by Calculated Risk on 6/15/2012 09:15:00 AM

Friday, June 15, 2012

Industrial Production down in May, Capacity Utilization declined

From the Fed: Industrial production and Capacity Utilization

Industrial production edged down 0.1 percent in May after having gained 1.0 percent in April. A decrease of 0.4 percent for manufacturing production in May partially reversed a large increase in April. Outside of manufacturing, the output of mines advanced 0.9 percent in May, while the output of utilities rose 0.8 percent. At 97.3 percent of its 2007 average, total industrial production in May was 4.7 percent above its year-earlier level. Capacity utilization for total industry declined 0.2 percentage point to 79.0 percent, a rate 1.3 percentage points below its long-run (1972--2011) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.0% is still 1.3 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production declined in May to 97.3. This is 16.6% above the recession low, but still 3.4% below the pre-recession peak.

The consensus was for no change in Industrial Production in April, and for no change in Capacity Utilization at 79.2%. This was below expectations.

NY Fed: Regional manufacturing activity "expanded slightly" in June Survey

by Calculated Risk on 6/15/2012 08:30:00 AM

From the NY Fed: Empire State Manufacturing Survey

The June Empire State Manufacturing Survey indicates that manufacturing activity expanded slightly over the month. The general business conditions index fell fifteen points, but remained positive at 2.3. The new orders index declined six points to 2.2, and the shipments index fell a steep nineteen points to 4.8. Price indexes were markedly lower, with the prices paid index falling eighteen points to 19.6 and the prices received index dropping eleven points to 1.0. Employment indexes also retreated, though they still indicated a small increase in employment levels and a slightly longer average workweek.The employment index declined to 12.4 from 20.5.

This is the first regional manufacturing survey released for June, and this was well below the consensus forecast of 13.8.

Thursday, June 14, 2012

Look Ahead: Industrial Production, Consumer Sentiment and more

by Calculated Risk on 6/14/2012 09:58:00 PM

It seems like it is all about Europe, but there are several US economic indicators to be released tomorrow:

• At 8:30 AM ET, The NY Fed Empire Manufacturing Survey for June will be released. The consensus is for a reading of 13.8, down from 17.1 in May (above zero is expansion).

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for May. The consensus is for no change in Industrial Production in May, and for Capacity Utilization to be unchanged at 79.2%.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for June) will be released. The consensus is for sentiment to decline to 77.5 from 79.3 in May.

• At 10:00 AM, the BLS will release the Regional and State Employment and Unemployment report for May 2012.

But most of the discussion tomorrow will be about Greece, Spain, Italy and the rest of Europe.

Greece: Election results expected at 2:30 PM ET Sunday, Unemployment Rate hits Record 22.6%

by Calculated Risk on 6/14/2012 06:21:00 PM

My understanding is the Greek polls close at noon ET on Sunday. According to the Athens News: First safe election estimation to be given at 21.30 on Sunday

The first "safe" estimate of the result of Sunday's repeat general elections is expected to be released at around 9:30 on Sunday night, according the IT firm Singular Logic, which has been assigned the job of collecting and transmitting the results of voting throughout the country.9:30 PM Athens time is 2:30 PM ET.

And from the Athens News: Quarterly unemployment hits record 22.6%

Unemployment hit a record high in the first quarter of 2012, data showed on Thursday ... The jobless rate hit 22.6 percent in the first three months of the year - double the euro zone average ... The statistics service said the number officially unemployed reached 1.12 million in the first quarter, up 57.3 percent year-on-year

Hotels: Occupancy Rate close to Pre-Recession Levels

by Calculated Risk on 6/14/2012 03:54:00 PM

From HotelNewsNow.com: Luxury hotels on top in weekly results

Overall, the U.S. hotel industry’s occupancy ended the week with a 1.3% increase to 68.5%, ADR increased 5.1% to $107.48 and RevPAR rose 6.5% to $73.59.Hotel occupancy, ADR and RevPAR have improved from 2011, and occupancy is back close to normal. ADR is now back to precession levels.

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

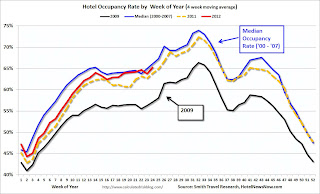

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2012, yellow is for 2011, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Looking forward, leisure travel usually increases over the summer months, and occupancy rates will probably average 70% for the next couple of months. So far it looks like 2012 will have higher occupancy than 2011, and be close to the pre-rececession median. Hotels have come a long way since 2008 when I was writing about The Coming Hotel Bust. But it will be sometime before investment increases again.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Key Measures show slowing inflation in May

by Calculated Risk on 6/14/2012 12:47:00 PM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) decreased 0.3 percent in May on a seasonally adjusted basis ... The gasoline index declined 6.8 percent in May, leading to a sharp decrease in the energy index and the decline in the all items index. ... The index for all items less food and energy rose 0.2 percent in May, the third consecutive such increase..The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.5% annualized rate) in May. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.1% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for May here.

...

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers decreased 0.3% (-3.4% annualized rate) in May. The CPI less food and energy increased 0.2% (2.4% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.1%, and core CPI rose 2.3%. Core PCE is for April and increased 1.9% year-over-year.

Most of these measures show inflation on a year-over-year basis are still above the Fed's 2% target, but it appears the inflation rate is slowing. On a monthly basis (annualized), most of these measure were below the Fed's target; median CPI was at 1.5%, trimmed-mean CPI was at 1.1%, and Core PCE for April was at 1.6% - although core CPI was at 2.4%.

With the unemployment rate well above the Fed's goal, and inflation slowing, this opens the door for further Fed action, possibly even at the Fed meeting next week.

CoreLogic: Existing Home Shadow Inventory declines 15% year-over-year

by Calculated Risk on 6/14/2012 10:28:00 AM

Note: there are different measures of "shadow" inventory. CoreLogic tries to add up the number of properties that are seriously delinquent, in the foreclosure process, and already REO (lender Real Estate Owned) that are NOT currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

From CoreLogic: CoreLogic® Reports Shadow Inventory Fell in April 2012 to October 2008 Levels

CoreLogic ... reported today that the current residential shadow inventory as of April 2012 fell to 1.5 million units, representing a supply of four months. This was a 14.8 percent drop from April 2011, when shadow inventory stood at 1.8 million units, or a six-months’ supply, which is approximately the same level as the country was experiencing in October 2008.

...

“Since peaking at 2.1 million units in January 2010, the shadow inventory has fallen by 28 percent. The decline in the shadow inventory is a positive development because it removes some of the downward pressure on house prices,” said Mark Fleming, chief economist for CoreLogic. “This is one of the reasons why some markets that were formerly identified as deeply distressed, like Arizona, California and Nevada, are now experiencing price increases.”

...

CoreLogic estimates the current stock of properties in the shadow inventory, also known as pending supply, by calculating the number of distressed properties that are seriously delinquent, in foreclosure and held as real estate owned (REO) by mortgage servicers but not currently listed on multiple listing services (MLSs).

...

Of the 1.5 million properties currently in the shadow inventory, 720,000 units are seriously delinquent, 410,000 are in some stage of foreclosure, and 390,000 are already in REO.

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic shows the breakdown of "shadow inventory" by category.

Note: The "shadow inventory" could be higher or lower using other numbers and methods; the key is that CoreLogic uses a consistent method (and removes properties currently listed) - and that their estimate of the shadow inventory is declining.

Weekly Initial Unemployment Claims increase to 386,000

by Calculated Risk on 6/14/2012 08:30:00 AM

The DOL reports:

In the week ending June 9, the advance figure for seasonally adjusted initial claims was 386,000, an increase of 6,000 from the previous week's revised figure of 380,000. The 4-week moving average was 382,000, an increase of 3,500 from the previous week's revised average of 378,500.The previous week was revised up from 377,000 to 380,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 382,000.

The average has been between 363,000 and 384,000 all year, and this is near the high for the year.

And here is a long term graph of weekly claims:

This was above to the consensus forecast of 375,000.

This was above to the consensus forecast of 375,000.Wednesday, June 13, 2012

Look Ahead: CPI, Weekly Unemployment Claims, Greece

by Calculated Risk on 6/13/2012 10:25:00 PM

The Greek election is this coming Sunday, and the polls will close at noon ET. The election will probably be very close between "New Democracy" and "Syriza".

The 1st place party gets a 50 seat bonus (out of 300 total seats) and the parties split the remaining seats by the percent of the vote (excluding all parties with less than 3% of the vote).

From Merrill Lynch today:

[T]he baseline scenario [is ]that Greece gets a pro-program government - most likely led by New Democracy and supported by Pasok ... the probability of a disorderly Greek exit from the Euro is significantly reduced.Sunday will be the new Monday once again!

...

Should the less likely scenario of an anti-program government led by Syriza materialize, however, our markets would probably trade as if Greece is on the path of a disorderly exit from the Euro.

On Thursday:

• At 8:30 AM ET, the Consumer Price Index for May will be released. The consensus is for headline CPI to decline 0.2% (with the decline in energy prices). The consensus is for core CPI to increase 0.2%.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for claims to decline to 375 thousand from 377 thousand last week.

DataQuick: SoCal home sales up in May

by Calculated Risk on 6/13/2012 07:49:00 PM

From DataQuick: More Gains for Southern California Home Sales and Median Prices

Last month’s total Southland sales rose nearly 21 percent compared with a year ago, and activity increased across the home-price spectrum. But the gains were strongest above $300,000. The volume of transactions in lower-cost markets has been restrained by, among other things, the dwindling inventories of homes for sale, especially foreclosures.The percent of distressed sales is still very high, but this is the lowest level since March 2008.

...

In May, a total of 22,192 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties. That was up 15.1 percent from 19,284 in April, and up 20.6 percent from 18,394 in May 2011.

...

On a year-over-year basis, Southland home sales have increased for five consecutive months, with last month’s 20.6 percent annual gain the largest in the series. Sales have also increased year-over-year in nine out of the last ten months. Still, last month’s sales were 14.5 percent lower than the average sales tally for all the months of May since 1988.

The month-to-month and year-over-year increases in sales last month would not have been as great if this May hadn’t had one extra business day on which sales could close. While last month had 22 business days, this April and May 2011 had 21 business days.

...

Distressed sales – the combination of foreclosure resales and short sales – made up 44.8 percent of last month’s resale market. That was the lowest level since the figure was 44.4 percent in March 2008.

The median price is being impacted by the mix and isn't useful for measuring house price changes (with fewer low end distressed sales, the median has increased).

The NAR is scheduled to report May existing home sales and inventory next week on Thursday, June 21st.