by Calculated Risk on 4/13/2014 11:51:00 AM

Sunday, April 13, 2014

Q1 Review: Ten Economic Questions for 2014

At the end of last year, I posted Ten Economic Questions for 2014. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2014 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand why I was wrong).

By request, here is a Q1 review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2014: Downside Risks

Happily, looking forward, it seems the downside risks have diminished significantly. China remains a key risk ... There are always potential geopolitical risks (war with Iran, North Korea, or turmoil in some oil producing country). Right now those risks appear small, although it is always hard to tell. ...China remains a downside risk, and the situation in Russia and Ukraine is serious, but overall it appears that downside risks have diminished.

When I look around, I see few obvious downside risks for the U.S. economy in 2014. No need to borrow trouble - diminished downside risks are a reason for cheer.

9) Question #9 for 2014: How much will housing inventory increase in 2014?

Right now my guess is active inventory will increase 10% to 15% in 2014 (inventory will decline seasonally in December and January, but I expect to see inventory up 10% to 15% year-over-year toward the end of 2014). This will put active inventory close to 6 months supply this summer. If correct, this will slow house price increases in 2014.Right now, through April 7th, inventory is up 7.7% compared to last year according to Housing Tracker. The NAR reported inventory was up 5.3% year-over-year in February. So far a 10% to 15% increase this year looks about right.

8) Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

Bottom line: I expect lending standards to loosen a bit in 2014 from the tight level of the last few years. It will be difficult to measure, but I'll be watching what Mel Watt says, what private lenders say, comments from mortgage brokers, and MEW.It is early in the year, but so far there is little evidence of looser mortgage lending standards.

7) Question #7 for 2014: What will happen with house prices in 2014?

In 2014, inventories will probably remain low, but I expect inventories to continue to increase on a year-over-year basis. This suggests more house price increases in 2014, but probably at a slow pace.We only have Case-Shiller data for January - and price increases might be slowing, but it is too early to tell.

As Khater noted, some of the "bounce back" in certain areas is probably over, also suggesting slower price increases going forward. And investor buying appears to have slowed. A positive for the market will probably be a little looser mortgage credit.

All of these factors suggest further prices increases in 2014, but at a slower rate than in 2013. There tends to be some momentum for house prices, and I expect we will see prices up mid-to-high single digits (percentage) in 2014 as measured by Case-Shiller.

6) Question #6 for 2014: How much will Residential Investment increase?

New home sales will still be competing with distressed sales (short sales and foreclosures) in some judicial foreclosure states in 2014. However, unlike last year when I reported that some builders were land constrained (not enough finished lots in the pipeline), land should be less of an issue this year. Even with the foreclosures, I expect another solid year of growth for new home sales.Through February, new home sales were unchanged from 2013, and housing starts were actually down 1% year-over-year (permits were up 5%). This is a slow start to 2014, and I don't blame all of the recent weakness on the weather (probably just a small factor). There are also higher mortgage rates, higher prices and probably supply constraints in some areas. But I still think fundamentals support a higher level of starts, and I expect starts and new home sales to pick up solidly again this year.

... I expect growth for new home sales and housing starts in the 20% range in 2014 compared to 2013. That would still make 2014 the tenth weakest year on record for housing starts (behind 2008 through 2012 and few other recession lows).

5) Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

[E]ven though the Fed is data-dependent, I currently expect the Fed to reduce their asset purchases by $10 billion per month (or so) at each meeting this year and conclude QE3 at the end of the 2014.So far right on schedule.

4) Question #4 for 2014: Will too much inflation be a concern in 2014?

[C]urrently I think inflation (year-over-year) will increase a little in 2014 as growth picks up, but too much inflation will not be a concern in 2014.It is early, but inflation was still low through February.

3) Question #3 for 2014: What will the unemployment rate be in December 2014?

My guess is the participation rate will stabilize or only decline slightly in 2014 (less than in 2012 and 2013) ... it appears the unemployment rate will decline to the low-to-mid 6% range by December 2014.The unemployment rate was 6.7% in March, unchanged from December.

2) Question #2 for 2014: How many payroll jobs will be added in 2014?

Both state and local government and construction hiring should improve further in 2014. Federal layoffs will be a negative, but most sectors should be solid. So my forecast is somewhat above the previous three years, and I expect gains of about 200,000 to 225,000 payroll jobs per month in 2014.Through March 2014, the economy has added 533,000 thousand jobs; 178,000 per month. Employment was clearly impacted by the poor weather, and I still expect employment gains to average 200,000 to 225,000 per month in 2014.

1) Question #1 for 2014: How much will the economy grow in 2014?

I expect PCE to pick up again into the 3% to 4% range, and this will give a boost to GDP. This increase in consumer spending should provide an incentive for business investment. Add in the ongoing housing recovery, some increase in state and local government spending, and 2014 should be the best year of the recovery with GDP growth at or above 3%The first quarter will be disappointing (most early estimates are around 1% growth in Q1), but I expect economic activity to pick up in the last three quarters of the year.

Overall activity in 2014 is a somewhat lower than I expected. However my outlook for the year remains about the same.

Saturday, April 12, 2014

Unofficial Problem Bank list declines to 530 Institutions

by Calculated Risk on 4/12/2014 01:15:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for April 11, 2014.

Changes and comments from surferdude808:

There were three removals this week from the Unofficial Problem Bank List. After removal, the list holds 530 institutions with assets of $170.8 billion. A year ago, the list held 786 institutions with assets of $289.4 billion.

Actions were terminated against Riverview Community Bank, Vancouver, WA ($803 million); The National Bank of Cambridge, Cambridge, MD ($190 million); and Pikes Peak National Bank, Colorado Springs, CO ($80 million).

The Federal Reserve issued a Prompt Corrective Action order against NBRS Financial, Rising Sun, MD ($207 million), which has been operating under a Written Agreement since February 2010.

Next Friday, we anticipate the OCC will release its enforcement action activity through Mid-March 2014.

Schedule for Week of April 13th

by Calculated Risk on 4/12/2014 09:31:00 AM

The key reports this week are March retail sales on Monday and March housing starts on Wednesday.

For manufacturing, the March Industrial Production and Capacity Utilization report, and the April NY Fed (Empire State) and Philly Fed surveys, will be released this week.

For prices, CPI will be released on Tuesday.

Fed Chair Janet Yellen speaks on Wednesday "Monetary Policy and the Economic Recovery".

8:30 AM ET: Retail sales for March will be released.

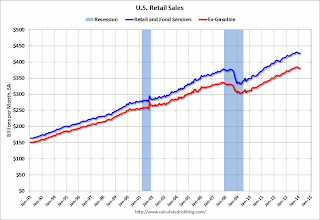

8:30 AM ET: Retail sales for March will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales increased 0.3% from January to February (seasonally adjusted), and sales were up year-over-year 1.5% from February 2013.

The consensus is for retail sales to increase 0.8% in March, and to increase 0.4% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for February. The consensus is for a 0.5% increase in inventories.

11:00 AM: CBO will release its updated 10-year baseline projections of federal spending, revenues, and budget deficits.

8:30 AM ET: Consumer Price Index for March. The consensus is for a 0.1% increase in CPI in February and for core CPI to increase 0.1%.

8:30 AM: NY Fed Empire Manufacturing Survey for April. The consensus is for a reading of 7.5, up from 5.6 in March (above zero is expansion).

8:45 AM: Speech by Fed Chair Janet Yellen, Opening Remarks, At the Federal Reserve Bank of Atlanta Conference: 2014 Financial Markets Conference, Stone Mountain, Georgia

10:00 AM: The April NAHB homebuilder survey. The consensus is for a reading of 50, up from 47 in March. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for March.

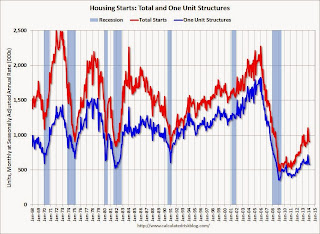

8:30 AM: Housing Starts for March. Total housing starts were at 907 thousand (SAAR) in February. Single family starts were at 583 thousand SAAR in February.

The consensus is for total housing starts to increase to 965 thousand (SAAR) in March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.This graph shows industrial production since 1967.

The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 78.8%.

12:25 PM: Speech by Fed Chair Janet Yellen, Monetary Policy and the Economic Recovery, At the Economic Club of New York, New York, New York

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 320 thousand from 300 thousand.

10:00 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of 9.1, up from 9.0 last month (above zero indicates expansion).

All US markets will be closed in observance of Good Friday.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for March 2014.

Friday, April 11, 2014

Update: The Mortgage Debt Forgiveness Tax Break

by Calculated Risk on 4/11/2014 09:42:00 PM

CR Note: Historically the IRS has considered debt forgiveness (like short sales) as taxable income. In 2007, Congress passed a measure to exempt most forgiven mortgage debt from being considered taxable income (this helped increase short sale activity). This measure expired on Dec 31, 2013. However, according to a letter from the IRS:

"[I]f a property owner cannot be held personally liable for the difference between the loan balance and the sales price, we would consider the obligation as a nonrecourse obligation. In this situation, the owner would not treat the cancelled debt as income."So in states that passed anti-deficiency provisions (like California), this means many loans will be considered nonrecourse by the IRS (and forgiven debt will not be taxed).

However, in many other states, forgiven debt will be taxed. There is little opposition to extending the debt relief act, and extending it would probably be helpful - especially in judicial foreclosure states (like New Jersey) where housing is still struggling to recover.

Note2: I looked for an update today after reading Dina ElBoghdady's article at the WaPo: Distressed homeowners seeking mortgage relief could get stuck with a big tax bill

This was written in February from Laurie Goodman and Ellen Seidman at the Urban Institute: The Mortgage Forgiveness Debt Relief Act Has Expired—Renewal Could Benefit Millions

Under the federal tax code, when a lender forgives part or all of a mortgage, the borrower must count that forgiveness as taxable income. Congress wisely recognized that this tax rule would discourage the forgiveness of debt as a tool to reduce foreclosures and add insult to injury for borrowers already struggling to pay their bills, many of whom had just lost their home. So in 2007, it passed the Mortgage Debt Forgiveness Act (the Act), which excludes this forgiveness from taxable income.

On December 31, 2013, the Mortgage Forgiveness Debt Relief Act expired.1 Unless Congress extends it, housing debt that has been forgiven or written off after 2013—through short sales, foreclosures, or loan modifications that include principal forgiveness—will generally be treated as taxable income. A bill that would extend the Act for two years has been introduced by Representative Bill Foster (D-IL), and many analysts predict that the Act will eventually be renewed. In the meantime, however, uncertainty over its renewal has made it increasingly difficult for lenders and borrowers alike to take actions that will be beneficial to both parties. We calculate this uncertainty will affect up to 2 million borrowers who are seriously delinquent or in foreclosure, many of whom will lose their homes, and as many as 1.4 million more who could potentially benefit from loan modifications that include principal reductions.

The case for rapid resolution is made more poignant by the fact that failure to do so contradicts other public policy initiatives. Last July, the U.S. Department of the Treasury extended the Home Affordable Modification Program (HAMP) for two years, until year-end 2015. HAMP loan modifications may include principal reduction, a technique that has proven especially effective in keeping homeowners in their homes. With the expiration of the Act, borrowers receiving principal reductions risk being taxed on the forgiven debt, sharply reducing the utility of the modification. Just as important, the large settlements between government regulators, lenders, and servicers are increasingly including commitments by institutions to provide significant sums of debt forgiveness. In the 2012 settlement between the State Attorneys General, the Department of Justice, and the nation’s five largest lenders, $10 billion of the $25 billion settlement was set aside for principal forgiveness. The actions under this settlement have been substantially completed but it has set the template for others to follow. In November 2013, JPMorgan Chase reached a $13 billion settlement with regulators over soured mortgage securities sold prior to the 2008 crisis; $4 billion of the settlement was set aside for consumer relief, which will take various forms, including principal reduction loan modifications. In December 2013, Ocwen reached a $2.2 billion settlement, with $2 billion to be used for principal reduction modifications. We can expect to see a series of additional settlements in the coming year, with much of the restitution in the form of principal reduction.

The timing of the expiration of the Mortgage Forgiveness Debt Relief Act is thus particularly unfortunate because it undermines the effectiveness of an increasingly utilized tool to reduce foreclosures. In this paper we describe the implications of the Act’s expiration and call for its rapid reenactment.

WSJ: Zelman still Bullish on New Home Sales, Cuts forecast for Existing Home Sales

by Calculated Risk on 4/11/2014 03:30:00 PM

From Nick Timiraos at the WSJ: Fewer Foreclosures Could Mean Fewer Homes for Sale

In a report Friday, her firm Zelman & Associates said it now expected a 5% drop in sales of previously owned homes for 2014 to a seasonally adjusted annual level of 4.8 million units. At the start of the year, the firm had forecast nearly a 6% gain from last year, to 5.4 million from last year’s 5.1 million units.This is a reminder that a decline in existing home sales isn't "bad news" for the overall economy, and what matters most for jobs and the economy are new home sales. This updated Zelman forecast fits with my view of a decline in existing home sales this year, but a solid increase in new home sales.

...

Ms. Zelman isn’t changing her forecasts for new home sales, which are forecast to hit 505,000 units this year, up 17% from last year. ... recent data, including a proprietary survey her firm also released Friday, point to a pick-up in new-home orders since last fall ...

FNC: Residential Property Values increased 9.0% year-over-year in February

by Calculated Risk on 4/11/2014 12:08:00 PM

In addition to Case-Shiller, CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their February index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.5% from January to February (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.7% and 0.8% in February. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Since these indexes are NSA, this is a strong month-to-month increase.

The year-over-year change continued to increase in February, with the 100-MSA composite up 9.0% compared to February 2013. In January, the year-over-year increase was 8.9%. The index is still down 22.8% from the peak in 2006.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the year-over-year change based on the FNC index (four composites) through February 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

There is still no clear evidence of a slowdown in price increases yet.

The February Case-Shiller index will be released on Tuesday, April 29th.

Preliminary April Consumer Sentiment increases to 82.6

by Calculated Risk on 4/11/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for April was at 82.6, up from 80.0 in March.

This was above the consensus forecast of 81.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

I expect to see sentiment at post-recession highs very soon.

Thursday, April 10, 2014

Friday: PPI, Consumer Sentiment

by Calculated Risk on 4/10/2014 08:56:00 PM

For amusement: Years ago, whenever there was a market sell-off, my friend Tak Hallus (Stephen Robinett) would shout at his TV tuned to CNBC "Bring out the bears!".

This was because CNBC would usually bring on the bears whenever there was a sell-off, and bulls whenever the market rallied.

Today was no exception with Marc Faber on CNBC:

"This year, for sure—maybe from a higher diving board—the S&P will drop 20 percent," Faber said, adding: "I think, rather, 30 percent"And Faber from August 8, 2013:

Faber expect to see stocks end the year "maybe 20 percent [lower], maybe more!"And from October 24, 2012:

"I believe globally we are faced with slowing economies and disappointing corporate profits, and I will not be surprised to see the Dow Jones, the S&P, the major indices, down from the recent highs by say, 20 percent," Faber said...Since the market is up 30% since his 2012 prediction, shouldn't he be expecting a 50% decline now?

Friday:

• At 8:30 AM ET, the Producer Price Index for March from the BLS. The consensus is for a 0.1% increase in prices.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for April). The consensus is for a reading of 81.0, up from 80.0 in March.

NY Times on the Smaller Budget Deficit

by Calculated Risk on 4/10/2014 06:29:00 PM

First an error ...

From the NY Times: Tax Revenue Soars, Decreasing Deficit, U.S. says

Over all, the deficit is expected to equal 4.1 percent of gross domestic product in 2014, down from nearly 10 percent in 2009, during the depths of the recession.Actually in February the CBO projected the deficit to be 3.0% of GDP in fiscal 2014 (4.1% was for fiscal 2013). Next week the CBO will update their projections, and I expect the deficit projection for 2014 to be revised down again.

NY Times:

The deficits in the next few years are expected to stay at 2 to 3 percent of gross domestic product, before widening sharply again toward the end of the decade.It depends on what "widening sharply" means, but the CBO is projecting 3.4% in 2019 and 3.7% in 2020.

And this is a key point:

“It is the fastest four-year reduction in deficits since the demobilization after World War II,” [said Ernie Tedeschi, head of fiscal analysis at ISI], “but it has come in the middle of an economy that is not yet healed from the worst recession since the Great Depression.”The economy would probably be better off (more employment, faster GDP growth) if the deficit hadn't been reduced so quickly.

"Reasons for the Decline in Prime-Age Labor Force Participation"

by Calculated Risk on 4/10/2014 04:25:00 PM

This is a follow-up to a previous post: A Closer Look at Post-2007 Labor Force Participation Trends

From Melinda Pitts, John Robertson, and Ellyn Terry at Marcoblog: Reasons for the Decline in Prime-Age Labor Force Participation. They focus on prime working-age population (25 to 54 years old). They discuss a number of topics with several graphs. Here is their conclusion:

The health of the labor market clearly affects the decision of prime-age individuals to enroll in school or training, apply for disability insurance, or stay home and take care of family. Discouragement over job prospects rose during the Great Recession, causing many unemployed people to drop out of the labor force. The rise in the number of prime-age marginally attached workers reflects this trend and can account for some of the decline in participation between 2007 and 2009.CR note: I think this is an important graph ...

But most of the postrecession rise in prime-age nonparticipation is from the people who say they don't currently want a job. How much does that increase reflect trends established well before the recession, and how much can be attributed to the recession and slow recovery? It's hard to say with much certainty. For example, participation by prime-age men has been on a secular decline for decades, but the pace accelerated after 2007—see here for more discussion.

Undoubtedly, some people will reenter the labor market as it strengthens further, especially those who left to undertake additional training. But for others, the prospect of not finding a satisfactory job will cause them to continue to stay out of the labor market. The increased incidence of disability reported among prime-age individuals suggests permanent detachment from the labor market and will put continued downward pressure on participation if the trend continues. The Bureau of Labor Statistics projects that the prime-age participation rate will stabilize around its 2013 level. Given all the contradictory factors in play, we think this projection should have a pretty wide confidence interval around it.

Click on graph for larger image.

Click on graph for larger image.This graph shows the population distribution of the 25 to 54 age group over time. In 2013, the largest group is the tail end of the "boomers" - and this is a key reason why disability has increased in the prime working-age population. This also probably explains the slight pickup in retirement for prime-age workers.

A very interesting post.