by Calculated Risk on 8/19/2012 09:30:00 PM

Sunday, August 19, 2012

Sunday Night Futures

My baseline scenario is for economic growth to remain sluggish but to start to increase as housing improves and the impact of state and local austerity subsides. I think QE3 remains likely, although the timing is still uncertain. My baseline also assumes that some sort of reasonable resolution to the "fiscal cliff" is found, that the European crisis doesn't take down the world economy and that President Obama is reelected.

The Asian markets are mostly green tonight, with the Nikkei up 0.5% and the Shanghai Composite up slightly.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are down slightly, and the DOW futures down about 4 points.

Oil prices are moving up again with WTI futures are at $96.21 and Brent is at $114.10 per barrel. Using the calculator at Econbrowser suggests national gasoline prices at about $3.69 per gallon.

Yesterday:

• Summary for Week Ending Aug 17th

• Schedule for Week of Aug 19th

Two more questions for the August economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Gasoline Prices up 30 cents over last 7 weeks

by Calculated Risk on 8/19/2012 06:56:00 PM

Just filled up my car, and I paid $4.11 per gallon. Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.68 per gallon. That is about the current level according to Gasbuddy.com (see graph below). In California, where I live, gasoline prices are always higher than the national average. Update: Some of the recent increase in California was due to the refinery fire in Richmond

The following graph shows the recent increase in gasoline prices. Gasoline prices are down from the peak in early April, but up about 30 cents over the last seven weeks. Note: This will push up the headline CPI numbers.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Weekend:

• Summary for Week Ending Aug 17th

• Schedule for Week of Aug 19th

Report: ECB Considering setting limits on Sovereign Debt Yields

by Calculated Risk on 8/19/2012 12:15:00 PM

The European crisis will be back in the headlines soon ...

From Bloomberg: ECB May Set Yield Limits on Euro Sovereign Bonds, Spiegel Says

The European Central Bank is considering setting limits on yields of euro area sovereign debt by pledging unlimited bond purchases, Germany’s Spiegel magazine reported ...On Thursday German Chancellor Merkel and French President Hollande will meet in Berlin, and on Friday, the Spanish Government is expected to announce the details of the bank bailout. Also on Friday, Greek Prime Minister Samaras and German Chancellor Merkel will meet in Berlin with a press conference to follow.

The following week, the Jackson Hole Economic Symposium starts on Thursday, with Fed Chairman Ben Bernanke speaking on Friday, August 31st at 10 AM ET, and ECB President Mario Draghi speaking on Saturday, September 1st at 10 AM.

San Diego: "Fears recede of second crash from 'shadow inventory'"

by Calculated Risk on 8/19/2012 08:01:00 AM

From Eric Wolff at the North County Times: Fears recede of second crash from 'shadow inventory'

For years, some real estate analysts feared that banks would suddenly release a wave of foreclosed houses, swamping the local housing market and sending house prices into a second collapse.Wolff has plenty of data for North County San Diego in his article. There isn't as much "shadow inventory" as feared.

That second tsunami isn't happening, according to an analysis by the North County Times.

A house-price crash precipitated a series of foreclosure spikes in 2007 and 2008, leaving banks holding thousands of houses and struggling to hire staff to process them.

After 2009, real estate agents and some analysts became convinced that lenders were holding off on foreclosures, and sitting on foreclosed properties in order to prop up prices, creating a "shadow inventory."

They feared lenders would have to process and release all those houses ---- sending house prices, which have been bouncing along a price bottom for two years, into another downward spiral.

Instead, the number of homes in default has been steadily declining in the region, thanks to a host of programs from government and private banks and a turn toward short sales, in which borrowers sell their properties for less than they owe.

And once lenders have foreclosed on properties, they have moved quickly to sell them, so the stock of properties held by banks is declining, according to an analysis of foreclosure data by the North County Times.

Saturday, August 18, 2012

Unofficial Problem Bank list declines to 899 Institutions

by Calculated Risk on 8/18/2012 06:27:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 17, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

While the latest monthly release of enforcement action activity by the OCC contributed to many changes to the Unofficial Problem Bank List, it finished the week largely unchanged at 899 institutions with assets of $347.5 billion, compared to 900 institutions and assets of $348.6 billion last week. A year ago, the list held 984 institutions with assets of $412.5 billion.Earlier:

The OCC terminated actions against Seaside National Bank & Trust, Orlando, FL ($762 million); The First National Bank of Santa Fe, Santa Fe, NM ($751 million); Executive National Bank, Miami, FL ($285 million); First Community Bank, National Association, San Benito, TX ($216 million); Security Federal Savings Bank, Logansport, IN ($201 million); and Home Loan Investment Bank, F.S.B., Warwick, RI ($190 million).

Additions this week were The Bank of Maine, Portland, ME ($793 million); A J Smith Federal Savings Bank, Midlothian, IL ($228 million); CenTrust Bank, National Association, Northbrook, IL ($95 million); The Citizens National Bank of Meyersdale, Meyersdale, PA ($90 million); and Commonwealth National Bank, Mobile, AL ($68 million).

Next week, there is an outside chance for the FDIC to release its actions through July 2012.

• Summary for Week Ending Aug 17th

• Schedule for Week of Aug 19th

Schedule for Week of August 19th

by Calculated Risk on 8/18/2012 01:29:00 PM

Update: Dates fixed!

Earlier:

• Summary for Week Ending Aug 17th

There are two key housing reports to be released this week: July existing home sales on Wednesday, and July new home sales on Thursday.

On Friday Durable Goods orders for July will be released.

There are a few key European meetings and announcements on Thursday and Friday (included below).

Note: The FDIC might release the Q2 Quarterly Banking Profile late this week.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for sales of 4.50 million on seasonally adjusted annual rate (SAAR) basis. Sales in June 2012 were 4.37 million SAAR.

Housing economist Tom Lawler is forecasting the NAR will report sales of 4.47 million in July.

A key will be inventory and months-of-supply.

2:00 PM: FOMC Minutes for Meeting of July 31-August 1, 2012. Once again the minutes will be closely scrutinized for hints about QE3.

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

9:00 AM: The Markit US PMI Manufacturing Index Flash. This is a new release and might provide hints about the ISM PMI for August. The consensus is for a reading of 51.0, down from 51.8 in July.

10:00 AM ET: New Home Sales for July from the Census Bureau.

10:00 AM ET: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the June sales rate.

The consensus is for an increase in sales to 362 thousand Seasonally Adjusted Annual Rate (SAAR) in July from 350 thousand in June. Watch for upgrades to the sales rate for previous months.

10:00 AM: FHFA House Price Index for June 2012. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic). The consensus is for a 0.6% increase in house prices.

Europe Note: German Chancellor Merkel and French President Hollande will meet in Berlin

10:00 AM: Worker Displacement from the BLS for January 2012. This report will probably receive some attention because of weak labor market.

Europe Note: On Friday, the Spanish Government is expected to announce the details of the bank bailout. Also on Friday, Greek Prime Minister Samaras and German Chancellor Merkel will meet in Berlin with a press conference to follow.

Summary for Week Ending August 17th

by Calculated Risk on 8/18/2012 08:57:00 AM

The economic data was a little more upbeat this week. Retail sales were up sharply in July (reversing the decline in June), housing starts were solid (running about 20% ahead of last year), industrial production increased, the 4-week for initial unemployment claims was near the post-recession low, homebuilder confidence improved, and even consumer sentiment ticked up a little.

Recently the most positive data has been housing related and I wrote this week: Even though housing starts are increasing, it is from a very low level, and 2012 will still be one of the worst years for housing starts (only 2009, 2010, and 2011 will be worse). Still, even with these weak sales, this is good news for the economy: housing starts are on pace to be up 20% from last year (how many sectors are growing 20% this year?), and housing starts could double again over the next several years.

This reminds me of the recovery for auto sales. Auto sales bottomed in February 2009 at close to a 9 million annual sales rate. Now auto sales are running at a 14 million pace; over a 50% increase. That strong increase in auto sales really contributed to GDP growth over the last few years, see from Cardiff Garcia at FT Alphaville: Car-driven GDP growth.

Now we are starting to see a rebound for housing. And housing will have an even larger impact on GDP and employment growth than autos; and housing will probably double from here (more than the 50% increase for autos). Barring policy mistakes in the US and Europe (a big IF), this improvement for housing suggests the economy will continue to grow. However the recovery in housing will probably be gradual.

Here is the take from Merrill Lynch on the economic impact of the housing recovery:

The housing market has become a bright spot for the US economy, offering glimmers of hope for a stronger recovery. The good news is that housing should provide a boost to the economy this year. The bad news is that it will likely be insufficient to save the rest of the economy. While we believe that the housing market has decidedly turned a corner and the recovery has begun, we think it will be a gradual recovery.Note: Merrill think GDP growth will slow over the next few quarters and remain sluggish through next year.

Here is a summary of last week in graphs:

• Housing Starts declined to 746 thousand in July

Click on graph for larger image.

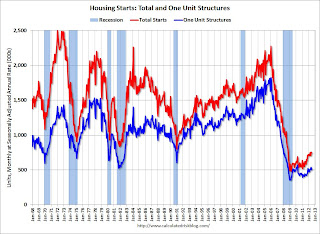

Click on graph for larger image.Total housing starts were at 746 thousand (SAAR) in July, down 1.1% from the revised June rate of 754 thousand (SAAR). Note that June was revised from 760 thousand.

Single-family starts decreased 6.5% to 502 thousand in July.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years. Total starts are up 56% from the bottom start rate, and single family starts are up 42% from the low.

This was slightly below expectations of 750 thousand starts in July, but the key is starts are up solidly from last year. Right now starts are on pace to be up about 20% from 2011. Also note that total permits were at the highest level since 2008.

• Retail Sales increased 0.8% in July

On a monthly basis, retail sales were up 0.8% from June to July (seasonally adjusted), and sales were up 4.1% from July 2011. Ex-autos, retail sales increased 0.8% in July.

On a monthly basis, retail sales were up 0.8% from June to July (seasonally adjusted), and sales were up 4.1% from July 2011. Ex-autos, retail sales increased 0.8% in July.Sales for June were revised down to a 0.7% decrease (from 0.5% decrease).

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

This was above the consensus forecast for retail sales of a 0.3% increase in July, and above the consensus for a 0.4% increase ex-auto.

This mostly just reversed the sharp decline in June.

• Industrial Production increased 0.6% in July, Capacity Utilization increased

From the Fed: Industrial production and Capacity Utilization "Industrial production increased 0.6 percent in July after having risen 0.1 percent in both May and June. ... Capacity utilization for total industry moved up 0.4 percentage point to 79.3 percent, a rate 1.0 percentage point below its long-run (1972--2011) average."

From the Fed: Industrial production and Capacity Utilization "Industrial production increased 0.6 percent in July after having risen 0.1 percent in both May and June. ... Capacity utilization for total industry moved up 0.4 percentage point to 79.3 percent, a rate 1.0 percentage point below its long-run (1972--2011) average."This graph shows Capacity Utilization. This series is up 12.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.3% is still 1.0 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 80.6% in December 2007.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in July to 98.0. This is 17.4% above the recession low, but still 2.7% below the pre-recession peak.

The consensus was for Industrial Production to increase 0.5% in July, and for Capacity Utilization to increase to 79.2%. The increase in IP and Capacity Utilization was above expectations.

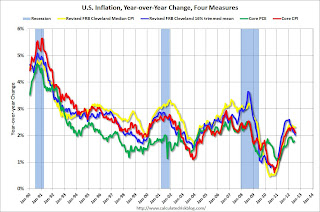

• Key Measures show slowing inflation in July

On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.0%, and core CPI rose 2.1%. Core PCE is for June and increased 1.8% year-over-year.

On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.0%, and core CPI rose 2.1%. Core PCE is for June and increased 1.8% year-over-year. These measures suggest inflation is now at the Fed's target of 2% on a year-over-year basis and it appears the inflation rate is slowing. On a monthly basis (annualized), two of these measure were well below the Fed's target; trimmed-mean CPI was at 1.3%, Core CPI at 1.1% - although median CPI was at 2.5% and and Core PCE for June was at 2.5%. Based on initial data - and comparing to the increase in August 2011 - it is very likely that the August report will show a further decline in the year-over-year inflation rate.

• Weekly Initial Unemployment Claims increase to 366,000

The DOL reports:" In the week ending August 11, the advance figure for seasonally adjusted initial claims was 366,000, an increase of 2,000 from the previous week's revised figure of 364,000. The 4-week moving average was 363,750, a decrease of 5,500 from the previous week's revised average of 369,250."

The DOL reports:" In the week ending August 11, the advance figure for seasonally adjusted initial claims was 366,000, an increase of 2,000 from the previous week's revised figure of 364,000. The 4-week moving average was 363,750, a decrease of 5,500 from the previous week's revised average of 369,250." This graph shows the 4-week moving average of weekly claims since January 2000. The dashed line on the graph is the current 4-week average.

This was at the consensus forecast of 365,000.

The 4-week average post-bubble low is 363,000; this week the average was just above that level at 363,750.

• Consumer Sentiment increases in August to 73.6

The preliminary Reuters / University of Michigan consumer sentiment index for August increased to 73.6, up from the July reading of 72.3.

The preliminary Reuters / University of Michigan consumer sentiment index for August increased to 73.6, up from the July reading of 72.3.This was above the consensus forecast of 72.0 but still fairly low. Sentiment remains weak due to the high unemployment rate and sluggish economy - and rising gasoline prices probably aren't helping.

• Other Economic Stories ...

• July Update: Early Look at 2013 Cost-Of-Living Adjustments indicates 1% increase

• NAHB Builder Confidence increases in August, Highest since February 2007

• House Prices and a Foreclosure Supply Shock

• Comment on Housing, and Starts and Completions

• State Unemployment Rates increased in 44 States in July

• Quarterly Housing Starts by Intent compared to New Home Sales

• Jackson Hole Economic Symposium 2012 Dates

Friday, August 17, 2012

Preliminary: Fed manufacturing surveys and ISM index for August

by Calculated Risk on 8/17/2012 06:33:00 PM

Below is a graph I usually post after the release of the NY Fed and Philly Fed manufacturing surveys. Most of the economic data this week was a little more upbeat, but both of these surveys were disappointing ...

This week the Philly Fed survey indicated contraction:

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased 6 points, to a reading of ‐7.1. This marks the fourth consecutive negative reading for the index but also its highest reading since MayAnd the NY Fed (Empire State) survey was also weak:

The August Empire State Manufacturing Survey indicates that conditions for New York manufacturers deteriorated over the month. The general business conditions index slipped below zero for the first time since October 2011, falling thirteen points to -5.9.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through August. The ISM and total Fed surveys are through July.

The average of the Empire State and Philly Fed surveys declined in August, and has remained negative for three consecutive months. This suggests another weak reading for the ISM manufacturing index.

Lawler: Early Look At Existing Home Sales in July

by Calculated Risk on 8/17/2012 03:35:00 PM

From economist Tom Lawler:

Based on reports from various state and local realtor associations, boards, and/or MLS, I estimate that US existing home sales as estimated by the NAR ran at a seasonally adjusted annual rate of 4.47 million in July, up 2.3% from June’s preliminary estimated pace. On the NAR’s preliminary June sales estimate, which was way below consensus and lower than my below-consensus forecast, state and local realtor/MLS reports released following the NAR’s EHS release were for the most part lower than I had assumed, and seemed to confirm the below-consensus pace of existing home sales in June. By the same token, however, the local realtor data released across the country seemed to suggest that existing home sales were a bit stronger than the NAR’s preliminary estimate (as was the case in May, when sales were revised upward from a SAAR of 4.55 million to 4.62 million). My “best guess” is that June’s existing home sales will be revised upward by a similar amount – from 4.37 million to around 4.44 million. Net, then, I expect that July’s seasonally adjusted existing home sales pace will be little changed from June’s upwardly revised pace.

While June and July existing home sale at first glance seem a bit disappointing relative to previous expectations, a major reason for the weaken-than-consensus sales is a much larger-than-consensus decline in the “distressed” – and especially the foreclosure – share of resales. E.g., in the markets shown in the “distressed home sales share” table [below], the distressed home sales share for those combined markets this July was down about ten percentage points from last July! (The drop for the whole country, of course, was probably smaller). “Non-distressed” sales have actually been running very strong relative to a year ago – for the markets on page one the YOY gain in “non-distressed” sales was over 30% -- and that strength, combined with significant declines in the inventory of homes for sale, has contributed to the upturn in home prices this year.

On the inventory front, the combination of various “trackers” of select metro markets and realtor reports suggests to me that the inventory of existing homes for sale at the end of July was probably down by about 22% or so from a year ago. How that will translate into a NAR estimate, however, is not clear. E.g., firms that track listings and/or folks who track realtor reports were very surprised that the NAR’s existing home inventory fell by 3.2% from June to July, and that July’s inventory number was down 24.4% from last July. I’m guessing that the June inventory number will be revised upward by around 1.7% (reflecting the upward sales revision), and that the NAR’s inventory estimate for July will be down by about 22.2% from last July, which would imply a monthly increase (from an assumed upward revision in June) of 0.8%.

On the median sales price side, for two months in a row the NAR’s preliminary median sales price estimates have been revised downward significantly, with the biggest revisions coming in the Northeast. I wouldn’t be surprised to see a downward revision in the June MSP as well. For July, using a sales-weighted average methodology, I estimate that the July median existing SF home sales price as estimated by the NAR will show YOY gain of about 7.8%.

CR Note: The NAR is scheduled to release the existing home sales report on Wednesday, August 22nd at 10 AM ET. The preliminary consensus is for sales of 4.50 million SAAR in July (close to Lawler's estimate). Based on Lawler's sales and inventory estimates, months-of-supply would be unchanged at 6.6 months.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-July | 11-July | 12-July | 11-July | 12-July | 11-July | |

| Las Vegas | 40.0% | 20.2% | 20.7% | 50.2% | 60.7% | 70.4% |

| Reno | 38.0% | 28.0% | 15.0% | 37.0% | 53.0% | 65.0% |

| Phoenix | 29.5% | 23.6% | 14.6% | 43.1% | 44.1% | 66.7% |

| Sacramento | 32.0% | 22.3% | 22.4% | 39.0% | 54.4% | 61.3% |

| Minneapolis | 9.3% | 11.0% | 24.8% | 34.4% | 34.1% | 45.4% |

| Mid-Atlantic (MRIS) | 11.3% | 10.2% | 8.7% | 15.1% | 20.0% | 25.2% |

| Orlando | 28.2% | 29.4% | 23.7% | 28.2% | 51.9% | 57.6% |

| Southern California | 18.7% | 17.4% | 21.0% | 32.6% | 39.7% | 50.0% |

| California (DQ) | 19.0% | 17.3% | 22.0% | 34.5% | 41.0% | 51.8% |

| Lee County, FL | 17.3% | 18.8% | 15.9% | 30.6% | 33.2% | 49.4% |

| Hampton Roads VA | 29.1% | 30.3% | ||||

| Northeast Florida | 39.0% | 44.1% | ||||

| Sarasota | 32.4% | 38.0%* | ||||

| Chicago | 36.1% | 36.7% | ||||

| Rhode Island | 24.8% | 20.3% | ||||

LA area Port Traffic: Imports and Exports down YoY in July

by Calculated Risk on 8/17/2012 01:48:00 PM

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for July. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, both inbound and outbound traffic are down slightly compared to the 12 months ending in June.

In general, inbound and outbound traffic has been moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of July, loaded outbound traffic was down slightly compared to July 2011, and loaded inbound traffic was down 2% compared to July 2011.

For the month of July, loaded outbound traffic was down slightly compared to July 2011, and loaded inbound traffic was down 2% compared to July 2011.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday - so imports might increase over the next couple of months, but probably not by much.

This suggests import traffic might be down a little in July.