by Calculated Risk on 4/10/2014 12:26:00 PM

Thursday, April 10, 2014

Freddie Mac: "Fixed Mortgage Rates Tick Down"

From Freddie Mac today: Fixed Mortgage Rates Tick Down

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving down slightly as we head into the spring homebuying season. ...

30-year fixed-rate mortgage (FRM) averaged 4.34 percent with an average 0.7 point for the week ending April 10, 2014, down from last week when it averaged 4.41 percent. A year ago at this time, the 30-year FRM averaged 3.43 percent.

15-year FRM this week averaged 3.38 percent with an average 0.6 point, down from last week when it averaged 3.47 percent. A year ago at this time, the 15-year FRM averaged 2.65 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the 30 and 15 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

After increasing last June, mortgage rates have mostly moved sideways for the last 9 or 10 months.

Trulia: Asking House Prices up 10.0% year-over-year in March

by Calculated Risk on 4/10/2014 10:16:00 AM

From Trulia chief economist Jed Kolko: Home Prices and Population Growth: Cities vs. Suburbs

Despite declining investor purchases and more inventory coming onto the market, asking home prices continued to rise at the start of the spring housing season. Month-over-month, asking prices rose 1.2% nationally in March 2014, seasonally adjusted. Quarter-over-quarter, asking prices rose 2.9% in March 2014, seasonally adjusted, reflecting three straight months of solid month-over-month gains.In November 2013, year-over-year asking prices were up 12.2%. In December, the year-over-year increase in asking home prices slowed slightly to 11.9%. In January, the year-over-year increase was 11.4%, in February, the increase was 10.4% - and now the increase is 10.0%.

Year-over-year, asking prices are up 10% nationally and up in 97 of the 100 largest metros. Albany, NY, Hartford, CT, and New Haven, CT, are the only three large metros where prices fell year-over-year, albeit slightly.

...

In March, rents rose 3.9% year-over-year nationally. Rent increases were higher for apartments (4.4% year-over-year) than for single-family homes (1.9% year-over-year).

emphasis added

This suggests prices are still increasing, but at a slightly slower pace.

Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases, but at a slower rate, over the next few months on a seasonally adjusted basis.

Weekly Initial Unemployment Claims decline to 300,000

by Calculated Risk on 4/10/2014 08:35:00 AM

The DOL reports:

In the week ending April 5, the advance figure for seasonally adjusted initial claims was 300,000, a decrease of 32,000 from the previous week's revised level. The last time intial claims were this low was May 12, 2007 when they were 297,000. The previous week's level was revised up by 6,000 from 326,000 to 332,000. The 4-week moving average was 316,250, a decrease of 4,750 from the previous week's revised average.The previous week was revised up from 326,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 316,250.

This was lower than the consensus forecast of 320,000. The 4-week average is close to normal levels during an expansion.

Wednesday, April 09, 2014

Thursday: Weekly Unemployment Claims

by Calculated Risk on 4/09/2014 08:16:00 PM

An interesting post on the stock market from Joshua Brown: The Most Important Difference Between 2007 and 2014

Of course, in 2007, it was clear the country was headed into recession and that house prices would decline much further. Now there is no recession in sight ... and in addition to corporate balance sheets being in much better shape (as Brown notes), household balance sheets are much stronger too.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 320 thousand from 326 thousand.

• Early, the Trulia Price Rent Monitors for March. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 2:00 PM, the Monthly Treasury Budget Statement for March.

Lawler: Number of Home Owners Lower than 2006!

by Calculated Risk on 4/09/2014 05:16:00 PM

From housing economist Tom Lawler:

Below are my “best guess” estimates of the number of US households – total and by tenure – from 2006 to 2013. The numbers for 2000 and 2010 are the “official” decennial Census numbers, while the numbers for other years from 2006 to 2012 are yearly averages derived from ACS data, adjusted (1) to reflect differences between ACS and decennial Census results; and (2) to reflect updated population estimates (total and by age group) for each year. Numbers for 2013 are “guesstimates” based on population estimates and headship/homeownership rates.

Also shown are homeownership rates. These homeownership rates are lower than the ones shown in the more widely followed Housing Vacancy Survey, as the HVS homeownership rates, both total and by age group, were “way off” from Decennial Census results for 2010.

| US Household Estimates (000's) | ||||

|---|---|---|---|---|

| Owners | Renters | Total | Homeownership Rate | |

| 2000 (Census) | 69,816 | 35,664 | 105,480 | 66.2% |

| 2006 | 76,126 | 37,356 | 113,482 | 67.1% |

| 2007 | 76,706 | 37,799 | 114,505 | 67.0% |

| 2008 | 76,656 | 38,748 | 115,404 | 66.4% |

| 2009 | 76,409 | 39,811 | 116,220 | 65.7% |

| 2010 (Census) | 75,986 | 40,730 | 116,716 | 65.1% |

| 2011 | 75,600 | 41,843 | 117,443 | 64.4% |

| 2012 | 75,481 | 43,006 | 118,487 | 63.7% |

| 2013 | 75,683 | 43,814 | 119,497 | 63.3% |

One of the most striking statistics is the number of US home owners: There were fewer US home owners in 2013 than there were in 2006, despite a 7% increase in the 15+ year old population!

While the number of SF (detached and attached) homes occupied by owners in 2013 appears to be about the same as in 2006, the number occupied by renters appears to have increased by about 3 1/2 million.

FOMC Minutes: SEP changes need "not be viewed as signifying a less accommodative reaction function"

by Calculated Risk on 4/09/2014 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee, March 18-19, 2014 . Excerpt:

In their discussion of monetary policy going forward, participants focused primarily on possible changes to the Committee's forward guidance for the federal funds rate. Almost all participants agreed that it was appropriate at this meeting to update the forward guidance, in part because the unemployment rate was seen as likely to fall below its 6-1/2 percent threshold value before long. Most participants preferred replacing the numerical thresholds with a qualitative description of the factors that would influence the Committee's decision to begin raising the federal funds rate. One participant, however, favored retaining the existing threshold language on the grounds that removing it before the unemployment rate reached 6-1/2 percent could be misinterpreted as a signal that the path of policy going forward would be less accommodative. Another participant favored introducing new quantitative thresholds of 5-1/2 percent for the unemployment rate and 2-1/4 percent for projected inflation. A few participants proposed adding new language in which the Committee would indicate its willingness to keep rates low if projected inflation remained persistently below the Committee's 2 percent longer-run objective; these participants suggested that the inclusion of this quantitative element in the forward guidance would demonstrate the Committee's commitment to defend its inflation objective from below as well as from above. Other participants, however, judged that it was already well understood that the Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance. Most participants therefore did not favor adding new quantitative language, preferring to shift to qualitative language that would describe the Committee's likely reaction to the state of the economy.Rates will be low for a long time. Note: SEP: "Summary of Economic Projections"

Most participants also believed that, as part of the process of clarifying the Committee's future policy intentions, it would be appropriate at this time for the Committee to provide additional guidance in its postmeeting statement regarding the likely behavior of the federal funds rate after its first increase. For example, the statement could indicate that the Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run. Participants observed that a number of factors were likely to have contributed to a persistent decline in the level of interest rates consistent with attaining and maintaining the Committee's objectives. In particular, participants cited higher precautionary savings by U.S. households following the financial crisis, higher global levels of savings, demographic changes, slower growth in potential output, and continued restraint on the availability of credit. A few participants suggested that new language along these lines could instead be introduced when the first increase in the federal funds rate had drawn closer or after the Committee had further discussed the reasons for anticipating a relatively low federal funds rate during the period of policy firming. A number of participants noted the overall upward shift since December in participants' projections of the federal funds rate included in the March SEP, with some expressing concern that this component of the SEP could be misconstrued as indicating a move by the Committee to a less accommodative reaction function. However, several participants noted that the increase in the median projection overstated the shift in the projections. In addition, a number of participants observed that an upward shift was arguably warranted by the improvement in participants' outlooks for the labor market since December and therefore need not be viewed as signifying a less accommodative reaction function. Most participants favored providing an explicit indication in the statement that the new forward guidance, taken as a whole, did not imply a change in the Committee's policy intentions, on the grounds that such an indication could help forestall misinterpretation of the new forward guidance.

emphasis added

Goldman's Hatzius: "Rays of Light"

by Calculated Risk on 4/09/2014 11:09:00 AM

A couple of excerpts from a research note by Goldman chief economist Jan Hatzius: "Rays of Light on the Supply Side"

First, on the outlook:

US economic growth is accelerating as the economy bounces back from the inventory and weather-related weakness of the first quarter. Our current activity indicator (CAI) is up a preliminary 3.6% in March, well above the 2% pace of the prior three months and consistent with our forecast for a rebound into the 3%-3.5% range for real GDP growth in the remainder of 2014.And on the labor force participation rate:

[T]he labor force participation rate has risen by 0.39 percentage points since December, the biggest increase over a three-month period since 2007. The main reason for the increase has been a significant pickup in the gross flow of individuals from inactivity to employment (and to a lesser degree unemployment). We view this as a potentially promising sign that labor demand is picking up sufficiently to pull discouraged workers back into the labor force.CR Note: My expectation at the beginning of the year was the participation rate would mostly hold steady (returning workers would offset demographics in 2014). So far (just three months) that looks about right. I also expect a pick up in GDP after Q1.

The increase in labor force participation is especially encouraging because the expiration of emergency unemployment benefits at the end of December should have acted to reduce participation. We have received questions whether the impact might have gone the other way. Some argue that the loss of benefits might have forced some workers to seek employment, and that this could have increased participation. But this assumes that prior to year-end there were a significant number of individuals who told the unemployment benefit office that they were actively seeking work but said the opposite in the household survey. We find this hard to believe; most people would probably be reluctant to tell "the government" that they are not actually seeking work when doing so is a prerequisite for drawing benefits.

MBA: Mortgage Purchase Applications Increase, Refinance Applications Decrease

by Calculated Risk on 4/09/2014 07:01:00 AM

From the MBA: Mortgage Purchase Applications Increase in Latest MBA Weekly Survey

Mortgage applications decreased 1.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 4, 2014. ...

The Refinance Index decreased 5 percent from the previous week and is at its lowest level since the end of 2013. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained constant at 4.56 percent, with points increasing to 0.33 from 0.31 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

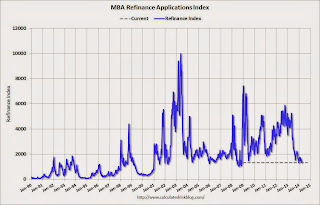

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 19% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index - but this is still very weak.

Tuesday, April 08, 2014

Wednesday: FOMC Minutes

by Calculated Risk on 4/08/2014 08:59:00 PM

On Sunday I listed a few possible reasons for the decline in the labor force participation rate for prime-working age men. One of the reasons I suggested was more men were being "Mr. Mom". I looked for some research on this, and sure enough the percent of stay-at-home father families has increased from 0.7% in the 1968 to 1979 period, to 2.5% in the 2000 to 2012 period (percent of married families).

Meanwhile the prime-working age men participation rate fell from an average of 95.0% (1968 to 1979) to 90.3% (2000 - 2012). Clearly "Mr. Mom" has been a factor.

From Karen Z. and Amit Kramer at the University of Illinois at Urbana-Champaign The Rise of Stay-at-Home Father Families in the U.S.: The Role of Gendered Expectations, Human Capital, and Economic Downturns

Stay-at-home father families in which the mother is the sole- or primary-earner of income (Chesley 2011) represent a small but growing percentage of two-parent families in the United States. These families, in which the mother is the sole income earner, are estimated to make up three to four percent of two-parent households in the United States (Fields 2002; Kramer, Kelly, and McCulloch forthcoming). The higher participation rates of women in the labor force, as well as the impact of the 2009 Great Recession, which have affected men’s employment more than women’s (Harrington, Van Deusen, and Ladge 2010), combined with greater projected growth rates in occupations that are dominated by women, such as health and education (Boushey 2009), suggest that the proportion of stay-at-home father families in the U.S. is likely to increase.The other factors too as I noted in the post on Sunday.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for February. The consensus is for a 0.5% increase in inventories.

• At 2:00 PM, the FOMC Minutes for the Meeting of March 18-19, 2014.

"A Closer Look at Post-2007 Labor Force Participation Trends"

by Calculated Risk on 4/08/2014 06:42:00 PM

This is an excellent overview of many of the labor force participation trends.

From Melinda Pitts, John Robertson, and Ellyn Terry at Marcoblog: A Closer Look at Post-2007 Labor Force Participation Trends

And the promise of another post using micro data:

[A]n important assumption in the BLS projection is that the post-2007 decline in prime-age participation will not persist. Indeed, the data for the first quarter of 2014 does suggest that some stabilization has occurred.

But separating what is trend from what is cyclical is challenging. The rapid pace of the decline in participation among the prime-age population between 2007 and 2013 is somewhat puzzling. Could this decline reflect a temporary cyclical effect or something more permanent? A follow-up blog will explore this question in more detail using the micro data from the Current Population Survey.