by Calculated Risk on 8/11/2012 08:32:00 PM

Saturday, August 11, 2012

Update: Real GDP Percent Change Graph, 1980-Q2 2012

Earlier:

• Summary for Week Ending Aug 10th

• Schedule for Week of Aug 12th

When the Q2 GDP report was released, I focused on the revisions and didn't post the usual graph showing the real GDP change since 1980. By request, here is an update.

The graph shows the annualized real quarterly change in GDP from 1980 through Q2 2012.

Click on graph for larger image.

For Q2, the BEA's advance estimate was 1.5%. Since Q3 2009, GDP has been positive every quarter and averaged about 2.2% real growth.

Another way to look at GDP is on a rolling year-over-year basis. See Tim Duy's graphs at US Baseline

Note: I've also update several graphs in the GDP graph gallery. See: GDP Graphs

Unofficial Problem Bank list increases to 900 Institutions

by Calculated Risk on 8/11/2012 06:09:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 10, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Activity by the Federal Reserve was responsible for most of the changes to the Unofficial Problem Bank List this week. The list pushed back up to 900 institutions but assets dropped by $780 million to $348.6 billion after three additions and two removals. A year ago, the list held 988 institutions with assets of $411.3 billion.Earlier:

The Federal Reserve terminated actions against LegacyTexas Bank, Plano, TX ($1.6 billion) and Coastal Community Bank, Everett, WA ($311 million). The additions were Beacon Federal, East Syracuse, NY ($1.0 billion Ticker: BFED); Asian Bank, Philadelphia, PA ($71 million); and The State Bank of Blue Mound, Blue Mound, IL ($37 million). The Federal Reserve issued a Prompt Corrective Action order against Gold Canyon Bank, Gold Canyon, AZ ($60 million).

Other news to report is the bankruptcy filing by Capitol Bancorp LTD (See Form 8-K) on August 9th. Back in the middle part of last decade, Capitol Bancorp owned/controlled more than 50 banks. After divestitures in an effort to prevent the collapse of the company, Capitol Bancorp is down to owning/controlling 15 banks, with 11 on the Unofficial Problem Bank List. The FDIC has issued cross-guaranty waivers in conjunction with several of the divestitures. This will bear watching to see if the bankruptcy filing results in any closings of the banks that Capitol Bancorp owns/controls.

• Summary for Week Ending Aug 10th

• Schedule for Week of Aug 12th

Schedule for Week of August 12th

by Calculated Risk on 8/11/2012 01:05:00 PM

Earlier:

• Summary for Week Ending Aug 10th

This will be a very busy week for economic data. There are two key housing reports to be released this week: August homebuilder confidence on Wednesday, and July housing starts on Thursday.

Another key report is retail sales for July. For manufacturing, the August NY Fed (Empire state) and Philly Fed surveys, and the July Industrial Production and Capacity Utilization report will be released this week.

On prices, PPI for July will be released on Tuesday, and CPI will be released on Wednesday.

No releases scheduled.

7:30 AM ET: NFIB Small Business Optimism Index for July. The consensus is for a decrease to 91.3 in July from 91.4 in June.

8:30 AM: Producer Price Index for July. The consensus is for a 0.2% increase in producer prices (0.2% increase in core).

8:30 AM ET: Retail Sales for July.

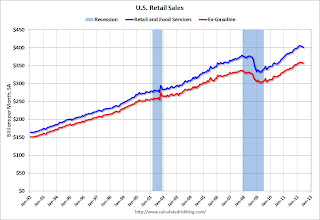

8:30 AM ET: Retail Sales for July. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 21.2% from the bottom, and now 6.0% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.3% in July, and for retail sales ex-autos to increase 0.4%.

10:00 AM: Manufacturing and Trade: Inventories and Sales for June (Business inventories). The consensus is for 0.2% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:30 AM: Consumer Price Index for July. The consensus is for CPI to increase 0.2% in July and for core CPI to increase 0.2%.

8:30 AM: NY Fed Empire Manufacturing Survey for August. The consensus is for a reading of 7.0, down from 7.4 in July (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.This shows industrial production since 1967.

The consensus is for Industrial Production to increase 0.5% in July, and for Capacity Utilization to increase to 79.2%.

10:00 AM: The August NAHB homebuilder survey. The consensus is for a reading of 35, unchanged from 35 in July. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for July.

8:30 AM: Housing Starts for July. Total housing starts were at 760 thousand (SAAR) in June, up 6.9% from the revised May rate of 711 thousand (SAAR).

The consensus is for total housing starts to decrease to 750,000 (SAAR) in July, down from 760,000 in June.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand from 361 thousand.

10:00 AM: Philly Fed Survey for August. The consensus is for a reading of -5.0, up from -12.9 last month (above zero indicates expansion).

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for August). The consensus is for sentiment to decrease slightly to 72.0 from 72.3 in July.

10:00 AM: Conference Board Leading Indicators for August. The consensus is for a 0.2% increase in this index.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for July 2012

Summary for Week ending Aug 10th

by Calculated Risk on 8/11/2012 08:01:00 AM

Note: For amusement, here are the original Ryan plan projections. Enjoy. Note: I know numbers, and these are hilarious (look at the unemployment rate and residential investment). I saved these immediately after they were released because I expected them to be changed or deleted. They quickly disappeared.

The few economic releases this week were mostly a little more upbeat than we’ve seen recently.

The trade deficit declined in June as exports increased and oil prices declined. Also - so far - there is little evidence of the Eurozone problems significantly impacting US exports to the euro area. Another positive was the decline in initial weekly unemployment claims. The 4-week average of unemployment claims is near the low for the year, and might signal a little improvement in the labor market.

For housing, CoreLogic reported a 2.5% year-over-year increase in house prices, and both Fannie and Freddie credit the increase in house prices for their improved results. The slight increase in house prices, along with the ongoing, albeit sluggish recovery in housing is having a positive impact on the economy.

Here is the summary from Jan Hatzius, chief economist at Goldman Sachs:

“We expect a moderate pickup in US growth from the dreary 1%-1½% pace of the past few months. The data released this week, while sparse, were consistent with our view. Jobless claims logged a surprise decline, which looks potentially meaningful now that the seasonal adjustment distortions related to the summer auto shutdowns are behind us. The June wholesale inventory report showed much less accumulation than expected, which explains some of the recent weakness in the goods-producing sector and should be positive for the near-term production outlook. Combined with a narrowing of the June trade deficit, this boosted our Q3 GDP estimate to 2.2%, compared with 2.0% at the start of the week."Here is a summary of last week in graphs:

• Trade Deficit declined in June to $42.9 Billion

Click on graph for larger image.

Click on graph for larger image.The Department of Commerce reported:

"[T]otal June exports of $185.0 billion and imports of $227.9 billion resulted in a goods and services deficit of $42.9 billion, down from $48.0 billion in May, revised. June exports were $1.7 billion more than May exports of $183.3 billion. June imports were $3.5 billion less than May imports of $231.4 billion."

The second graph shows the U.S. trade deficit, with and without petroleum, through June.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $100.13 in June, down from $107.91 per barrel in May. The decline in oil prices contributed to the overall decline in the trade deficit. The trade deficit with China increased to $27.4 billion in June, up from $26.6 billion in June 2011. Once again most of the trade deficit is due to oil and China.

Exports to the euro area were $17.4 billion in June, up from $16.4 billion in June 2011; so the euro area recession didn't lead to less US exports to the euro area in June.

• MBA: Mortgage Delinquencies increased in Q2

The MBA reported that 11.85 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q2 2012 (delinquencies seasonally adjusted). This is up slightly from 11.79 percent in Q1 2012. This graph shows the percent of loans delinquent by days past due.

The MBA reported that 11.85 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q2 2012 (delinquencies seasonally adjusted). This is up slightly from 11.79 percent in Q1 2012. This graph shows the percent of loans delinquent by days past due.Loans 30 days delinquent increased to 3.18% from 3.13% in Q1. This is at about 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket increased to 1.22% in Q2, from 1.21% in Q1.

The 90 day bucket increased to 3.19% from 3.06%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 4.27% from 4.39% and is now at the lowest level since Q1 2010.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.The top states are Florida (13.70% in foreclosure down from 14.31% in Q1), New Jersey (7.65% down from 8.37%), Illinois (7.11% down from 7.46%), New York (6.47% up from 6.17%) and Nevada (the only non-judicial state in the top 13 at 6.09% down from 6.47%).

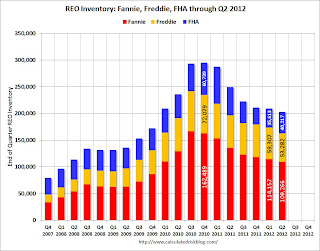

• Fannie, Freddie, FHA REO declined 18% Year-over-year

The combined Real Estate Owned (REO) by Fannie, Freddie and the FHA declined to 202,765 at the end of Q2 2012, down from 209,077 in Q1, and down 18% from 249,501 in Q2 2012. The peak for the combined REO of the F's was 295,307 in Q4 2010.

The combined Real Estate Owned (REO) by Fannie, Freddie and the FHA declined to 202,765 at the end of Q2 2012, down from 209,077 in Q1, and down 18% from 249,501 in Q2 2012. The peak for the combined REO of the F's was 295,307 in Q4 2010.This graph shows the REO inventory for Fannie, Freddie and the FHA.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions, VA and more. REO has been declining for those categories too. Most analysts expect an increase in foreclosures, and the number of REO might increase over the next several quarters.

• BLS: Job Openings increased in June

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. Jobs openings increased in June to 3.762 million, up from 3.657 million in May. The number of job openings (yellow) has generally been trending up, and openings are up about 16% year-over-year compared to June 2011. This is the most job openings since mid-2008.

Quits decreased slightly in June, however quits are up about 9.5% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

• CoreLogic: House Price Index increases in June, Up 2.5% Year-over-year

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.The index was up 1.3% in May, and is up 2.5% over the last year.

The index is off 29% from the peak - and is up 7% from the post-bubble low set in February (the index is NSA, so some of the increase is seasonal).

The second graph is from CoreLogic. The year-over-year comparison has turned positive.

The second graph is from CoreLogic. The year-over-year comparison has turned positive.This is the fourth consecutive month with a year-over-year increase, and excluding the tax credit bump, these are the first year-over-year increases since 2006.

“Home prices are responding positively to reductions in both visible and shadow inventory over the past year,” said Mark Fleming, chief economist for CoreLogic. “This trend is a bright spot because the decline in shadow inventory translates to fewer distressed sales, which helps sustain price appreciation.”

• Weekly Initial Unemployment Claims decline to 361,000

The DOL reports:"In the week ending August 4, the advance figure for seasonally adjusted initial claims was 361,000, a decrease of 6,000 from the previous week's revised figure of 367,000. The 4-week moving average was 368,250, an increase of 2,250 from the previous week's revised average of 366,000."

The DOL reports:"In the week ending August 4, the advance figure for seasonally adjusted initial claims was 361,000, a decrease of 6,000 from the previous week's revised figure of 367,000. The 4-week moving average was 368,250, an increase of 2,250 from the previous week's revised average of 366,000."The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 368,250.

This was below the consensus forecast of 367,000 and is near the lowest level for the four week average this year.

• Other Economic Stories ...

• Fed: Some domestic banks "eased lending standards", seeing "stronger demand"

• Housing: Inventory down 23% year-over-year in early August

• The economic impact of a slight increase in house prices

• Trulia: Asking House Prices increased in July

• Freddie Mac: Increase in Home Prices contributes to Lower Credit Losses

• Fannie Mae reports $5.1 Billion Net Income, Improvement due to increase in house prices, REO sales prices

Friday, August 10, 2012

WSJ: More Pain for Cities

by Calculated Risk on 8/10/2012 09:20:00 PM

From the WSJ: Rising Health, Pension Costs Top the List as Municipalities Struggle to Recover From the Recession

Fiscal woes that have caused high-profile bankruptcies in California are surfacing across the country as municipalities struggle with uneven growth and escalating health and pension costs ...These state and local layoffs have been a significant drag on employment. I still think the layoffs will slow, but clearly many of these cities still have severe budget shortfalls.

Moody's Investors Service recently said that while municipal bankruptcies are likely to remain rare, it warned of a "a small but growing trend in fiscally troubled cities unwilling to pay their debt obligations."

...

Local government cuts are one factor slowing the broader economic recovery, offsetting stronger private-sector growth. State and local government spending and investment fell at a rate of 2.1% in the second quarter, according to the Commerce Department, the 11th consecutive quarterly drop. Local governments also have cut 66,000 jobs in the past year, mostly teachers and other school employees.

Comparing Housing Recoveries

by Calculated Risk on 8/10/2012 03:22:00 PM

In the previous post, I noted that I think the housing recovery will continue to be sluggish relative to previous housing recoveries. There are several reasons for this.

First, the causes of this downturn were different than in most cycles. Usually housing down cycles are related to the Fed fighting inflation, and then housing comes back strongly when the Fed starts to ease again. But in this cycle, the housing downturn was the result of the bursting of the housing bubble and the financial crisis.

As everyone now knows (or should know by now), recoveries following a financial crisis are sluggish. This is especially true for housing as all the excesses have to be worked down before the recovery will become robust. In some areas of the country, housing is starting to recover, and in other areas there are still a large number of excess vacant houses (although the number is being reduced just about everywhere).

There are also a large number of houses in the foreclosure process, especially in certain states with a judicial foreclosure process (like New Jersey). This means there will be competition for homebuilders from foreclosures for an extended period in these areas.

Contrast this to a typical recovery were most areas recover at the same time.

There are other factors too. Employment gains are sluggish following a financial crisis, there is still quite a bit of consumer deleveraging ongoing, and lending standards are still tight (in a typical recovery, lending standards are loosened pretty quickly).

For a great piece today on mortgage lending standards, see from Cardiff Garcia at FT Alphaville: Still waiting on looser lending standards (for mortgages)

Click on graph for larger image.

Click on graph for larger image.

This graph compares the current housing recovery (single family starts) to previous recoveries. The bottom is set to 100 for each housing cycle.

Note: This doesn't even consider the depth of the current cycle (the deepest decline in housing starts since the Census Bureau started collecting data).

The only comparable sluggish recovery (first year) was the one that started in 1981, and that was sluggish because mortgage rates were around 17%. When mortgage rates fell to only 13%, housing took off.

With excess inventory, more foreclosures (especially in certain states), more consumer deleveraging, and tight lending standards, I expect this recovery to remains sluggish. The good news is - barring a significant policy mistake - this housing recovery will probably continue for several years (last for more years than usual).

The Housing Bottom and the Unemployment Rate

by Calculated Risk on 8/10/2012 11:55:00 AM

Early this year when I wrote The Housing Bottom is Here and Housing: The Two Bottoms, I pointed out there are usually two bottoms for housing: the first for new home sales, housing starts and residential investment, and the second bottom is for house prices.

For the bottom in activity, I presented a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

When I posted that graph, the bottom wasn't obvious to everyone. Now it should be, so here is an update to that graph.

Click on graph for larger image.

Click on graph for larger image.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

For the current housing bust, the bottom was spread over a few years from 2009 into 2011. This was a long flat bottom - something a number of us predicted given the overhang of existing vacant housing units.

Now the question is: How strong will the recovery be? (I think it will be somewhat sluggish compared to previous recoveries).

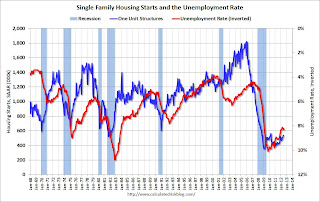

Housing plays a key role for employment too. Here is an update to a graph I've been posting for a few years. This graph shows single family housing starts (through June) and the unemployment rate (inverted) also through July. Note: there are many other factors impacting unemployment, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) increased a little in 2009 with the homebuyer tax credit - and then declined again - but mostly starts moved sideways for two and a half years and only started increasing last year. This was one of the reasons the unemployment rate has remained elevated.

Usually near the end of a recession, residential investment (RI) picks up as the Fed lowers interest rates. This leads to job creation and also additional household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover.

However, following the recent recession with the huge overhang of existing housing units, this key sector didn't participate. Going forward I expect housing activity to increase and help push down the unemployment rate. Unfortunately I expect the housing recovery to be somewhat sluggish.

Import Price declined 0.6 percent in July

by Calculated Risk on 8/10/2012 09:13:00 AM

I rarely mention import prices, but this suggests less price pressure ... from the BLS: U.S. Import and Export Price Indexes - July 2012

U.S. import prices declined 0.6 percent in July, the U.S. Bureau of Labor Statistics reported today, after decreasing 2.4 percent in June and 1.5 percent in May. In each of the past three months, falling prices for both fuel and nonfuel imports contributed to the overall drop. In contrast, U.S. export prices rose 0.5 percent in July following a 1.7 percent decline the previous month. ... Prices of U.S. imports fell 0.6 percent in July, the fourth consecutive monthly decline for the index following a 1.4 percent increase in March. Import prices also fell over the past 12 months, declining 3.2 percent after increasing 13.7 percent between July 2010 and July 2011. ... The price index for import fuel decreased 1.2 percent in July following declines of 8.8 percent, 5.6 percent, and 0.9 percent, respectively, in the previous three months.It wasn't just energy. On non-fuel prices:

Nonfuel prices also fell in July, declining 0.4 percent following a 0.3 percent decrease in June and a 0.1 percent drop in May. The July decline was the largest monthly drop since a 0.4 percent decrease in June 2010, and was driven by lower prices for nonfuel industrial supplies and materials and foods, feeds, and beverages. Despite the decline over the past three months, nonfuel import prices were unchanged for the year ended in July ...There will be more on prices next week with the PPI for July released on Tuesday and the CPI on Wednesday.

Thursday, August 09, 2012

NAHB: Builder Confidence in the 55+ Housing Market Increases in Q2

by Calculated Risk on 8/09/2012 09:24:00 PM

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008, so all readings are very low. This is expected to be key a demographic over the next couple of decades - if the baby boomers can sell their current homes.

From the NAHB: Builder Confidence in the 55+ Housing Market Shows Improvement in the Second Quarter

Builder confidence in the 55+ housing market for single-family homes showed improvement in the second quarter of 2012 compared to the same period a year ago, according to the National Association of Home Builders’ (NAHB) latest 55+ Housing Market Index (HMI) released today. The index more than doubled year over year from a level of 13 to 29, which is the highest second-quarter reading since the inception of the index in 2008.

The 55+ single-family HMI measures builder sentiment based on a survey that asks if current sales, prospective buyer traffic and anticipated six-month sales for that market are good, fair or poor (high, average or low for traffic). An index number below 50 indicates that more builders view conditions as poor than good. Although all index components remain below 50, they increased considerably from a year ago: Present sales more than doubled (from 12 to 30), while expected sales for the next six months increased 17 points to 35 and traffic of prospective buyers rose nine points to 22.

...

“We are seeing buyers slowly return to the 55+ housing market as home prices begin to improve” said NAHB Chief Economist David Crowe. “This helps unlock some of the pent-up demand from 55+ consumers who have been sitting on the sidelines until they are able to sell their current homes at a reasonable price.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q2 2012. All of the readings are very low for this index, but there has been a fairly sharp increase over the last three quarters.

LPS: Mortgage Delinquencies increased slightly in June, HARP refinance activity increased

by Calculated Risk on 8/09/2012 04:15:00 PM

LPS released their Mortgage Monitor report for June today. According to LPS, 7.14% of mortgages were delinquent in June, up from 6.91% in May, and down from 7.71%% in June 2011.

LPS reports that 4.09% of mortgages were in the foreclosure process, down slightly from 4.17% in May, and down slightly from 4.13% in June 2011.

This gives a total of 11.23% delinquent or in foreclosure. It breaks down as:

• 2,012,000 loans less than 90 days delinquent.

• 1,590,000 loans 90+ days delinquent.

• 2,061,000 loans in foreclosure process.

For a total of 5,663,000 loans delinquent or in foreclosure in June. This is down from 6,114,000 in June 2011.

This following graph shows the total delinquent and in-foreclosure rates since 1995.

Click on graph for larger image.

Click on graph for larger image.

The total delinquency rate has fallen to 7.14% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

The in-foreclosure rate was at 4.09%. There are still a large number of loans in this category (about 2.06 million).

The second graph shows percent of loans in the foreclosure process by process (Judicial vs. non-judicial).

The second graph shows percent of loans in the foreclosure process by process (Judicial vs. non-judicial).

Foreclosure inventory in judicial states is 6.42%, far above the level in non-judicial states (2.41%). The national average is 4.09%. A key change is that foreclosure inventory is now declining in judicial states too. Foreclosure inventory in non-judicial states has been falling since late 2010.

The third graph shows GSE prepayment speed by current LTV.

From LPS:

From LPS:

The June Mortgage Monitor report ... shows that while overall mortgage prepayment activity remains stable, despite historically low rates, the federal government’s Home Affordable Refinance Program (HARP) has seen considerable activity since the beginning of 2012.

“For this month’s Mortgage Monitor, we looked at Fannie Mae and Freddie Mac [GSE] 30-year fixed-rate loans across a variety of loan-to-value ratios,” explained Herb Blecher, senior vice president, LPS Applied Analytics. “Since the beginning of this year, high loan-to-value refinances have increased significantly. As an example, 2006 vintage GSE loans with six percent interest rates and LTV ratios between 100 and 125 percent increased from a 10 percent annualized prepayment rate at the end of 2011 to more than 40 percent in June 2012. Our data also shows that this rise in loan activity extends beyond that subsection – the same type of increase holds true across other vintages with the same characteristics.”