by Calculated Risk on 4/27/2014 10:38:00 AM

Sunday, April 27, 2014

Ranking Economic Data

Here is an update to a list I posted several years ago with my ranking of economic data releases.

These lists are not exhaustive (I'm sure I left a few off), and the rankings are not static. As an example, a few years ago I ranked initial weekly unemployment claims as ‘B List’ data, but now that claims are close to normal levels, I've moved weekly claims down to the 'C List'. Currently I'm watching measures of household debt a little closer and I've moved up the NY Fed's quarterly "Household Debt and Credit Report" to the C-list.

Note: There has been some research by Wall Street analysts about how "surprises" for many of these indicators impact the stock market. In general the ranking is similar with the employment situation report being #1.

The NAR existing home sales report is difficult to rank. 'For sale' inventory is important - almost "B-List" - but the headline sales number is more "C-List".

For each indicator I've included a link to the source and a recent post with graphs (in parenthesis).

Some of the lower ranked data is useful as leading indicators. As an example, the Architecture Billings Index is a leading indicator for investment in commercial real estate. And the NMHC apartment survey leads changes in apartment rents and vacancy rates. Also some of the lower ranked data helps forecast some of the more important data.

Both A-List reports (employment and GDP) will be released this week.

A-List

• BLS: Employment Situation Report, (March Employment Report: 192,000 Jobs, 6.7% Unemployment Rate and Comments on Employment Report)

• BEA: GDP Report (quarterly) (Q4 GDP Revised up to 2.6%)

B-List

• Census: New Home Sales (New Home Sales decline to 384,000 Annual Rate in March)

• Census: Housing Starts (Housing Starts at 946 Thousand Annual Rate in March and A comment on Housing Starts)

• ISM Manufacturing Index (ISM Manufacturing index increased in March to 53.7)

• Census: Retail Sales (Retail Sales increased 1.1% in March)

• BEA: Personal Income and Outlays (Personal Income increased 0.3% in February, Spending increased 0.3%)

• Fed: Industrial Production (Fed: Industrial Production increased 0.7% in March)

• BLS: Core CPI (Key Inflation Measures Shows Slight Increase, but still Low in March)

C-List

• NAR: Existing Home Sales (Existing Home Sales in March: 4.59 million SAAR, Inventory up 3.1% Year-over-year)

• DOL: Weekly Initial Unemployment Claims (Weekly Initial Unemployment Claims at 329,000)

• Manufacturers: Light Vehicle Sales (U.S. Light Vehicle Sales increase to 16.4 million annual rate in March, Highest since 2007)

• Philly Fed: Philly Fed Index (Philly Fed Manufacturing Survey indicated Faster Expansion in April)

• NY Fed Empire State Manufacturing Index (NY Fed: Empire State Manufacturing Survey indicates "business activity was flat" in April)

• Chicago ISM: Chicago PMI (Chicago PMI declines to 55.9)

• Census: Durable Goods

• ISM Non-Manufacturing Index (ISM Non-Manufacturing Index increases to 53.1 in March)

• House Prices: Case-Shiller and CoreLogic (CoreLogic: House Prices up 12.2% Year-over-year in February and Comment on House Prices: Graphs, Real Prices, Price-to-Rent Ratio, Cities)

• BLS: Job Openings and Labor Turnover Survey (BLS: Jobs Openings increase to 4.2 million in February)

• Census: Construction Spending (Construction Spending increased slightly in February)

• Census: Trade Balance (Trade Deficit increased in February to $42.3 Billion)

• MBA: Mortgage Delinquency Data (Quarterly) (MBA: Mortgage "Delinquency and Foreclosure Rates Decline to Lowest Level in Six Years" in Q4)

• LPS: Mortgage Delinquency Data (Black Knight: Mortgage delinquency rate in March lowest since October 2007)

• CoreLogic and Zillow: Negative Equity Report and Zillow (quarterly) (CoreLogic: 4 Million Residential Properties Returned to Positive Equity in 2013 and Zillow: Negative Equity declines further in Q4 2013)

• AIA: Architecture Billings Index (AIA: Architecture Billings Index indicated contraction in March)

• NY Fed: Household Debt and Credit Report (Quarterly) (NY Fed: Household Debt increased in Q4, Delinquency Rates Improve)

D-List

• Fed: Household Debt Service and Financial Obligations Ratios (Quarterly) (Fed: Q4 Household Debt Service Ratio near 30 year low)

• Fed: Flow of Funds (Quarterly) (Mortgage Equity Withdrawal Still Negative in Q4)

• Richmond Fed: Richmond Fed Manufacturing Index

• Kansas City Fed: Kansas City Fed Manufacturing Index

• Dallas Fed: Dallas Fed Manufacturing Index

• Reis: Office, Mall, Apartment Vacancy Rates (Quarterly) (Reis: Office Vacancy Rate declined slightly in Q1 to 16.8% and Reis: Apartment Vacancy Rate declined to 4.0% in Q1 2014 and Reis: Mall Vacancy Rates unchanged in Q1)

• NMHC Apartment Survey (Quarterly) (NMHC Survey: Apartment Market Conditions Softer in Q4)

• Reuters / Univ. of Michigan Consumer Sentiment Index (Final April Consumer Sentiment at 84.1)

• MBA: Mortgage Purchase Applications Index (MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey)

• NAHB: Housing Market Index (NAHB: Builder Confidence increased slightly in April to 47)

• Census: Housing Vacancy Survey (Quarterly) (HVS: Q4 2013 Homeownership and Vacancy Rates)

• Fed: Senior Loan Officer Survey (Quarterly) (Fed Survey: Banks eased lending standards, Experienced increased demand)

• ATA: Trucking (ATA Trucking Index increased in February)

• NFIB: Small Business Survey (NFIB: Small Business Optimism Index increases in March)

• STR: Hotel Occupancy (Hotels: Occupancy Rate, RevPAR decrease in latest weekly survey)

• NRA: Restaurant Performance Index

• Fed: Consumer Credit

• DOT: Vehicle Miles Driven (DOT: Vehicle Miles Driven decreased 0.8% year-over-year in February)

• LA and Long Beach Port Traffic: LA area Port Traffic: Up year-over-year in March, Exports at New High)

• BLS: Producer Price Index

• ADP Employment Report

• Conference Board Confidence Index

• NAR: Pending Home Sales

Sources (Government):

BEA: Bureau of Economic Analysis

BLS: Bureau of Labor Statistics

Census: Census Bureau

DOL: Dept of Labor

DOT: Dept. of Transportation

Fed: Federal Reserve

Sources (Industry):

AIA: American Institute of Architects

ISM: Institute for Supply Management

LPS: Black Knight

MBA: Mortgage Bankers Association

NAHB: National Association of Homebuilders

NAR: National Association of Realtors

NFIB: National Federation of Independent Business

NRA: National Restaurant Association

STR: Smith Travel Research

Saturday, April 26, 2014

Schedule for Week of April 27th

by Calculated Risk on 4/26/2014 01:11:00 PM

This will be a busy week for economic data with several key reports including the April employment report on Friday and the advance Q1 GDP report on Wednesday.

Other key reports include the ISM manufacturing index on Thursday, April vehicle sales, also on Thursday, and the February Case-Shiller house price index on Tuesday.

There will a two-day FOMC meeting on Tuesday and Wednesday, and the Fed is expected to announce on Wednesday a decrease in asset purchases from $55 billion per month to $45 billion per month.

10:00 AM ET: Pending Home Sales Index for March. The consensus is for a 0.6% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for April. This is the last of the regional Fed manufacturing surveys for April.

9:00 AM: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February.

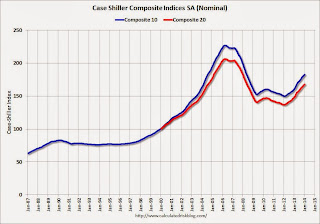

9:00 AM: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through January 2014 (the Composite 20 was started in January 2000).

The consensus is for a 13.0% year-over-year increase in the Composite 20 index (NSA) for February. The Zillow forecast is for the Composite 20 to increase 12.8% year-over-year, and for prices to increase 0.6% month-to-month seasonally adjusted.

10:00 AM: Conference Board's consumer confidence index for April. The consensus is for the index to increase to 83.0 from 82.3.

10:00 AM: Q1 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in April, up from 191,000 in March.

8:30 AM: Q1 GDP (advance estimate). This is the advance estimate of Q1 GDP from the BEA. The consensus is that real GDP increased 1.1% annualized in Q1.

9:45 AM: Chicago Purchasing Managers Index for April. The consensus is for an increase to 56.9, up from 55.9 in March.

2:00 PM: FOMC Meeting Announcement. No change in interest rates is expected (for a long time). However the FOMC is expected to reduce QE3 asset purchases by $10 billion per month at this meeting.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 320 thousand from 329 thousand.

All day: Light vehicle sales for April. The consensus is for light vehicle sales to decrease to 16.2 million SAAR in April (Seasonally Adjusted Annual Rate) from 16.3 million SAAR in March.

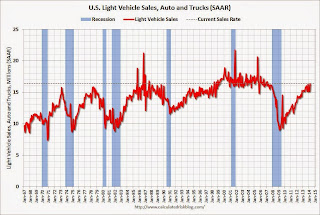

All day: Light vehicle sales for April. The consensus is for light vehicle sales to decrease to 16.2 million SAAR in April (Seasonally Adjusted Annual Rate) from 16.3 million SAAR in March.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the March sales rate.

8:30 AM: Personal Income and Outlays for March. The consensus is for a 0.4% increase in personal income, and for a 0.6% increase in personal spending. And for the Core PCE price index to increase 0.2%.

8:30 AM: Speech by Fed Chair Janet Yellen, Community Bank Supervision, At the Independent Community Bankers of America 2014 Washington Policy Summit, Washington, D.C.

9:00 AM ET: The Markit US PMI Manufacturing Index for April.

10:00 AM ET: ISM Manufacturing Index for April. The consensus is for an increase to 54.2 from 53.7 in March.

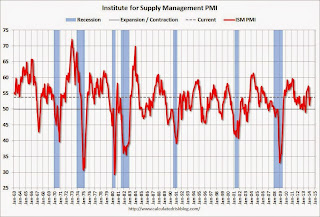

10:00 AM ET: ISM Manufacturing Index for April. The consensus is for an increase to 54.2 from 53.7 in March.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in March at 53.7%. The employment index was at 51.1%, and the new orders index was at 55.1%.

10:00 AM: Construction Spending for March. The consensus is for a 0.6% increase in construction spending.

8:30 AM: Employment Report for April. The consensus is for an increase of 215,000 non-farm payroll jobs in April, up from the 192,000 non-farm payroll jobs added in March.

The consensus is for the unemployment rate to decline to 6.6% in April.

This graph shows the percentage of payroll jobs lost during post WWII recessions through March.

This graph shows the percentage of payroll jobs lost during post WWII recessions through March.The economy has added 8.9 million private sector jobs since employment bottomed in February 2010 (8.3 million total jobs added including all the public sector layoffs).

There are 110 thousand more private sector jobs now than when the recession started in 2007, but total employment is still 437 thousand below the pre-recession peak.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for March. The consensus is for a 1.3% increase in March orders.

Unofficial Problem Bank list declines to 513 Institutions

by Calculated Risk on 4/26/2014 07:53:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for April 25, 2014.

Changes and comments from surferdude808:

Today, the FDIC released an update on its enforcement action activities through March 2013 that contributed to many changes to the Unofficial Problem Bank List. For the week, there were nine removals and one addition that leave the list at 513 institutions with assets of $167.3 billion. A year ago, the list held 775 institutions with assets of $285.3 billion. During the month, the list declined from 538 to 513 institutions after 21 action terminations, five mergers, one failure, and two additions. Assets fell by $7.0 billion this month.

Actions were terminated against Finance Factors, Ltd., Honolulu, HI ($482 million); Oxford Bank & Trust, Oak Brook, IL ($446 million); Mohave State Bank Lake, Havasu City, AZ ($288 million Ticker: SBAZ); Mariners Bank, Edgewater, NJ ($249 million); Coast National Bank, San Luis Obispo, CA ($120 million Ticker: CTBP); State Central Bank, Bonaparte, IA ($71 million); The Home Building and Loan Company, Greenfield, OH ($38 million); and The First State Bank, Ryan, OK ($29 million).

Allendale County Bank, Fairfax, SC ($55 million) left the list by being the sixth failure of the year. With an initial loss estimate of 31.4 percent of assets, this is the most costly failure this year when measured as a share of assets. Since the on-set of the Great Recession, there have been 10 failures in South Carolina, which ranks 13th highest across all states. Moreover, failures in the FDIC Southeast's office based in Atlanta now total 187 across seven states with a loss estimate of $31.8 billion or nearly 29 percent of failed bank assets. Guess the high number of costly failures is what happens when warnings about the developing real estate bubble went unheeded. Many of us are waiting for the FDIC to publish a comprehensive post-mortem analysis on the regulatory failures of the last decade similar to what they published after the 1980s (see History of the 80s). Instead all they chose to publish is research on the state of community banking.

Added this week was New Jersey Community Bank, Freehold, NJ ($144 million). Also, the FDIC issued a Prompt Corrective Action order against Columbia Savings Bank, Cincinnati, OH ($38 million), which has been operating under a Cease & Desist order since February 2011.

Friday, April 25, 2014

Bank Failure #6 in 2014: Allendale County Bank, Fairfax, South Carolina

by Calculated Risk on 4/25/2014 05:35:00 PM

From the FDIC: Palmetto State Bank, Hampton, South Carolina, Assumes All of the Deposits of Allendale County Bank, Fairfax, South Carolina

As of December 31, 2013, Allendale County Bank had approximately $54.5 million in total assets and $51.0 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $17.1 million. ... Allendale County Bank is the sixth FDIC-insured institution to fail in the nation this year, and the first in South Carolina.Does anyone remember bank failures? (this is the first failure since February!)

Vehicle Sales Forecasts: Solid in April

by Calculated Risk on 4/25/2014 01:52:00 PM

Auto sales were clearly impacted by the harsh winter weather in January and February, and then rebounded sharply in March. The rebound in March was predicted by Atif Mian and Amir Sufi Weakening Economy or Just Bad Winter?

Note: The automakers will report April vehicle sales on Thursday, May 1st. Sales in March were at a 16.3 million seasonally adjusted annual rate (SAAR), and it appears sales in April will be above 16 million (SAAR) too.

Here are a few forecasts:

From J.D. Power: April New-Vehicle Retail Sales Showing Growth, With Consumer Spending at Record-Level Pace

New light-vehicle retail sales are expected to reach their highest levels for the month of April since 2005, according to a monthly sales forecast developed jointly by J.D. Power and LMC Automotive. ... Total light-vehicle sales in April 2014 are expected to reach 1.4 million units, a 4 percent increase from April 2013. [16.1 million SAAR]Note: In April 2014, there was one more selling day than in April 2013 (26 days vs. 25 last year).

From Edmunds.com: Car Sales Settle into a Groove in April, Says Edmunds.com

Edmunds.com ... forecasts that 1,401,606 new cars and trucks will be sold in the U.S. in April for an estimated Seasonally Adjusted Annual Rate (SAAR) of 16.2 million. ... The forecast anticipates that the auto industry will enjoy its best April performance since dealers sold 1,444,587 vehicles in April 2006.From TrueCar: April SAAR to Hit 16.2 Million Vehicles, According to TrueCar; 2014 New Vehicle Sales Expected to be up 8 Percent Year-Over-Year

New light vehicle sales in the U.S. (including fleet) are expected to reach 1,382,000 units, up 7.5 percent from April 2013 and down 10.0 percent from March 2014. ... Seasonally Adjusted Annualized Rate ("SAAR") of 16.2 million new vehicle sales is up 9.2 percent from April 2013 and down 0.5 percent over March 2014.

A Few Q1 GDP Forecasts

by Calculated Risk on 4/25/2014 11:01:00 AM

The BEA is scheduled to release the advance estimate for Q1 Gross Domestic Product (GDP) next week on Wednesday, April 30th. The consensus forecast is for real GDP to increase 1.1% in Q1 (from Q4, annualized). Here are a few forecasts:

From Kris Dawsey at Goldman Sachs:

Despite GDP likely growing at an anemic rate of around 1.0% in Q1, we remain optimistic about the rest of 2014. The core narrative for a pickup in growth this year has not changed. The fiscal drag is still lower, consumer spending should still strengthen, and business investment seems poised for a comeback. We see the weakness in Q1 as mainly driven by temporary factors, including a large drag from weather and inventories. The recent encouraging dataflow—with the exception of some of the housing numbers—appears consistent with our forecast for a near-term pickup. For the remainder of 2014, 3%+growth remains our baseline. ...From Merrill Lynch:

We forecast 1.8% growth in real final sales in Q1 (GDP growth excluding the effects of the volatile inventories category). ... Inventory investment was a significant positive contributor to growth in 2013, adding 3/4 percentage point to growth over the four quarters of the year. ... In Q1, the rate of real inventory accumulation appears to have moderated based on the incoming data on manufacturing, wholesale, and retail inventories, which will be a drag on Q1 GDP growth.

emphasis added

We think the first estimate of 1Q GDP will show sluggish growth of only 1.2% qoq saar. A large part of the weakness owes to the cold weather which held back economic activity in the beginning of the year. Inventories are also being drawn down, albeit gradually, as businesses were caught with excess stockpiles. We estimate that inventories will slice 0.6pp from growth, matching the drag to the economy from a wider trade deficit. Residential investment is also likely to contract, reflecting the decline in home sales and sluggish housing starts. ... We think momentum will improve in the spring, setting the stage for a rebound in 2Q with growth above 3.0%.From Nomura:

For the first release of 1Q GDP, we are looking for relatively soft readings on key inflation metrics in this report. Specifically, we expect both the GDP deflator and the core PCE deflator to rise 1.3% qoq saar for 1Q.

Disregard the backward-looking Q1 GDP, April data should show the recovery taking off. ... Weather weighed on economic activity early in the year. This should be reflected in a markedly slower pace of GDP growth in Q1. We expect GDP to grow at an annualized rate of 0.9% in Q1, compared with 2.6% in Q4.And on the April employment report to be released next Friday, the consensus is for 210 thousand payroll jobs added with Merrill forecasting 215 thousand and Nomura forecasting 225 thousand.

Final April Consumer Sentiment at 84.1

by Calculated Risk on 4/25/2014 09:58:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for April increased to 84.1 from the March reading of 80.0, and was up from the preliminary April reading of 82.6.

This was above the consensus forecast of 82.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

I expect to see sentiment at post-recession highs very soon.

Thursday, April 24, 2014

Friday: Consumer Sentiment

by Calculated Risk on 4/24/2014 08:08:00 PM

From Nick Timiraos at the WSJ: Demand for Home Loans Plunges

Lenders originated $235 billion in mortgage loans during the January-March quarter, down 58% from the same period a year ago and down 23% from the fourth quarter of 2013, according to industry newsletter Inside Mortgage Finance.Note: Many of the smaller lenders focus on the home purchase market and many of these small lenders are not included in the weekly MBA index. That is why the MBA purchase index is down about 18% year-over-year, but actual purchase activity is flat (according to Inside Mortgage Finance).

...

The decline in mortgage lending last quarter stemmed almost entirely from the slide in refinancing. Loans for home purchases were basically flat from a year earlier and down from the fourth quarter.

...

The top 25 lenders accounted for 63.9% of all originations in the first quarter, also a 14-year low. That is down from 65.3% at the end of last year and a high of 90.9% in 2008, according to Inside Mortgage Finance.

Friday:

• At 9:55 AM ET, the Reuter's/University of Michigan's Consumer sentiment index (final for April). The consensus is for a reading of 82.5, down from the preliminary reading of 82.6, but up from the March reading of 80.0.

Lawler: More Builder Results, Summary of Q1 Results so far

by Calculated Risk on 4/24/2014 03:29:00 PM

D.R. Horton, the nation’s largest home builder, reported that net home orders in the quarter ended March 31, 2014 totaled 8,569, up 8.8% from the comparable quarter of 2013. Horton’s average community count last quarter was up 11% from a year ago. The company’s sales cancellation rate, expressed as a % of gross orders, was 19%, unchanged from a year ago. Home deliveries totaled 6,194 last quarter, up 13.4% from the comparable quarter, at an average sales price of $271,230, up 11.8% from a year ago. The company’s order backlog at the end of March was 10,059, up 5.3% from last March.

In response to overall weak demand from first-time home buyer, partly attributable in home price increases over the past two years, Horton announced in its conference call that is initiating a new product line called “express homes,” which will be smaller and priced lower than its current product lines and will be targeted to first-time buyers. An official said that first-time home buyers represented 42% of the purchase mortgages handled by its mortgage subsidiary last quarter, down from 50% in the comparable quarter of 2013. An official also said that the company increased sales incentives “some, but not significantly,” last quarter.

D.R. Horton’s results were stronger than consensus.

PulteGroup, the nation’s second largest home builder, reported that net home orders in the quarter ended March 31, 2014 totaled 4,863, down 6.5% from the comparable quarter of 2013. While net orders were down from a year ago, the company said that absorptions per community were up from last year. (Pulte has focused more on returns and less on expansion). Home deliveries last quarter totaled 3,436, down 10.4% from the comparable quarter of 2013, at an average sales price of $317,000, up 10.5% from a year ago. The company’s order backlog at the end of March was 7,199, down 8% from last March. Company officials noted that absorption rates per community were up significantly from a year ago in its lower-priced Centex division, but that this gain mainly reflected the strong Texas market, and not strength in first-time home buyer demand.

The Ryland Group, the nation’s eighth largest home builder, reported that net home orders in the quarter ended March 31, 2014 totaled 2,186, up 6.5% from the comparable quarter of 2013. Ryland’s community count in March was up 18.8% from last March, and the company’s average sales absorption rate per community last quarter was down by over 10% from a year ago. The company’s sales cancellation rate, expressed as a % of gross orders, was 15.3%, little changed from 15.4% a year earlier. Home deliveries last quarter totaled 1,470, up 11.8% from the comparable quarter of 2013, at an average sales price of $327,000, up 18.1% from a year ago. The company’s order backlog at the end of March was 3,342, up 6.6% from last March, with an average order price of $330,000, up 14.2% from a year ago. Ryland owned or controlled 39,482 lots at the end of March, up 30.3% from last March and up 69.5% from two years ago.

M/I Homes, the nation’s 16th largest home builder, reported that net home orders in the quarter ended March 31, 2014 totaled 982, down 6.2% from the comparable quarter of 2013. M/I’s average community count last quarter was 158, up 17.0% from the comparable quarter of 2013, and the company’s net sales per community last quarter were down 21% from a year ago. The company’s sales cancellation rate, expressed as a % of gross orders, was 16% last quarter up slightly from 15% a year earlier. Home deliveries last quarter totaled 737, up 17.5% from the comparable quarter of 2013, at an average sales price of $299,000, up 5.3% from a year ago. The company’s order backlog at the end of March was 1,525, up 10.1% from last March. M/I owned or controlled 20,965 lots at the end of March, up 28.2% from a year ago.

Here is a summary of some results from large, publicly-traded builders

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 3/14 | 3/13 | % Chg | 3/14 | 3/13 | % Chg | 3/14 | 3/13 | % Chg |

| D.R. Horton | 8,569 | 7,879 | 8.8% | 6,194 | 5,463 | 13.4% | $271,230 | $242,548 | 11.8% |

| Pulte Group | 4,863 | 5,200 | -6.5% | 3,436 | 3,833 | -10.4% | $317,000 | $287,000 | 10.5% |

| NVR | 3,325 | 3,510 | -5.3% | 2,211 | 2,272 | -2.7% | $361,400 | $330,400 | 9.4% |

| The Ryland Group | 2,186 | 2,052 | 6.5% | 1,470 | 1,315 | 11.8% | $327,000 | $277,000 | 18.1% |

| Meritage Homes | 1,525 | 1,547 | -1.4% | 1,109 | 1,052 | 5.4% | $365,896 | $314,363 | 16.4% |

| M/I Homes | 982 | 1,047 | -6.2% | 737 | 627 | 17.5% | $299,000 | $284,000 | 5.3% |

| Total | 21,450 | 21,235 | 1.0% | 15,157 | 14,562 | 4.1% | $308,445 | $278,040 | 10.9% |

Hotels: Occupancy Rate, RevPAR decrease in latest weekly survey

by Calculated Risk on 4/24/2014 03:12:00 PM

From HotelNewsNow.com: US hotels report occupancy, RevPAR decreases

The U.S. hotel industry reported occupancy and revenue-per-available-room decreases during the week of 13-19 April 2014, according to data from STR, parent company of Hotel News Now.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

Overall, in year-over-year measurements, the industry’s occupancy decreased 2.7% to 62.8%. RevPAR decreased 0.3% to $70.58. Average daily rate increased 2.5% to $112.37.

emphasis added

The weekly decline was probably related to the timing of Easter, however the 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is at the highest level since 2000.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014 and black is for 2009 - the worst year since the Great Depression for hotels.

Through April 19th, the 4-week average of the occupancy rate is tracking higher than pre-recession levels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com