by Calculated Risk on 5/22/2014 10:00:00 AM

Thursday, May 22, 2014

Existing Home Sales in April: 4.65 million SAAR, Inventory up 6.5% Year-over-year

The NAR reports: April Existing-Home Sales Show Modest Improvement Behind Gaining Inventory

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 1.3 percent to a seasonally adjusted annual rate of 4.65 million in April from 4.59 million in March, but are 6.8 percent below the 4.99 million-unit level in April 2013.

Total housing inventory at the end of April jumped 16.8 percent to 2.29 million existing homes available for sale, which represents a 5.9-month supply at the current sales pace, up from 5.1 months in March. Unsold inventory is 6.5 percent higher than a year ago, when there was a 5.2-month supply.

Click on graph for larger image.

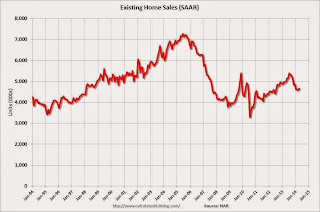

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April (4.65 million SAAR) were higher than last month, but were 6.8% below the April 2013 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.29 million in April from 1.96 million in March. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.29 million in April from 1.96 million in March. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 6.5% year-over-year in April compared to April 2013. This year-over-year increase in inventory suggests inventory bottomed early last year.

Inventory increased 6.5% year-over-year in April compared to April 2013. This year-over-year increase in inventory suggests inventory bottomed early last year.Months of supply was at 5.9 months in April.

This was slightly below expectations of sales of 4.67 million. For existing home sales, the key number is inventory - and inventory is still low, but up year-over-year. I'll have more later ...

Weekly Initial Unemployment Claims increase to 326,000

by Calculated Risk on 5/22/2014 08:30:00 AM

The DOL reports:

In the week ending May 17, the advance figure for seasonally adjusted initial claims was 326,000, an increase of 28,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 297,000 to 298,000. The 4-week moving average was 322,500, a decrease of 1,000 from the previous week's revised average. The previous week's average was revised up by 250 from 323,250 to 323,500.The previous week was revised up from 297,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 322,500.

This was above the consensus forecast of 310,000. The 4-week average is close to normal levels for an expansion.

Black Knight: Mortgage Loans in Foreclosure Process Lowest since September 2008

by Calculated Risk on 5/22/2014 12:02:00 AM

According to Black Knight's First Look report for April, the percent of loans delinquent increased seasonally in April compared to March, but declined by 9.5% year-over-year.

Also the percent of loans in the foreclosure process declined further in April and were down 36% over the last year. Foreclosure inventory was at the lowest level since September 2008.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 5.62% in April from 5.52% in March. The normal rate for delinquencies is around 4.5% to 5%. The increase in delinquencies was in the 'less than 90 days' bucket.

The percent of loans in the foreclosure process declined to 2.02% in April from 2.13% in March.

The number of delinquent properties, but not in foreclosure, is down 207,000 properties year-over-year, and the number of properties in the foreclosure process is down 572,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for March in early May.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| April 2014 | March 2014 | April 2013 | |

| Delinquent | 5.62% | 5.52% | 6.21% |

| In Foreclosure | 2.02% | 2.13% | 3.17% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,634,000 | 1,571,000 | 1,717,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,187,000 | 1,199,000 | 1,394,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,016,000 | 1,070,000 | 1,588,000 |

| Total Properties | 3,837,000 | 3,840,000 | 4,699,000 |

Wednesday, May 21, 2014

Thursday: Existing Home Sales, Unemployment Claims

by Calculated Risk on 5/21/2014 07:52:00 PM

From economist Tom Lawler: Realogy: Spring Selling Season Softer than Expected: Cites Weak First-Time Homebuyers, Blames Tight Mortgage Underwriting AND FHA’s “Onerous” Premiums

Speaking of FHA and first-time home buyers, first-time home buyers came up 18 times, and FHA 17 times, in Realogy Holdings Corporation’s earnings conference call earlier this month – and not in a good way. ... Realogy’s results last quarter, of course, were well below “consensus” (RLGY is down about 17% from the day before it released earnings), and company officials gave a somewhat downbeat assessment of the spring selling season and likely home sales in Q2 – especially for first-time home buyers. Here are a few excerpts from the conference call transcript.Thursday:

“As we have moved into our spring selling season, thus far the level of open activity we expected has not materialized particularly as it relates to home sale transaction size.Realtors and home builders have noted that home purchases by first-time home buyers so far this year have fallen short of last year’s pace.

“Tight credit standards and limited inventory are factors affecting the first-time buyers but we also believe that the high costs of an FHA loan are discouraging first-time homebuyers. The FHA's unusually high mortgage insurance premium structure which was raised to help improve the overall health of the FHA, is now more than double its historic average

“Our current forecasts for 2014 are not assuming any significant increase in first-time buyer activity. But I think most people are expecting some increase principally because -- we hope -- change in credit underwriting for next year. So I don't expect to see a material change in first-time buyer activity this year but we do expect to see some change -- some improvement next year.

“I don't see anything else that has changed or impacted the market with the exception of the first-time buyer. The first-time buyer continues to be under pressure from a cost perspective. I mean the FHA loan is extraordinarily high, the insurance premiums are very high, up about twice what they have been previously. I think that is an impediment to many first-time buyers.

“This is where we have faith in the private sector so let's say FHA continues with its onerous minimum premium obligations which are very onerous by any definition, this private sector will step in and capture that market share that otherwise would not be available if FHA were more reasonable. So you can see examples of that as FICO scores are starting to decline, Wells Fargo as an example has made it clear they are going after business they haven't tackled in the past by reducing the down payment requirements. They are more I think reasonable in their underwriting. So still have a long ways to go but they are getting there.

“So if this persists, we are of the view that the private sector will jump in and be more relevant to the first-time buyer. That is not going to happen overnight but it will happen as industry shift gears. Remember the mortgage industry is trying to recover from the downturn in refinance as well so they are going to be aggressive in going after purchase money and we see that now so we just expect they will become more aggressive.”

• At 12:01 AM ET, the Black Knight “First Look” at April 2014 Mortgage Data

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 297 thousand.

• Also at 8:30 AM, the Chicago Fed National Activity Index for April. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for sales of 4.67 million on seasonally adjusted annual rate (SAAR) basis. Sales in March were at a 4.59 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.70 million SAAR.

• At 11:00 AM, the Kansas City Fed manufacturing survey for May.

Lawler: Negative Equity Quiz

by Calculated Risk on 5/21/2014 02:52:00 PM

From housing economist Tom Lawler:

Based on proprietary AVMs and available mortgage data, well-known private entities estimate that the percent of residential properties with mortgages where the owner of the property is in a negative equity position (estimated mortgage balance exceeds the value of the property) is:

A. About 10%

B. About 13%

C. About 19%

D. All of the above.

The “correct” answer, of course, is “D,” All of the above.

The 10% estimate is from Black Knight Financial Services (formerly LPS), and is for March 2014.

The 13% estimate (13.3%) is from CoreLogic, and is for Q4/2013.

The 19% estimate (18.8%) is from Zillow, and is for Q1/2014.

Zillow estimates that 10% of mortgaged residential properties have a current LTV of 120% or more.

For Q4/2013, CoreLogic estimates that 5.1% of mortgaged residential properties had a current LTV of 125% or more.

FOMC Minutes: Monetary Policy Normalization Discussion

by Calculated Risk on 5/21/2014 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee, April 29-30, 2014 . Excerpt on Monetary Policy Normalization:

In a joint session of the Federal Open Market Committee (FOMC) and the Board of Governors of the Federal Reserve System, meeting participants discussed issues associated with the eventual normalization of the stance and conduct of monetary policy. The Committee's discussion of this topic was undertaken as part of prudent planning and did not imply that normalization would necessarily begin sometime soon. A staff presentation outlined several approaches to raising short-term interest rates when it becomes appropriate to do so, and to controlling the level of short-term interest rates once they are above the effective lower bound, during a period when the Federal Reserve will have a very large balance sheet. The approaches differed in terms of the combination of policy tools that might be used to accomplish those objectives. In addition to the rate of interest paid on excess reserve balances, the tools considered included fixed-rate overnight reverse repurchase (ON RRP) operations, term reverse repurchase agreements, and the Term Deposit Facility (TDF). The staff presentation discussed the potential implications of each approach for financial intermediation and financial markets, including the federal funds market, and the possible implications for financial stability. In addition, the staff outlined options for additional operational testing of the policy tools.

Following the staff presentation, meeting participants discussed a wide range of topics related to policy normalization. Participants generally agreed that starting to consider the options for normalization at this meeting was prudent, as it would help the Committee to make decisions about approaches to policy normalization and to communicate its plans to the public well before the first steps in normalizing policy become appropriate. Early communication, in turn, would enhance the clarity and credibility of monetary policy and help promote the achievement of the Committee's statutory objectives. It was emphasized that the tools available to the Committee will allow it to reduce policy accommodation when doing so becomes appropriate. Participants considered how various combinations of tools could have different implications for the degree of control over short-term interest rates, for the Federal Reserve's balance sheet and remittances to the Treasury, for the functioning of the federal funds market, and for financial stability in both normal times and in periods of stress. Because the Federal Reserve has not previously tightened the stance of policy while holding a large balance sheet, most participants judged that the Committee should consider a range of options and be prepared to adjust the mix of its policy tools as warranted. Participants generally favored the further testing of various tools, including the TDF, to better assess their operational readiness and effectiveness. No decisions regarding policy normalization were taken; participants requested additional analysis from the staff and agreed that it would be helpful to continue to review these issues at upcoming meetings.

emphasis added

AIA: "Contraction in Architecture Billings Index Continues"

by Calculated Risk on 5/21/2014 09:36:00 AM

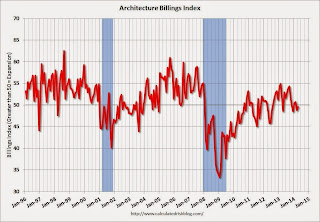

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Contraction in Architecture Billings Index Continues

The Architecture Billings Index (ABI) has reverted into negative territory for the last two months. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the [April] ABI score was 49.6, up slightly from a mark of 48.8 in March. This score reflects a decrease in design activity (any score above 50 indicates an increase in billings). The new projects inquiry index was 59.1, up from the reading of 57.9 the previous month.

The AIA has added a new indicator measuring the trends in new design contracts at architecture firms that can provide a strong signal of the direction of future architecture billings. The score for design contracts in April was 54.6.

“Despite an easing in demand for architecture services over the last couple of months, there is a pervading sense of optimism that business conditions are poised to improve as the year moves on,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “With a healthy figure for design contracts this should translate into improved billings in the near future.”

•Regional averages: South (57.5),West (48.9), Midwest 47.0), Northeast (42.9) [three month average]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 49.6 in April, up from 48.8 in March. Anything below 50 indicates contraction in demand for architects' services. This index has indicated expansion during 16 of the last 21 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. The index has been moving sideways near the expansion / contraction line recently. However, the readings over the last year and a half suggest some increase in CRE investment in 2014.

MBA: Mortgage Refinance Activity increases as Mortgage Rates Decline

by Calculated Risk on 5/21/2014 07:01:00 AM

From the MBA: Refinance Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 16, 2014. ...

The Refinance Index increased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. ...

...

“Renewed concerns about the state of the global economy, particularly in Europe, led to a flight to quality to US Treasury securities, thereby pushing interest rates down in the US,” said Mike Fratantoni, MBA’s Chief Economist. “Rates on conforming loans hit 6 month lows and jumbo rates hit 12 month lows. Refinance volume picked up somewhat as a result, but it still remains more than 65 percent below last year's pace. Purchase volume continues to run more than 10 percent below last year's pace."

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.33 percent, the lowest rate since November 2013, from 4.39 percent, with points decreasing to 0.20 from 0.22 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 73% from the levels in May 2013 (one year ago).

As expected, with the mortgage rate increases, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 12% from a year ago.

Tuesday, May 20, 2014

Wednesday: FOMC Minutes, Architecture Billings Index

by Calculated Risk on 5/20/2014 07:28:00 PM

From Professor Tim Duy: Dudley Revisits Exit Strategy

Today New York Federal Reserve President William Dudley gave what was both an interesting and depressing speech. Interesting in that he provides some new thoughts on the exit strategy. Depressing in that he outlines a case for persistently low interest rates. One wonders why, given such an outlook, the Fed is so firmly focused on the exit strategy to begin with, rather than accelerating the pace of the recovery.Wednesday:

...

Bottom Line: Dudley reinforces expectations that the low rate environment will persist long into the future. The data flow is not providing reason to think otherwise at this point; we would need to see higher inflation numbers coupled with real reason to believe labor market slack was rapidly evaporating, probably in the form of stronger wage growth. It remains interesting that the Fed does not view their own outlook as reason to accelerate the pace of activity. They seem relatively content to accept what they themselves acknowledge is a ongoing disappointment.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, the AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

• At 11:30 AM, Fed Chair Janet Yellen Speaks, Commencement Remarks, At the New York University Commencement, New York, New York

• At 2:00 PM, FOMC Minutes for the Meeting of April 29-30, 2014.

Apartments: Supply and Demand

by Calculated Risk on 5/20/2014 02:39:00 PM

Time flies! It was four years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive.

The drivers were 1) very low new supply, and 2) strong demand (favorable demographics, and people moving from owning to renting).

Demographics are still favorable, but my sense is the move "from owning to renting" has slowed. And more supply is now coming online.

On demographics, a large cohort has been moving into the 20 to 34 year old age group (a key age group for renters). Also, in 2015, based on Census Bureau projections, the two largest 5 year cohorts will be 20 to 24 years old, and 25 to 29 years old (the largest cohorts will no longer be the "boomers"). Note: Household formation would be a better measure than population, but reliable data for households is released with a long lag.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the population in the 20 to 34 year age group has been increasing. This is actual data from the Census Bureau for 1985 through 2010, and current projections from the Census Bureau from 2015 through 2035.

The circled area shows the recent and projected increase for this group.

From 2020 to 2030, the population for this key rental age group is expected to remain mostly unchanged.

This favorable demographic is a key reason I've been positive on the apartment sector for the last several years - and I expect new apartment construction to stay strong for several more years.

And on supply, the table below shows the number of 5+ units started and completed per year since 1990 (Completions matter for supply). New supply will probably increase by 250,000 to 260,000 units this year - and increase further in 2015 since it can take over a year from start to completion for large complexes. Note: This doesn't include houses converted to rentals - and that is a substantial number in recent years.

This suggests new supply will probably balance demand soon, and that means vacancy rates are probably close to a bottom.

| 5+ Units, Starts and Completions (000s)1 | ||

|---|---|---|

| Year | Completions | Starts |

| 1990 | 297.3 | 260.4 |

| 1991 | 216.6 | 137.9 |

| 1992 | 158.0 | 139.0 |

| 1993 | 127.1 | 132.6 |

| 1994 | 154.9 | 223.5 |

| 1995 | 212.4 | 244.1 |

| 1996 | 251.3 | 270.8 |

| 1997 | 247.1 | 295.8 |

| 1998 | 273.9 | 302.9 |

| 1999 | 299.3 | 306.6 |

| 2000 | 304.7 | 299.1 |

| 2001 | 281.0 | 292.8 |

| 2002 | 288.2 | 307.9 |

| 2003 | 260.8 | 315.2 |

| 2004 | 286.9 | 303.0 |

| 2005 | 258.0 | 311.4 |

| 2006 | 284.2 | 292.8 |

| 2007 | 253.0 | 277.3 |

| 2008 | 277.2 | 266.0 |

| 2009 | 259.8 | 97.3 |

| 2010 | 146.5 | 104.3 |

| 2011 | 129.9 | 167.3 |

| 2012 | 157.6 | 233.9 |

| 2013 | 186.2 | 293.7 |

| 20142 | 240.0 | 334.0 |

| 1 5+ units is close to the number of units built for rent each year. | ||

| 2 Pace through April 2014, completions will probably be above 240,000 for 2014 | ||