by Calculated Risk on 5/05/2014 04:38:00 PM

Monday, May 05, 2014

Weekly Update: Housing Tracker Existing Home Inventory up 8.6% year-over-year on May 5th

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for March). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 8.6% above the same week in 2013.

Inventory is still very low - still below the level in 2012 (yellow) when prices started increasing - but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

Construction Employment: Pace of Hiring Increasing

by Calculated Risk on 5/05/2014 01:19:00 PM

Here is an excerpt from a post I wrote in 2012: Where are the construction jobs?

Back in 2006, I predicted we'd see construction job losses in the seven figures. All through 2006 and into 2007, I was constantly asked: "Where are the construction job losses you predicted?"And from Michelle Meyer last year on the lag between activity and construction employment: Construction Coming Back and other researchers More Research on Construction Employment

And then it started ... and the BLS reported construction employment fell 2.27 million from peak to trough. No one asks that question any more.

There were several reasons why construction jobs didn't decline at the same time as housing starts. First, construction includes residential, commercial and other construction (like roads). Even after housing starts began to collapse, commercial real estate was still booming and workers shifted from residential to commercial (many commercial projects have long time frames - and many developers remained in denial). Also some construction workers are paid in cash (illegal immigrants), and these workers weren't counted on the BLS payrolls.

Now people are asking "Where are the construction jobs?"

Oh, Grasshopper ... the construction jobs are coming.

Now is appears the pace of hiring is starting to pickup:

| Annual Change in Construction Payroll jobs (000s) | |

|---|---|

| Year | Total Construction Jobs |

| 2002 | -85 |

| 2003 | 127 |

| 2004 | 290 |

| 2005 | 416 |

| 2006 | 152 |

| 2007 | -195 |

| 2008 | -789 |

| 2009 | -1,047 |

| 2010 | -192 |

| 2011 | 144 |

| 2012 | 114 |

| 2013 | 156 |

| 20141 | 124 |

| 1Change through April, 372 thousand annualized rate | |

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 568 thousand.

Historically there is a lag between an increase in activity and more hiring - and it appears hiring should pickup significant in 2014.

ISM Non-Manufacturing Index increased in April to 55.2

by Calculated Risk on 5/05/2014 10:00:00 AM

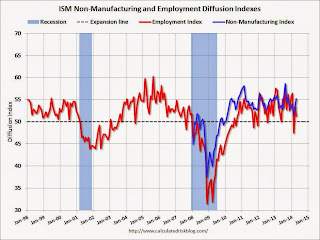

The April ISM Non-manufacturing index was at 55.2%, up from 53.1% in March. The employment index decreased in April to 51.3%, down from 53.6% in March. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: April 2014 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in April for the 51st consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 55.2 percent in April, 2.1 percentage points higher than March's reading of 53.1 percent. The Non-Manufacturing Business Activity Index increased substantially to 60.9 percent, which is 7.5 percentage points higher than the March reading of 53.4 percent, reflecting growth for the 57th consecutive month at a much faster rate. The New Orders Index registered 58.2 percent, 4.8 percentage points higher than the reading of 53.4 percent registered in March. The Employment Index decreased 2.3 percentage points to 51.3 percent from the March reading of 53.6 percent and indicates growth for the second consecutive month, but at a slower rate. The Prices Index increased 2.5 percentage points from the March reading of 58.3 percent to 60.8 percent, indicating prices increased at a faster rate in April when compared to March. According to the NMI®, 14 non-manufacturing industries reported growth in April. The majority of survey respondents' comments indicate that both business conditions and the economy are improving."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 54.0% and suggests faster expansion in April than in March.

Mortgage Monitor: Mortgage delinquency rate in March lowest since October 2007, "Only One in 10 American Borrowers Underwater"

by Calculated Risk on 5/05/2014 09:14:00 AM

Black Knight Financial Services (BKFS, formerly the LPS Data & Analytics division) released their Mortgage Monitor report for March today. According to BKFS, 5.52% of mortgages were delinquent in March, down from 5.97% in February. BKFS reports that 2.13% of mortgages were in the foreclosure process, down from 3.38% in March 2013.

This gives a total of 7.65% delinquent or in foreclosure. It breaks down as:

• 1,571,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,199,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,070,000 loans in foreclosure process.

For a total of 3,840,000 loans delinquent or in foreclosure in March. This is down from 4,997,000 in March 2013.

Click on graph for larger image.

This graph from BKFS shows percent of loans delinquent and in the foreclosure process over time.

Delinquencies and foreclosures are moving down - and might be back to normal levels in a couple of years.

The data showed that, as home prices have risen over the past two years and many distressed loans have worked their way through the system, the percentage of Americans in negative equity positions on their mortgage has declined considerably. Meanwhile, those loans already in the foreclosure process have been aging substantially. According to Kostya Gradushy, Black Knight’s manager of Loan Data and Customer Analytics, both data trends point to a healthier housing market.There is much more in the mortgage monitor.

“Two years of relatively consecutive home price increases and a general decline in the number of distressed loans have contributed to a decreasing number of underwater borrowers,” said Gradushy. “Looking at current combined loan-to-value (CLTV), we see that while four years ago 34 percent of borrowers were in negative equity positions, today that number has dropped to just about 10 percent of active mortgage loans. While negative equity levels have declined for both judicial vs. non-judicial foreclosure states from the peak of the crisis, non-judicial states are now at just under eight percent, as compared to 13.4 percent in their judicial counterparts. Overall, nearly half of all borrowers today are both in positive equity positions and of strong credit quality – credit scores of 700 or above. Four years ago, that category of borrowers represented over a third of active mortgages.

emphasis added

Sunday, May 04, 2014

Sunday Night Futures

by Calculated Risk on 5/04/2014 08:25:00 PM

Some great analysis and graphs from Jim Hamilton at Econbrowser: Is the Fed near its target?

Monday:

• Early: the Black Knight Mortgage Monitor for March.

• At 10:00 AM ET, ISM non-Manufacturing Index for April. The consensus is for a reading of 54.0, up from 53.1 in March. Note: Above 50 indicates expansion, below 50 contraction.

Weekend:

• Schedule for Week of May 4th

• Goldman Sachs on the Labor Force Participation Rate

• Participation Rate: Trends and Cohorts

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and DOW futures are up slightly (fair value).

Oil prices are down over the last week with WTI futures at $99.88 per barrel and Brent at $108.59 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.65 per gallon (might have peaked, but still more than 10 cents above the level of a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Participation Rate: Trends and Cohorts

by Calculated Risk on 5/04/2014 12:59:00 PM

A frequent question is: "I've heard the participation rate for older workers is increasing, yet you say one of the reasons the overall participation rate has fallen is because people are retiring. Is this a contradiction?"

Answer: This isn't a contradiction. When we talk about an increasing participation rate for older workers, we are referring to people in a certain age group. As an example, for people in the "60 to 64" age group, the participation rate has increased over the last ten years from 51.1% in April 2004 to 55.7% in April 2014 (see table at bottom for changes in all 5 year age groups over the last 10 years).

However, when we talk about the overall participation rate, we also need to know how many people are in a particular age group at a given time. As an example, currently there is a large cohort that has recently moved into the "60 to 69" age group. To calculate the overall participation rate we need to multiple the participation rate for each age group by the number of people in the age group.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the population in each 5 year age group in April 2004 (blue) and April 2014 (red). Note: Not Seasonally Adjusted, Source: BLS.

In April 2004, the two largest groups were in the "40 to 44" and "45 to 49" age groups. These people are now the 50 to 59 age group.

In April 2004, there were also a large number of people in the 50 to 59 age group. These people are now 60 to 69.

The following table summarizes what has happened if we follow these two cohorts (40 to 49 in April 2004, and 50 to 59 and April 2004).

| Cohort 11 | Apr-04 | Apr-14 |

|---|---|---|

| Population | 44,508 | 43,455 |

| Participation Rate | 83.8% | 74.9% |

| Labor Force | 37,294 | 32,535 |

| Cohort 22 | Apr-04 | Apr-14 |

| Population | 35,373 | 33,322 |

| Participation Rate | 76.1% | 45.2% |

| Labor Force | 26,915 | 15,065 |

| 1Cohort 1: People aged 40 to 49 in April 2004. 2Cohort 2: People aged 50 to 59 in April 2004. | ||

So even though the participation rate for an age group is increasing, the participation rate for a cohort decreases as it moves into an older age group. This shows we need to follow 1) the trend for each age group, and 2) the number of people in each age group.

Note in the table below that the participation rate has been falling sharply for younger age groups (staying in school - a positive for the future) - and that the population is increasing for those age groups. This is another key trend that has been pushing down the overall participation rate.

This table is population, labor force and participation rate by age group for April 2004 and April 2014.

| Populaton and Labor Force by Age Group (000s) NSA | |||

|---|---|---|---|

| Apr-04 | Apr-14 | ||

| 16 to 19 Age Group | Population | 16,198 | 16,652 |

| Participation Rate | 40.7% | 31.1% | |

| Labor Force | 6,600 | 5,174 | |

| 20 to 24 Age Group | Population | 20,173 | 22,107 |

| Participation Rate | 74.2% | 69.2% | |

| Labor Force | 14,970 | 15,287 | |

| 25 to 29 Age Group | Population | 18,886 | 21,151 |

| Participation Rate | 81.4% | 79.8% | |

| Labor Force | 15,383 | 16,871 | |

| 30 to 34 Age Group | Population | 20,027 | 20,877 |

| Participation Rate | 83.4% | 81.4% | |

| Labor Force | 16,712 | 17,001 | |

| 35 to 39 Age Group | Population | 20,595 | 19,332 |

| Participation Rate | 83.3% | 81.9% | |

| Labor Force | 17,151 | 15,841 | |

| 40 to 44 Age Grou[ | Population | 22,683 | 20,232 |

| Participation Rate | 83.9% | 82.6% | |

| Labor Force | 19,026 | 16,701 | |

| 45 to 49 Age Group | Population | 21,825 | 20,554 |

| Participation Rate | 83.7% | 81.4% | |

| Labor Force | 18,268 | 16,737 | |

| 50 to 54 Age Group | Population | 19,247 | 22,306 |

| Participation Rate | 80.4% | 78.1% | |

| Labor Force | 15,480 | 17,416 | |

| 55 to 59 Age Group | Population | 16,126 | 21,149 |

| Participation Rate | 70.9% | 71.5% | |

| Labor Force | 11,435 | 15,119 | |

| 60 to 64 Age Group | Population | 12,499 | 18,441 |

| Participation Rate | 51.1% | 55.7% | |

| Labor Force | 6,384 | 10,273 | |

| 65 to 69 Age Group | Population | 9,716 | 14,881 |

| Participation Rate | 26.6% | 32.2% | |

| Labor Force | 2,585 | 4,792 | |

| 70 to 74 Age Group | Population | 8,349 | 10,915 |

| Participation Rate | 15.3% | 19.0% | |

| Labor Force | 1,280 | 2,070 | |

| 75 and older | Population | 16,434 | 18,841 |

| Participation Rate | 6.0% | 8.3% | |

| Labor Force | 986 | 1,563 | |

| Total | Population | 222,758 | 247,438 |

| Participation Rate | 65.7% | 62.6% | |

| Labor Force | 146,260 | 154,845 | |

Saturday, May 03, 2014

Goldman Sachs on the Labor Force Participation Rate

by Calculated Risk on 5/03/2014 06:05:00 PM

Another note on the labor force participation rate:

From Goldman Sachs chief economist Jan Hatzius:

• Since the start of the Great Recession in late 2007, the labor force participation rate has fallen by more than three percentage points, including a sharp drop in April back to the late-2013 lows. The extent of the decline has surprised many economists, ourselves included. What accounts for it, and will it continue?CR Notes:

• The first question is relatively easy to answer. Using an approach similar to that of a recent Philadelphia Fed study, we can show that the decline reflects a combination of 1) more retirements, 2) more disability, 3) higher school enrollment, and 4) more discouraged workers.

• The second question is more difficult, but we believe the answer is no. The most important reason is that the big increase in retirements in the last three years looks far less “structural” to us than generally believed. Many people seem to have pulled forward their retirement because of the weak job market. This leaves correspondingly fewer retirements for future years, and it means that the impact of retirements on participation is likely to become much less negative.

• The other drags on participation are also likely to abate or reverse. Inflows into disability insurance are now slowing sharply, consistent with past cyclical patterns. The school enrollment surge has started to reverse as young workers are finding better job opportunities. And stronger labor demand is likely to pull many discouraged workers back into the job market.

• If participation does stabilize or rise a bit, the decline in the unemployment rate should slow even if payroll growth stays at the sturdy levels seen in recent months. This is one key reason why we believe Fed rate hikes are still far off.

1) Here is the referenced Philadelphia Fed study:

Analyzing people’s reasons for not participating in the labor force provides a relatively clear idea of the causes of declines in the labor force participation rate. The number of disabled persons has been steadily rising; retirement had not played much of a role until around 2010, at which point it started to make a large impact on the overall participation rate. In particular, the decline in the participation rate in the past one-and-a-half years (when the unemployment rate declined faster than expected) is mostly due to retirement. Furthermore, nonparticipation due to enrollment in school has been another significant contributor to the secular decline in the participation rate since 2000.2) Here are the most recent projections from BLS economist Mitra Toossi: Labor force projections to 2022: the labor force participation rate continues to fall. The participation rate is projected to decline for the next couple of decades.

There is no question that more workers dropped out of the labor force due to discouragement during and after the Great Recession and that there are more discouraged workers now than before the recession. These facts clearly reflect the continued weakness of the U.S. labor market. However, it is not clear whether the overall participation rate will increase any time soon, given that the underlying downward trend due to retirement is likely to continue.

Several studies try to separate “cyclical” factors from “structural” factors when explaining the behavior of the participation rate. However, the foregoing analysis casts some doubt on the usefulness of such labeling. For example, the label “cyclical” often implies — whether implicitly or explicitly — that declines in the participation rate explained by “cyclical” factors will reverse as the economy improves. However, this presumption may not hold. In particular, the decision to retire is clearly affected by cyclical factors, but this decision is unlikely to be reversed.

3) Headlines that blare Workforce Participation at 36-Year Low as Jobs Climb aren't helpful. A large decline in the participation rate has been expected for some time, and those that keep saying "the participation rate is at a multi-decade low" are not contributing to the discussion. There is a question of how much of the decline is related to demographic trends (retirement, more young people staying in school are two key trends), and how much is cyclical - but some key recent research now supports my view that a majority is demographics.

Schedule for Week of May 4th

by Calculated Risk on 5/03/2014 01:02:00 PM

This will be a light week for economic data.

The key reports are the Trade Balance report for March, and the ISM non-manufacturing (service) survey for April.

Also Fed Chair Janet Yellen will testify to Congress on the economic outlook.

Early: the Black Knight Mortgage Monitor for March.

10:00 AM: ISM non-Manufacturing Index for April. The consensus is for a reading of 54.0, up from 53.1 in March. Note: Above 50 indicates expansion, below 50 contraction.

8:30 AM: Trade Balance report for March from the Census Bureau.

8:30 AM: Trade Balance report for March from the Census Bureau. Imports increased and exports decreased in February.

The consensus is for the U.S. trade deficit to be at $40.2 billion in March from $42.3 billion in February.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Testimony by Fed Chair Janet Yellen, The Economic Outlook, Before the Joint Economic Committee, U.S. Congress

3:00 PM: Consumer Credit for March from the Federal Reserve. The consensus is for credit to increase $15.1 billion.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 344 thousand.

Early: Trulia Price Rent Monitors for April. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

9:30 AM: Testimony by Fed Chair Janet Yellen, The Economic Outlook, Before the Committee on the Budget, U.S. Senate

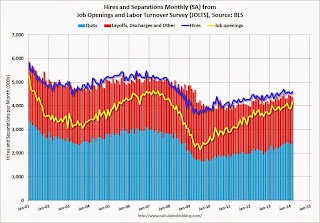

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

In February, the number of job openings (yellow) were up 4% year-over-year compared to February 2013, and Quits were up about 5% year-over-year.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for March. The consensus is for a 0.5% increase in inventories.

Unofficial Problem Bank list declines to 509 Institutions

by Calculated Risk on 5/03/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 2, 2014.

Changes and comments from surferdude808:

With four removals this week, the Unofficial Problem Bank List fell to 509 institutions with assets of $163.3 billion. A year ago, the list held 773 institutions with assets of $284.9 billion.

Actions were terminated against Ocean Bank, Miami, FL ($3.3 billion); TruPoint Bank, Grundy, VA ($441 million); and Liberty Bank, South San Francisco, CA ($219 million). First Federal Savings and Loan Association of Hammond, Hammond, IN ($40 million) found its way off the list through an unassisted merger. Next week should be light in terms of changes to the list as we will not receive an update from the OCC for another two weeks.

Friday, May 02, 2014

Merrill: Q1 GDP now tracking negative 0.4%

by Calculated Risk on 5/02/2014 06:30:00 PM

The data flow suggests Q1 was even weaker than the 0.1% real annualized growth rate reported earlier this week. From Merrill Lynch:

The advance 1Q GDP report revealed growth of only 0.1% qoq saar, about a full percentage point less than we had expected. After accounting for weaker-than-expected construction spending and nondurable inventories in March, 1Q GDP is now tracking -0.4%. This is clearly disappointing and pulls down estimates for annual GDP growth.

...

With all the optimism to start this year, nobody was predicting the economy would contract in 1Q. Based on the Blue Chip forecasts in December last year, the average forecast for 1Q was 2.5% with the top 10 highest forecasts of 3.2% and bottom 10 of 2.0%. Obviously, we were all taken by surprise by this brutally cold winter.

It seems that the economy cannot catch a break – each year there is some explanation for a lack of momentum. It was the European crisis in 2010, the US debt rating downgrade/Greek exit in 2011, gridlock in Washington in 2012 and fiscal tightening/government shutdown in 2013. But the shock from weather does not linger and actually reverses quite quickly. With the harsh winter weather in our rearview mirror, we can focus on the underlying healing of the economy, which we think has been significant.

We believe the economy is on track to bounce back, leading us to revise up 2Q GDP growth to 3.6% from 3.2%. However, this increase does not entirely offset the weakness in 1Q, leaving our forecast for annual GDP growth to slip to 2.5% from 2.7%.

...

Importantly, we think the strength in 2Q is not just a one-quarter bounce. We expect growth to remain strong, averaging 3.4% growth in both 3Q and 4Q.