by Calculated Risk on 8/17/2012 10:50:00 AM

Friday, August 17, 2012

State Unemployment Rates increased in 44 States in July

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed or slightly higher in July. Forty-four states recorded unemployment rate increases, two states and the District of Columbia posted rate decreases, and four states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada continued to record the highest unemployment rate among the states, 12.0 percent in July. Rhode Island and California posted the next highest rates, 10.8 and 10.7 percent, respectively. North Dakota again registered the lowest jobless rate, 3.0 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Two states - New Jersey and New York - are at the maximum unemployment rate for the recession and set new cycle highs in July.

The New York unemployment rate increased to 9.1%, the previous cycle high was 8.9%. The New Jersey unemployment rate increased to 9.8%, the previous cycle high was 9.7%. Every other state has some blue indicating some improvement.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. This is the fewest since January 2009, although New Jersey is close. In early 2010, 18 states and D.C. had double digit unemployment rates.

Consumer Sentiment increases in August to 73.6

by Calculated Risk on 8/17/2012 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for August increased to 73.6, up from the July reading of 72.3.

This was above the consensus forecast of 72.0 but still fairly low. Sentiment remains weak due to the high unemployment rate and sluggish economy - and rising gasoline prices probably aren't helping.

Thursday, August 16, 2012

Friday: Consumer sentiment, State Employment and Unemployment

by Calculated Risk on 8/16/2012 09:15:00 PM

First from Bloomberg: U.S. to sell off some mortgages

A $1.7 billion portfolio of nonperforming, federally insured home loans will be offered for sale at auction next month [on Sept 12th].• At 9:55 AM ET, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for August) will be released. The consensus is for sentiment to decrease slightly to 72.0 from 72.3 in July.

The loans will be auctioned in pools consisting of homes in Chicago; Phoenix; Newark, N.J.; and Tampa, Fla. ... the portfolio ... consists of 9,442 loans with an average balance of $182,000, for the Department of Housing and Urban Development.

• At 10:00 AM, the Conference Board Leading Indicators for August will be released. The consensus is for a 0.2% increase in this index..

• Also at 10:00 AM, the Regional and State Employment and Unemployment (Monthly) for July 2012 is scheduled to be released.

Earlier on housing starts:

• Housing Starts declined to 746 thousand in July

• Quarterly Housing Starts by Intent compared to New Home Sales

• Comment on Housing, and Starts and Completions

• On Yahoo Daily Ticker: Housing Starts Jump 20% in One Year: Recovery Ahead, Says Bill McBride

Comment on Housing, and Starts and Completions

by Calculated Risk on 8/16/2012 02:57:00 PM

This is a very important year for housing and for the economy. The budding recovery for housing starts and new home sales is positive for GDP and employment. Even though housing starts are increasing, it is from a very low level, and 2012 will still be one of the worst years for housing starts (only 2009, 2010, and 2011 will be worse). But that is good news for the economy: housing starts are on pace to be up 20% from last year (how many sectors are growing 20% this year?), and housing starts could double again over the next several years.

This reminds me of the recovery for auto sales. Auto sales bottomed in February 2009 at close to a 9 million annual sales rate. Now auto sales are running at a 14 million pace; over a 50% increase. That strong increase in auto sales really contributed to GDP growth over the last few years, see from Cardiff Garcia at FT Alphaville: Car-driven GDP growth.

Now we are starting to see a rebound for housing. And housing will have an even larger impact on GDP and employment growth than autos; and housing will probably double from here (more than the 50% increase for autos). Even with the downside risks from Europe and the fiscal cliff, this suggests more growth in the medium term (policy mistakes in the US and Europe are probably the biggest economic risk).

Through July, single family starts are on pace for over 500 thousand in 2012, and total starts are on pace for about 730 thousand. That is up from 431 thousand single family starts in 2011, and 609 thousand total starts. Starts are running above the forecasts for most analysts (however Lawler and the NAHB were close).

But even with the increase in starts, completions will be near record lows again in 2012. Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up over the course of the year (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries next year.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions. Completions have barely turned up, but will increase over the next several months.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions. Completions have barely turned up, but will increase over the next several months.

For the sixth consecutive month, the rolling 12 month total for starts has been above completions - that usually only happens after housing has bottomed.

Earlier on housing starts:

• Housing Starts declined to 746 thousand in July

• Quarterly Housing Starts by Intent compared to New Home Sales

• On Yahoo Daily Ticker: Housing Starts Jump 20% in One Year: Recovery Ahead, Says Bill McBride (Note: Doing the interview was a little more difficult than I expected. The room was mostly dark except the lights in my face. There was a green screen behind me, and I couldn't see Aaron.

Quarterly Housing Starts by Intent compared to New Home Sales

by Calculated Risk on 8/16/2012 01:42:00 PM

In addition to housing starts for July, the Census Bureau released Housing Starts by Intent for Q2. This is a very useful report.

First, we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released this morning showed there were 106,000 single family starts, built for sale, in Q2 2012, and that was just above the 103,000 new homes sold for the same quarter (Using Not Seasonally Adjusted data for both starts and sales).

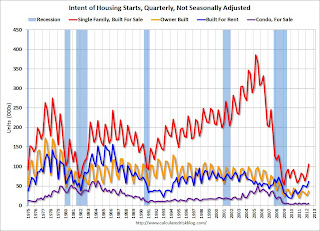

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Click on graph for larger image.

Click on graph for larger image.Single family starts built for sale were up about 28% compared to Q2 2011. This is the highest level since 2008.

Owner built starts were up slightly year-over-year from Q2 2011. And condos built for sale are still near the record low.

The 'units built for rent' has increased significantly and is up about 48% year-over-year.

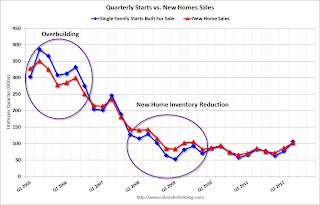

The second graph shows quarterly single family starts, built for sale and new home sales (NSA).

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

For the last 3 years, the builders have sold a few more homes than they started, and inventory levels are now at record lows (117,000 under construction and completed as of June 2012).

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control, and also suggests that the year-over-year increase in housing starts is directly related to an increase in demand and not renewed speculative building.

Timiraos on Absorption of Excess Vacant Supply of Housing Inventory

by Calculated Risk on 8/16/2012 11:22:00 AM

From Nick Timiraos at the WSJ: Shadow Inventory: How Low New Construction Helps the Outlook

There’s been a lot of attention over the last few years on the “shadow inventory” of potential foreclosures — a pent-up supply of homes that could smother an incipient housing recovery.The record low level of completions over the last four years - and record low level of housing units added to the housing stock - is an important reason for the budding recovery in housing. See: Housing: Record Low Total Completions in 2011. The last four years have seen record low completions, and 2012 will also be very low. This low level of completions means that a significant portion of the excess vacant housing supply has been absorbed. And completions in 2012 will still be very low even with the 20%+ increase in housing starts.

But there’s been comparatively less attention on the lack of new housing construction, which has helped to offset the potential damage from elevated levels of foreclosed properties. New home building has been at its lowest levels since World War II in 2009, 2010, and 2011.

From Timiraos:

“Not too many people talk about the lack of new construction over the last several years, which has set the foundation for a snapback in pricing,” says Michael Sklarz, president of real-estate research firm Collateral Analytics.Nothaft is using the Housing Vacancies and Homeownership (HVS) and that survey is not consistent with other measures (like the decennial Census and the ACS). The Census Bureau is looking into the differences between the surveys, but I'm not confident in using the HVS to estimate the excess vacant supply.

Frank Nothaft, the chief economist at Freddie Mac, elaborated on this point in a research note published last week ... “the relatively small amount of new construction, coupled with increased household formation, has allowed much of the excess vacant inventory to be absorbed over the past few years,” he wrote.

However I do agree with Nothaft that "much of the excess vacant" has been absorbed.

Housing Starts declined to 746 thousand in July

by Calculated Risk on 8/16/2012 08:57:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 746,000. This is 1.1 percent below the revised June estimate of 754,000, but is 21.5 percent above the July 2011 rate of 614,000.

Single-family housing starts in July were at a rate of 502,000; this is 6.5 percent below the revised June figure of 537,000. The July rate for units in buildings with five units or more was 229,000.

Building Permits:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 812,000. This is 6.8 percent above the revised June rate of 760,000 and is 29.5 percent above the July 2011 estimate of 627,000.

Single-family authorizations in July were at a rate of 513,000; this is 4.5 percent above the revised June figure of 491,000. Authorizations of units in buildings with five units or more were at a rate of 274,000 in July.

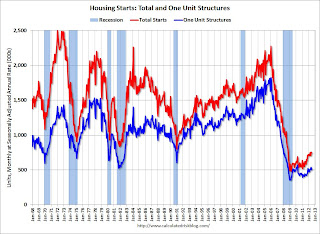

Click on graph for larger image.

Click on graph for larger image.Total housing starts were at 746 thousand (SAAR) in July, down 1.1% from the revised June rate of 754 thousand (SAAR). Note that June was revised from 760 thousand.

Single-family starts decreased 6.5% to 502 thousand in July.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years. Total starts are up 56% from the bottom start rate, and single family starts are up 42% from the low.

This was slightly below expectations of 750 thousand starts in July, but the key is starts are up solidly from last year. Right now starts are on pace to be up about 20% from 2011. Also note that total permits were at the highest level since 2008.

Weekly Initial Unemployment Claims increase to 366,000

by Calculated Risk on 8/16/2012 08:30:00 AM

The DOL reports:

In the week ending August 11, the advance figure for seasonally adjusted initial claims was 366,000, an increase of 2,000 from the previous week's revised figure of 364,000. The 4-week moving average was 363,750, a decrease of 5,500 from the previous week's revised average of 369,250.The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 363,750.

This was at the consensus forecast of 365,000.

And here is a long term graph of weekly claims:

And here is a long term graph of weekly claims:The 4-week average post-bubble low is 363,000; this week the average was just above that level at 363,750.

Wednesday, August 15, 2012

Thursday: Housing Starts, Weekly Unemployment Claims, Philly Fed Index

by Calculated Risk on 8/15/2012 09:54:00 PM

First, informative reading from Bond Girl at Nemo's site: The well-known story of municipal bond defaults

And from Jim Hamilton at Econbrowser: Recent developments in oil markets

And from Tim Duy at Economist'sView: Data Dump

• At 8:30 AM ET, Housing Starts for July will be released. The consensus is for total housing starts to decrease to 750,000 (SAAR) in July, down from 760,000 in June.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand from 361 thousand last week. Initial weekly unemployment claims have been declining recently, and the 4-week average last week was just above the post-bubble low of 363,000.

• At 10:00 AM, the Philly Fed Survey for August will be released. This has been negative the last three months with readings of -5.8, -16.6 and -12.9. The consensus is for another negative reading of -5.0 in August (above zero indicates expansion).

Another question for the monthly economic prediction contest:

Jackson Hole Economic Symposium 2012 Dates

by Calculated Risk on 8/15/2012 07:16:00 PM

The Kansas City Fed doesn't publicly release the dates of the symposium ahead of time. I'll post the schedule when it is available, but here are a few tentative details:

• Jackson Hole Economic Symposium, Thursday, August 30th through Saturday, Sept 1st.

• Fed Chairman Ben Bernanke speaks on Friday, August 31st at 10 AM ET.

• ECB President Mario Draghi speaks on Saturday, September 1st at 10 AM.

Note: Markets will be closed the following Monday for Labor Day on September 3rd.

Here are a few other more dates:

• Political conventions: Republicans August 27–30 in Tampa, and Democrats September 3–6 in Charlotte. The election is on November 6th.

• September 3rd, EU Finance Minsters Meeting.

• September 6th, Governing Council meeting of the European Central Bank in Frankfurt with a press conference to follow. ECB President Mario Draghi is expected to discuss how the ECB will help lower Spanish and Italian borrowing costs.

• September 12th at 6 AM ET, Germany's Constitutional Court is expected to rule on the new eurozone bailout fund and fiscal treaty.

• September 12th and 13th: the Federal Open Market Committee (FOMC) meets. After this meeting the FOMC will release updated Summary of Economic Projections, and Fed Chairman Ben Bernanke will hold a press conference. Major economic releases before the FOMC meeting: August 29th, second estimate of Q2 GDP, and September 7th, the August employment report. PCE price index for July will be released on August 30th.

• Mid-September: Euro-zone finance ministers' informal meetings in Nicosia.

• October 4th, Governing Council meeting of the European Central Bank in Ljubljana with a press conference to follow.

• October 8th, Finance Ministers meeting in Luxembourg.

• European Council meeting, October 18th and 19th in Brussels.

• October 23rd and 24th: the Federal Open Market Committee (FOMC) meets.