by Calculated Risk on 5/14/2014 02:58:00 PM

Wednesday, May 14, 2014

DataQuick on California Bay Area: April Home Sales down slightly Year-over-year, Non-Distressed sales up 15% Year-over-year

From DataQuick: Bay Area Home Prices Continue to Rise; Sales Up from March, Flat Yr/Yr

A total of 7,555 new and resale houses and condos were sold in the nine-county Bay Area last month. That was up 19.8 percent from 6,308 in March and down 0.9 percent from 7,621 in April a year ago, according to San Diego-based DataQuick.Sales declined 0.9% year-over-year in April compared to a 12.9% year-over-year decline in March.

Bay Area sales generally increase from March to April, but the 19.8 percent increase this year was high. The average increase is 4.8 percent. ...

Foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 3.6 percent of resales in April, down from a revised 4.3 percent the month before, and down from 8.4 percent a year ago. Foreclosure resales peaked at 52.0 percent in February 2009. The monthly average for foreclosure resales over the past 17 years is 9.9 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 3.8 percent of Bay Area resales last month. That was down from an estimated 4.6 percent in March and down from 11.8 percent a year earlier.

Last month absentee buyers – mostly investors – purchased 20.2 percent of all Bay Area homes. That was down from March’s 20.7 percent and down from 24.2 percent for April a year ago.

emphasis added

And even though total sales were still down slightly year-over-year, the percent of non-distressed sales is up almost 15%. There were 7,555 total sales this year in April, and 7.4% were distressed. In April 2013, there were 7,621 total sales, and 20.1% were distressed. A big positive change.

Flashback to March 2009

by Calculated Risk on 5/14/2014 12:13:00 PM

For fun: This morning Barry Ritholtz reminded me of an article by Charlie Gasparino from March 2009: Is the Worst Yet to Come?

[T]hey can’t believe what they are witnessing: an economic agenda that is contradictory at best, and possibly reckless in its extreme. Policies that will certainly make a very bad situation even worse ...Gasparino basically called the market bottom! (Ritholtz wrote yesterday: The Parasites of Finance)

Not to pick on Gasparino - we all make bad calls - but here is what I wrote at the same time: What is a depression?

It seems like the "D" word is everywhere. And that raises a question: what is a depression? Although there is no formal definition, most economists agree it is a prolonged slump with a 10% or more decline in real GDP.This was one of a series of my more positive posts in 2009 (after being very negative for several years). Not perfect, but clearly my outlook was changing.

...

I still think a depression is very unlikely. More likely the economy will bottom later this year or at least the rate of economic decline will slow sharply. I also still believe that the eventual recovery will be very sluggish, and it will take some time to return to normal growth.

...

It is possible - see Looking for the Sun - that new home sales and housing starts will bottom in 2009, but any recovery in housing will probably be sluggish.

That leaves Personal Consumption Expenditures (PCE) - and as households increase their savings rate to repair their balance sheets, it seems unlikely that PCE will increase significantly any time soon. So even if the economy bottoms in the 2nd half of 2009, any recovery will probably be very sluggish.

Note:

1) The recession ended in June 2009 according to NBER.

2) Housing starts bottomed in 2009, but new home sales didn't bottom until 2010-2011. Note: I predicted house prices would continue to decline, and finally called the bottom for house prices in Feb 2012.

3) The recovery has been sluggish - for housing, PCE, and the overall economy.

Sometimes it is fun to look back. I remember watching CNBC at that time, and it seemed every talking head was bearish - and many were predicting a depression. Gasparino wasn't alone, and those of us looking for the economy to bottom were definitely in the minority.

Closing a Loophole in California's Prop 13 (Property Taxes)

by Calculated Risk on 5/14/2014 09:25:00 AM

From Melanie Mason at the LA Times: Howard Jarvis group won't oppose bill to close Prop. 13 loophole

The legislation would eliminate the ability of businesses to elude higher property taxes by carving up ownership in commercial property purchases so no one has a majority stake. The tactic averts a reassessment of the property that can increase its taxes.This has been going on for years, and there lower properties taxes on existing commercial properties tends to discourage some new construction (hard to compete). This is a positive step and is supported by just about everyone.

The 2006 sale of Santa Monica's Fairmont Miramar Hotel to computer magnate Michael Dell cast one of the brightest lights on that loophole. Dell divided ownership shares among his wife and two business partners, with no one taking on more than 49% of the property.

The move saved him about $1 million a year in property taxes.

MBA: Refinance Applications Increase in Latest Survey, Mortgage Rates lowest since last November

by Calculated Risk on 5/14/2014 07:00:00 AM

From the MBA: Refinance Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 9, 2014. ...

The Refinance Index increased 7 percent from the previous week to its highest level since the week ending April 11, 2014. The seasonally adjusted Purchase Index decreased less than 1 percent from one week earlier. The unadjusted Purchase Index increased less than 1 percent compared with the previous week and was 12 percent lower than the same week one year ago. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.39 percent, the lowest rate since November 2013, from 4.43 percent, with points increasing to 0.22 from 0.21 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 74% from the levels in May 2013 (one year ago).

As expected, with the mortgage rate increases, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 12% from a year ago.

Note: I've wondered if the purchase index was understating purchase activity because small lenders tend to focus on purchases, and those small lenders might be underrepresented in the purchase index. The Mortgage Bankers Association (MBA) told me the mortgage purchase index includes many smaller "purchase focused" lenders, and the MBA doesn't believe their purchase index is "skewed" by large lenders who were focused on refinance applications.

Tuesday, May 13, 2014

A Few links on FHFA Watt's Speech

by Calculated Risk on 5/13/2014 06:56:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Producer Price Index for April from the BLS. The consensus is for a 0.2% increase in prices.

From FHFA Director Melvin Watt: Managing the Present: The 2014 Strategic Plan for the Conservatorships of Fannie Mae and Freddie Mac

From Nick Timiraos at the WSJ: Fannie, Freddie Regulator Signals Broad Shift in Housing Policy

Also from Nick Timiraos at the WSJ: Six Takeaways From Mel Watt’s Speech on Housing

NO COMMENT ON LEGISLATION: ...From David Stevens at the Mortgage Bankers Association: MBA Statement on FHFA Director Watt’s Comments

NO CHANGES ON LOAN LIMITS: ...

...

ENCOURAGING BROADER CREDIT ACCESS: ...

NEIGHBORHOOD STABILIZATION PILOT PROGRAM: The FHFA will launch a pilot project in Detroit ...

OFFLOADING MORTGAGE-CREDIT RISK: Rather than focus on contracting the footprint of Fannie and Freddie ... Mr. Watt said the companies would now focus on reducing taxpayer risk without necessarily shrinking the companies’ size. ..

MOVING FANNIE AND FREDDIE TO A SINGLE SECURITY:

In his first major speech outlining his priorities as the conservator for, and regulator of, Fannie Mae and Freddie Mac, Director Watt is showing that he has hit the ground running and put a lot of thought into the path he intends to take with the two companies. ...From Jim Parrott at the Urban Institute: A strong pivot from the new director of FHFA

“Given the difficulties passing GSE reform legislation as the mid-term elections approach, it is good to see Director Watt looking hard at the tools he has at his disposal to help reform and improve the housing finance system. To be sure, this does not in any way lessen the need for Congress to enact needed reforms, but the Director’s comments today indicate that positive change could be on its way in the meantime.”

With this speech, Director Watt has formally ushered in a new era for the FHFA and GSEs. He has pivoted, rather emphatically, from the prior regime’s focus on preparing the enterprises for wind-down to better positioning them to serve as the central conduit for mortgage financing for the indefinite future. At a time when access to credit remains a serious challenge and the timing and shape of long term reform from Congress is deeply unclear, the pivot is a useful one. Even if one believes, as do I, that we need to chart a course for long-term reform, and that that course should involve the winding down of these two enterprises, that is arguably not the job of their conservator. The job of the FHFA is first and foremost to increase the stability and efficiency of the system as it stands. Director Watt has recognized this challenge and risen to it admirably.

DataQuick on SoCal: April Home Sales down 6.6% Year-over-year, Non-Distressed sales up 17% Year-over-year

by Calculated Risk on 5/13/2014 03:13:00 PM

From DataQuick: Faster Pace for Southland Home Sales; Median Sale Price Edges Higher

Southern California’s housing market perked up a bit in April, with sales rising more than usual from March and dipping below a year earlier by the smallest degree in six months. Home prices edged higher again but at a slower pace, the result of more inventory, affordability constraints and less pressure from investors, a real estate information service reported.Both distressed sales and investor buying is declining - and this has been dragging down overall sales. However the year-over-year decline for sales in April was the smallest since last October.

A total of 20,008 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 13.4 percent from 17,638 sales in March, and down 6.6 percent from 21,415 sales in April last year, according to San Diego-based DataQuick.

On average, sales have increased 1.4 percent between March and April since 1988, when DataQuick’s statistics begin. Southland sales have fallen on a year-over-year basis for seven consecutive months, but last month’s decline was the smallest since sales fell 4.4 percent last October.

This April’s sales were higher than in April 2012 and 2011. That’s a significant change from February and March this year, which had the lowest home sales for those particular months in six years.

...

“The housing market’s pulse quickened a bit in April. If the inventory grows more, which we consider likely, it’s going to make it a lot easier for sales to reach at least an average level, which we haven’t seen in more than seven years. There are certainly factors undermining housing demand, including affordability constraints, credit challenges and less investment activity. But there are considerable forces fueling demand, too: Employment is rising, families are growing, and more people can qualify to buy again after losing a home to foreclosure or a short sale over the past eight years,” said Andrew LePage, a DataQuick analyst.

Foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 5.9 percent of the Southland resale market in April. That was down from a revised 6.3 percent the prior month and down from 12.4 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 5.4 percent of Southland resales last month. That was down from a revised 7.3 percent the prior month and down from 16.6 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 26.1 percent of the homes sold last month, which is the lowest share since November 2011, when 25.1 percent of homes sold to absentee buyers.

emphasis added

Even though total sales are still down year-over-year, the percent of non-distressed sales is up almost 17%. There were 20,008 total sales this year, and 11.3% were distressed. In April 2013, there were 21,415 total sales, and 29% were distressed. A big positive change.

NFIB: Small Business Optimism Index increases in April, Highest since 2007

by Calculated Risk on 5/13/2014 01:25:00 PM

From the National Federation of Independent Business (NFIB) earlier this morning: NFIB: Optimism Improves, But Don't Get Too Excited

April’s Small Business Optimism Index rose 1.8 points to a post-recession high of 95.2. The economy continues to perform modestly and April’s index followed suit as it crossed the 95 marker for the first time since 2007. ...

Labor Markets. NFIB owners increased employment by an average of 0.07 workers per firm in April (seasonally adjusted), weaker than March but the seventh positive month in a row and the best string of gains since 2006.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 95.2 in April from 93.4 in March.

NY Fed: Household Debt increased in Q1 2014, Delinquency Rates Lowest Since Q3 2007

by Calculated Risk on 5/13/2014 11:00:00 AM

Here is the Q1 report: Household Debt and Credit Report. From the NY Fed:

In its Q1 2014 Household Debt and Credit Report, the Federal Reserve Bank of New York announced that outstanding household debt increased $129 billion from the previous quarter. The increase was led by rises in mortgage debt ($116 billion), student loan debt ($31 billion) and auto loan balances ($12 billion), slightly offset by a $27 billion declines in credit card and HELOC balances. Total household indebtedness stood at $11.65 trillion, 1.1 percent higher than the previous quarter. Overall household debt remains 8.1 percent below the peak of $12.68 trillion reached in Q3 2008. The report is based on data from the New York Fed’s Consumer Credit Panel, a nationally representative sample drawn from anonymized Equifax credit data.

Additionally, an update to a recent blog discussing the impact of student loan debt on housing and auto markets is available on our Liberty Street Economics Blog.

“We’ve observed household debt increase three quarters in a row and delinquency rates at their lowest levels since 2008,” said Andy Haughwout, vice president and economist at the New York Fed. “However, the direction of future mortgage originations will have an important implication on the household financial outlook and we will continue to monitor it.”

emphasis added

Click on graph for larger image.

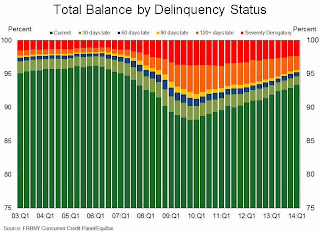

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q1.

This suggests households (in the aggregate) may be near the end of deleveraging. If so, this is a significant change that started mid-2013.

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is steadily declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is steadily declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate has declined to 6.61% in Q1, from 7.12% in Q4. This is the lowest rate since Q3 2007.

The Severely Derogatory (red) rate has fallen to 2.34%, the lowest since Q1 2008.

The 120+ days late (orange) rate has declined to 2.09%, the lowest since Q3 2008.

Short term delinquencies are back to normal levels (lowest since 2006).

Here is the press release from the NY Fed: Household Debt Grows for the Fourth Consecutive Quarter

There are a number of credit graphs at the NY Fed site.

Retail Sales increased 0.1% in April

by Calculated Risk on 5/13/2014 08:30:00 AM

On a monthly basis, retail sales increased 0.1% from March to April (seasonally adjusted), and sales were up 3.8% from April 2013. Sales in March were revised up from a 1.1% increase to a 1.5% increase. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for April, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $434.6 billion, an increase of 0.1 percent from the previous month, and 4.0 percent above April 2013.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos were unchanged.

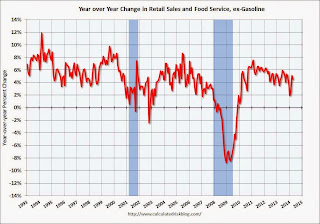

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.6% on a YoY basis (4.0% for all retail sales).

Retail sales ex-gasoline increased by 4.6% on a YoY basis (4.0% for all retail sales).The increase in April was well below consensus expectations - however sales in March were revised up.

Monday, May 12, 2014

Tuesday: Retail Sales, Q1 Household Debt and Credit

by Calculated Risk on 5/12/2014 07:45:00 PM

This could be significant from Nick Timiraos at the WSJ: Regulator Extends Greater Shield to Lenders on Mortgage 'Put-Backs'

Fannie Mae and Freddie Mac will extend new waivers to lenders ...Tuesday:

The changes are significant because some industry analysts and economists have said they could lay the groundwork for lenders to relax credit standards. Lenders and policy makers have faulted ambiguous rules around mortgage put-backs for lending standards that they say are unnecessarily rigid.

...

The FHFA's new director, Mel Watt, is set to make his first public speech on Tuesday in Washington.

emphasis added

• At 7:30 AM ET, the NFIB Small Business Optimism Index for April.

• At 8:30 AM, Retail sales for April will be released. The consensus is for retail sales to increase 0.4% in April, and to increase 0.6% ex-autos.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for March. The consensus is for a 0.4% increase in inventories.

• At 11:00 AM, the Q1 2014 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York. Note: "In conjunction with the release of the report, the New York Fed will also post an update to a recent blog discussing the impact of student loan debt on housing and auto markets."