by Calculated Risk on 6/20/2012 02:00:00 PM

Wednesday, June 20, 2012

FOMC Projections and Bernanke Press Conference

Here are the updated projections from the FOMC meeting.

Fed Chairman Ben Bernanke's press conference starts at 2:15 PM ET. Here is the video stream.

Live Video streaming by Ustream

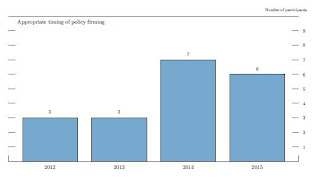

Below are the update projections starting with when participants project the initial increase in the target federal funds rate should occur, and the participants view of the appropriate path of the federal funds rate. I've included the chart from the April meeting to show the change.

Click on graph for larger image.

"The shaded bars represent the number of FOMC participants who project that the initial increase in the target federal funds rate (from its current range of 0 to ¼ percent) would appropriately occur in the specified calendar year."

There was a shift to 2015 with two additional participants.

A key is the same number of participants think the FOMC should raise rates before 2014.

Most participants still think the Fed Funds rate will be in the current range into 2014.

On the projections, GDP was revised down, unemployment rate up, and inflation down.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.9 to 2.4 | 2.2 to 2.8 | 3.0 to 3.5 |

| April 2012 Projections | 2.4 to 2.9 | 2.7 to 3.1 | 3.1 to 3.6 |

| January 2012 Projections | 2.2 to 2.7 | 2.8 to 3.2 | 3.3 to 4.0 |

GDP projections have been revised down for 2012, and revised down for 2013 and 2014.

The unemployment rate increased to 8.2% in April, and the projection for 2012 has been revised up.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| June 2012 Projections | 8.0 to 8.2 | 7.5 to 8.0 | 7.0 to 7.7 |

| April 2012 Projections | 7.8 to 8.0 | 7.3 to 7.7 | 6.7 to 7.4 |

| January 2012 Projections | 8.2 to 8.5 | 7.4 to 8.1 | 6.7 to 7.6 |

The forecasts for overall and core inflation were revised down to reflect the recent decrease in inflation.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.2 to 1.7 | 1.5 to 2.0 | 1.5 to 2.0 |

| April 2012 Projections | 1.9 to 2.0 | 1.6 to 2.0 | 1.7 to 2.0 |

| January 2012 Projections | 1.4 to 1.8 | 1.4 to 2.0 | 1.6 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.7 to 2.0 | 1.6 to 2.0 | 1.6 to 2.0 |

| April 2012 Projections | 1.8 to 2.0 | 1.7 to 2.0 | 1.8 to 2.0 |

| January 2012 Projections | 1.5 to 1.8 | 1.5 to 2.0 | 1.6 to 2.0 |

FOMC Statement: Continue Twist through end of Year

by Calculated Risk on 6/20/2012 12:30:00 PM

Information received since the Federal Open Market Committee met in April suggests that the economy has been expanding moderately this year. However, growth in employment has slowed in recent months, and the unemployment rate remains elevated. Business fixed investment has continued to advance. Household spending appears to be rising at a somewhat slower pace than earlier in the year. Despite some signs of improvement, the housing sector remains depressed. Inflation has declined, mainly reflecting lower prices of crude oil and gasoline, and longer-term inflation expectations have remained stable.At 2:00 PM, the FOMC Forecasts will be released, and at 2:15 PM, Fed Chairman Ben Bernanke will hold a press briefing.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects economic growth to remain moderate over coming quarters and then to pick up very gradually. Consequently, the Committee anticipates that the unemployment rate will decline only slowly toward levels that it judges to be consistent with its dual mandate. Furthermore, strains in global financial markets continue to pose significant downside risks to the economic outlook. The Committee anticipates that inflation over the medium term will run at or below the rate that it judges most consistent with its dual mandate.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee expects to maintain a highly accommodative stance for monetary policy. In particular, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.

The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities. Specifically, the Committee intends to purchase Treasury securities with remaining maturities of 6 years to 30 years at the current pace and to sell or redeem an equal amount of Treasury securities with remaining maturities of approximately 3 years or less. This continuation of the maturity extension program should put downward pressure on longer-term interest rates and help to make broader financial conditions more accommodative. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. The Committee is prepared to take further action as appropriate to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Dennis P. Lockhart; Sandra Pianalto; Jerome H. Powell; Sarah Bloom Raskin; Jeremy C. Stein; Daniel K. Tarullo; John C. Williams; and Janet L. Yellen. Voting against the action was Jeffrey M. Lacker, who opposed continuation of the maturity extension program.

Here is the previous FOMC Statement for comparison.

AIA: Architecture Billings Index declines sharply in May

by Calculated Risk on 6/20/2012 11:42:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Substantial Drop in Architecture Billings Index

Following the first negative reading in five months, the Architecture Billings Index (ABI) has had a significant drop in May. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the May ABI score was 45.8, following a mark of 48.4 in April. This score reflects a sharp decrease in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 54.0, down slightly from mark of 54.4 the previous month.

“For the second year in a row, we’re seeing declines in springtime design activity after a healthy first quarter. Given the ongoing uncertainly in the economic outlook, particularly the weak job growth numbers in recent months, this should be an alarm bell going off for the design and construction industry,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “The commercial/industrial sector is the only one recording gains in design activity at present, and even this sector has slowed significantly. Construction forecasters will have to reassess what conditions will look like moving forward.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 45.8 in May, the lowest since July of last year. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further weakness in CRE investment (it will be some time before investment in offices and malls increases).

LPS: Mortgage delinquencies increased in May

by Calculated Risk on 6/20/2012 09:00:00 AM

LPS released their First Look report for May today. LPS reported that the percent of loans delinquent increased in May from April, and declined year-over-year. The percent of loans in the foreclosure process decreased slightly and remains at a very high level.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 7.20% from 7.12% in March. The percent of delinquent loans is still significantly above the normal rate of around 4.5% to 5%. The percent of delinquent loans peaked at 10.97%, so delinquencies have fallen over half way back to normal. The increase was in the less than 90 days delinquent category.

The following table shows the LPS numbers for May 2012, and also for last month (April 2012) and one year ago (May 2011).

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| May-12 | Apr-12 | May-11 | |

| Delinquent | 7.20% | 7.12% | 7.96% |

| In Foreclosure | 4.12% | 4.14% | 4.11% |

| Number of loans: | |||

| Loans Less than 90 days | 1,967,000 | 1,927,000 | 2,265,000 |

| Loans More than 90 days | 1,575,000 | 1,595,000 | 1,921,000 |

| Loans In foreclosure | 2,027,000 | 2,048,000 | 2,164,000 |

| Total | 5,569,000 | 5,570,000 | 6,350,000 |

The number of delinquent loans, but not in foreclosure, is down about 15% year-over-year (644,000 fewer mortgages delinquent), and the number of loans in the foreclosure process is down 6% or 137,000 year-over-year (the percent in foreclosure is mostly unchanged, but the number of total loans has declined).

The percent of loans less than 90 days delinquent is about normal, but the percent (and number) of loans 90+ days delinquent and in the foreclosure process are still very high.

MBA: FHA Mortgage Refinance Applications increase sharply

by Calculated Risk on 6/20/2012 07:00:00 AM

From the MBA: Government Refinance Applications More Than Double in Latest MBA Survey

The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index fell 9 percent from one week earlier.

“Refinance volume increased again last week, but the composition of activity changed markedly. Despite rates remaining near all-time lows, conventional refinance application volume declined, and the HARP share of refinance activity dropped to 20 percent,” said Michael Fratantoni, MBA's Vice President of Research and Economics. “On the other hand, FHA refinance volume exploded to an all-time high, more than doubling over the week. New, lower FHA premiums on streamlined refinance loans came fully into effect, and borrowers seized the opportunity to lower their mortgage rates without increasing their FHA premiums. Purchase activity fell off last week, but this is likely only a recalibration following the Memorial Day holiday, as the level of activity remains within the narrow band seen for the past 3 years.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.87 percent, matching the lowest rate in the history of the survey, from 3.88 percent, with points increasing to 0.49 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

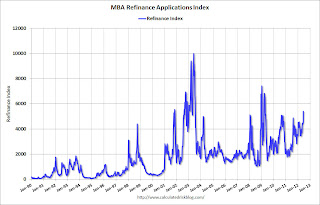

Click on graph for larger image.

Click on graph for larger image.The purchase index is still very weak, and is mostly moving sideways.

Refinance activity continues to increase, especially with the surge in FHA streamline refinancing - and because mortgage rates are near the record low set the previous week.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates have fallen about that far - and refinance activity is now at the highest level since 2009.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates have fallen about that far - and refinance activity is now at the highest level since 2009.

Tuesday, June 19, 2012

Look Ahead: Fed Day

by Calculated Risk on 6/19/2012 09:47:00 PM

For those suffering with insomnia, here is the G20 communiqué released tonight. There is no grand bond buying scheme mentioned as was rumored earlier in the day.

The decision of the FOMC tomorrow is very uncertain. Cardiff Garcia at Alphaville has an excellent overview: Problems with extending Twist, and one final preview

The WSJ argues there are several possible outcomes: Europe, Weak Economy Add to Pressure on Fed

Fed officials ... could extend a program known as "Operation Twist," in which the central bank sells short-term Treasury bills and notes and plows the proceeds into longer-term securities. They also could decide to shift the proceeds into mortgage- backed securities rather than long-term Treasury bonds.The consensus seems to be the FOMC will expand and extend Operation Twist, but anything - including QE3 - or doing nothing are possible.

Among other choices: launching a new round of bond-buying, known to some as quantitative easing, to expand the central bank's portfolio of assets. Or they could alter the way they describe their plans for interest rates with an assurance that short-term interest rates will stay near zero beyond 2014.

Policy makers also could stand pat but offer assurance that they stand ready to act if the economy gets weaker.

And on Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Refinance activity has been increasing sharply, and it appears purchase activity is increasing too.

• At 12:30 PM, the FOMC statement will be released.

• At 2:00 PM, the Federal Open Market Committee (FOMC) participants' projections will be released.

• And at 2:15 PM, Fed Chairman Ben Bernanke will hold a press briefing.

• Also tomorrow, the AIA's Architecture Billings Index for May will be released (expect some weakness), and the LPS First Look Mortgage Report.

ATA Trucking index declined 0.7% in May

by Calculated Risk on 6/19/2012 05:15:00 PM

From ATA: ATA Truck Tonnage Fell 0.7% in May

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.7% in May after falling 1.1% in April. (April’s loss was the same as ATA reported on May 22.) The latest drop lowered the SA index to 117.8 (2000=100), down from April’s level of 118.7. Compared with May 2011, the SA index was 4.1% higher, the largest year-over-year increase since February 2012. Year-to-date, compared with the same period last year, tonnage was up 3.8%.

...

“Two straight months of contractions is disappointing,” ATA Chief Economist Bob Costello said. “The drops in tonnage are reflective of the broader economy, which has slowed.”

“The good news is that the decrease in fuel prices will help support retail sales going forward, which is a big part of truck tonnage,” he said. As a negative, Costello said he’s concerned about businesses sitting on cash instead of hiring more workers or spending it on capital, both of which would give the economy and tonnage a shot in the arm, as they are worried about Europe and the so-called U.S. fiscal cliff at the end of the year. He also reiterated last month’s comment: “Annualized tonnage growth should be in the 3% to 3.9% range this year.”

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. The index is above the pre-recession level and still up 3.8% year-over-year - but has been moving mostly sideways in 2012.

From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.Earlier on Housing:

• On Yahoo: McBride: Total Housing Starts Decline in May, but the Trend Is Positive

• Comments on Housing

• Housing Starts at 708 thousand in May, Single Family starts increase to 516 thousand

Comments on Housing and Article on Yahoo

by Calculated Risk on 6/19/2012 01:39:00 PM

Over on Yahoo today: McBride: Total Housing Starts Decline in May, but the Trend Is Positive

Here are some more thoughts ...

For the housing industry, the recovery has started. As I've noted before, the debate is now about the strength of the recovery, not whether there is a recovery. My view is housing will remain sluggish for some time, and I expect 2012 to be another weak year, but better than 2011.

Economist Michelle Meyer at Merrill Lynch, who remains cautious on housing, wrote the following this morning:

We look for residential investment to increase 8% in Q2, following the 19% pop in Q1. This will add 0.2pp to GDP growth in the quarter. Assuming similar gains in the second half of the year, real residential investment should be up 10% this year, adding 0.2pp to annual GDP growth. This is the first annual contribution since before the housing bubble burst in 2006.The question about house prices is not as clear. Although I think prices have bottomed for the national repeat sales indexes, others are more pessimistic. As an example, from RadarLogic this morning:

... Although housing demand is improving ... it is still slow and many potential homebuyers are restricted due to tight credit. Moreover, homebuilders are continuing to compete with the overhang of distressed inventory in many markets. The gain in homebuilding is about relative strength - multifamily building (to satisfy the increase in renters) and single family construction in non-distressed markets.

Radar Logic also contends that there is a grave risk that economic forces outside the housing market will deliver a significant blow to housing demand. Given the excess supply in the market, such a reduction in demand could in turn result in another precipitous decline in housing prices.I think this is an argument for little or no increase in house prices, not for an additional "precipitous decline".

The excess supply consists of homes that are currently on the market as well as homes that are not currently for sale but could enter the market when home prices start to strengthen. As home prices start to firm, home owners who are eager to sell but have been unable or unwilling to do so at prior price levels will put their homes on the market. The increase in supply will cut off price appreciation and, to the extent that the newly unleashed supply exceeds demand, push down home prices.

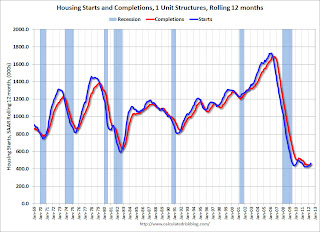

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing since mid-2010. The 12 month total for starts is steadily increasing, and completions (red line) is lagging behind - but completions will following starts up over the course of the year (completions lag starts by about 12 months).

This second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

This second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions. For the fourth consecutive month, the rolling 12 month total for starts has been above completions. This usually only happens at a bottom, although the recovery for single family starts will probably remain sluggish.

BLS: Job Openings declined in April

by Calculated Risk on 6/19/2012 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 3.4 million job openings on the last business day of April, down from 3.7 million in March, the U.S. Bureau of Labor Statistics reported today.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Although the number of total nonfarm job openings declined in April, the number of openings was 1.0 million higher than at the end of the recession in June 2009.

...

The quits rate can serve as a measure of workers’ willingness or ability to change jobs. In April, the quits rate was unchanged for total nonfarm, and essentially unchanged for total private and government. The number of quits was 2.1 million in April 2012, up from 1.8 million at the end of the recession in June 2009.

This is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for April, the most recent employment report was for May.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings declined in April to 3.416 million, down from 3.741 million in March. However the number of job openings (yellow) has generally been trending up, and openings are up about 13% year-over-year compared to April 2011.

Quits declined slightly in April, and quits are now up about 10% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

Housing Starts at 708 thousand in May, Single Family starts increase to 516 thousand

by Calculated Risk on 6/19/2012 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 708,000. This is 4.8 percent below the revised April estimate of 744,000, but is 28.5 percent above the May 2011 rate of 551,000.

Single-family housing starts in May were at a rate of 516,000; this is 3.2 percent above the revised April figure of 500,000. The May rate for units in buildings with five units or more was 179,000.

Building Permits:

Privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 780,000. This is 7.9 percent above the revised April rate of 723,000 and is 25.0 percent above the May 2011 estimate of 624,000.

Single-family authorizations in May were at a rate of 494,000; this is 4.0 percent above the revised April figure of 475,000. Authorizations of units in buildings with five units or more were at a rate of 266,000 in May.

Click on graph for larger image.

Click on graph for larger image.Total housing starts were at 708 thousand (SAAR) in May, down 4.8% from the revised April rate of 744 thousand (SAAR). Note that April was revised up from 717 thousand. March was revised up too.

Single-family starts increased 3.2% to 516 thousand in May. April was revised up to 500 thousand from 492 thousand.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years. Total starts are up 55% from the bottom start rate, and single family starts are up 41% from the low.

This was below expectations of 720 thousand starts in May, but the decline was because of the volatile multi-family sector. Single family starts were up, and building permits were up sharply. And previous months were revised up. This is a fairly strong report.