the record sales pace set in 2011, when GLVAR reported that 48,186 existing properties were sold in Southern Nevada.

According to GLVAR, the total number of local homes, condominiums and townhomes sold in May was 4,134. That’s up from 3,924 in April and up from 3,991 total sales in May 2011.

...

GLVAR reported a total of 3,728 condos and townhomes listed for sale on its MLS at the end of May. That’s down 2.8 percent from 3,836 condos and townhomes listed at the end of April, and down 29.1 percent from one year ago. As in recent months, the number of available homes listed for sale without any sort of pending or contingent offer also dropped sharply compared to the previous month and year. By the end of May, GLVAR reported 3,800 single-family homes listed without any sort of offer. That’s down 8.7 percent from 4,162 such homes listed in April and down 66.3 percent from one year ago. ...

32.6 percent of all existing local homes sold during May were short sales ... That’s up from 29.9 percent in April

Bank-owned homes accounted for 34.7 percent of all existing home sales in May, down from 36.9 percent in April.

AAR: Rail Traffic "mixed" in May

by Calculated Risk on 6/08/2012 12:18:00 PM

Once again rail traffic was "mixed". This was mostly due to the sharp decline in coal traffic (mild winter, low natural gas prices). Most commodities were up, such as building related commodities such as lumber and crushed stone, gravel, sand. Lumber was up 16.9% from May 2011.

From the Association of American Railroads (AAR): AAR Reports Mixed Rail Traffic for May

The Association of American Railroads (AAR) today reported U.S. rail carloads originated in May 2012 totaled 1,392,352, down 40,405 carloads or 2.8 percent, compared with May 2011. Intermodal volume in May 2012 was 1,178,312 trailers and containers, up 39,696 units or up 3.5 percent, compared with May 2011. The May 2012 weekly intermodal average of 235,662 trailers and containers is the highest May average in history.

...

Thirteen of the 20 commodity categories tracked by the AAR saw carload gains in May 2012 compared with May 2011, including: motor vehicles, up 17,066 cars or 27.7 percent; petroleum and petroleum products, up 16,460 carloads, or 49.2 percent; crushed stone, sand and gravel, up 7,535 carloads, or 8.2 percent; lumber and wood products, up 2,357 carloads, or 16.9 percent, and primary metal products, up 2,260 carloads, or 4.3 percent.

Commodities with carload declines in May were led by coal, down 74,469 carloads, or 12.1 percent compared with May 2011. Other commodities with declines included grain, down 13,322 carloads, or 11.8 percent; chemicals, down 3,563 carloads, or 2.4 percent, and nonmetallic minerals, down 2,181 carloads, or 8.7 percent. Carloads excluding coal and grain were up 47,386 carloads, or 6.7 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

It’s a broken record (for those of who you still remember what that phrase means) to say this, but coal and grain were again to blame for the U.S. carload decline in May. Coal carloads were down 12.1% (74,469 carloads) in May 2012 to 542,503 carloads. To look on the bright side, that’s an improvement over the 16.6% decline in April 2012 and the 15.8% decline in March 2012.Grains are down due to fewer exports.

U.S. rail grain carloads totaled 99,372 in May 2012, down 11.8% (13,322 carloads) from May 2011.

The second graph is just for coal and shows the sharp decline this year.

The second graph is just for coal and shows the sharp decline this year.From AAR:

It was another tough month for coal, in the U.S. at least. Coal carloads on U.S. railroads in May 2012 were down 12.1% (74,469 carloads) from May 2011, equivalent to 573 130-car coal trains. ... It would take a really, really hot summer for coal consumption in 2012 to come close to what it was in 2011.The third graph is for intermodal traffic (using intermodal or shipping containers):

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is now at peak levels.

U.S. intermodal traffic, which is not included in carloads, was up 3.5% (39,696 containers and trailers) in May 2012 over May 2011 to 1,178,312 units. The weekly average in May 2012 was 235,662 intermodal units, which is the highest average of any May in history and the 16th highest of any month in history.The top months for intermodal are usually in the fall.

Trade Deficit declines in April to $50.1 Billion

by Calculated Risk on 6/08/2012 08:30:00 AM

The Department of Commerce reported:

[T]otal April exports of $182.9 billion and imports of $233.0 billion resulted in a goods and services deficit of $50.1 billion, down from $52.6 billion in March, revised. April exports were $1.5 billion less than March exports of $184.4 billion. April imports were $4.1 billion less than March imports of $237.1 billion.The trade deficit was above the consensus forecast of $49.3 billion.

The first graph shows the monthly U.S. exports and imports in dollars through April 2012.

Click on graph for larger image.

Click on graph for larger image.Exports decreased in April. Imports decreased even more. Exports are 11% above the pre-recession peak and up 4% compared to April 2011; imports are 2% above the pre-recession peak, and up about 6% compared to April 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through April.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $109.94 per barrel in April, up from $107.95 in March. Import oil prices will probably start to decline in May. The trade deficit with China increased to $24.6 billion in April, up from $21.6 billion in April 2011. Once again most of the trade deficit is due to oil and China.

Exports to the euro area were $16.3 billion in April, down from $17.1 billion in April 2011, so the euro area recession appears to be a drag on US exports.