by Calculated Risk on 6/13/2012 04:28:00 PM

Wednesday, June 13, 2012

Tim Duy: "Is Anyone Answering the Phones at the ECB?"

From Professor Tim Duy: Is Anyone Answering the Phones at the ECB?. Excerpt:

It is never a good sign when the monetary authority - the lender of last resort - is no longer willing to buy your bonds. If the ECB sees only risk at these rates, why should private investors jump into the pool?

Honestly, I find it incomprehensible to believe that the ECB will not soon come to the aid of Spain and Italy with additional bond purchases. Only the most irresponsible policy body would take such a risk. To not do so almost guarantees the destruction of the Eurozone and a deepening recession if not depression throughout Europe. They cannot possibly believe that fiscal and structural reforms will bear sufficient fruit in any reasonable time frame. Nor can they possibly believe that Spain and Italy can implement a IMF-type structural reform program in the absence of the competitive boost provided by currency devaluation.

Or can they? If they do believe these things - that they can do no more, the job is entirely on the shoulders of fiscal policymakers - then we all need to be afraid, very afraid. Because when the ECB fully abdicates its role as a provider of financial stability for the Eurozone, all Hell is going to break loose.

Report: Housing Inventory declines 20.1% year-over-year in May

by Calculated Risk on 6/13/2012 01:40:00 PM

From Realtor.com: May 2012 Real Estate Data

On the national level, inventory of for-sale single family homes, condominiums, townhouses and co-ops declined by -20.07% in May 2012 compared to a year ago, and declined in all but two of the 146 markets covered by REALTOR.com.Realtor.com also reports that inventory was up 2.0% from the April level.

The median age of the inventory fell -9.78% on a year-over-year basis last month, and the median national list price increased 3.17% last month compared to May 2011.

Signs of recovery are evident in a growing number of markets that were once the epicenter of the housing crisis, and older industrialized areas in the Northeast and the Midwest are showing emerging signs of weaknesses. For example, the recovery process that began in Florida approximately one year ago has since spread to Phoenix and most recently California. At the same time, markets such as Reading, PA, Allentown, PA and Milwaukee, WI continue to lag behind the rest of the market.

The NAR is scheduled to report May existing home sales and inventory next week on Thursday, June 21st.

Redfin: House prices increased 2.2% Year-over-year in May

by Calculated Risk on 6/13/2012 11:51:00 AM

Another house price index, this one is based on price per sq ft ...

From Redfin: May Real Estate Prices Increase 2.2% as Inventory Continues to Fall

Redfin today released a new 19-market analysis of May home prices, sales volume and inventory levels. The Redfin Real-Time Price Tracker ... showed an annual price gain of 2.2% and a monthly gain of 2.7%. Inventory levels were down 23.5% compared to last year, and down 1.7% compared to last month. Sales volume was up 7.4% over this time last year, and pending sales were up even more, by 10.7%.There is limited historical data for this index. In 2011, sales were fairly weak in the May through July period, and a 7.4% increase in year-over-year sales would be less than the 10% year-over-year increase in April.

“We expected real estate to soften in May along with the larger economy, but we actually saw home prices continue to increase,” said Redfin CEO Glenn Kelman. “This trend seems likely to hold at least through mid-summer. Redfin’s business saw a stronger-than-expected rebound from Memorial Day weekend: with rates low and rents high more new home-buyers were touring homes last weekend, and more are now writing offers. The limit on sales volume is inventory. Not enough sellers have stepped in to provide the liquidity that once came from banks with foreclosures to sell.”

“The 2011 decline in inventory was seasonal and largely expected,” said Tim Ellis, Redfin’s real estate analyst. “But once the trend continued into the outset of 2012′s home-buying cycle, inventory shocks resulted in the first sharp price increases for many areas in five years.”

The reported 23.5% decrease in inventory is similar to other sources and is a key driver for the small year-over-year price increase.

Retail Sales decline 0.2% in May

by Calculated Risk on 6/13/2012 08:46:00 AM

On a monthly basis, retail sales were down 0.2% from April to May (seasonally adjusted), and sales were up 5.3% from May 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for May, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $404.6 billion, a decrease of 0.2 percent from the previous month, but 5.3 percent above May 2011.Ex-autos, retail sales declined 0.4% in May.

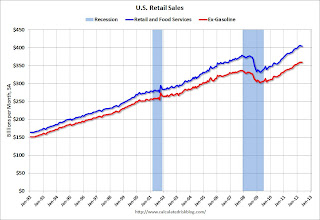

Click on graph for larger image.

Click on graph for larger image.Sales for April was revised down to a 0.2% decrease from a 0.1% increase.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 22.1% from the bottom, and now 6.8% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 18.9% from the bottom, and now 6.8% above the pre-recession peak (not inflation adjusted).

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 18.9% from the bottom, and now 6.8% above the pre-recession peak (not inflation adjusted).The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.9% on a YoY basis (5.3% for all retail sales). Retail sales ex-gasoline decreased 0.1% in May.

This was at the consensus forecast for retail sales of a 0.2% decrease in May, and below the consensus for a 0.1% decrease ex-auto.

This was at the consensus forecast for retail sales of a 0.2% decrease in May, and below the consensus for a 0.1% decrease ex-auto. MBA: Mortgage Applications Reach Highest Level Since 2009

by Calculated Risk on 6/13/2012 07:00:00 AM

From the MBA: Mortgage Applications Reach Highest Level Since 2009 in Latest MBA Weekly Survey

The Refinance Index increased over 19 percent from the previous week to the highest index level since April 2009. The seasonally adjusted Purchase Index increased around 13 percent from one week earlier.

“Mortgage application volume increased sharply last week. The increase was accentuated due to the comparison to the week including Memorial Day, but the level of refinance and total market activity is the highest since the spring of 2009,” said Michael Fratantoni, MBA's Vice President of Research and Economics. “Refinance volume increased as borrowers were able to lock in at mortgage rates below 4 percent, and purchase application volume was its highest level in over six months. HARP volume has been steady in recent weeks at about 28 percent of refinance applications.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.88 percent from 3.87 percent, with points decreasing to 0.43 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The purchase index is still very weak, but appears to be moving up recently.

Refinance activity continues to increase as mortgage rates are near the record low set the previous week.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates have fallen about that far - and refinance activity is now at the highest level since 2009.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates have fallen about that far - and refinance activity is now at the highest level since 2009.According to the MBA, HARP volume was still at 28% of all refinance activity, so HARP activity is increasing at the same rate as overall refinance activity.

Tuesday, June 12, 2012

Look Ahead: Retail Sales

by Calculated Risk on 6/12/2012 09:45:00 PM

Over in Europe, eurozone industrial production will be released. The consensus is for a 1% decline.

As a reminder, the Greek election is this coming Sunday, and currently polls show no clear winner.

From Bloomberg: Greek Bank Deposit Outflows Said to Have Risen Before Elections

Daily withdrawals have increased to the upper end of a 100 million-euro ($125 million) to 500 million-euro range this month, one banker said, asking not to be identified because the figures aren't public. A second banker said the drawdown may have exceeded 700 million euros yesterday.• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Expect record or near record low mortgage rates and a sharp increase in refinance activity.

• At 8:30 AM, Retail sales for May will be released. The consensus is for retail sales to decrease 0.2% in May, and for retail sales ex-autos to decrease 0.1%.

• Also at 8:30 AM, the Producer Price Index for May. The consensus is for a 0.6% decrease in producer prices due to the decline in oil prices (0.2% increase in core).

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales for April will be released (Business inventories). The consensus is for 0.3% increase in inventories.

JPMorgan Provides example of "Orderly Liquidation" after a catastrophic loss

by Calculated Risk on 6/12/2012 08:08:00 PM

From the Financial Times: JPMorgan plan for ‘catastrophic’ event

[T]he presentation given at a Harvard Law School event is also an unusually frank acknowledgement that there are limits to the capital buffers of even healthy banks.Here is the presentation: Orderly Liquidation of a Failed SIFI (systemically important financial institutions).

In the doomsday scenario set out by [Gregory Baer, deputy general counsel], a $50bn loss would trigger “a run on the bank” - with $375bn of funding, including bank deposits, draining away.

The government would then step in and mark down the bank’s assets, leading to an additional $150bn loss. Shareholders would be wiped out but senior creditors would be transferred to a new bridge company that allows “critical activities [to] continue to operate smoothly”.

excerpt with permission

This provides a "Hypothetical, illustrative example of the orderly liquidation of JPMorgan Chase". This is a pretty catastrophic event: "For illustrative purposes, we describe the impact of a catastrophic, idiosyncratic event causing a $200B loss and $550B of liquidity outflows – leading to Orderly Liquidation Authority being invoked to resolve JPMC"

European Crisis Commentary

by Calculated Risk on 6/12/2012 04:08:00 PM

Some interesting articles ...

From Brad DeLong and Barry Eichengreen: New preface to Charles Kindleberger, The World in Depression 1929-1939. A brief excerpt:

The parallels between Europe in the 1930s and Europe today are stark, striking, and increasingly frightening. We see unemployment, youth unemployment especially, soaring to unprecedented heights. Financial instability and distress are widespread. There is growing political support for extremist parties of the far left and right.From Mark Blyth and Matthias Matthijs at Foreign Affairs: The World Waits For Germany. An excerpt:

Both the existence of these parallels and their tragic nature would not have escaped Charles Kindleberger, whose World in Depression, 1929-1939 was published exactly 40 years ago, in 1973. Where Kindleberger’s canvas was the world, his focus was Europe. While much of the earlier literature, often authored by Americans, focused on the Great Depression in the US, Kindleberger emphasised that the Depression had a prominent international and, in particular, European dimension. It was in Europe where many of the Depression’s worst effects, political as well as economic, played out. And it was in Europe where the absence of a public policy authority at the level of the continent and the inability of any individual national government or central bank to exercise adequate leadership had the most calamitous economic and financial effects.

So Germany has shifted, but not enough to make any real difference to the outcome. Germany is both devoutly anti-reflationary and leadership averse, which is the worst possible combination at the worst possible moment. It would be nice, to use an American expression, for Germany to step up to the plate and put its full economic weight behind a fiscal and a banking union, including euro-denominated sovereign debt. But for reasons of history and ideology, as well as political and economic context, Europe may well be about to re-run Kindleberger's 1930s ...And from Sebastian Mallaby at Foreign Affairs: The Fate of the Monetary Union Lies in Germany’s Hands

And from the WSJ: ECB Says Euro Zone Needs Banking Union

The European Central Bank repeated its call for a common banking union to shore up the euro zone's financial system, even as Germany's central bank warned such proposals are "premature" and risky.

The ECB's No. 2 official, Vitor Constancio of Portugal, also said the central bank should have the power to supervise large European banks, saying it has the institutional resources and knowledge to perform such a task.

...

"There is a need to…conceive a banking union as an integral counterpart of monetary union," the ECB said in its semiannual financial stability review. Such a union would include euro-zone-wide bank supervision, deposit guarantees and a funding mechanism from banks.

Lawler: Table of Short Sales and Foreclosures for Selected Cities

by Calculated Risk on 6/12/2012 02:28:00 PM

CR Note: Yesterday I posted some distressed sales data for Sacramento. I'm following the Sacramento market to see the change in mix over time (short sales, foreclosure, conventional). Economist Tom Lawler has been digging up similar data, and he sent me the table below for several more distressed areas. For all of these areas, except Las Vegas, the share of distressed sales is down from May 2011 - and for the areas that break out short sales, the share of short sales has increased (except Minneapolis) and the share of foreclosure sales are down - and down significantly in some areas.

From Lawler:

Note that the distressed sales shares in the below table are based on MLS data, and often based on certain “fields” or comments in the MLS files, and some have questioned the accuracy of the data. Some MLS/associations only report on overall “distressed” sales, while others (e.g., Birmingham) only report on the foreclosure share of sales.

I’m not quite sure why the short-sales share (based on MLS reports) in the Minneapolis area is so low relative to other MLS-based reports for areas with “high” distressed-sales shares.

The most striking shift from a year ago, of course, is the sharp drop in the foreclosure share of home sales – with the drop in Phoenix being nothing short of amazing. Most, but not all, areas also saw a significant increase from a year ago in the short-sales share of resales. And finally, most areas have seen a YOY drop in the overall “distressed” sales share, and saw a significant YOY increase in non-distressed sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-May | 11-May | 12-May | 11-May | 12-May | 11-May | |

| Las Vegas | 32.6% | 23.0% | 34.7% | 43.8% | 67.3% | 66.8% |

| Reno | 39.0% | 29.0% | 22.0% | 40.0% | 61.0% | 69.0% |

| Phoenix | 26.6% | 21.4% | 16.9% | 43.8% | 43.5% | 65.2% |

| Sacramento | 30.1% | 23.2% | 28.1% | 42.4% | 58.2% | 65.6% |

| Minneapolis | 10.5% | 11.2% | 28.9% | 40.1% | 39.4% | 51.3% |

| Mid-Atlantic (MRIS) | 11.8% | 11.3% | 10.2% | 18.6% | 22.1% | 29.8% |

| Hampton Roads VA | 26.3% | 31.0% | ||||

| Birmingham AL | 27.3% | 29.8% | ||||

Report: HARP 2 Refinancing activity increases

by Calculated Risk on 6/12/2012 11:43:00 AM

From Kathleen Pender at the San Francisco Chronicle: Harp 2 starts to help the severely underwater

On June 1, the Federal Housing Finance Agency reported that total Harp refinances had jumped to 180,185 in the first quarter of this year - almost double the number done in the previous quarter.HARP 2 doesn't always lead to lower payments - one of the goals of the program was to get borrowers to pay down principal faster with a shorter amortization period. This will help borrowers get out of a negative equity situation sooner. Here is an example from the article:

...

The vast majority of Harp refis in the first quarter were loans with LTV ratios in the 80 to 105 percent range. Guy Cecala, publisher of Inside Mortgage Finance, calls these loans the "low-hanging fruit lenders have been willing" to refinance.

Only 20 percent had LTVs between 105 and 125 percent and only 2 percent had LTVs greater than 125 percent.

...

Starting last week, loans with LTVs greater than 125 percent can be bundled into securities sold to investors, although they still must be segregated from other loans, Cecala says. That should give Harp 2 a big boost.

One obstacle for borrowers is that most big banks, including Bank of America and Chase, won't refinance a loan under Harp 2 unless they already service it.

Oliver and his wife owed $372,000 on their home, now worth about $230,000. With a loan-to-value ratio of 161 percent, Oliver had little hope of refinancing his 5.875-percent mortgage ...A quick calculation: if the house value stays at $230,000, the borrowers would be out of negative equity around June 2023 with the current loan. With the new loan they will be out of negative equity at the end of 2018 (still a long time, but they have quite a bit of negative equity).

The Olivers had only 21 years remaining on their original mortgage, so rather than refinance into a new 30-year loan, they took out a 15-year loan at 3.5 percent with no closing costs.

"We will be paying roughly $300 more per month, but we are saving $171,000 over the course of the loan," says Oliver, who closed a few weeks ago.