by Calculated Risk on 7/22/2012 10:15:00 PM

Sunday, July 22, 2012

Monday: Chicago Fed National Activity Index

First, from the Financial Times on "open-ended QE": Bleak jobs outlook raises heat on Fed

In an interview with the Financial Times, [San Francisco Fed President John Williams] forecast that unless “further action” was taken, there would be a lack of progress in boosting the jobs market ...The key releases this week are the new home sales report on Wednesday and the advance Q2 GDP report on Friday.

He added that there would also be benefits in having an open-ended programme of QE, where the ultimate amount of purchases was not fixed in advance ... “The main benefit from my point of view is it will get the markets to stop focusing on the terminal date [when a programme of purchases ends] and also focusing on, ‘Oh, are they going to do QE3?’” he said. Instead, markets would adjust their expectation of Fed purchases as economic conditions changed.

excerpt with permission

• On Monday, at 8:30 AM ET, the Chicago Fed is schedule to release the National Activity Index for June. This is a composite index of other data and will probably be fairly weak.

The Asian markets are red tonight, with the Nikkei down 1.3% and the Shanghai Composite down 1.1%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are down about 6, and the DOW futures down about 50.

Oil: WTI futures are at $91.12 (this is down from $109.77 in February, but up last week) and Brent is at $106.17 per barrel.

Yesterday:

• Summary for Week Ending July 13th

• Schedule for Week of July 15th

Two more questions this week for the July contest:

WSJ: "As Homes Go, So Do Pickups"

by Calculated Risk on 7/22/2012 08:34:00 PM

As residential investment increases, there will be positive spillover effects ... usually it is "As housing goes, so goes the economy!"

From Mike Ramsey at the WSJ: As Homes Go, So Do Pickups (ht Joe)

[I]n the past few months, more lots have been cleared for construction and [Hardwood's] phone has been ringing more frequently. So in June he went out and bought a new Chevrolet 2500 diesel truck with a backup camera and a hands-free Bluetooth phone link.Yesterday:

"There is a lot more steady and consistent work," said the 30-year-old Mr. Harwood, whose company Broadleaf Landscape, in Damascus, Md., does a lot of work at new homes. "I was more comfortable with buying a new truck at this point in time because of the market change."

...

In the first half of this year, sales of full-size pickups made by the Detroit Three increased 13%, to 707,175 vehicles.

• Summary for Week Ending July 20th

• Schedule for Week of July 22nd

DOT: Vehicle Miles Driven increased 2.3% in May

by Calculated Risk on 7/22/2012 03:03:00 PM

The Department of Transportation (DOT) reported on Friday:

Travel on all roads and streets changed by +2.3% (5.7 billion vehicle miles) for May 2012 as compared with May 2011. Travel for the month is estimated to be 258.4 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

The rolling 12 month total is mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 54 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices peaked in April at close to $4.00 per gallon, and then started falling.

Gasoline prices peaked in April at close to $4.00 per gallon, and then started falling.Gasoline prices were down in May to an average of $3.79 per gallon according to the EIA. Last year, prices in May averaged $3.96 per gallon, so it makes sense that miles driven are up year-over-year in May.

However, as I've mentioned before, gasoline prices is just part of the story. The lack of growth in miles driven over the last 4+ years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 50 drivers drive fewer miles) and changing driving habits of young drivers.

A new report suggests that driving preferences are changing for younger drivers:

From 2001 to 2009, the average annual number of vehicle miles traveled by young people (16 to 34-year-olds) decreased from 10,300 miles to 7,900 miles per capita—a drop of 23 percent.With all these factors, it may be years before we see a new peak in miles driven.

Yesterday:

• Summary for Week Ending July 20th

• Schedule for Week of July 22nd

Unofficial Problem Bank list declines to 905 Institutions

by Calculated Risk on 7/22/2012 08:03:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 20, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Closings and enforcement activities by the FDIC and OCC led to many changes to the Unofficial Problem Bank List. This week just about every type of change occurred except for the issuance/termination of a Prompt Corrective Action order. In all there were nine additions and 16 removals that included four failures, one voluntary liquidation, two unassisted mergers, and nine action terminations. These changes leave the list with 905 institutions with assets of $349.7 billion. A year ago, the list held 993 institutions with assets of $415.7 billion.Earlier:

The nine additions were First Federal Savings Bank, Ottawa, IL ($408 million); Newton Federal Bank, Covington, GA ($239 million); Borrego Springs Bank, National Association, La Mesa, CA ($141 million); Clay County Savings Bank, Liberty, MO ($102 million Ticker: CCFC); Pickens Savings and Loan Association, FA, Pickens, SC ($101 million); Central Federal Savings and Loan Association of Chicago, Chicago, IL ($97 million); The First National Bank of Wellston, Wellston, OH ($95 million Ticker: MDWE); Commonwealth National Bank, Mobile, AL ($68 million); and Summit National Bank, Hulett, WY ($67 million).

The nine action terminations were Meridian Bank, National Association, Wickenburg, AZ ($886 million); Great Lakes Bank, National Association, Blue Island, Il ($626 million); First Trade Union Bank, Boston, MA ($588 million); Metro United Bank, San Diego, CA ($396 million Ticker: MCBI); Premier Bank, Dubuque, IA ($260 million); Canon National Bank, Canon City, CO ($228 million); First National Bank of Wyoming, Laramie, WY ($172 million); Heritage Bank, National Association, Phoenix, AZ ($102 million); and The Federal Savings Bank, Overland Park, KS ($75 million Ticker: KCLI).

Union Bank, Kansas City, MO ($456 million) voluntarily surrender its charter. Unassisted mergers were done by First National Bank of the Mid-Cities, Bedford, TX ($35 million) and The First State Bank of Burlingame, Burlingame, KS ($25 million).

The four failures were First Cherokee State Bank, Woodstock, GA ($223 million); Second Federal Savings and Loan Association of Chicago, Chicago, IL ($199 million); Heartland Bank, Leawood, KS ($110 million); and The Royal Palm Bank of Florida, Naples, FL ($87 million). Heartland Bank and Royal Palm Bank were affiliates and commonly owned by Mercantile Bancorp, Inc., Quincy Il. Mercantile Bancorp also owns Mercantile Bank, Quincy, Il ($510 million), which is on the Unofficial Problem Bank List that was not closed. The FDIC failed bank press releases did not indicate if any of the affiliates were closed under cross guaranty authority or why Mercantile Bank was allowed to remain open. The other failure Friday night was Georgia Trust Bank, Buford, GA, which appears to have failed not being subject to a timely issued enforcement action. Hard to believe at this stage of the crisis, especially in Georgia where 82 banks have failed, for a bank to fail without a corrective plan in place.

There were three name changes that were made this week -- First Midwest Bank, Centerville, SD; is now known as One American Bank; Community Business Bank, Sauk City, WI; is now known as Wisconsin River Bank; and Madison National Bank, Merrick, NY, is now known as First National Bank of New York.

Next week we anticipate the FDIC will release its actions through June 2012.

• Summary for Week Ending July 20th

• Schedule for Week of July 22nd

Saturday, July 21, 2012

Bank makes $1 Million on Foreclosure

by Calculated Risk on 7/21/2012 08:10:00 PM

It looks like Capital One Bank made $1 million on this foreclosure.

From the O.C. Register: $8.1M oceanfront home sells as foreclosure

Located at 989 Cliff Drive on the oceanfront above Laguna Beach's Shaw's Cove, the Mission style villa sold for $8.1 million in an all cash deal ... The Cliff Drive property sold to the bank for $7,006,347 December 28, 2011.Actress Diane Keaton bought the house in 2004 for "around $7.5 million" and sold it in 2005 for $14.5 million (nice flip!).

Capital One Bank foreclosed on the home in December 2011. There were no bidders and the house went back to the bank for just over $7 million.

Of course Capital One Bank could have bid less than they were owed at auction (maybe someone can pull up the details), but with the house selling at the asking price of $8.1 million for all cash, it appears Bank One made $1.1 million minus expenses.

Update: Any extra proceeds probably go to the borrower above what the bank was owed - I'm trying to find the state law in California. (ht Shnaps)

Update2: It appears update 1 was incorrect in California. Also apparently the first was greater than $7 million (around $7.8 million with costs), and the bank wouldn't have made any money after selling expenses. But if there was some extra, it would go to the bank in California according to several sources.

Earlier:

• Summary for Week Ending July 20th

• Schedule for Week of July 22nd

Schedule for Week of July 22nd

by Calculated Risk on 7/21/2012 01:01:00 PM

Earlier:

• Summary for Week Ending July 20th

This will be an important week for economic data. The key U.S. economic report for the coming week is the Q2 advance GDP report to be released on Friday; this is the last major economic release before the FOMC meeting the following week.

Also New Home sales will be released on Wednesday.

For manufacturing, two regional manufacturing reports will be released (Richmond and Kansas City Fed surveys).

8:30 AM: Chicago Fed National Activity Index (June). This is a composite index of other data.

9:00 AM: The Markit US PMI Manufacturing Index Flash. This is a new release and might provide hints about the ISM PMI for July. The consensus is for a reading of 52.6, down slightly from 52.9 in June.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for July. The consensus is for an increase to 0 for this survey from -3 in June (above zero is expansion).

10:00 AM: FHFA House Price Index for May 2012. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic). The consensus is for a 0.3% increase in house prices.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

10:00 AM ET: New Home Sales for June from the Census Bureau.

10:00 AM ET: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the May sales rate.

The consensus is for an increase in sales to 370 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 369 thousand in May.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 380 thousand from 386 thousand.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 0.6% increase in durable goods orders.

10:00 AM ET: Pending Home Sales Index for June. The consensus is for a 0.9% increase in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for July. The consensus is for an increase to 4 from 3 in June (above zero is expansion).

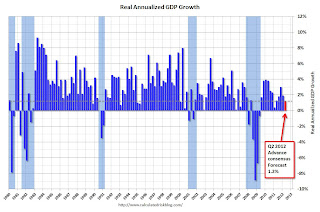

8:30 AM: Q2 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 1.2% annualized in Q2.

8:30 AM: Q2 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 1.2% annualized in Q2.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column (and dashed line) is the consensus forecast for Q2 GDP. The BEA will also release the revised estimates for 2009 through First Quarter 2012.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for July). The consensus is for no change from the preliminary reading of 72.0.

10:00 AM: Q2 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, based on the initial evaluation, it appears the vacancy rates are too high. The Census Bureau is looking into the differences between the HVS, the ACS, and the decennial Census, and until the issues are resolved, this survey probably shouldn't be used to estimate the excess vacant housing supply.

Summary for Week ending July 20th

by Calculated Risk on 7/21/2012 08:01:00 AM

For the last few months, the economic data has been weak and disappointing. Last week I joked: "Luckily there are a few housing reports next week, so all the data will not be grim.", and sure enough the housing data was better than expected (still historically weak, but definitely improving).

Housing started the week off with July home builder confidence at the highest level since March 2007. Then housing starts for June were reported at 760 thousand, and finally the existing home sales report showed the largest year-over-year decline in inventory ever reported. (Sales were weaker than expected, but the key number in the NAR report is inventory).

Unfortunately some non-housing economic data was released too. Retail sales were especially weak in June, initial weekly unemployment claims increased sharply, the Architecture Billings Index (mostly commercial real estate) showed further contraction, and the regional manufacturing surveys suggested ongoing weakness in July.

There were a couple of non-housing positives: Industrial production was up in June, and inflation was benign.

Luckily there is another housing report next week: June New Home sales. But the key report next week will be Q2 GDP - and that will be UGLY (update: around 1%).

Here is a summary of last week in graphs:

• Housing Starts increased to 760 thousand in June, Highest since October 2008

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 760 thousand (SAAR) in June, up 6.9% from the revised May rate of 711 thousand (SAAR). Note that May was revised up from 708 thousand. April was revised up slightly too.

Single-family starts increased 4.7% to 539 thousand in June.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

Total starts are up 59% from the bottom start rate, and single family starts are up 53% from the low.

This was above expectations of 745 thousand starts in June. This is another fairly strong housing report.

• Existing Home Sales in June: 4.37 million SAAR, 6.6 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in June 2012 (4.37 million SAAR) were 5.4% lower than last month, and were 4.5% above the June 2011 rate.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 24.4% year-over-year in June from June 2011. This is the sixteenth consecutive month with a YoY decrease in inventory, and the largest year-over-year decline reported.

Inventory decreased 24.4% year-over-year in June from June 2011. This is the sixteenth consecutive month with a YoY decrease in inventory, and the largest year-over-year decline reported.Months of supply increased to 6.6 months in June.

This was below expectations of sales of 4.65 million. However, as I've noted before, those focusing on sales of existing homes, looking for a recovery for housing, are looking at the wrong number. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

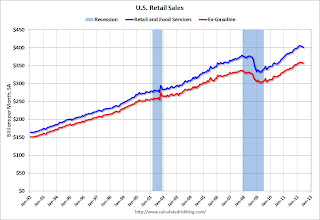

• Retail Sales declined 0.5% in June

On a monthly basis, retail sales were down 0.5% from May to June (seasonally adjusted), and sales were up 3.8% from June 2011.

On a monthly basis, retail sales were down 0.5% from May to June (seasonally adjusted), and sales were up 3.8% from June 2011.Sales for May were unchanged at a 0.2% decrease.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 21.2% from the bottom, and now 6.0% above the pre-recession peak (not inflation adjusted)

The next graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.2% on a YoY basis (3.8% for all retail sales). Retail sales ex-gasoline decreased 0.3% in June.

Retail sales ex-gasoline increased by 4.2% on a YoY basis (3.8% for all retail sales). Retail sales ex-gasoline decreased 0.3% in June.This was below the consensus forecast for retail sales of a 0.2% increase in June, and below the consensus for a 0.1% increase ex-auto.

Some of the decrease was related to the decline in gasoline prices, but this is another indicator of a weak June.

• Industrial Production increased 0.4% in June, Capacity Utilization increased

From the Fed: Industrial production and Capacity Utilization

From the Fed: Industrial production and Capacity Utilization Industrial production increased 0.4 percent in June after having declined 0.2 percent in May. ... Capacity utilization for total industry moved up 0.2 percentage point in June to 78.9 percent, a rate 1.4 percentage points below its long-run (1972--2011) average.This graph shows Capacity Utilization. This series is up 12.1 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.9% is still 1.4 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in June to 97.4. This is 16.7% above the recession low, but still 3.3% below the pre-recession peak.

The consensus is for Industrial Production to increase 0.3% in June, and for Capacity Utilization to increase to 79.2%. The increase IP was slightly above expectations, but Capacity Utilization was below expectations.

• AIA: Architecture Billings Index shows "drop in design activity" in June

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Weak Market Conditions Persist According to Architecture Billings Index

From AIA: Weak Market Conditions Persist According to Architecture Billings IndexThis graph shows the Architecture Billings Index since 1996. The index was at 45.9 in June, up slightly from May. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further weakness in CRE investment later this year and into next year (it will be some time before investment in offices and malls increases).

• Weekly Initial Unemployment Claims increase to 386,000

Here is a long term graph of weekly claims:

Here is a long term graph of weekly claims:The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 375,500.

The sharp decline last week due to onetime factors, and some increase was expected.

This was well above the consensus forecast of 365,000 and suggests ongoing weakness in the labor market.

• Regional Manufacturing Surveys

From the NY Fed: Empire State Manufacturing Survey

From the NY Fed: Empire State Manufacturing Survey The general business conditions index rose five points to 7.4. New orders, however, declined, as that index slipped into negative territory for the first time since November 2011, falling five points to -2.7.From the Philly Fed: July 2012 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of −16.6 in June to −12.9. This marks the third consecutive negative reading for the index ...Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through July. The ISM and total Fed surveys are through June.

The average of the Empire State and Philly Fed surveys increased in July, but the average is still negative (contraction).

• Other Economic Stories ...

• NAHB Builder Confidence increases strongly in July, Highest since March 2007

• First Look at 2013 Cost-Of-Living Adjustments and Maximum Contribution Base

• Bernanke: Semiannual Monetary Policy Report to the Congress

• State Unemployment Rates little changed in June

• Fed's Beige Book: Economic activity increased at "modest to moderate" pace, Residential real estate "largely positive"

• Key Measures show slowing inflation in June

Friday, July 20, 2012

Bank Failure #38: Second Federal Savings and Loan Association of Chicago, Chicago, Illinois

by Calculated Risk on 7/20/2012 08:53:00 PM

Pillaged the Chicago way

Illinois inept

by Soylent Green is People

From the FDIC: Hinsdale Bank & Trust Company, Hinsdale, Illinois, Assumes All of the Deposits of Second Federal Savings and Loan Association of Chicago, Chicago, Illinois

As of March 31, 2012, Second Federal Savings and Loan Association of Chicago had approximately $199.1 million in total assets and $175.9 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $76.9 million. ... Second Federal Savings and Loan Association of Chicago is the 38th FDIC-insured institution to fail in the nation this year, and the fifth in Chicago.Pretty large loss for the DIF. That makes five today ...

Bank Failure #37 in 2012: Heartland Bank, Leawood, Kansas

by Calculated Risk on 7/20/2012 06:07:00 PM

Asset drought wilts more bankers

Scorched earth arrives

by Soylent Green is People

From the FDIC: Metcalf Bank, Lees Summit, Missouri, Assumes All of the Deposits of Heartland Bank, Leawood, Kansas

As of March 31, 2012, Heartland Bank had approximately $110.0 million in total assets and $102.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $3.1 million. Compared ... Heartland Bank is the 37th FDIC-insured institution to fail in the nation this year, and the first in Kansas.Pretty small hit to the DIF. That makes four today so far ...

Bank Failures #34 - 36 in 2012: Florida and Georgia

by Calculated Risk on 7/20/2012 05:18:00 PM

From the FDIC: First National Bank of the Gulf Coast, Naples, Florida, Assumes All of the Deposits of the Royal Palm Bank of Florida, Naples, Florida

As of March 31, 2012, The Royal Palm Bank of Florida had approximately $87.0 million in total assets and $85.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $13.5 million. ... The Royal Palm Bank of Florida is the 34th FDIC-insured institution to fail in the nation this year, and the fifth in Florida.From the FDIC: Community & Southern Bank, Atlanta, Georgia, Assumes All of the Deposits of Georgia Trust Bank, Buford, Georgia

As of March 31, 2012, Georgia Trust Bank had approximately $119.8 million in total assets and $117.4 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $20.9 million. ... Georgia Trust Bank is the 35th FDIC-insured institution to fail in the nation this year, and the seventh in Georgia.From the FDIC: Community & Southern Bank, Atlanta, Georgia, Assumes All of the Deposits of First Cherokee State Bank, Woodstock, Georgia

As of March 31, 2012, First Cherokee State Bank had approximately $222.7 million in total assets and $193.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $36.9 million. ... First Cherokee State Bank is the 36th FDIC-insured institution to fail in the nation this year, and the eighth in Georgia.Two more in Georgia ... not a surprise.