by Calculated Risk on 7/18/2012 05:12:00 PM

Wednesday, July 18, 2012

Starts and Completions: Multi-family and Single Family

Halfway through 2012, single family starts are on pace for over 500 thousand this year, and total starts are on pace for about 730 thousand. That is above the forecasts for most analysts (however Lawler and the NAHB were close).

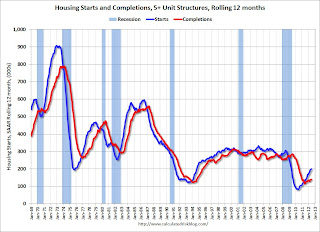

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up over the course of the year (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries next year.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

For the fifth consecutive month, the rolling 12 month total for starts has been above completions - that usually only happens after housing has bottomed.

Earlier on housing starts:

• Housing Starts increased to 760 thousand in June, Highest since October 2008

Fed's Beige Book: Economic activity increased at "modest to moderate" pace, Residential real estate "largely positive"

by Calculated Risk on 7/18/2012 02:00:00 PM

Reports from most of the twelve Federal Reserve Districts indicated that overall economic activity continued to expand at a modest to moderate pace in June and early July.This is a downgrade from the previous beige book that reported "moderate" growth.

And on real estate:

Reports on residential housing markets remained largely positive. Sales were characterized as improving in Philadelphia, New York, Richmond, Chicago, St. Louis, and Minneapolis, while home sales increased in Boston, Cleveland, Atlanta, St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco."Prepared at the Federal Reserve Bank of Atlanta and based on information collected before July 9, 2012."

...

Most Districts reported declines in home inventories. Homes prices have begun to stabilize in some markets and price increases were noted in select markets. Boston and Atlanta noted that appraisals were coming in below market prices.

...

Rental markets continued to strengthen by most accounts.

...

Recent activity in commercial real estate markets has been mixed. Modest improvements were noted in Boston, Atlanta, and St. Louis and demand strengthened in the San Francisco District. Softer conditions were reported in the New York and Richmond Districts, while demand held steady in the Philadelphia and Dallas Districts. Nonresidential construction activity varied as well.

More sluggish growth, but still "modest to moderate". And a few positive comments on residential real estate ...

August 1st QE3 Departure Date?

by Calculated Risk on 7/18/2012 11:47:00 AM

There is quite a bit of discussion on when (not if) the Fed will embark on QE3. As an example, from Goldman Sachs yesterday:

While we think that a modest easing step is a strong possibility at the August or September meeting, we suspect that a large move is more likely to come after the election or in early 2013, barring rapid further deterioration in the already-cautious near term Fed economic outlook.And from Merrill Lynch this morning:

We expect that, as the data continue to soften, the Fed will undershoot its own forecasts and thus respond with further easing. We expect the Fed to push out its forward guidance until at least mid-2015, perhaps at the August 1 FOMC meeting, and to launch a $500bn QE3 asset purchase plan by the September 13 meeting.Although the date is uncertain, I think there is a strong possibility that the Fed will launch QE3 on August 1st.

First, I think Bernanke paved the way for QE3 at the press conference on June 20th. Before embarking on previous rounds of QE, Bernanke always outlined the reasons - and I thought he made it clear that if the economy didn't improve, more accommodation was coming. And, if anything, the data has been worse since the last meeting. However there has only been a limited amount of data (Q2 GDP will be released next week), and some participants might argue they need additional data before supporting QE3.

Second, two of the key undecided voting members of the FOMC are clearly moving closer to supporting QE3. Last week Atlanta Fed President Dennis Lockhart came close to advocating QE3. Although Lockhart weighed both sides of each issue in his speech, he concluded: 1) the risks of QE3 are "manageable", 2) QE3 will be modestly effective, and 3) his earlier forecast is becoming "untenable" and that means he will support more accommodation if the recent weak data continues.

And yesterday, Cleveland Fed President Sandra Pianalto said more easing could be warranted.

My outlook calls for the pace of growth to pick up over the course of this year and into 2013 as the headwinds holding back the recovery gradually abate. I also expect inflation to remain close to 2 percent. If the expansion were to continue to lose momentum, and inflation threatened to run persistently below 2 percent, additional policy action could be warranted.I expect Pianalto will revise down her outlook over the next couple of weeks.

Third, it appears some key members of the FOMC (Yellen, Dudley, Williams) are all pushing harder for QE now. San Francisco Fed President John Williams is definitely being more aggressive, from July 9th:

We are falling short on both our employment and price stability mandates, and I expect that we will make only very limited progress toward these goals over the next year. ... If further action is called for, the most effective tool would be additional purchases of longer-maturity securities, including agency mortgage-backed securities. ... At the Fed, we take our dual mandate with the utmost seriousness. ... We stand ready to do what is necessary to attain our goals of maximum employment and price stability.By my count, if Bernanke decides that QE3 is appropriate, he will have 10 or 11 votes on August 1st. Maybe the FOMC will wait for more data, but I think QE3 is likely very soon.

AIA: Architecture Billings Index shows "drop in design activity" in June

by Calculated Risk on 7/18/2012 10:41:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Weak Market Conditions Persist According to Architecture Billings Index

The Architecture Billings Index (ABI) saw more poor conditions last month, indicating a drop in design activity at U.S. architecture firms, and suggesting upcoming weakness in spending on nonresidential construction projects. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the June ABI score was 45.9, nearly identical to the mark of 45.8 in May. This score reflects a decrease in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 54.4, up slightly from mark of 54.0 the previous month.

“The downturn in design activity that began in April and accelerated in May has continued into June, likely extending the weak market conditions we’ve seen in nonresidential building activity ,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “While not all firms are experiencing negative conditions, a large share is still coping with a sluggish and erratic marketplace.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 45.9 in June, up slightly from May. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further weakness in CRE investment later this year and into next year (it will be some time before investment in offices and malls increases).

Housing Starts increased to 760 thousand in June, Highest since October 2008

by Calculated Risk on 7/18/2012 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in June were at a seasonally adjusted annual rate of 760,000. This is 6.9 percent above the revised May estimate of 711,000 and is 23.6 percent above the June 2011 rate of 615,000.

Single-family housing starts in June were at a rate of 539,000; this is 4.7 percent above the revised May figure of 515,000. The June rate for units in buildings with five units or more was 213,000.

Building Permits:

Privately-owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 755,000. This is 3.7 percent below the revised May rate of 784,000, but is 19.3 percent above the June 2011 estimate of 633,000.

Single-family authorizations in June were at a rate of 493,000; this is 0.6 percent above the revised May figure of 490,000. Authorizations of units in buildings with five units or more were at a rate of 241,000 in June.

Click on graph for larger image.

Click on graph for larger image.Total housing starts were at 760 thousand (SAAR) in June, up 6.9% from the revised May rate of 711 thousand (SAAR). Note that May was revised up from 708 thousand. April was revised up slightly too.

Single-family starts increased 4.7% to 539 thousand in June.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years. Total starts are up 59% from the bottom start rate, and single family starts are up 53% from the low.

This was above expectations of 745 thousand starts in June. This is another fairly strong housing report.

MBA: "Record Low Mortgage Rates Lead to Jump in Refinance Activity"

by Calculated Risk on 7/18/2012 07:04:00 AM

From the MBA: Record Low Mortgage Rates Lead to Jump in Refinance Activity

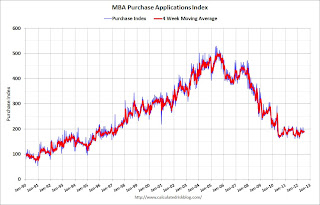

The Refinance Index increased 22 percent from the previous week and is at the highest level since mid-June. The seasonally adjusted Purchase Index decreased 0.1 percent from one week earlier.

“Refinance application volume increased last week to near peak levels for the year as mortgage rates dropped to a new low, driven down by growing concerns about the health of the US economy,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Applications for HARP refinance loans accounted for 24 percent of refinance activity last week, in line with the HARP share for the past few weeks.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.74 percent, the lowest rate in the history of the survey, from 3.79 percent, with points increasing to 0.45 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the purchase index, and the purchase index is mostly moving sideways over the last two years - but has been moving a little recently.

The second graph shows the refinance index.

This index is back to the high for the year.

This index is back to the high for the year.Some of the increase in the refinance index is related to HARP (HARP activity has picked up this year), but most of this activity is related to the record low mortgage rates.

Tuesday, July 17, 2012

Wednesday: Housing Starts, Beige Book, more Bernanke

by Calculated Risk on 7/17/2012 10:01:00 PM

Wednesday will be another busy day for economic data, but first from Binyamin Appelbaum at the NY Times: Cautious on Growth, Bernanke Offers No Hint of New Action

The Federal Reserve chairman, Ben S. Bernanke, said Tuesday that the Fed was seeking greater clarity about the health of the recovery, suggesting that officials were not ready to approve another round of stimulus.• At 7:00 AM AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

...

Rather than committing to new steps, Mr. Bernanke told the Senate Banking Committee that the decision would turn on the judgment of Fed officials about the pace of job growth in the coming months.

The major issue, he said, is “whether or not there is in fact a sustained recovery going on in the labor market, or are we stuck in the mud?” Mr. Bernanke added a wrinkle, saying the central bank “would certainly want to react against any increase in deflation risk.”

• 8:30 AM: Housing Starts for June will be released. The consensus is for total housing starts to increase to 745,000 (SAAR) in June from 708,000 in May.

• At 10:00 AM, Fed Chairman Ben Bernanke will testify before the Committee on Financial Services, U.S. House of Representatives. (same report again).

• At 2:00 PM, the Federal Reserve Beige Book will be released.

Also during the day, the AIA's Architecture Billings Index for June will be released (a leading indicator for commercial real estate).

For the July contest:

Lawler: Early Read on Existing Home Sales in June

by Calculated Risk on 7/17/2012 06:29:00 PM

From economist Tom Lawler:

Based on an admittedly limited sample of realtor/MLS reports across the country, I estimate that existing home sale ran at a seasonally adjusted annual rate of 4.56 million in June, little changed from May’s SA pace and up 9.1% from last June’s SA pace. Unadjusted data clearly show a smaller YOY gain in June sales relative to May sales, which was expected, as this May had one more business day than last May, while this June had one fewer business day than last May.CR Note: This would put the months-of-supply at about 6.6 months, unchanged from May. For the month of June, this would be the lowest level of inventory since 2004, and the lowest months-of-supply since 2005. The NAR is scheduled to report June sales on Thursday.

It is worth noting that in several “distressed” markets, sales this June were down from a year ago, even though in many of these markets non-distressed (and especially non-foreclosure) sales, were up -- in some cases by a lot.

On the inventory front, various entities that track listings showed modestly different trends, though all show big YOY declines. Realtor.com, e.g., reported that the AVERAGE number of listings in the month of June was up 0.5% from May, but down 19.4% from last June, while HousingTracker.Net reported that average listings (actually, the average number of listings on Mondays) in June in the 54 metro markets it tracks were down 1.3% from May and down 22.0% from last June. Looking at these data, combined with realtor reports, my “best guess” is that the NAR’s estimate for the number of existing homes for sale at the end of June will be about 2.5 million, up 0.4% from May but down 20.9% from last June.

On the median sales price front, it’s pretty clear that the national median existing SF sales price this June will show another YOY gain – the fourth in a row – though local realtor/MLS data suggest that June’s YOY increase will be a bit less than May’s. My best guess is that the NAR’s estimate of the median existing SF home sales price in June will be up about 6.4% from last June.

Tom also sent me the following updated table on distressed sales. From Lawler: "Note that all of these shares are based on MLS data or realtor reports save for those for Southern California, which come from Dataquick and are based on property records."

CR Note: Notice the decline in distressed sales. Foreclosure are down in all these areas, and short sales are up in most.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-June | 11-June | 12-June | 11-June | 12-June | 11-June | |

| Las Vegas | 34.2% | 21.6% | 27.8% | 47.2% | 62.0% | 68.8% |

| Reno | 37.0% | 25.0% | 21.0% | 41.0% | 58.0% | 66.0% |

| Phoenix | 32.8% | 27.0% | 14.1% | 40.8% | 46.8% | 67.8% |

| Sacramento | 31.0% | 22.2% | 23.2% | 43.0% | 54.2% | 65.2% |

| Mid-Atlantic (MRIS) | 10.2% | 10.0% | 8.7% | 14.9% | 18.9% | 24.9% |

| Minneapolis | 9.6% | 10.5% | 25.1% | 33.9% | 34.6% | 44.3% |

| Southern California | 17.7% | 17.9% | 24.5% | 32.9% | 42.2% | 50.8% |

| Northeast Florida | 36.3% | 43.2% | ||||

| Hampton Roads | 28.8% | 29.7% | ||||

| Chicago | 33.5% | 36.0% | ||||

| Charlotte | 14.2% | 30.6% | ||||

And from DataQuick on SoCal:

The number of homes sold in Southern California rose above a year earlier for the sixth month in a row in June, the result of robust investor demand and significant sales gains for mid- to high-end homes.

Foreclosure resales – properties foreclosed on in the prior 12 months – accounted for 24.5 percent of the Southland resale market last month, down from a revised 26.9 percent the month before and 32.9 percent a year earlier. Last month’s figure was the lowest since foreclosure resales were 24.3 percent of the resale market in December 2007. In the current cycle, the figure hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 17.7 percent of Southland resales last month. That was down slightly from an estimated 18.0 percent the month before and 17.9 percent a year earlier.

First Look at 2013 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 7/17/2012 03:21:00 PM

The BLS reported this morning: "The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.6 percent over the last 12 months to an index level of 226.036 (1982-84=100). For the month, the index decreased 0.2 percent prior to seasonal adjustment."

CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is an explanation ...

The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W1 for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

Since the highest Q3 average was in 2011, at 223.233, we only have to compare to last year. Note: The last few years we needed to compare to Q3 2008 since that was the previous highest Q3 average.

Click on graph for larger image.

Click on graph for larger image.

This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Currently CPI-W is above the Q3 2011 average. If the current level holds, COLA would be around 1.3% for next year (the current 226.036 divided by the Q3 2011 level of 223.233).

This is very early, but it appears COLA will be slightly positive next year.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA, the contribution base will be adjusted using the National Average Wage Index.

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.This is based on a one year lag. The National Average Wage Index is not available for 2011 yet, but wages probably didn't increase much from 2010. If wages increased the same as last year, and COLA is positive (seems likely right now), then the contribution base next year will be increased to around $112,500 from the current $110,100.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

Remember - this is an early look. What matters is CPI-W during Q3 (July, August and September).

(1) CPI-W usually tracks CPI-U (headline number) pretty well. From the BLS:

The Bureau of Labor Statistics publishes CPIs for two population groups: (1)the CPI for Urban Wage Earners and Clerical Workers (CPI-W), which covers households of wage earners and clerical workers that comprise approximately 32 percent of the total population and (2) the CPI for All Urban Consumers (CPI-U) ... which cover approximately 87 percent of the total population and include in addition to wage earners and clerical worker households, groups such as professional, managerial, and technical workers, the self- employed, short-term workers, the unemployed, and retirees and others not in the labor force.

Key Measures show slowing inflation in June

by Calculated Risk on 7/17/2012 01:09:00 PM

Earlier today the BLS reported:

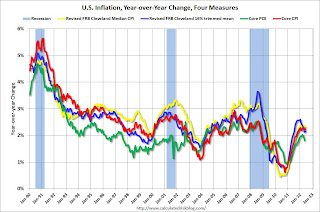

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.7 percent before seasonal adjustment. ... The index for all items less food and energy rose 0.2 percent in June, the fourth consecutive such increase.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.5% annualized rate) in June. The 16% trimmed-mean Consumer Price Index increased 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for June here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was virtually flat at 0.0% (0.5% annualized rate) in June. The CPI less food and energy increased 0.2% (2.5% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.2%, and core CPI rose 2.2%. Core PCE is for May and increased 1.8% year-over-year.

Most of these measures show inflation on a year-over-year basis are still above the Fed's 2% target, but it appears the inflation rate is slowing. On a monthly basis (annualized), most of these measure were below the Fed's target; median CPI was at 1.5%, trimmed-mean CPI was at 1.9%, and Core PCE for May was at 1.4% - although core CPI was at 2.5%.