by Calculated Risk on 5/18/2014 09:07:00 AM

Sunday, May 18, 2014

CoStar: Commercial Real Estate prices increased in Q1, Distress Sales just 10% of all sales

Here is a price index for commercial real estate that I follow.

From CoStar: Major Commercial Real Estate Price Indices Advance In First Quarter

BROAD PRICING INDICES MOVE UPWARD IN FIRST QUARTER: The two broadest measures of aggregate pricing for commercial properties within the CCRSI — the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index — each finished the first quarter of 2014 on a positive note. The U.S. equal-weighted index, which represents lower-value properties, has the most momentum in early 2014, with pricing up 4.2% for the first quarter of 2014 and 17.1% year-over-year. Meanwhile the U.S. value-weighted index, which is more heavily weighted toward larger, higher-value properties, has already recovered to within 5% of its prior peak levels. As a result, pricing gains in the value-weighted Composite Index have slowed, advancing by a more modest 0.5% for the first quarter and 10.1% for the year ending in March 2014.

...

The percentage of commercial property selling at distressed prices has also fallen by more than two-thirds from the peak levels reached in 2011, to just 10% of all composite pair trades in the first quarter of 2014.

...

The Multifamily Index continued to post steady growth, advancing by 7.8% for the 12 months ended March 2014, even though pricing in the Prime Metros Index has surpassed its previous peak set in 2007 by 10%. Pricing in the overall Multifamily Index is now within 8% of its pre-recession peak.Given the steep competition and pricing for Class A assets in prime metro areas, recent pricing gains likely reflect shifting investor interest to Class B properties in primary markets and higher quality properties in secondary and tertiary markets.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Primary Property Type Quarterly indexes. Multi-family has recovered the most, and offices the least.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Saturday, May 17, 2014

Schedule for Week of May 18th

by Calculated Risk on 5/17/2014 01:02:00 PM

The key reports this week are April Existing Home Sales on Thursday and April New Home sales on Friday.

For manufacturing, the May Kansas City Fed survey will be released.

No economic releases scheduled.

No economic releases scheduled.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

11:30 AM, Fed Chair Janet Yellen Speaks, Commencement Remarks, At the New York University Commencement, New York, New York

2:00 PM: FOMC Minutes for the Meeting of April 29-30, 2014.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 297 thousand.

8:30 AM ET: Chicago Fed National Activity Index for April. This is a composite index of other data.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for sales of 4.67 million on seasonally adjusted annual rate (SAAR) basis. Sales in March were at a 4.59 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.70 million SAAR.

As always, a key will be inventory of homes for sale.

11:00 AM: the Kansas City Fed manufacturing survey for May.

10:00 AM: New Home Sales for April from the Census Bureau.

10:00 AM: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the March sales rate.

The consensus is for an in increase in sales to 420 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 384 thousand in March.

Unofficial Problem Bank list declines to 502 Institutions

by Calculated Risk on 5/17/2014 08:53:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 16, 2014.

Changes and comments from surferdude808:

As expected, the OCC provided an update on its recent enforcement action activity and the FDIC shuttered a bank this Friday. In all, there were seven removals from the Unofficial Problem Bank List leaving it at 502 institutions with assets of $161.2 billion. A year ago, the list held 770 institutions with assets of $284.1 billion.

Actions were terminated against Modern Bank, National Association, New York, NY ($678 million); American Bank and Trust Company, National Association, Davenport, IA ($368 million); Provident Community Bank, National Association, Rock Hill, SC ($323 million Ticker: PCBS); First Texoma National Bank, Durant, OK ($155 million); Mission Oaks National Bank, Temecula, CA ($96 million Ticker: MOKB); and Treasure State Bank, Missoula, MT ($66 million Ticker: TRSU).

AztecAmerica Bank, Berwyn, IL ($66 million) was the seventh bank failure this year. Since the on-set of the Great Recession, there have been 58 bank failures in Illinois, which only trails the 87 failures in Georgia and 70 failures in Florida.

Most likely, the FDIC will provide an update on its recent enforcement action activity in two weeks. Moreover, they will likely release industry results for the first quarter and refreshed problem bank list figures that week as well.

Friday, May 16, 2014

Bank Failure #7 in 2014: AztecAmerica Bank, Berwyn, Illinois

by Calculated Risk on 5/16/2014 07:18:00 PM

From the FDIC: Republic Bank of Chicago, Oak Brook, Illinois, Assumes All of the Deposits of AztecAmerica Bank, Berwyn, Illinois

As of December 31, 2013, AztecAmerica Bank had approximately $66.3 million in total assets and $65.0 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $18.0 million. ... AztecAmerica Bank is the seventh FDIC-insured institution to fail in the nation this year, and the second in Illinois.The FDIC is back to work! At the current pace, the number of failures this year will be the lowest since 2007 (when 3 banks failed).

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in April

by Calculated Risk on 5/16/2014 06:28:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for selected cities in April.

Total "distressed" share is down in all of these markets, mostly because of a sharp decline in short sales.

Foreclosures are down in most of these areas too, although foreclosures are up in the mid-Atlantic area, Orlando and Las Vegas (there was a state law change that slowed foreclosures dramatically in Nevada at the end of 2011 - so it isn't a surprise that foreclosures are up a little year-over-year).

The All Cash Share (last two columns) is mostly declining year-over-year. This is the opposite of recent media reports that the cash share increased year-over-year (obviously doesn't fit this data).

In general it appears the housing market is slowly moving back to normal.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Apr-14 | Apr-13 | Apr-14 | Apr-13 | Apr-14 | Apr-13 | Apr-14 | Apr-13 | |

| Las Vegas | 12.4% | 32.5% | 11.4% | 10.0% | 23.8% | 42.5% | 41.4% | 59.3% |

| Reno** | 15.0% | 33.0% | 6.0% | 8.0% | 21.0% | 41.0% | ||

| Phoenix | 4.0% | 12.7% | 6.5% | 11.3% | 10.5% | 24.1% | 32.2% | 42.0% |

| Sacramento | 7.5% | 8.8% | 9.5% | 23.1% | 17.0% | 31.9% | 21.9% | 37.2% |

| Minneapolis | 5.0% | 7.4% | 15.9% | 24.0% | 20.9% | 31.4% | ||

| Mid-Atlantic | 5.9% | 9.9% | 10.0% | 8.6% | 15.9% | 18.5% | 19.5% | 19.4% |

| Orlando | 9.1% | 21.2% | 23.7% | 20.5% | 32.9% | 41.8% | 42.4% | 54.8% |

| California * | 5.5% | 16.1% | 6.7% | 13.5% | 12.2% | 29.6% | ||

| Bay Area CA* | 3.8% | 11.8% | 3.6% | 8.4% | 7.4% | 20.2% | 22.9% | 28.3% |

| So. California* | 5.4% | 16.6% | 5.9% | 12.4% | 11.3% | 29.0% | 26.7% | 34.4% |

| Hampton Roads | 24.4% | 27.8% | ||||||

| Northeast Florida | 38.1% | 39.5% | ||||||

| Toledo | 33.4% | 40.3% | ||||||

| Des Moines | 17.1% | 19.6% | ||||||

| Peoria | 21.2% | 24.4% | ||||||

| Tucson | 30.5% | 33.5% | ||||||

| Omaha | 22.3% | 17.4% | ||||||

| Pensacola | 35.6% | 34.5% | ||||||

| Georgia*** | 34.3% | NA | ||||||

| Houston | 6.1% | 10.4% | ||||||

| Memphis* | 16.6% | 24.7% | ||||||

| Birmingham AL | 16.8% | 24.1% | ||||||

| Springfield IL** | 13.2% | 14.4% | ||||||

| Georgia*** | 34.3% | N/A | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Lawler: Early look at Existing Home Sales in April

by Calculated Risk on 5/16/2014 04:19:00 PM

From housing economist Tom Lawler:

Based on realtor association/board/MLS reports across the country, I estimate that existing home sales as measured by the National Association of Realtors will come in at a seasonally adjusted annual rate of 4.70 million in April, up 2.4% from March’s pace, but down 5.8% from last April’s pace. This modest rebound is not just weather-related – e.g., home sales in California, while down from a year ago, showed a larger-than-the-seasonal norm increase from March to April. Many areas hard hit by weather, in contrast, didn’t see much of a bounce in sales, reflecting very weak contract activity during the past few months.

I also estimate that the NAR’s median existing home sales price estimate for April will be up 6.7% from last April’s MSP. The YOY increase in March was 7.4%.

On the inventory front, publicly-available realtor/MLS reports combined with data from various listings trackers would suggest that existing homes for sale in April were up about 6% from March. However, as I have noted in the past, NAR data has consistently shown larger March-to-April inventory increases than publicly-available reports would suggest. I’m not sure why, but it may be related to the timing of “pull-dates” for the official “NAR Reports” that various realtor groups/MLS send directly to the NAR. As a reminder, here is what I wrote last May ahead of the April existing home sales report.

“On the inventory side, all entities tracking residential listings show a decent-sized increase in national listings from March to April, and local realtor reports suggest a gain as well – probably in the range of about 4%. However, for many years the NAR’s reported inventory gain in April has substantially exceeded that suggested by those who track residential listings, for reasons not readily apparent but that may reflect the timing of “pull-dates” by MLS in the NAR’s sample. Adjusting for this “observation,” my “best guess” is that the NAR’s existing home inventory number in April will be up 8.8% from March, and down 16.0% from last April.” (LEHC, May 15, 2013).Current NAR estimates show a monthly jump in the inventory of existing homes for sales from March 2013 to April 2013 of 11.4%.

Realtor/MLS reports as well as “listing-tracker” reports indicate that the monthly increase in listings this April was in aggregate larger than last April, and a “reasonable guesttimate” would be that the NAR’s inventory number for April would be about 2.26 million, up 13.6% from March and up 5.1% from last April.

CR Note: The NAR will report April existing home sales next Thursday, May 22nd. The consensus forecast is for the NAR to report sales of 4.67 million SAAR.

Sacramento Housing in April: Total Sales down 5% Year-over-year, Equity (Conventional) Sales up 17%, Active Inventory increases 46%

by Calculated Risk on 5/16/2014 03:47:00 PM

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a long time, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In April 2014, 16.3% of all resales (single family homes) were distressed sales. This was unchanged from last month, and down from 31.9% in April 2013.

The percentage of REOs was at 7.2%, and the percentage of short sales was 9.1%.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales over the last 2 years (blue).

Active Listing Inventory for single family homes increased 46.3% year-over-year in April.

Cash buyers accounted for 21.9% of all sales, down from 37.2% in April 2013, and down from 22.5% last month (frequently investors). This has been trending down, and it appears investors are becoming less of a factor in Sacramento.

Total sales were down 4.8% from April 2013, but conventional equity sales were up 17.0% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

As I've noted before, we are seeing a similar pattern in other distressed areas.

A few comments on Housing Starts

by Calculated Risk on 5/16/2014 12:46:00 PM

The Census Bureau reported that housing starts increased 26.4 percent year-over-year in April to a 1.072 million seasonally adjusted annual rate (SAAR). A few points:

1) This is just one month of data (the usual caveat).

2) Most of the month-to-month increase was due to multi-family starts (Multi-family is volatile month-to-month).

3) Some of the increase appears to be payback from the severe weather earlier this year.

4) This was an easy year-over-year comparison since starts in April last year were near the low for 2013 (see first graph below).

Most of the commentary today is focused on the increase in multi-family starts - and that single family starts have stalled. Yes, but going forward I expect multi-family starts to mostly move sideways and for single family starts to pickup (the opposite of most of the commentary).

There were 301 thousand total housing starts during the first four months of 2014 (not seasonally adjusted, NSA), up 6% from the 284 thousand during the same period of 2013. Single family starts are up close to 2%, and multi-family starts up 17%. The weak start to 2014 was due to several factors: severe weather, higher mortgage rates, higher prices and probably supply constraints in some areas.

It is also important to note that Q1 was a difficult year-over-year comparison for housing starts. There was a huge surge for housing starts in Q1 2013 (up 34% over Q1 2012). Then starts softened a little over the next 7 months until November.

Click on graph for larger image.

Click on graph for larger image.

This year, I expect starts to be stronger over the next few quarters (I expect Q1 was the weakest) - and more starts combined with an easier comparison means starts will be up solidly year-over-year.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family completions in 2014, but probably still below the 1997 through 2007 level of multi-family completions. Multi-family starts will probably move more sideways in 2014.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Starts have been moving up (but the increase has slowed recently), and completions have followed.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

BLS: "State unemployment rates were generally lower in April"

by Calculated Risk on 5/16/2014 10:57:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally lower in April. Forty-three states had unemployment rate decreases, two states had increases, and five states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

Rhode Island had the highest unemployment rate among the states in April, 8.3 percent. North Dakota again had the lowest jobless rate, 2.6 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. No state has double digit or even a 9% unemployment rate. Only Rhode Island (8.3%) and Nevada are at or above 8%.

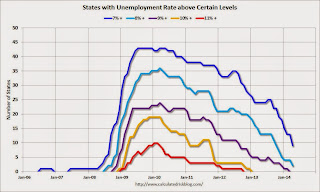

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 9% (purple), 2 states are at or above 8% (light blue), and 9 states are at or above 7% (blue).

Preliminary May Consumer Sentiment decreases to 81.8

by Calculated Risk on 5/16/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for May was at 81.8, down from 84.1 in April.

This was below the consensus forecast of 84.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

I expect to see sentiment at post-recession highs very soon.