by Calculated Risk on 11/29/2012 09:04:00 PM

Thursday, November 29, 2012

Friday: October Personal Income and Outlays, Chicago PMI

A couple of articles on the fiscal slope negotiations:

Suzy Khimm at the WaPo has the initial White House proposal: The White House’s fiscal cliff proposal

Jonathan Weisman at the NY Times writes: G.O.P. Balks at White House Plan on Fiscal Crisis

Treasury Secretary Timothy F. Geithner presented the House speaker, John A. Boehner, a detailed proposal on Thursday to avert the year-end fiscal crisis with $1.6 trillion in tax increases over 10 years, $50 billion in immediate stimulus spending, home mortgage refinancing and a permanent end to Congressional control over statutory borrowing limits.For the economy this proposal would resolve the "fiscal cliff" uncertainty, significant reduce the fiscal drag, and also reduce the deficit. Of course there are other agendas too - this proposal is a starting point - but hopefully eliminating the debt ceiling nonsense is part of the final agreement.

My guess is an agreement will be reached, perhaps in early January after the tax cuts expire, so politicians can claim to be cutting taxes.

Friday:

• At 8:30 AM, the Personal Income and Outlays report for October will be released. The consensus is for a 0.3% increase in personal income in October, and for 0.1% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for November. The consensus is for an increase to 50.3, up from 49.9 in October.

The last question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Freddie Mac: Mortgage Rates Near Record Lows

by Calculated Risk on 11/29/2012 05:05:00 PM

From Freddie Mac today: Mortgage Rates Virtually Unchanged

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates virtually unchanged and remaining near their record lows ...

30-year fixed-rate mortgage (FRM) averaged 3.32 percent with an average 0.8 point for the week ending November 29, 2012, up from last week when it averaged 3.31 percent. Last year at this time, the 30-year FRM averaged 4.00 percent.

15-year FRM this week averaged 2.64 percent with an average 0.6 point, up from last week when it averaged 2.63 percent. A year ago at this time, the 15-year FRM averaged 3.30 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and mortgage rates are currently near the record low for the last 40 years.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a significant refinance boom, and refinance activity has picked up.

There has also been an increase in refinance activity due to HARP.

Here is an update to an old graph - by request - that shows the relationship between the 10 year Treasury Yield and 30 year mortgage rates.

Here is an update to an old graph - by request - that shows the relationship between the 10 year Treasury Yield and 30 year mortgage rates.The y-intercept is around 2.6%, so if the 10 year Treasury yield falls to zero, 30 year mortgage rates would still be around 2.6% (using this fit).

Currently the 10 year Treasury yield is 1.62% and 30 year mortgage rates are at 3.32%.

The third graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).

The third graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).Note: Mortgage rates were at or below 5% back in the 1950s.

A few comments on GDP Revision and Unemployment Claims

by Calculated Risk on 11/29/2012 02:21:00 PM

• GDP Revision: Although Q3 real GDP growth was revised up from 2.0% annualized to 2.7%, the underlying details were disappointing. There were three main sources for the revision: 1) Personal consumption expenditures (PCE) increased at a 1.4% annualized rate, revised down from 2.0%. This means PCE contributed 0.99 percentage points to real growth in Q3 (revised down from a 1.42 percentage point contribution in the advance release), and 2) the change in private inventories added 0.77 percentage point contribution to growth (revised up from -0.12), and 3) exports were revised up to a 0.16 percentage point contribution (revised up from -0.23).

This suggests weaker final demand in the US than originally estimated.

Also Justin Wolfers at Bloomberg discusses the weak Gross Domestic Income (GDI) data: The Bad News in Today's Happy Growth Report. Sluggish growth continues.

• Unemployment Claims: A reader sent me some "analysis" on the initial weekly unemployment claims report released this morning that was incorrect. The writer wrote that the 1) the 4-week moving average was at the highest level this year, 2) that there were 30,603 fewer layoffs in New York "last week", so 3) the recent increase in the 4-week average can't be blamed on Hurricane Sandy.

The first point is correct. The 4-week average is at the highest level since October 2011, but the conclusion about not blaming Sandy is incorrect.

First, the initial claims data is very noisy, so most analysts use the 4-week average to smooth out the noise. When an event happens - like Hurricanes Katrina in 2005 or Sandy this year - the 4-week average lags the event. Here is the unemployment claims data for the last 10 weeks:

| Week Ending | Initial Claims (SA) | 4-Week Average |

|---|---|---|

| 9/22/2012 | 363,000 | 375,000 |

| 9/29/2012 | 369,000 | 375,500 |

| 10/6/2012 | 342,000 | 364,750 |

| 10/13/2012 | 392,000 | 366,500 |

| 10/20/2012 | 372,000 | 368,750 |

| 10/27/2012 | 363,000 | 367,250 |

| 11/3/2012 | 361,000 | 372,000 |

| 11/10/2012 | 451,000 | 386,750 |

| 11/17/2012 | 416,000 | 397,750 |

| 11/24/2012 | 393,000 | 405,250 |

It is no surprise that the 4-week average increased this week. The 363,000 claims for the week ending Oct 27th were dropped out of the average and replaced with the 393,000 initial claims this week - so the 4-week average increased even though initial unemployment claims are declining.

The 4-week average will probably increase again next week as the 361,000 claims for the week ending Nov 3rd will be replaced with the claims for this week. Note: There are some large seasonal adjustment this time of year - especially the week after Thanksgiving - so it is hard to predict the level of claims. But the math is simple.

The good news is in two weeks the 451,000 claims for the week of Nov 10th will be dropped out of the 4-week average.

Key point: the 4-week average is intended to smooth out noise, but it lags events.

The writer's conclusion about 30,603 fewer layoffs in New York "last week" so the increase in the 4-week average can't be blamed on hurricane Sandy are incorrect. As part of the weekly release, the DOL notes the UNADJUSTED state data for the PREVIOUS week. The headline number was for the week ending Nov 24th, but the unadjusted state data was for Nov 17th.

The state data for New York showed a large decline, but the week before the New York data showed an even large increase. Since this data is unadjusted, we can't tell if claims are still elevated in New York, but since the increase for the week ending Nov 10th was much larger than the decrease for the week ending Nov 17th, my guess would be that claims are still above normal.

The bottom line is the recent increase in unemployment claims is most likely due to Hurricane Sandy, and there is nothing in the data that would suggest otherwise. And using simple arithmetic, we'd expect the 4-week average to lag the event. The state data supports this view, and I expect the 4-week average to increase again next week, and then start declining the following week (although there can be large seasonal effects this time of year, so we could be off a week or two).

Kansas City Fed: Regional Manufacturing Activity "Eased Further" in November

by Calculated Risk on 11/29/2012 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Eased Further

The Federal Reserve Bank of Kansas City released the November Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity eased further in November, while producers’ expectations were unchanged from last month at modestly positive levels.Most of the regional manufacturing surveys were weak in November (Richmond was the exception).

“We saw a decline in regional factory activity for the second straight month, and firms have put hiring plans on hold for the next six months” said Wilkerson. “However, overall production and capital spending are expected to rise moderately in coming months.”

...

Several contacts noted uncertainties about the upcoming fiscal cliff, and a few producers cited delayed deliveries and reduced orders from the East Coast as a result of the Hurricane Sandy. Price indexes moderated slightly.

The month-over-month composite index was -6 in November, down from -4 in October and 2 in September. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. This marked the first time the composite index has been negative for two straight months since mid-2009. Manufacturing slowed at durable goods-producing plants, while nondurable factories reported a slight uptick in activity, particularly for food and plastics products. Other month-over-month indexes were mixed in November. The production index was unchanged at -6, while the new orders and order backlog indexes declined for the third straight month to their lowest levels in three years. In contrast, the employment index increased from -6 to 0, and the shipments and new orders for exports indexes were less negative.

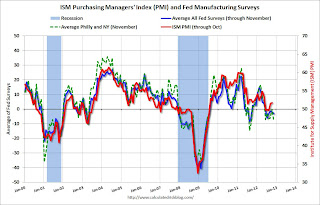

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through November), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

The ISM index for November will be released Monday, Dec 3rd, and these surveys suggest another weak reading.

NAR: Pending Home Sales Index increases in October

by Calculated Risk on 11/29/2012 10:16:00 AM

From the NAR: Pending Home Sales Rise in October to Highest Level in Over Five Years

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 5.2 percent to 104.8 in October from an upwardly revised 99.6 in September and is 13.2 percent above October 2011 when it was 92.6. The data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in November and December. However, because of the increase in short sales that take longer to close, some of these contract signings are probably for next year.

...

Outside of a few spikes during the tax credit period, pending home sales are at the highest level since March 2007 when the index also reached 104.8. On a year-over-year basis, pending home sales have risen for 18 consecutive months.

Weekly Initial Unemployment Claims decline to 393,000

by Calculated Risk on 11/29/2012 08:30:00 AM

Note: From MarketWatch: U.S. Q3 GDP revised up to 2.7% from 2.0% (I'll have more later on the GDP revision).

The DOL reports:

In the week ending November 24, the advance figure for seasonally adjusted initial claims was 393,000, a decrease of 23,000 from the previous week's revised figure of 416,000. The 4-week moving average was 405,250, an increase of 7,500 from the previous week's revised average of 397,750.The previous week was revised up from 410,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 405,250.

This sharp increase in the 4 week average is due to Hurricane Sandy as claims increased significantly in the impacted areas (update: claims increased in NY, NJ and other impacted areas over the 4-week period - some of those areas saw a decline this week). Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were about at the consensus forecast.

And here is a long term graph of weekly claims:

Mostly moving sideways this year until the recent spike due to Hurricane Sandy. Weekly claims should continue to decline over the next few weeks.

Wednesday, November 28, 2012

Thursday: Q3 GDP, Unemployment claims, Pending Home Sales

by Calculated Risk on 11/28/2012 08:55:00 PM

First, Jon Hilsenrath at the WSJ discusses some of the issues that will be discussed at the next FOMC meeting in December: Fed Likely to Keep Buying Bonds

Central bank officials face critical decisions at their next policy meeting Dec. 11-12. ... Since September the Fed has been buying $40 billion a month of mortgage-backed securities and looks set to continue that program. ...My guess is the Fed will expand "QE3" to around $85 billion per month when Operation Twist concludes. On communication, I'm not sure they are ready to change to thresholds for unemployment and inflation, so that will probably wait until March (but it could happen in December).

The more urgent issue is what to do with a $45 billion-a-month program known as Operation Twist, in which the central bank is buying long-term Treasury securities and funding the purchases with sales of short-term Treasurys.

...

Another issue for officials to consider at the December meeting is whether to alter their communications strategy. For several months, they have been debating whether to state explicitly what unemployment rates or inflation rates would get them to raise short-term interest rates from their very low levels. ... If the Fed is going to adopt such a move, it would make sense to do it either at the December meeting or in March, when Mr. Bernanke will hold news conferences and be able to explain the central bank's thinking on the complicated subject.

emphasis added

Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 390 thousand from 410 thousand.

• Also at 8:30 AM, the second estimate for Q3 GDP will be released. The consensus is that real GDP increased 2.8% annualized in Q3, revised up from 2.0% in the advance release.

• At 10:00 AM, the NAR will release Pending Home Sales Index for October. The consensus is for a 1.0% increase in the index.

• At 11:00 AM, the Kansas City Fed regional Manufacturing Survey for November. This is the last of the regional surveys for November, and the consensus is for a reading of -1, up from -4 in October (below zero is contraction).

Earlier on New Home Sales:

• New Home Sales at 368,000 SAAR in October

• New Home Sales and Distressing Gap

• New Home Sales graphs

Another question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

FHFA: HARP Refinance Boom Continued in September

by Calculated Risk on 11/28/2012 04:38:00 PM

Note: HARP is the program that allows borrowers with loans owned or guaranteed by Fannie Mae or Freddie Mac - and with high loan-to-value (LTV) ratios - to refinance at low rates. Fannie or Freddie are already responsible for the loan, and allowing the borrower to refinance lowers the default risk.

From the FHFA:

The Federal Housing Finance Agency (FHFA) today released its September Refinance Report, which shows that Fannie Mae and Freddie Mac loans refinanced through the Home Affordable Refinance Program (HARP) accounted for nearly one-quarter of all refinances in the third quarter of 2012. More than 90,000 homeowners refinanced their mortgage in September through HARP with more than 709,000 loans refinanced since the beginning of this year. The continued high volume of HARP refinances is attributed to record-low mortgage rates and program enhancements announced last year.Note: the automated system wasn't released until the end of March - and there were some issues with that system - so HARP refinances didn't really pickup until sometime in Q2. Now they are on pace for around 1 million refinances this year.

...

In September, half of the loans refinanced through HARP had loan-to-value (LTV) ratios greater than 105 percent and one-fourth had LTVs greater than 125 percent.

In September, 19 percent of HARP refinances for underwater borrowers were for shorter-term 15- and 20-year mortgages, which help build equity faster than traditional 30-year mortgages.

HARP refinances in September represented 45 percent of total refinances in states hard hit by the housing downturn–Nevada, Arizona, Florida and Georgia–compared with 21 percent of total refinances nationwide.

These "underwater" borrowers are current (most took out loans 5 to 7 years ago), and they will probably stay current with the lower interest rate.

This table shows the number of HARP refinances by LTV through September of this year compared to all of 2011. Clearly there has been a sharp increase in activity. Note: Here is the September report.

| HARP Activity | |||

|---|---|---|---|

| 2012, Through September | All of 2011 | Since Inception | |

| Total HARP | 709,006 | 400,024 | 1,730,857 |

| LTV >80% to 105% | 407,330 | 340,033 | 1,338,565 |

| LTV >105% to 125% | 159,980 | 59,991 | 250,596 |

| LTV >125% | 141,696 | 0 | 141,696 |

Fed's Beige Book: "Economic activity expanded at a measured pace"

by Calculated Risk on 11/28/2012 02:00:00 PM

Economic activity expanded at a measured pace in recent weeks, according to reports from contacts in the twelve Federal Reserve Districts. Cleveland, Richmond, Atlanta, Chicago, Kansas City, Dallas, and San Francisco grew at a modest pace, while St. Louis and Minneapolis indicated a somewhat stronger increase in activity. In contrast, Boston reported a slower rate of growth. Weaker conditions in New York were attributed to widespread disruptions at the end of October and into November caused by Hurricane Sandy. Philadelphia reported general weakness that was exacerbated by the hurricane. ...And on real estate:

Among key sectors, consumer spending grew at a moderate pace in most Districts, while manufacturing weakened, on balance. Seven of the twelve Districts reported either slowing or outright contraction in manufacturing, and two others gave mixed reports. ...

Overall, markets for single-family homes continued to improve across most Districts with the exception of Boston and Philadelphia. Residential real estate markets in the New York District were mixed but generally firm prior to the storm. Selling prices were steady or rising. Boston, New York, Richmond, Atlanta, Kansas City, and Dallas noted declining or tight inventories.Hmmm ... from "moderate" growth a few months ago, to "modest" growth in the last report, and now "measured". I'm not sure about the difference, but it does suggest sluggish growth. Real estate continues to be the bright spot.

Construction and commercial real estate activity generally improved across Districts since the last report. Gains, albeit modest in most cases, were reported by Philadelphia, Richmond, Chicago, and Minneapolis. The gains among Cleveland's contacts were tempered by reports in recent weeks of a slowdown in inquiries and a decline in public-sector projects. Kansas City described activity as holding firm and noted that real estate markets remained stronger than a year ago.

New Home Sales and Distressing Gap

by Calculated Risk on 11/28/2012 11:49:00 AM

New home sales in October were below expectations at a 368 thousand seasonally adjusted annual rate (SAAR). And sales for September were revised down from 389 thousand SAAR to 369 thousand.

This has led to some worrying about the housing recovery, as an example from Reuters: New Home Sales Drop 0.3%, Cast Shadow on Recovery

The data leaves the pace of new home sales just below the pace reported in May, suggesting little upward momentum the market for new homes.Yes, new home sales have been moving sideways for the last 6 months. However sales are still up significantly from 2011, and I expect sales to continue to increase over the next few years.

New home sales have averaged 361,000 on an annual rate basis through October. That means sales are on pace to increase 18% from last year. Most sectors would be pretty upbeat about an 18% increase in sales.

But even with the significant increase this year, 2012 will be the 3rd lowest year since the Census Bureau started tracking new home sales in 1963. This year will be above 2010 and 2011, but below the 375,000 sales in 2009. I expect sales to double from here within the next several years as distressed sales continue to decline.

Click on graph for larger image.

Click on graph for larger image.I started posting this graph four years ago when the "distressing gap" first appeared.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through October. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier:

• New Home Sales at 368,000 SAAR in October

• New Home Sales graphs