by Calculated Risk on 12/04/2012 12:45:00 PM

Tuesday, December 04, 2012

FDIC reports Fewer Problem banks, Total REO Declines in Q3

The FDIC released the Quarterly Banking Profile for Q3 today.

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $37.6 billion in the third quarter of 2012, a $2.3 billion (6.6 percent) improvement from the $35.2 billion in profits the industry reported in the third quarter of 2011. This is the 13th consecutive quarter that earnings have registered a year-over-year increase. Increased noninterest income and lower provisions for loan losses accounted for most of the year-over-year improvement in earnings.The FDIC reported the number of problem banks declined:

Also noteworthy was a decline in the number of banks on the FDIC's "Problem List" from 732 to 694. This marked the sixth consecutive quarter that the number of "problem" banks has fallen, and the first time in three years that there have been fewer than 700 banks on the list. Total assets of "problem" institutions declined from $282 billion to $262 billion

Click on graph for larger image.

Click on graph for larger image.The dollar value of Real Estate Owned (REOs, foreclosure houses) declined from $9.5 billion in Q2 to $8.8 billion in Q3. This is the lowest level of REOs since Q1 2008. Even in good times, the FDIC insured institutions have about $2.5 billion in residential REO.

This graph shows the dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

Trulia: Asking House Prices increased in November

by Calculated Risk on 12/04/2012 10:08:00 AM

Press Release: Home Prices Rebound in Hard-Hit Atlanta, Sacramento, and the Inland Empire at the Price Recovery Accelerates in November

In November, asking home prices rose 0.8 percent month-over-month (M-o-M), seasonally adjusted–which implies an annualized growth rate of 10 percent. Year-over-year (Y-o-Y) prices increased 3.8 percent, which was also the largest yearly increase to date. Quarter-over-quarter (Q-o-Q) prices rose 2.2 percent, seasonally adjusted, another post-crisis high; in fact, prices rose 0.8 percent Q-o-Q without adjusting for seasonality (not shown in table), even though prices typically decline after the summer. Excluding foreclosures, asking prices rose 4.3 percent Y-o-Y and 1.6 percent Q-o-Q, seasonally adjusted.These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a SA basis.

...

For the first time since the housing crisis began, Atlanta and two inland California metros—Riverside-San Bernardino and Sacramento—all experienced significantly large Q-o-Q asking home price gains. Unlike other hard-hit metros such as Phoenix, Las Vegas, and Miami, prices in these metros have been slower to bounce back, declining in February and making smaller gains in August and May.

...

Nationally, rents rose 5.6 percent Y-o-Y, outpacing the national price gain of 3.8 percent. However, asking prices in 14 of the 25 largest rental markets actually rose faster than rents as the price recovery picks up.

...

“The key factors behind today’s price gains are job growth, falling vacancies, and–above all–rebounding from the huge price declines of the housing bust,” said Jed Kolko, Trulia’s Chief Economist. “The latest metros to join the price rebound are Atlanta, Sacramento, and Riverside-San Bernardino. Now, all of the metros that suffered most during the bust have had year-over-year price gains.”

More from Jed Kolko, Trulia Chief Economist: Asking Price Gains Accelerate in November, but Local Differences Widen

CoreLogic: House Prices up 6.3% Year-over-year in October, Largest increase since 2006

by Calculated Risk on 12/04/2012 09:01:00 AM

Notes: This CoreLogic House Price Index report is for October. The recent Case-Shiller index release was for September. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® Home Price Index Marks Eighth Consecutive Month of Year-Over-Year Gains

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 6.3 percent in October 2012 compared to October 2011. This change represents the biggest increase since June 2006 and the eighth consecutive increase in home prices nationally on a year-over-year basis. On a month-over-month basis, including distressed sales, home prices decreased by 0.2 percent in October 2012 compared to September 2012*. Decreases in month-over-month home prices are expected as the housing market enters the offseason.

...

Excluding distressed sales, home prices nationwide also increased on a year-over-year basis by 5.8 percent in October 2012 compared to October 2011. On a month-over-month basis excluding distressed sales, home prices increased 0.5 percent in October 2012 compared to September 2012, the eighth consecutive month-over-month increase. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that November 2012 home prices, including distressed sales, are expected to rise by 7.1 percent on a year-over-year basis from November 2011 and fall by 0.3 percent on a month-over-month basis from October 2012 as sales exhibit a seasonal slowdown going into the winter.

...

“The housing recovery that started earlier in 2012 continues to gain momentum," said Mark Fleming, chief economist for CoreLogic. “The recovery is geographically broad-based with almost all markets experiencing some appreciation. Sand and energy states continue to experience the most robust appreciation and some judicial foreclosure states are even recording increasing prices.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 0.2% in October, and is up 6.3% over the last year.

The index is off 27% from the peak - and is up 9.6% from the post-bubble low set in February (the index is NSA, so some of the increase is seasonal).

The second graph is from CoreLogic. The year-over-year comparison has been positive for eight consecutive months suggesting house prices bottomed earlier this year on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for eight consecutive months suggesting house prices bottomed earlier this year on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

Since this index is not seasonally adjusted, it was expected to decline on a month-to-month basis in October, and will probably stay negative on a month-to-month basis until the March 2013 report is released. The key for the next several months will be to watch the year-over-year change.

Monday, December 03, 2012

Housing: Inventory down 22% year-over-year in early December

by Calculated Risk on 12/03/2012 09:07:00 PM

Tuesday economic releases:

• At 10:00 AM ET, Trulia Price & Rent Monitors for November. This is the index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

Here is another update using inventory numbers from HousingTracker / DeptofNumbers to track changes in listed inventory. Tom Lawler mentioned this last year.

According to the deptofnumbers.com for (54 metro areas), overall inventory is down 22% year-over-year and probably at the lowest level since the early '00s.

This graph shows the NAR estimate of existing home inventory through October (left axis) and the HousingTracker data for the 54 metro areas through early December.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory last year, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms in December and January and then increases through the summer. So inventory will probably decline a little further over the next month or so, before increasing again next year.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early December listings, for the 54 metro areas, declined 21.7% from the same period last year.

HousingTracker reported that the early December listings, for the 54 metro areas, declined 21.7% from the same period last year.

The year-over-year declines will probably start to get smaller since inventory is already very low. It seems very unlikely we will see 20%+ year-over-year declines next summer, but it does appear that inventory will be very low in 2013.

U.S. Light Vehicle Sales at 15.5 million annual rate in November, Highest Since 2007

by Calculated Risk on 12/03/2012 03:45:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 15.54 million SAAR in November. That is up 15% from November 2011, and up 9% from the sales rate last month. This is the highest level of sales since December 2007.

This was above the consensus forecast of 15.0 million SAAR (seasonally adjusted annual rate), however some of the increase was a bounce back from Hurricane Sandy that negatively impacted sales at the end of October.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for November (red, light vehicle sales of 15.54 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

Sales have averaged a 14.4 million annual sales rate this year through November, up from 12.7 million rate for the same period of 2011. Last year sales were depressed for several months (May through August) due to supply chain issues related to the tsunami in Japan.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

This shows the huge collapse in sales in the 2007 recession.

Most (or all) of the month-to-month decline in October was related to Hurricane Sandy, and some of the sharp increase this month was a bounce back.

CoreLogic: 58,000 Completed Foreclosures in October

by Calculated Risk on 12/03/2012 01:59:00 PM

From CoreLogic: CoreLogic® Reports 58,000 Completed Foreclosures in October

CoreLogic ... today released its National Foreclosure Report for October that provides data on completed U.S. foreclosures and the overall foreclosure inventory. According to CoreLogic, there were 58,000 completed foreclosures in the U.S. in October 2012, down from 70,000 in October 2011 representing a year-over-year decrease of 17 percent. On a month-over-month basis, completed foreclosures fell from 77,000* in September 2012 to the current 58,000, representing a decrease of 25 percent. As a basis of comparison, prior to the decline in the housing market in 2007, completed foreclosures averaged 21,000 per month between 2000 and 2006. Completed foreclosures are an indication of the total number of homes actually lost to foreclosure. Since the financial crisis began in September 2008, there have been approximately 3.9 million completed foreclosures across the country.Note: The foreclosure inventory reported by CoreLogic is lower than the number reported by LPS of 3.61% of mortgages or 1.8 million in foreclosure.

Approximately 1.3 million homes, or 3.2 percent of all homes with a mortgage, were in the national foreclosure inventory as of October 2012 compared to 1.5 million, or 3.6 percent, in October 2011. Month-over-month, the national foreclosure inventory was down 1.3 percent from September 2012 to October 2012. The foreclosure inventory is the share of all mortgaged homes in any stage of the foreclosure process.

...

“As a result of completed foreclosures and alternative disposition methods, the foreclosure inventory has declined by 9 percent year-to-date. This is good news for housing markets as we look forward to 2013,” said Mark Fleming, chief economist for CoreLogic.

Many observers expected a "surge" in foreclosures this year, but that hasn't happened. However there are still a large number of properties in the foreclosure inventory in some states:

The five states with the highest foreclosure inventory as a percentage of all mortgaged homes were: Florida (11.1 percent), New Jersey (7.7 percent), New York (5.3 percent), Illinois (5.0 percent) and Nevada (4.8 percent).

Construction Spending increased in October

by Calculated Risk on 12/03/2012 11:27:00 AM

Three key construction spending themes:

• Residential construction is usually the largest category for construction spending, but there was a huge collapse in spending following the housing bubble (as expected). Looking forward, private residential construction spending will be the largest category again very soon - but spending is still very low (at 1998 levels not adjusted for inflation).

• Private non-residential construction spending picked up last year mostly due to energy spending (power and electric), but spending on office buildings, hotels and malls is still very low.

• Public construction spending declined for several years, but the decline appears to be mostly over. Note: Public construction spending is mostly state and local spending, and the drag from state and local cutbacks appears to be ending.

The Census Bureau reported that overall construction spending increased in October:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during October 2012 was estimated at a seasonally adjusted annual rate of $872.1 billion, 1.4 percent above the revised September estimate of $860.4 billion. The October figure is 9.6 percent above the October 2011 estimate of $795.7 billion.Both private and public construction spending increased:

Spending on private construction was at a seasonally adjusted annual rate of $592.1 billion, 1.6 percent above the revised September estimate of $582.7 billion. ... In October, the estimated seasonally adjusted annual rate of public construction spending was $280.1 billion, 0.8 percent above the revised September estimate of $277.7 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 57% below the peak in early 2006, and up 32% from the post-bubble low. Non-residential spending is 28% below the peak in January 2008, and up about 31% from the recent low.

Public construction spending is now 14% below the peak in March 2009 and just above the post-bubble low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 21%. Non-residential spending is also up 11% year-over-year mostly due to energy spending (power and electric). Public spending is down 1% year-over-year.

ISM Manufacturing index declines in November to 49.5, Lowest since July 2009

by Calculated Risk on 12/03/2012 10:00:00 AM

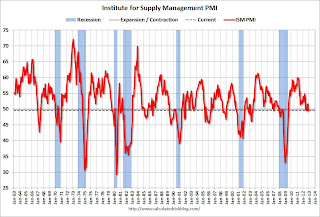

The ISM manufacturing index indicated contraction in November. PMI was at 49.5% in November, down from 51.7% in October. The employment index was at 48.4%, down from 52.1%, and the new orders index was at 50.3%, down from 54.2%.

From the Institute for Supply Management: November 2012 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector contracted in November following two months of modest expansion, while the overall economy grew for the 42nd consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI™ registered 49.5 percent, a decrease of 2.2 percentage points from October's reading of 51.7 percent, indicating contraction in manufacturing for the fourth time in the last six months. This month's PMI™ reading reflects the lowest level since July 2009 when the PMI™ registered 49.2 percent. The New Orders Index registered 50.3 percent, a decrease of 3.9 percentage points from October, indicating growth in new orders for the third consecutive month. The Production Index registered 53.7 percent, an increase of 1.3 percentage points, indicating growth in production for the second consecutive month. The Employment Index registered 48.4 percent, a decrease of 3.7 percentage points, which is the index's lowest reading since September 2009 when the Employment Index registered 47.8 percent. The Prices Index registered 52.5 percent, reflecting a decrease of 2.5 percentage points. Comments from the panel this month generally indicate that the second half of the year continues to show a slowdown in demand; respondents also express concern over how and when the fiscal cliff issue will be resolved."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was well below expectations of 51.7% and suggests manufacturing contracted in November.

Unofficial Problem Bank list declines to 856 Institutions

by Calculated Risk on 12/03/2012 08:44:00 AM

CR Note: Usually I post this on Saturday - sorry for the delay. The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining recently.

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 30, 2012.

Changes and comments from surferdude808:

This week, the FDIC released its enforcement actions through October but did not release industry results for the third quarter. Changes to the Unofficial Problem Bank List include six removals and five additions that leave the list at 856 institutions with assets of $326.4 billion. A year ago, the list held 980 institutions with assets of $400.5 billion. For the month of November, the list declined by eight institutions after 13 action terminations, three failures, two unassisted mergers, and 10 additions.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

The six removals were for action terminations against Johnson Bank, Racine, WI ($3.8 billion); NexBank, SSB, Dallas, TX ($607 million); Ohana Pacific Bank, Honolulu, HI ($94 million Ticker: OHPB): Lead Bank, Garden City, MO ($84 million); Prosper Bank, Prosper, TX ($64 million); and Millennium Bank, Des Plaines, IL ($44 million).

Additions this week were Inland Bank and Trust, Oak Brook, IL ($1.3 billion); Cornerstone Bank, Moorestown, NJ ($351 million Ticker: CFIC); Devon Bank, Chicago, IL ($250 million); First Citizens Bank of Georgia, Dawsonville, GA ($95 million); and Community State Bank, Norwalk, WI ($27 million).

Look for the FDIC to release industry third quarter results this Tuesday.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Weekend:

• Summary for Week Ending Nov 30th

• Schedule for Week of Dec 2nd

Sunday, December 02, 2012

Monday: ISM Manufacturing, Auto Sales, Construction Spending

by Calculated Risk on 12/02/2012 08:43:00 PM

This will be another week of sausage making - uh, "fiscal cliff", or more accurately "austerity slope" - negotiations. The key question for the economy is: When and how much austerity will the US fiscal authorities enact?

My guess is an agreement will be reached in early January, and Federal austerity will subtract 1% to 1.5% from GDP in 2013. Note: There is no drop dead date – despite the silly countdown timers on some sites.

Monday economic releases:

• At 10:00 AM ET, the ISM Manufacturing Index for November will be released. The consensus is for be PMI to be unchanged at 51.7. (above 50 is expansion).

• Also at 10:00 AM, the Construction Spending for October. The consensus is for a 0.4% increase in construction spending.

• All day: Light vehicle sales for November. The consensus is for light vehicle sales to increase to 15.0 million SAAR in November (Seasonally Adjusted Annual Rate) from 14.2 million in October (October sales were impacted by Hurricane Sandy).

The Asian markets are mostly green tonight, with the Nikkei up 0.4% and the Shanghai Composite is up 0.8%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 2 and DOW futures are up 20.

Oil prices are down slightly with WTI futures at $88.82 per barrel and Brent at $111.18 per barrel.

Weekend:

• Summary for Week Ending Nov 30th

• Schedule for Week of Dec 2nd

Four more questions this week for the December economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).