by Calculated Risk on 4/16/2014 08:55:00 PM

Wednesday, April 16, 2014

Thursday: Unemployment Claims, Philly Fed Mfg Survey

Some more data from DataQuick: California March Home Sales

An estimated 32,923 new and resale houses and condos sold statewide in March. That was up 28.2 percent from 25,680 in February, and down 12.8 percent from 37,764 sales in March 2013, according to San Diego-based DataQuick.A common theme now: As distress sales decline, overall sales decline too.

Last month’s sales were the lowest for a March since 2008, when 24,565 homes sold – a record low for the month of March. California’s high for March sales was 68,848 in 2005. Last month's sales were 23.9 percent below the average of 43,251 sales for all months of March since 1988, when DataQuick's statistics begin. California sales haven’t been above average for any particular month in more than eight years.

...

Of the existing homes sold last month, 7.4 percent were properties that had been foreclosed on during the past year. That was down from a revised 8.0 percent in February and down from 15.0 percent a year earlier. California’s foreclosure resales peaked at 58.8 percent in February 2009.

Short sales - transactions where the sale price fell short of what was owed on the property - made up an estimated 7.4 percent of the homes that resold last month. That was down from an estimated 9.3 percent the month before and 18.7 percent a year earlier.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 320 thousand from 300 thousand.

• At 10:00 AM, the Philly Fed manufacturing survey for April. The consensus is for a reading of 9.1, up from 9.0 last month (above zero indicates expansion).

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in March

by Calculated Risk on 4/16/2014 05:11:00 PM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for several selected cities in March.

From CR: Total "distressed" share is down in all of these markets, mostly because of a sharp decline in short sales.

Foreclosures are down in most of these areas too, although foreclosures are up in the mid-Atlantic area and Orlando - and a little in Las Vegas (there was a state law change that slowed foreclosures dramatically in Nevada at the end of 2011 - so it isn't a surprise that foreclosures are up a little year-over-year).

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back, the share of all cash buyers will probably decline. Toledo's cash share is up.

In general it appears the housing market is slowly moving back to normal.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Mar-14 | Mar-13 | Mar-14 | Mar-13 | Mar-14 | Mar-13 | Mar-14 | Mar-13 | |

| Las Vegas | 12.9% | 33.3% | 11.7% | 11.2% | 24.6% | 44.5% | 43.1% | 57.5% |

| Reno** | 14.0% | 32.0% | 7.0% | 9.0% | 21.0% | 41.0% | ||

| Phoenix | 5.1% | 15.1% | 6.9% | 11.6% | 11.9% | 26.8% | 33.1% | 41.5% |

| Sacramento | 8.2% | 27.0% | 7.9% | 10.5% | 16.1% | 37.5% | 22.5% | 36.5% |

| Minneapolis | 4.7% | 9.3% | 21.9% | 28.3% | 26.6% | 37.6% | ||

| Mid-Atlantic | 6.4% | 11.4% | 10.9% | 10.7% | 17.3% | 22.1% | 19.9% | 20.6% |

| Orlando | 7.9% | 21.7% | 23.7% | 21.4% | 31.6% | 43.0% | 44.6% | 55.6% |

| So. California* | 7.7% | 18.7% | 6.4% | 13.8% | 14.1% | 32.5% | 29.1% | 35.1% |

| Hampton Roads | 24.5% | 28.4% | ||||||

| Northeast Florida | 39.1% | 40.2% | ||||||

| Toledo | 40.7% | 38.9% | ||||||

| Des Moines | 20.8% | 19.1% | ||||||

| Tucson | 33.5% | 35.0% | ||||||

| Georgia*** | 33.8% | NA | ||||||

| Houston | 6.8% | 12.3% | ||||||

| Memphis* | 18.5% | 26.7% | ||||||

| Springfield IL** | 14.0% | 26.1% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Fed's Beige Book: "Economic activity increased in most regions"

by Calculated Risk on 4/16/2014 02:07:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Richmond and based on information collected before April 7, 2014."

Reports from the twelve Federal Reserve Districts suggest economic activity increased in most regions of the country since the previous report. The expansion was characterized as modest or moderate by the Boston, Philadelphia, Richmond, Atlanta, Minneapolis, Kansas City, Dallas, and San Francisco Districts. Chicago reported that economic growth had picked up, and New York and Philadelphia indicated that business activity had rebounded from weather-related slowdowns earlier in the year. The Cleveland and St. Louis Districts both reported a decline in economic activity.And on real estate:

Reports on residential housing markets varied. However, across most Districts, home prices rose modestly and inventory levels remained low. Residential construction increased in several Districts; only Cleveland, St. Louis, and Minneapolis reported a decrease. ...Some positive comments on commercial real estate. This is similar to the previous beige book, but it appears there is some weather related rebound in some areas.

Commercial construction activity strengthened since the previous survey period for the Kansas City and Dallas Districts. The Richmond, Atlanta, Chicago, St. Louis, Minneapolis, and San Francisco Districts reported modest to moderate expansion in commercial construction. Philadelphia noted mild growth, while Cleveland reported a slight decline in commercial construction.

emphasis added

Yellen: Three Big Questions for the FOMC

by Calculated Risk on 4/16/2014 12:20:00 PM

From Fed Chair Janet Yellen: Monetary Policy and the Economic Recovery. Excerpts:

Is there still significant slack in the labor market?Currently Yellen sees substantial slack in the labor market, and is more concerned about low inflation than high inflation. This suggests rate will be low for a long time.

...

I will refer to the shortfall in employment relative to its mandate-consistent level as labor market slack, and there are a number of different indicators of this slack. Probably the best single indicator is the unemployment rate. At 6.7 percent, it is now slightly more than 1 percentage point above the 5.2 to 5.6 percent central tendency of the Committee's projections for the longer-run normal unemployment rate. This shortfall remains significant, and in our baseline outlook, it will take more than two years to close.

Other data suggest that there may be more slack in labor markets than indicated by the unemployment rate. For example, the share of the workforce that is working part time but would prefer to work full time remains quite high by historical standards. Similarly, while the share of workers in the labor force who are unemployed and have been looking for work for more than six months has fallen from its peak in 2010, it remains as high as any time prior to the Great Recession. ...

The low level of labor force participation may also signal additional slack that is not reflected in the headline unemployment rate. Participation would be expected to fall because of the aging of the population, but the decline steepened in the recovery. Although economists differ over what share of those currently outside the labor market might join or rejoin the labor force in a stronger economy, my own view is that some portion of the decline in participation likely represents labor market slack.

Lastly, economists also look to wage pressures to signal a tightening labor market. At present, wage gains continue to proceed at a historically slow pace in this recovery, with few signs of a broad-based acceleration.

Is inflation moving back toward 2 percent?

...

I will mention two considerations that will be important in assessing whether inflation is likely to move back to 2 percent as the economy recovers. First, we anticipate that, as labor market slack diminishes, it will exert less of a drag on inflation. However, during the recovery, very high levels of slack have seemingly not generated strong downward pressure on inflation. We must therefore watch carefully to see whether diminishing slack is helping return inflation to our objective.10 Second, our baseline projection rests on the view that inflation expectations will remain well anchored near 2 percent and provide a natural pull back to that level. But the strength of that pull in the unprecedented conditions we continue to face is something we must continue to assess.

Finally, the FOMC is well aware that inflation could also threaten to rise substantially above 2 percent. At present, I rate the chances of this happening as significantly below the chances of inflation persisting below 2 percent, but we must always be prepared to respond to such unexpected outcomes, which leads us to my third question.

What factors may push the recovery off track?

Myriad factors continuously buffet the economy, so the Committee must always be asking, "What factors may be pushing the recovery off track?" For example, over the nearly 5 years of the recovery, the economy has been affected by greater-than-expected fiscal drag in the United States and by spillovers from the sovereign debt and banking problems of some euro-area countries. Further, our baseline outlook has changed as we have learned about the degree of structural damage to the economy wrought by the crisis and the subsequent pace of healing.

A comment on Housing Starts

by Calculated Risk on 4/16/2014 11:27:00 AM

There were 203 thousand total housing starts in Q1 this year (not seasonally adjusted, NSA), down 2% from the 208 thousand during Q1 of 2013. Note: Permits were up 6% in Q1 2014 compared to Q1 2013 - still weak growth, but positive.

The weak start to 2014 was due to several factors: severe weather, higher mortgage rates, higher prices and probably supply constraints in some areas.

It is also important to note that Q1 was a difficult year-over-year comparison for housing starts. There was a huge surge for housing starts in Q1 2013 (up 34% over Q1 2012). Then starts softened a little over the next 7 months until November.

Click on graph for larger image.

Click on graph for larger image.

This year, I expect starts to be stronger over the next couple of quarters - and more starts combined with an easier comparison means starts will be up solidly year-over-year.

In 2013, the year-over-year comparisons ranged from a high of 42% to a low of just 2% - so there is quite a bit of variability. Overall starts finished up a solid 18.5% last year compared to 2012, and I still expect solid growth this year.

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family completions in 2014, but probably still below the 1997 through 2007 level of multi-family completions. Multi-family starts will probably move more sideways in 2014.

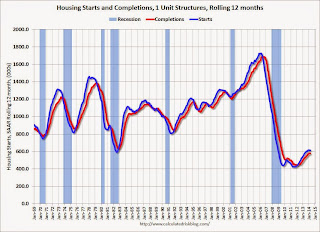

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Starts have been moving up, and completions have followed.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Fed: Industrial Production increased 0.7% in March

by Calculated Risk on 4/16/2014 09:15:00 AM

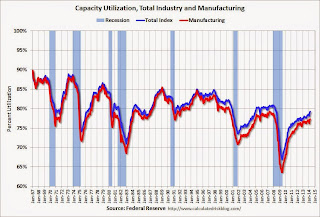

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.7 percent in March after having advanced 1.2 percent in February. The rise in February was higher than previously reported primarily because of stronger gains for durable goods manufacturing and for mining. For the first quarter as a whole, industrial production moved up at an annual rate of 4.4 percent, just slightly slower than in the fourth quarter of 2013. In March, the output of manufacturing rose 0.5 percent, the output of utilities increased 1.0 percent, and the output of mines gained 1.5 percent. At 103.2 percent of its 2007 average, total industrial production in March was 3.8 percent above its level of a year earlier. Capacity utilization for total industry increased in March to 79.2 percent, a rate that is 0.9 percentage point below its long-run (1972–2013) average but 1.2 percentage points higher than a year prior.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.2% is still 0.9 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.7% in March to 103.2. This is 23% above the recession low, and 2.5% above the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were above expectations.

Housing Starts at 946 Thousand Annual Rate in March

by Calculated Risk on 4/16/2014 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in March were at a seasonally adjusted annual rate of 946,000. This is 2.8 percent above the revised February estimate of 920,000, but is 5.9 percent below the March 2013 rate of 1,005,000.

Single-family housing starts in March were at a rate of 635,000; this is 6.0 percent above the revised February figure of 599,000. The March rate for units in buildings with five units or more was 292,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 990,000. This is 2.4 percent below the revised February rate of 1,014,000, but is 11.2 percent above the March 2013 estimate of 890,000.

Single-family authorizations in March were at a rate of 592,000; this is 0.5 percent above the revised February figure of 589,000. Authorizations of units in buildings with five units or more were at a rate of 370,000 in March.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in March (Multi-family is volatile month-to-month).

Single-family starts (blue) increased in March.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was below expectations of 965 thousand starts in March. Note: Starts for February were revised up to 920 thousand from 907 thousand. I'll have more later.

MBA: Mortgage Applications Increase

by Calculated Risk on 4/16/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 11, 2014. ...

The Refinance Index increased 7 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.47 percent from 4.56 percent, with points decreasing to 0.32 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 73% from the levels in May 2013.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 18% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index.

Tuesday, April 15, 2014

Wednesday: Housing Starts, Industrial Production, Yellen Speech, Beige Book

by Calculated Risk on 4/15/2014 08:04:00 PM

A reminder of a friendly bet I made with NDD on housing starts in 2014:

If starts or sales are up at least 20% YoY in any month in 2014, [NDD] will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.Of course, with the terms of the bet, we could both "win" at some point during the year. (I expect to "win" in a few months, but not quite yet).

In March 2013, starts were at a 1.005 million seasonally adjusted annual rate (SAAR). For me to win, starts would have to be up 20% or at 1.206 million SAAR in March (not likely). For NDD to win, starts would have to fall to 905 thousand SAAR (possible). NDD could also "win" if permits fall to 790 thousand SAAR from 890 thousand SAAR in March 2013 (not likely).

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for March. Total housing starts were at 907 thousand (SAAR) in February. Single family starts were at 583 thousand SAAR in February. The consensus is for total housing starts to increase to 965 thousand (SAAR) in March.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for March. The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 78.8%.

• At 12:25 PM, Speech by Fed Chair Janet Yellen, Monetary Policy and the Economic Recovery, At the Economic Club of New York, New York, New York

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Lawler: Early Read on Existing Home Sales in March

by Calculated Risk on 4/15/2014 04:39:00 PM

From housing economist Tom Lawler:

Based on realtor association/board/MLS reports from across the country, I estimate that US existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.64 million in March, up 0.9% from February’s preliminary pace, but down 6.5% from last March’s seasonally adjusted pace. If my estimate is correct, then first-quarter existing home sales this year would be down 6.3% from the comparable quarter of 2013. Depending on the area of the country, weather, lower distressed sales, lower investor purchases, and weak demand from primary-residence purchases (especially from first-time buyers), the latter partly reflecting lower inventories of affordably-priced homes (even though overall inventories of homes for sale were higher), contributed to the “surprisingly” weak pace of sales last quarter.

On the inventory front, I estimate (based on realtor/MLS reports, as well as reports from entities tracking listings) that the inventory of existing homes for sale as measured by the NAR increased by 4.0% from February to March to 2.080 million, which would be up 7.8% from last March’s level.

Finally, my “best guess” based on realtor reports is that the NAR’s estimate of the median existing SF home sales price in March will be up 8.7% from last March.

CR Note: The NAR is scheduled to report March existing home sales on Tuesday, April 22nd. Based on Lawler's estimates, months-of-supply increased to around 5.4 months in March - the highest level since mid-2012.