by Calculated Risk on 6/29/2012 08:35:00 PM

Friday, June 29, 2012

Unofficial Problem Bank List declines to 917 Institutions, Quarterly Transition Matrix

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 29, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

The Unofficial Problem Bank List finished the first half of 2012 with 917 institutions with assets of $354.6 billion. A year ago, the list held 1,003 institutions with assets of $419.9 billion, which was the peak level in terms of assets. Net change for the month was a decline of 14 institutions and $3.4 billion of assets.

This week, there were six removals and two additions. Action terminations include TNBank, Oak Ridge, TN ($177 million); Pan Pacific Bank, Fremont, CA ($116 million Ticker: PPFC); First Community Bank, Hammond, LA ($115 million); Columbus Community Bank, Columbus, GA ($109 million); and Ericson State Bank, Ericson, NE ($49 million). The other removal -- The Palm Bank, Tampa, FL ($117 million) -- came from an unassisted merger.

The additions include Putnam Bank, Putnam, CT ($450 million Ticker: PSBH) and First Bank of Miami, Coral Gables, FL ($248 million). The other change is the FDIC issuing a Prompt Corrective Action order against McHenry Savings Bank, McHenry, IL ($262 million).

With the passage of the calendar quarter, it is time to update the transition matrix. As seen in the table, there have been a total of 1,552 institutions with assets of $802.2 billion that have appeared on the list. About 41 percent or 635 institutions with assets of $369.4 billion have been removed from the list. Failure has been the prior manner of exodus as 330 institutions with assets of $286.0 billion have failed since appearing on the list. Since the list first appeared on August 7, 2009, 31 institutions have failed without being on the unofficial list. Removals from unassisted mergers and voluntary liquidations total 106 institutions.

Actions have been terminated against 199 institutions with assets of $93.5 billion. During the quarter, there was an acceleration in action terminations, particularly within the pool of institutions added after publication of the original list. This group had 44 terminations compared with six terminations in the original pool. Overall, 5.3 percent of the 948 institutions on the list at the start of the second quarter were removed because of action termination. For comparison purposes, the action termination rate was 3.3 percent in the first quarter of 2012 and 2.2 percent in the fourth quarter of 2011. Some cynical observers would say the acceleration in the termination rate results from industry outcry and Congressional pressure on the banking regulators. The difference in the termination rates among the pools may provide some insights as to vintage severity. In other words, were the early arrivers on the list in worse condition than the late comers?

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 71 | (20,287,691) | |

| Unassisted Merger | 21 | (3,538,086) | |

| Voluntary Liquidation | 2 | (4,855,164) | |

| Failures | 144 | (181,206,086) | |

| Asset Change | (14,743,502) | ||

| Still on List at 6/30/2012 | 145 | 51,682,900 | |

| Additions | 772 | 302,966,255 | |

| End (6/30/2012) | 917 | 354,649,155 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 122 | 73,210,715 | |

| Unassisted Merger | 78 | 43,642,243 | |

| Voluntary Liquidation | 5 | 1,259,188 | |

| Failures | 186 | 104,832,833 | |

| Total | 391 | 222,944,979 | |

| 1Institutions not on 8/7/2009 or 6/30/2012 list but appeared on a list between these dates. | |||

Fannie Mae and Freddie Mac Serious Delinquency rates declined in May

by Calculated Risk on 6/29/2012 04:41:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in May to 3.57% from 3.63% April. The serious delinquency rate is down from 4.14% in May last year, and this is the lowest level since April 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined slightly in May to 3.50%, from 3.51% in April. Freddie's rate is only down from 3.53% in May 2011. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

I don't know why Fannie's delinquency rate is falling faster than for Freddie.

The "normal" serious delinquency rate is under 1%, so there is a long way to go.

Restaurant Performance Index declines in May, Still shows expansion

by Calculated Risk on 6/29/2012 02:00:00 PM

Away from Europe ...

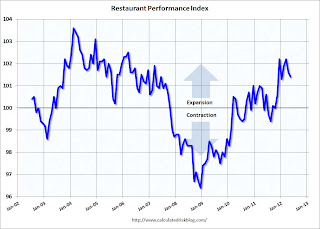

From the National Restaurant Association: Restaurant Performance Index Remains Above 100 for Seventh Consecutive Month, Reflecting Continued Positive Sales

The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.4 in May, down 0.2 percent from April’s level of 101.6. Despite the decline, May represented the seventh consecutive month that the RPI stood above 100, which signifies expansion in the index of key industry indicators.

“Despite a soft patch in the overall economy, restaurant operators reported positive same-store sales for the 12th consecutive month,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Looking forward, restaurant operators remain generally optimistic about sales growth in the months ahead, though they are somewhat less bullish about the direction of the economy.”

Restaurant operators reported positive same-store sales for the 12th consecutive month in May ... While sales results remained positive, restaurant operators reported softer customer traffic results in May.

Click on graph for larger image.

Click on graph for larger image.The index decreased to 101.4 in May, down from 101.6 in April (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month - and the index has been positive all year.

CoreLogic: 63,000 completed foreclosures in May

by Calculated Risk on 6/29/2012 11:29:00 AM

From CoreLogic: CoreLogic® Reports 63,000 completed foreclosures in May

CoreLogic ... today released its National Foreclosure Report for May, which provides monthly data on completed foreclosures and the overall foreclosure inventory. According to the report, there were 63,000 completed foreclosures in the U.S. in May 2012 compared to 77,000 in May 2011 and 62,000 in April 2012. Since the financial crisis began in September 2008, there have been approximately 3.6 million completed foreclosures across the country. Completed foreclosures are an indication of the total number of homes actually lost to foreclosure.So far we haven't seen a surge in completed foreclosures - or a large increase in REO (lender Real Estate Owned) coming on the market. Note: The foreclosure inventory reported by CoreLogic is lower than the number reported by LPS of 4.12% of mortgages or 2 million in foreclosure, and the Mortgage Bankers Association’s (MBA) Q1 report showing 4.39% of loans in the foreclosure process.

Approximately 1.4 million homes, or 3.4 percent of all homes with a mortgage, were in the national foreclosure inventory as of May 2012 compared to 1.5 million, or 3.5 percent, in May 2011 and 1.4 million, or 3.4 percent, in April 2012.

“There were more than 819,000 completed foreclosures over the past year, or an average of 2,440 completed foreclosures every day over the last 12 months,” said Mark Fleming, chief economist for CoreLogic. “Although the level of completed foreclosures remains high, it is down 27 percent from a peak of 1.1 million in all of 2010.”

...

“Though the national foreclosure inventory levels remain steady, around 1.4 million homes, there have been dramatic shifts at the state level,” said Anand Nallathambi, president and CEO of CoreLogic. “Nevada, Arizona and Michigan, for example, each experienced at least a 20-percent decline in the foreclosure inventory from a year ago. While foreclosure inventories in most states are declining, the foreclosure inventory is still rising in many judicial states, such as Hawaii, New York and Connecticut.”

My guess is the "surge" in foreclosures this year will be less than many people expect, although there has been an increase in some judicial states.

Consumer Sentiment declines in June to 73.2

by Calculated Risk on 6/29/2012 09:55:00 AM

Chicago PMI: The overall index increased to 52.9 in June, up from 52.7 in May. This was slightly below consensus expectations of 53.1 and indicates slow growth in June. Note: any number above 50 shows expansion. From the Chicago ISM:

The Chicago Purchasing Managers reported the June Chicago Business Barometer stabilized just above May's 33 month low. The short-term trend of the Chicago Business Barometer fell for the third month. The three-month moving average of each Business Activity index, except Employment, fell in June.New orders declined to 51.9 from 52.9, and employment increased to 60.4 from 57.0.

...

• PRODUCTION rebounded; • NEW ORDERS and ORDER BACKLOGS lowest since September 2009; • PRICES PAID were at a 30 month low.

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for June declined to 73.2, down from the May reading of 79.3, and the preliminary June reading of 74.1.

This was below the consensus forecast of 74.1 and the lowest level this year. Overall sentiment is still weak - and apparently the weak job market and sluggish economy are outweighing any positive impact from falling gasoline prices.

Personal Income increased 0.2% in May, Spending decreased slightly

by Calculated Risk on 6/29/2012 08:30:00 AM

The BEA released the Personal Income and Outlays report for May:

Personal income increased $25.4 billion, or 0.2 percent ... in May, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $4.7 billion, or less than 0.1 percent.The following graph shows real Personal Consumption Expenditures (PCE) through May (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in May, the same increase as in April. ... PCE price index -- The price index for PCE decreased 0.2 percent in May, compared with an increase of less than 0.1 percent in April. The PCE price index, excluding food and energy, increased 0.1 percent in May, the same increase as in April.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE. You can really see the slow down in Q2 of last year.

Using the two-month method, it appears real PCE will increase around 1.4% in Q2 (PCE is the largest component of GDP); the mid-month method suggests an increase of less than 1% in Q2. Also - so far - it appears spending is soft in June, so Q2 PCE growth will probably be fairly weak.

Another key point is the PCE price index has only increased 1.5% over the last year, and core PCE is up 1.8%. And it looks like the year-over-year increases will decline further in June.

Thursday, June 28, 2012

Tomorrow: Personal Income and Outlays for May, Chicago PMI, Consumer Sentiment

by Calculated Risk on 6/28/2012 09:43:00 PM

The focus tomorrow will be on the end of the two day European summit in Brussels. There will probably be some sort of agreement on a "growth pact". The Financial Times is live blogging the European summit: EU summit: Live blog

And late today, Ford said that the European recession will really hit Q2 earnings. From the NY Times: Ford Motor, Citing Europe’s Woes, Says Foreign Losses to Triple in Quarter

The company said on Thursday that its total international losses would triple in the second quarter, with Europe accounting for the most of the loss. Ford lost $190 million in the first quarter in its international operations ...On Friday:

The company’s chief financial officer, Robert Shanks, said in an interview that conditions in Europe were “getting tougher,” as manufacturers stepped up discounts to jump-start sales, which are at their lowest level in more than a decade.

• At 8:30 AM ET, The Personal Income and Outlays report for May will be released. The consensus is for a 0.3% increase in personal income in May, and for no change in personal spending. And for the Core PCE price index to increase 0.2%. Note: Q1 PCE was revised down slightly in the third estimate of GDP released this morning.

• At 9:45 AM, The Chicago Purchasing Managers Index for June. The consensus is for an increase to 53.1, up from 52.7 in May.

• At 9:55 AM, The final June Reuter's/University of Michigan's Consumer sentiment index will be released. The consensus is for no change from the preliminary reading of 74.1.

Europe: Growth Pact Update

by Calculated Risk on 6/28/2012 05:00:00 PM

There is a little news from the European summit meeting:

Herman Van Rompuy, President of the European Council did tweet:

With the #GrowthCompact we will boost the financing of the economy by mobilising around EUR 120 bn for immediate growth measures.This is the plan that was discussed last week.

Rompuy also wrote:

A EUR 10 bn increase of the EIB capital will increase the bank's overall lending capacity by EUR 60 bn. This money must flow across Europe.Earlier Angela Merkel cancelled a planned press conference.

The Financial Times is live blogging the European summit: EU summit: Live blog

Van Rompuy says no agreement yet on growth pact because they haven’t finished discussing all the chapters yet. He would not confirm it was being blocked by either Mario Monti or David Cameron; it was simply unfinished. He said two countries were most concerned to see agreement on both long and short term together – he didn’t name them, but Germany and Italy are the most likely suspects. Both inclined to say no agreement until it is all agreed.Meanwhile Bloomberg is reporting there is agreement: EU Leaders Agree 120 Billion-Euro Pact to Promote Growth, Jobs

excerpt with permission

A QE Timeline

by Calculated Risk on 6/28/2012 02:04:00 PM

By request, here is an updated timeline of QE (and Twist operations):

• November 25, 2008: Press Release: $100 Billion GSE direct obligations, $500 billion in MBS

• December 16, 2008 FOMC Statement: Evaluating benefits of purchasing longer-term Treasury Securities

• January 28, 2009: FOMC Statement: FOMC Stands Ready to expand program.

• March 18, 2009: FOMC Statement: Expand MBS program to $1.25 trillion, buy up to $300 billion of longer-term Treasury securities

• March 31, 2010: QE1 purchases were completed at the end of Q1 2010.

• August 27, 2010: Fed Chairman Ben Bernanke hints at QE2: Analysis: Bernanke paves the way for QE2

• November 3, 2010: FOMC Statement: $600 Billion QE2 announced.

• June 30, 2011: QE2 purchases were completed at the end of Q2 2011.

• September 21, 2011: "Operation Twist" announced. "The Committee intends to purchase, by the end of June 2012, $400 billion of Treasury securities with remaining maturities of 6 years to 30 years and to sell an equal amount of Treasury securities with remaining maturities of 3 years or less."

• June 20, 2012: "Operation Twist" extended. "The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities."

• June 20, 2012: "Operation Twist" extended. "The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities."

This graph show the S&P 500 and the Fed actions.

Click on graph for larger image.

Kansas City Fed: Growth in Regional Manufacturing Activity Slowed in June

by Calculated Risk on 6/28/2012 11:03:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Eased Further Activity Slowed

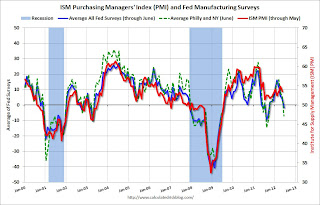

Growth in Tenth District manufacturing activity slowed in June, and expectations eased as producers grew more uncertain.. ...The regional manufacturing surveys were mostly weaker in June, especially the Philly Fed index.

The month-over-month composite index was 3 in June, down from 9 in May and equal to 3 in April ... The production index eased from 17 to 12, and the new orders index fell back into negative territory after rising slightly last month. Order backlogs continued to ease. The employment index moved lower but remained positive, while the new orders for exports index decreased.

Price indexes moderated for the second straight month, including an actual decline in monthly selling prices. The month-over-month finished goods price index dropped from 0 to -4, its lowest level since mid-2010, and the raw materials price index also decreased.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through June), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through May (right axis).

The ISM index for June will be released Monday, July 2nd, and these surveys suggest some decrease from the 53.5 reading in May.