by Calculated Risk on 7/31/2012 04:01:00 PM

Tuesday, July 31, 2012

Fannie, Freddie will not Participate in Principal Reduction Program

From Nick Timiraos at the WSJ: Fannie, Freddie Won't Cut Loan Balances

The federal regulator for Fannie Mae and Freddie Mac FMCC -2.10%will not permit the taxpayer-supported mortgage giants to participate in an Obama administration program that reduces mortgage balances for certain troubled homeowners, the agency said on Tuesday.Based on DeMarco's concerns about "strategic modifiers" (borrowers who default to get a principal reduction), I'm not surprised.

...

"The potential benefit was too small and uncertain relative to known and unknown costs and risks," said Edward DeMarco, the FHFA's acting director, in a briefing on Tuesday.

Earlier on house prices:

• Case Shiller: House Prices increased 2.2% in May

• House Price Comments, Real House Prices, Price-to-Rent Ratio

• All Current House Price Graphs

Misc: Chicago PMI increases slightly, Consumer Confidence up, CoreLogic 60,000 Foreclosures in June

by Calculated Risk on 7/31/2012 01:14:00 PM

Some earlier news ...

• From Chicago ISM: Chicago Business Barometer gained incrementally

The PMI increased to 53.7 from 52.9. Expectations were for a decrease to 52.5.

The employment index decreased to 53.5 from 60.4, and new orders increased to 52.9 from 51.9.

• From Reuters: Consumer confidence rises in July

The Conference Board, an industry group, said its index of consumer attitudes climbed to 65.9 from a upwardly revised 62.7 in June, topping economists' expectations for a decline to 61.5.This is still very low.

• From CoreLogic: CoreLogic Reports 60,000 Completed Foreclosures in June

According to the report, there were 60,000 completed foreclosures in the U.S. in June 2012 compared to 80,000 in June 2011 and 60,000 in May 2012.Earlier on house prices:

Approximately 1.4 million homes, or 3.4 percent of all homes with a mortgage, were in the national foreclosure inventory as of June 2012 compared to 1.5 million, or 3.5 percent, in June 2011. Month-over-month, the national foreclosure inventory was unchanged from May 2012 to June 2012. The foreclosure inventory is the share of all mortgaged homes in some stage of the foreclosure process.

• Case Shiller: House Prices increased 2.2% in May

• House Price Comments, Real House Prices, Price-to-Rent Ratio

• All Current House Price Graphs

House Price Comments, Real House Prices, Price-to-Rent Ratio

by Calculated Risk on 7/31/2012 11:14:00 AM

Reporting on the Case-Shiller house price indexes can be confusing. On a month-over-month basis, prices were up. On a year-over-year basis, prices were down. Sometimes reporting focuses on the Seasonally Adjusted (SA) numbers; sometimes on the Not Seasonally Adjusted (NSA) numbers.

I look at all of these numbers.

Unfortunately, the seasonal adjustment is being impacted by distressed sales and is not as useful as in earlier periods. This is because the level of distressed sales remains fairly constant all year - and the level of conventional sales follows a normal seasonal pattern (high in the spring and summer, low in the winter). This has distorted the seasonal factor.

However, if we just look at the month-over-month change NSA, we have to remember there is a seasonal pattern for prices (strong in the spring and summer). So the 2.2% month-to-month NSA increase in May is partially seasonal.

If we just look at the year-over-year change (down 1.0% year-over-year in May), we have to remember that year-over-year changes lag turning points in prices.

However we look at the numbers, it appears house prices increased in May from April, and that the year-over-year change will probably turn positive in the June or July report.

Here is another update to a few graphs: Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio. Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices, and the price-to-rent ratio, are back to late 1998 to 2001 levels depending on the index.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through May) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q4 2002 levels, and the Case-Shiller Composite 20 Index (SA) is back to August 2003 levels, and the CoreLogic index (NSA) is also back to August 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1998 levels, the Composite 20 index is back to March 2001, and the CoreLogic index back to May 2000.

As we've discussed before, in real terms, all of the appreciation early in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 1998 levels, the Composite 20 index is back to May 2000 levels, and the CoreLogic index is back to June 2000.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels.

Case Shiller: House Prices increased 2.2% in May

by Calculated Risk on 7/31/2012 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for May (a 3 month average of March, April and May).

This release includes prices for 20 individual cities and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Home Prices Continue to Rise in May 2012 According to the S&P/Case-Shiller Home Price Indices

Data through May 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices, the leading measure of U.S. home prices, showed that average home prices increased by 2.2% in May over April for both the 10- and 20-City Composites.

With May’s data, we found that home prices fell annually by 1.0% for the 10-City Composite and by 0.7% for the 20-City Composite versus May 2011. Both Composites and 17 of the 20 MSAs saw increases in annual returns in May compared to April. ... All 20 cities and both Composites posted positive monthly returns.

...

“With May’s data, we saw a continuing trend of rising home prices for the spring,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “On a monthly basis, all 20 cities and both Composites posted positive returns and 17 of those cities saw those rates of change increase compared to what was observed for April. Seventeen of the 20 cities and both Composites also saw improved annual rates of return. We have observed two consecutive months of increasing home prices and overall improvements in monthly and annual returns; however, we need to remember that spring and early summer are seasonally strong buying months so this trend must continue throughout the summer and into the fall.

“The 10- and 20-City Composites were each up 2.2% for the month and recorded respective annual rates of decline of 1.0% and 0.7%, compared to May 2011. While still negative, these annual changes are the best we’ve since in at least 18 months."

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.6% from the peak, and up 0.9% in May (SA). The Composite 10 is up from the post bubble low set in March, Not Seasonally Adjusted (NSA).

The Composite 20 index is off 32.3% from the peak, and up 0.9% (SA) in May. The Composite 20 is also up from the post-bubble low set in March (NSA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 1.0% compared to May 2011.

The Composite 20 SA is down 0.7% compared to May 2011. This was a smaller year-over-year decline for both indexes than in April, and the smallest year-over-year decline since 2010 (when the tax credit boosted prices temporarily).

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in April seasonally adjusted (all 20 cities increased NSA). Prices in Las Vegas are off 60.4% from the peak, and prices in Dallas only off 5.8% from the peak. Note that the red column (cumulative decline through May 2012) is above previous declines for most cities.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in April seasonally adjusted (all 20 cities increased NSA). Prices in Las Vegas are off 60.4% from the peak, and prices in Dallas only off 5.8% from the peak. Note that the red column (cumulative decline through May 2012) is above previous declines for most cities.This was better than the consensus forecast and it is now possible that prices will turn positive year-over-year in June. I'll have more on prices later.

Personal Income increased 0.5% in June, Spending decreased slightly

by Calculated Risk on 7/31/2012 08:30:00 AM

The BEA released the Personal Income and Outlays report for June:

Personal income increased $61.8 billion, or 0.5 percent ... in June, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $1.3 billion, or less than 0.1 percent.The following graph shows real Personal Consumption Expenditures (PCE) through June (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.1 percent in June, in contrast to an increase of 0.1 percent in May. ... PCE price index -- The price index for PCE increased 0.1 percent in June, in contrast to a decrease of 0.2 percent in May. The PCE price index, excluding food and energy, increased 0.2 percent, compared with an increase of 0.1 percent.

...

Personal saving -- DPI less personal outlays -- was $529.5 billion in June, compared with $472.4 billion in May. The personal saving rate -- personal saving as a percentage of DPI -- was 4.4 percent in June, compared with 4.0 percent in May.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE.

A key point is the PCE price index has only increased 1.5% over the last year, and core PCE is up 1.8%.

Monday, July 30, 2012

FHFA Nears Decision on Debt Forgiveness, and Tuesday: Case-Shiller House Prices

by Calculated Risk on 7/30/2012 09:29:00 PM

From Nick Timiraos at the WSJ: Data Show Fannie, Freddie Savings From Debt Forgiveness

As the regulator for Fannie Mae and Freddie Mac nears its decision on whether to approve debt forgiveness for troubled borrowers, a new analysis by the regulator suggests that taxpayers could actually benefit from the move...FHFA acting director Edward DeMarco focused on this last point in his speech in April:

In April, the agency said that loan forgiveness would save about $1.7 billion for the companies, relative to other types of relief. At the time, the agency said that because the Treasury was paying to subsidize those write-downs, the relief would still cost taxpayers $2.1 billion, offsetting any savings to the companies.

But the latest analysis done by the agency found that such write-downs would generate $3.6 billion in savings for the companies, under certain assumptions, according to people familiar with the analysis. Even after subtracting the cost of the Treasury subsidies, the program would save $1 billion, these people said. As many as 500,000 borrowers could be eligible, these people said.

...

The FHFA has raised other concerns beyond the cost of such write-downs. Chief among them is the fear that more borrowers, upon hearing that Fannie and Freddie are instituting a debt-forgiveness program, might default to seek more generous terms.

One factor that needs to be considered is the borrower incentive effects. That means, will some percentage of borrowers who are current on their loans, be encouraged to either claim a hardship or actually go delinquent to capture the benefits of principal forgiveness?The FHFA might decide that the risk from "strategic modifiers" outweighs the possible savings.

...

It is difficult to model these borrower incentive effects with any precision. What we can do is give a sense of how many current borrowers would have to become “strategic modifiers” for the NPV economic benefit provided by the HAMP triple PRA incentives to be eliminated. In this context, a “strategic modifier” would be a borrower that either claims a financial hardship or misses two consecutive mortgage payments in order to attempt to qualify for HAMP and a principal forgiveness modification.

Also from Nick Timiraos at the WSJ Are Home Prices Rising? A Price-Index Primer

On Tuesday:

• At 8:30 AM ET, the Personal Income and Outlays report for June will be released by the BEA. The consensus is for a 0.2% increase in personal income in June, and for 0.1% increase in personal spending, and for the Core PCE price index to increase 0.2%.

• At 9:00 AM, S&P/Case-Shiller House Price Index for May is scheduled to be released. The consensus is for a 1.4% decrease year-over-year in Composite 20 prices (NSA) in May. The Zillow forecast is for the Composite 20 to decline 1.0% year-over-year, and for prices to increase 0.8% month-to-month seasonally adjusted.

• At 9:45 AM: Chicago Purchasing Managers Index for July will be released. The consensus is for a decrease to 52.5, down from 52.9 in June.

• Also at 10:00 AM, the Conference Board's consumer confidence index for July. The consensus is for a decrease to 61.5 from 62.0 last month.

And the final question for the July economic contest:

More FOMC Preview

by Calculated Risk on 7/30/2012 08:09:00 PM

Most of this article is about the ECB and there isn't anything new on the Fed, from Jon Hilsenrath and Brian Blackstone at the WSJ: Heat Rises on Central Banks

The two-day Federal Open Market Committee meeting convenes Tuesday, following signs that Fed officials have become more willing to act to address disappointingly slow U.S. economic growth.From Goldman Sachs analysts today:

...

The Fed could unveil a new program for buying mortgage or government securities to bring down long-term interest rates, or take other actions to spur growth, or simply promise to do more later if necessary. Officials might wait until September, when they will formally update their economic forecasts, before deciding anything significant.

Although a new Fed asset purchase program is a possibility in the near term if the data continue to disappoint, our central expectation is for a return to QE in December or early 2013.

...

We expect an extension of the current “exceptionally low…at least through late 2014” interest rate guidance to "mid 2015." Such a shift would roughly restore the forward guidance to the same three-year horizon as at the January FOMC meeting, when the "late 2014" formulation was first adopted. We would, however, regard this rate extension as a relatively modest step.

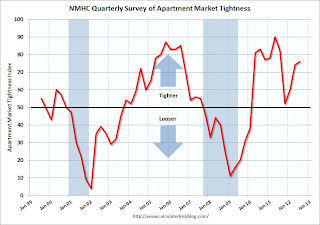

NMHC Apartment Survey: Market Conditions Tighten in Q2 2012

by Calculated Risk on 7/30/2012 04:51:00 PM

From the National Multi Housing Council (NMHC): Apartment Market Hot Streak Continues

For the sixth quarter in a row, the apartment industry improved across all indexes in the National Multi Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions. The survey’s indexes measuring Market Tightness (76), Sales Volume (54), Equity Financing (58) and Debt Financing (77) all measured at 50 or higher, indicating growth from the previous quarter.

“The apartment sector’s strength continues unabated,” said NMHC Chief Economist Mark Obrinsky. “Even as new construction ramps up, higher demand for apartment residences still outstrips new supply with no letup in sight. Despite the need for new apartments, acquisition and construction finance remains constrained in all but the best properties in the top markets.”

...

Majority report increased market tightness. The Market Tightness Index edged up to 76 from 74. For the first time in a year, more than half (55 percent) of respondents said that markets were tighter. By contrast, only 2 percent reported the markets as loosening and 43 percent reported no change over the past three months.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. The index has indicated tighter market conditions for the last ten quarters and suggests falling vacancy rates and or rising rents.

This fits with the recent Reis data showing apartment vacancy rates fell in Q2 2012 to 4.7%, down from 4.9% in Q1 2012, and down from 9.0% at the end of 2009. This was the lowest vacancy rate in the Reis survey in over 10 years.

This survey indicates demand for apartments is still strong. And even though multifamily starts have been increasing, completions lag starts by about a year - so the builders are still trying to catch up. There will be more completions in 2012 than in 2011, but it looks like another strong year for the apartment industry.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010 - and will probably be useful in indicating when the vacancy rate will stop falling.

Lawler on Manufactured Housing

by Calculated Risk on 7/30/2012 01:47:00 PM

From Tom Lawler:

The Commerce Department estimated that manufactured housing shipments ran at a seasonally adjusted annual rate of 54,000 in June, down from 56,000 in May. In the first five months of 2012 manufactured housing shipments ran at a SAAR of 57,000, up from 51,600 in 2011 but just a fraction of the pace prior to last decade’s collapse.

The Commerce Department also estimated that manufactured housing placements ran at a SAAR of 47,000 in May, down from 51,000 in April. In the first five months of 2012 manufactured housing shipments ran at a SAAR of 52,200, up from 47,000 in 2011.

| Manufactured Housing Shipments (Annual Average, 000's) | |

|---|---|

| 1961-1970 | 255.6 |

| 1971-1980 | 348.5 |

| 1981-1990 | 243.7 |

| 1991-2000 | 296.8 |

| 2001-2006 | 154 |

| 2006-2010 | 78.9 |

| 2011 | 51.6 |

| 2012YTD | 57 |

Click on graph for larger image.

Click on graph for larger image.Here is a graph from Lawler showing the annual manufactured housing shipments since 1959. The column for 2012 is the annual sales rate for the first six months of the year.

Although sales are running at about a 10% increase over last year, shipments in 2012 will still be the fourth lowest on record behind only 2009, 2010, and 2011.

Dallas Fed: "Slower Growth" in July Regional Manufacturing Activity

by Calculated Risk on 7/30/2012 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Posts Slower Growth Amid Weaker View of General Business Activity

Texas factory activity continued to increase in July, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 15.5 to 12, suggesting slightly slower output growth.This was below expectations of a 2.5 reading for the general business activity index.

The new orders index was positive for the second month in a row, although it moved down from 7.9 to 1.4. Similarly, the shipments index posted its second consecutive positive reading but edged down from 9.6 to 7.4. ... The general business activity plummeted to -13.2 after climbing into positive territory in June. Nearly 30 percent of manufacturers noted a worsening in the level of business activity in July, pushing the index to its lowest reading in 10 months.

...

Labor market indicators reflected stronger labor demand. Employment growth continued in July, although the index edged down from 13.7 to 11.8. ... The hours worked index was 4.1, up slightly from its June reading.

The regional manufacturing surveys were mostly weak in July. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through July), and five Fed surveys are averaged (blue, through July) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).

The ISM index for July will be released Wednesday, August 1st, and these surveys suggest another weak reading. The consensus is for an increase to 50.1, up from 49.7 in June. (below 50 is contraction).