by Calculated Risk on 8/14/2012 12:25:00 PM

Tuesday, August 14, 2012

House Prices and a Foreclosure Supply Shock

Those making the argument for further house price declines usually start with “shadow inventory”. Although there is no formal definition of “shadow inventory” it usually includes 1) some properties with homeowners who are current on their mortgages, but have negative equity in their homes, and 2) properties not listed for sale, but where the homeowner is seriously delinquent on their mortgage or already in the foreclosure process.

This can lead to some pretty scary numbers being bandied about. As an example, CoreLogic recently reported that “11.4 million, or 23.7 percent, of all residential properties with a mortgage were in negative equity at the end of the first quarter of 2012”. And LPS reported 1.6 million loans were 90+ days delinquent at the end of June, and another 2.1 million are in the foreclosure process.

These numbers suggest a coming “flood” of foreclosures to those arguing house prices will fall further. I think this is incorrect.

If we look at negative equity, it is a serious issue for many homeowners, but it seems unlikely they will default en masse. Recent homebuyers who have negative equity are probably less than 10% underwater. And homeowners with significant negative equity probably bought in the 2004 through 2006 period; and they’ve been paying their mortgage for 6 to 8 years – so it is unlikely they will just default without some unfortunate event (divorce, death, disease).

Probably the biggest impact on the housing market is that people with negative equity can’t sell, and this restricts supply (the opposite of the “shadow inventory” argument). For more on this, see: Zillow chief economist Stan Humphries has been discussing this: The Connection Between Negative Equity, Inventory Shortage and Increasing Home Values: Why the Bottom Won’t Be as Boring as We Expected

And I expect with the recent increase in house prices that the number of reported homeowners with negative equity will be down sharply in Q2. The HARP refinance program will help too.

A more immediate concern is the 3.7 million homeowners currently 90+ days delinquent or in the foreclosure process. Many of these properties will eventually be a distressed sale, either a foreclosure or short sale, although some will receive loan modifications. It is important to remember that some of these homes are already listed for sale (so they are included in the “visible inventory”), and there has been a significant shift by lenders from foreclosures to short sales (short sales have less of an impact on prices than foreclosures).

But here is the key: Although forecasting house prices is very complex, we can make some simplifying assumptions and think in terms of supply and demand with foreclosures being a supply shock (increased supply). It is important to remember that national prices are an aggregate of many local prices (although there are national impacts, housing markets are local). And housing prices are more complex than say commodity prices (as an example, house prices tend to be stick downwards).

Imagine a multi-year supply shock with a bell curve shape. The supply shock shifts the supply curve to the right relative to the height of the bell curve. Prices will bottom when the supply shock is at the peak, NOT when the supply shock is over.

The supply shock from foreclosures probably peaked in late 2008, with a second smaller peak in 2010. Prices didn’t bottom in 2008 because 1) prices are sticky downwards (so the bottom happens after the peak of the supply shock) and 2) fundamentals such as price-to-income and price-to-rent were still out of line.

Now fundamentals are close to normal, and any supply shock will probably be smaller than the 2008 or 2010 peaks. And this analysis assumed demand was stable. Actually there was a demand shock too (less demand) due to tighter lending, and buyer psychology (potential buyers were afraid that prices would fall further). There were few investors in 2008 when the supply shock hit – just a few individual and small group investors buying REOs. Now there are large well capitalized groups looking to buy. Of course lending standards are still tight, but as the recent Senior Loan Officer showed, demand is picking up.

The bottom line is house prices have probably bottomed, and the concern about more distressed sales coming is real – but will probably not push house prices to new post-bubble lows.

Note: For reference, back in April 2005 I argued that prices were way out of line and that speculation was the key, and that speculation could be modeled as storage, see: Housing: Speculation is the Key

Retail Sales increased 0.8% in July

by Calculated Risk on 8/14/2012 08:30:00 AM

On a monthly basis, retail sales were up 0.8% from June to July (seasonally adjusted), and sales were up 4.1% from July 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for July, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $403.9 billion, an increase of 0.8 percent from the previous month and 4.1 percent above July 2011. ... The May to June 2012 percent change was revised from -0.5 percent to -0.7%.Ex-autos, retail sales increased 0.8% in July.

Click on graph for larger image.

Click on graph for larger image.Sales for June were revised down to a 0.7% decrease (from 0.5% decrease).

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 21.9% from the bottom, and now 6.6% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data, but just since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 19.1% from the bottom, and now 7.0% above the pre-recession peak (not inflation adjusted).

The second graph shows the same data, but just since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 19.1% from the bottom, and now 7.0% above the pre-recession peak (not inflation adjusted).The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.0% on a YoY basis (4.1% for all retail sales). Retail sales ex-gasoline increased 0.8% in July.

This was above the consensus forecast for retail sales of a 0.3% increase in July, and above (edit) the consensus for a 0.4% increase ex-auto.

This was above the consensus forecast for retail sales of a 0.3% increase in July, and above (edit) the consensus for a 0.4% increase ex-auto. This mostly just reversed the sharp decline in June.

NFIB: Small Business Optimism Index declines in July

by Calculated Risk on 8/14/2012 07:54:00 AM

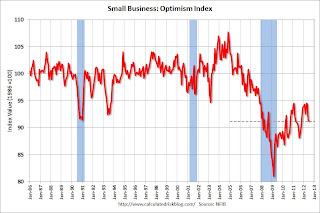

From the National Federation of Independent Business (NFIB): Small-Business Optimism Continues to Decline in July

Dipping for a second consecutive month, after ending several months of slow growth, the Small Business Optimism Index gave up 0.2 points, falling to 91.2. ... The Index has oscillated between 86.5 (July 2009) and 94.5 (February 2012) since the recession officially ended in June 2009. Prior to 2008, the Index averaged 100, well above the current reading.Note: These survey results are based on a small sample and the commentary is getting more and more political (calling the 2000s the "best economy in history" is absurd), so I'm going to discontinue posting this survey.

...

While "poor sales" has been eclipsed by other concerns as the top business problem, it still remains the No.1 issue for 20 percent of owners surveyed (down from 23 percent).

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index decreased to 91.2 in July from 91.4 in June.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy. This index remains low, and once again, lack of demand is a huge problem for small businesses.

Monday, August 13, 2012

Tuesday: July Retail Sales, PPI

by Calculated Risk on 8/13/2012 08:26:00 PM

Retail sales were down 0.5% in June, and that led some forecasters to argue that the US economy was contracting. My view is the economy is still growing sluggishly. For July, expectations are for an increase in retail sales. Here are the economic releases scheduled for Tuesday:

• On Tuesday, at 7:30 AM ET, the NFIB Small Business Optimism Index for July will be released. The consensus is for a decrease to 91.3 in July from 91.4 in June.

• At 8:30 AM, the Census Bureau will release Retail Sales for July. The consensus is for retail sales to increase 0.3% in July, and for retail sales ex-autos to increase 0.4%.

• Also at 8:30 AM, the Producer Price Index for July will be released. The consensus is for a 0.2% increase in producer prices (0.2% increase in core).

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales report for June (Business inventories) will be released. The consensus is for 0.2% increase in inventories.

For the August economic prediction contest:

Sacramento: Percentage of REOs lowest in years in July

by Calculated Risk on 8/13/2012 04:31:00 PM

I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

So far there has been a shift from REO to short sales, and the percentage of distressed sales has been declining year-over-year. This data would suggest some improvement although there are still more distressed sales to come.

In July 2012, 54.4% of all resales (single family homes and condos) were distressed sales. This was up slightly from 54.2% last month, and down from 61.3% in July 2011. The percentage of REOs fell to 22.4%, the lowest since the Sacramento Realtors started tracking the data and the percentage of short sales increased to 32.0%, the highest percentage recorded.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales. There is a seasonal pattern for conventional sales (stronger in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer and the increases in the fall and winter.

There has been an increase in conventional sales this year, and there were more short sales than REO sales in July for the fourth consecutive month. And the gap between short sales and REO sales is increasing.

Total sales were up 4.7% compared to June 2011, and conventional sales were up 23% year-over-year. Active Listing Inventory for single family homes declined 64.2% from last July and listings were down another 6.9% in July (from June).

Cash buyers accounted for 31.1% of all sales (frequently investors), and median prices were up 0.6% from last July.

This seems to be moving in the right direction, although the market is still in distress.

We are seeing a similar pattern in other distressed areas to more conventional sales, and a shift from REO to short sales,.

Serious Mortgage Delinquencies and In-Foreclosure by State

by Calculated Risk on 8/13/2012 01:24:00 PM

Last week the MBA released the results of their Q2 National Delinquency Survey. One of the key points was the difference in the number of mortgage in the foreclosure process between judicial and non-judicial foreclosure states.

The first graph below (repeat) is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

The second graph shows all stages of delinquency (and in-foreclosure) by states, sorted by the percent seriously delinquent (90+ days plus in-foreclosure).

The top states are Florida (13.70% in foreclosure down from 14.31% in Q1), New Jersey (7.65% down from 8.37%), Illinois (7.11% down from 7.46%), New York (6.47% up from 6.17%) and Nevada (the only non-judicial state in the top 13 at 6.09% down from 6.47%).

As Jay Brinkmann noted, California (3.07% down from 3.29%) and Arizona (3.24% down from 3.57%) are now a percentage point below the national average.

The second graph includes all delinquent loans (sorted by percent seriously delinquent).

The second graph includes all delinquent loans (sorted by percent seriously delinquent).

Florida and New Jersey have the highest percentage of serious delinquent loans, followed by Nevada, New York, Illinois, Maine and Maryland. Nevada still leads with the highest percent of loans 90+ days delinquent.

Previous high delinquency states like California and Arizona are now well down the list.

Comment: It continues to bother me that several southern states always have an elevated percentage of mortgage loans 30+ day delinquent (Mississippi, Alabama, Georgia, and Louisiana all have a large percentage light blue). Most of these borrowers always seem to catch up - they just make their payments late. That means lenders generate plenty of late fees in these states. This might be something for the Consumer Financial Protection Bureau to investigate.

Europe Update: More Contraction

by Calculated Risk on 8/13/2012 09:21:00 AM

On Sunday I put together a short list of key dates in Europe in September and October when European policymakers return from vacation.

Here are a couple more stories this morning ...

From Reuters: Italy Public Debt Hits Record High, Deficit Also up

Public debt at the end of June rose 6.6 billion euros to 1.973 billion euros, the Bank of Italy said ... The economy contracted 0.7 percent in the second quarter and gross domestic product was down 2.5 percent from a year earlier. ...From the Athens News: GDP sinks 6.2% in second quarter

Italy's one-year borrowing costs rose marginally at auction on Monday, with uncertainty over how and when the European Central Bank might move to ease both the country's and the region's mounting debt problems tempering appetite for risk.

The country’s economy contracted 6.2 percent in the second quarter ... Currently in its fifth consecutive year, the economic downturn has driven unemployment to record highs, with nearly one in four unemployed and more pain expected ahead. ...Europe will be in the headlines again soon and policymakers will be busy in September and October.

The jobless rate has already climbed to 23.1 percent, with nearly 55 percent of those aged 15-24 out of work.

Sunday, August 12, 2012

Sunday Night Futures

by Calculated Risk on 8/12/2012 09:36:00 PM

This will be a busy week for economic data, but there are no releases scheduled for Monday.

The Asian markets are mixed tonight, with the Nikkei up slightly and the Shanghai Composite down slightly.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are down slightly, and the DOW futures up slightly.

Oil prices are moving up again with WTI futures are at $93.30 and Brent is at $113.40 per barrel. Using the calculator at Econbrowser suggests national gasoline prices at about $3.67 per gallon.

Yesterday:

• Summary for Week Ending Aug 10th

• Schedule for Week of Aug 12th

Four more questions for the August economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Europe and US: A few misc dates in September and October

by Calculated Risk on 8/12/2012 04:43:00 PM

A few miscelleneous dates (just making some notes).

First, for Europe it looks like September and October will be very busy (after the Europeans get back from vacation). Greece will be back in the headlines in October according to the WSJ: Troika to Spend 'All of September' in Greece -EU Official

"The mission in September will stay the whole month in order to report to the October Eurogroup," the official said, referring to the ministers' meeting scheduled to take place in Luxembourg on Oct. 8.Here are a few key European dates:

• September 6th, Governing Council meeting of the European Central Bank in Frankfurt with a press conference to follow. ECB President Mario Draghi is expected to discuss how the ECB will help lower Spanish and Italian borrowing costs.

• September 12th, Germany's Constitutional Court is expected to rule on the new eurozone bailout fund and fiscal treaty.

• Mid-September: Euro-zone finance ministers' informal meetings in Nicosia.

• October 8th, Finance Ministers meeting in Luxembourg.

• European Council meeting, October 18th and 19th in Brussels.

And in the US:

• (Not key) Political conventions: Republicans August 27–30 in Tampa, and Democrats September 3–6 in Charlotte. The election is on November 6th.

• September 12th and 13th: the Federal Open Market Committee (FOMC) meets. After this meeting the FOMC will release updated Summary of Economic Projections, and Fed Chairman Ben Bernanke will hold a press conference. Major economic releases before the FOMC meeting: August 29th, second estimate of Q2 GDP, and September 7th, the August employment report.

Yesterday:

• Summary for Week Ending Aug 10th

• Schedule for Week of Aug 12th

Mortgage Delinquencies by Loan Type

by Calculated Risk on 8/12/2012 10:06:00 AM

The following graphs show the percent of loans delinquent by loan type based on the MBA National Delinquency Survey: Prime, Subprime, FHA and VA. First a table comparing the number of loans in Q2 2007 and Q2 2012 so readers can understand the shift in loan types.

Both the number of prime and subprime loans have declined over the last five years; the number of subprime loans is down by about 35%. Meanwhile the number of FHA loans has more than doubled and VA loans have increased sharply.

An interesting point: Each loan type improved in Q2 2012, but the total delinquency rate increased. The reason is the shift in loan types - from prime loans to more FHA and VA loans.

Note: There are about 42.5 million first-lien loans in the survey, and the MBA survey is about 88% of the total.

| MBA National Delinquency Survey Loan Count | ||||

|---|---|---|---|---|

| Q2 2007 | Q2 2012 | Change | Q2 2012 Seriously Delinquent | |

| Prime | 33,916,830 | 30,120,941 | -3,795,889 | 1,500,023 |

| Subprime | 6,204,535 | 4,031,216 | -2,173,319 | 918,714 |

| FHA | 3,030,214 | 6,827,727 | 3,797,513 | 614,495 |

| VA | 1,096,450 | 1,526,913 | 430,463 | 70,696 |

| Survey Total | 44,248,029 | 42,506,797 | -1,741,232 | 3,103,928 |

Click on graph for larger image.

Click on graph for larger image.First a repeat: This graph shows the percent of loans delinquent by days past due. Loans 30 days delinquent increased to 3.18% from 3.13% in Q1. This is at about 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket increased to 1.22% in Q2, from 1.21% in Q1.

The 90 day bucket increased to 3.19% from 3.06%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 4.27% from 4.39% and is now at the lowest level since Q1 2010.

Note: Scale changes for each of the following graphs.

The second graph is for all prime loans.

The second graph is for all prime loans. This is the category with the most seriously delinquent loans. Back in early 2007 when Fed Chairman Ben Bernanke said "the problems in the subprime market seems likely to be contained", my former co-blogger Tanta responded "We are all subprime!" - she was correct.

Since there are far more prime loans than any other category (see table above), about half the loans seriously delinquent now are prime loans - even though the overall delinquency rate is lower than other loan types.

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.Although the delinquency rate is still very high, the number of subprime loans has declined sharply.

This graph is for FHA loans. In Q2, there was a shift from 90+ days deliquent to in-foreclosure, but the overall percent of loans delinquent or in-foreclosure declined in Q2.

This graph is for FHA loans. In Q2, there was a shift from 90+ days deliquent to in-foreclosure, but the overall percent of loans delinquent or in-foreclosure declined in Q2. The improvement in late 2010 was a combination of the increase in number of loans (recent loans have lower delinquency rates) and eliminating Downpayment Assistance Programs (DAPs). These were programs that allowed the seller to give the buyer the downpayment through a 3rd party "charity" (for a fee of course). The buyer had no money in the house and the default rates were absolutely horrible.

The last graph is for VA loans. This is a fairly small but growing category (see table above).

The last graph is for VA loans. This is a fairly small but growing category (see table above).There are still quite a few subprime loans that are in distress, but the real keys are prime loans and FHA loans.