by Calculated Risk on 5/23/2014 09:48:00 PM

Friday, May 23, 2014

Goldman's Hatzius: Rationale for Economic Acceleration Is Intact

Excerpt from Goldman Sachs chief economist Jan Hatzius research: Sticking with Stronger

We currently estimate that real GDP fell -0.7% (annualized) in the first quarter, versus a December consensus estimate of +2½%. On the face of it, this is a large disappointment. It raises the question whether 2014 will be yet another year when initially high hopes for growth are ultimately dashed.I also remain optimistic that growth will pickup - I touched on this in February: Reasons for a 2014 Pickup in Economic Growth Intact

Today we therefore ask whether our forecast that 2014-2015 will show a meaningful pickup in growth relative to the first four years of the recovery is still on track. Our answer, broadly, is yes. Although the weak first quarter is likely to hold down real GDP for 2014 as a whole, the underlying trends in economic activity are still pointing to significant improvement.

...

The basic rationale for our acceleration forecast of late 2013 was twofold—(1) an end to the fiscal drag that had weighed on growth so heavily in 2013 and (2) a positive impulse from the private sector following the completion of the balance sheet adjustments specifically among US households. Both of these points remain intact.

Bank Failure #8 of 2014: Columbia Savings Bank, Cincinnati, Ohio

by Calculated Risk on 5/23/2014 05:19:00 PM

From the FDIC: United Fidelity Bank, fsb, Evansville, Indiana, Assumes All of the Deposits of Columbia Savings Bank, Cincinnati, Ohio

As of March 31, 2014, Columbia Savings Bank had approximately $36.5 million in total assets and $29.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $5.3 million. ... Columbia Savings Bank is the eighth FDIC-insured institution to fail in the nation this year, and the first in Ohio.A bank failure two weeks in a row ... that hasn't happened recently.

New Home Prices: Almost 45% of Home over $300K, Less than 5% under $150K

by Calculated Risk on 5/23/2014 03:04:00 PM

Here are two graphs I haven't posted for some time ...

As part of the new home sales report, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in April 2014 was $275,800; the average sales price was $320,100."

The following graph shows the median and average new home prices.

Click on graph for larger image.

Click on graph for larger image.

During the bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. With fewer distressed sales now, it appears the builders have moved to higher price points.

The average price in April 2014 was $320,100, and the median price was $275,800. Both are above the bubble high (this is due to both a change in mix and rising prices).

The second graph shows the percent of new homes sold by price. At the peak of the housing bubble, almost 40% of new homes were sold for more than $300K - and over 20% were sold for over $400K.

The percent of home over $300K declined to about 20% in January 2009. Now it has rebounded to almost 45% of homes over $300K.

The percent of home over $300K declined to about 20% in January 2009. Now it has rebounded to almost 45% of homes over $300K.

And less than 5% of homes sold were under $150K in April 2014. This is down from 30% in 2002 - and down from 20% as recently as August 2011. Quite a change.

Earlier on New Home Sales:

• New Home Sales increase to 433,000 Annual Rate in April

• Comments on the New Home Sales report

Comments on the New Home Sales report

by Calculated Risk on 5/23/2014 12:03:00 PM

The Census Bureau reported that new home sales this year, through April, were 148,000, Not seasonally adjusted (NSA). That is down 2.6% from 152,000 during the same four months in 2013 (NSA).

This disappointing start to the year is probably mostly due to higher mortgage rates and higher prices. Mortgage rates were at 3.45% in April 2013 and increased to 4.34% in April 2014. Also there were probably supply constraints in some areas and credit remains difficult for many potential borrowers.

Note: There was a sharp increase in sales in the Midwest region in April, and that appears to be a bounce back from the severe weather. In the Midwest, sales during the first four months are now essentially flat with the same period in 2013.

Maybe sales will move sideways for a little longer, but remember early 2013 was a difficult comparison period. Annual sales in 2013 were up 16.3% from 2012, but sales in the first four months of 2013 were up 26% from the same period in 2012!

Click on graph for larger image.

Click on graph for larger image.

This graph shows new home sales for 2013 and 2014 by month (Seasonally Adjusted Annual Rate).

The comparisons to last year will be a little easier in a few months - especially in Q3 - and I still expect to see solid year-over-year growth later this year.

And here is another update to the "distressing gap" graph that I first started posting several years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through April 2014. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through April 2014. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to decline some more or move sideways (distressed sales will slowly decline and be partially offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase to 433,000 Annual Rate in April

by Calculated Risk on 5/23/2014 10:00:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 433 thousand.

March sales were revised up from 384 thousand to 407 thousand, and February sales were revised down from 449 thousand to 437 thousand.

Sales of new single-family houses in April 2014 were at a seasonally adjusted annual rate of 433,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 6.4 percent above the revised March rate of 407,000, but is 4.2 percent below the April 2013 estimate of 452,000.

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales have bounced around recently, but have mostly moved sideways over the last year. Even with the increase in sales over the previous two years, new home sales are still near the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply decreased in April to 5.3 months from 5.6 months in March.

The months of supply decreased in April to 5.3 months from 5.6 months in March. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of April was 192,000. This represents a supply of 5.3 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, but moving up. The combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In April 2014 (red column), 41 thousand new homes were sold (NSA). Last year 43 thousand homes were also sold in April. The high for April was 116 thousand in 2005, and the low for April was 30 thousand in 2011.

This was above expectations of 420,000 sales in April, but still down year-over-year.

I'll have more later today .

Thursday, May 22, 2014

Friday: New Home Sales

by Calculated Risk on 5/22/2014 08:19:00 PM

First, a couple of manufacturing releases earlier today for May ...

From MarkIt: Markit Flash U.S. Manufacturing PMI™, Output rises at fastest pace in over three years

Operating conditions in the US manufacturing sector continued to improve during May, with strong rises in production and output complemented by further payroll growth.From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Expanded Solidly

After accounting for seasonal factors, the Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) improved to 56.2 in May, up from April’s 55.4.

The Federal Reserve Bank of Kansas City released the May Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity expanded solidly, and producers’ expectations for future factory activity remained at healthy levels.Friday:

“This was the third straight month of solid growth at factories in the region, following some weather-related weakness in previous months”, said Wilkerson. “More factories than in recent surveys were also able to raise selling prices.”

The month-over-month composite index was 10 in May, up from 7 in April and equal to 10 in March

• At 10:00 AM ET, New Home Sales for April from the Census Bureau. The consensus is for an increase in sales to 420 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 384 thousand in March.

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in April

by Calculated Risk on 5/22/2014 05:45:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for selected cities in April. Lawler writes: "Note the steep YOY decline in the short-sales share, and the significant increase in the foreclosure sales share of home sales in Florida."

Total "distressed" share is down in all of these markets, mostly because of a sharp decline in short sales.

Foreclosures are down in most of these areas too, although foreclosures are up in some judicial foreclosure areas and also in Las Vegas (there was a state law change that slowed foreclosures dramatically in Nevada at the end of 2011).

The All Cash Share (last two columns) is mostly declining year-over-year.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Apr-14 | Apr-13 | Apr-14 | Apr-13 | Apr-14 | Apr-13 | Apr-14 | Apr-13 | |

| Las Vegas | 12.4% | 32.5% | 11.4% | 10.0% | 23.8% | 42.5% | 41.4% | 59.3% |

| Reno** | 15.0% | 33.0% | 6.0% | 8.0% | 21.0% | 41.0% | ||

| Phoenix | 4.0% | 12.7% | 6.5% | 11.3% | 10.5% | 24.1% | 32.2% | 42.0% |

| Sacramento | 7.5% | 8.8% | 9.5% | 23.1% | 17.0% | 31.9% | 21.9% | 37.2% |

| Minneapolis | 5.0% | 7.4% | 15.9% | 24.0% | 20.9% | 31.4% | ||

| Mid-Atlantic | 5.9% | 9.9% | 10.0% | 8.6% | 15.9% | 18.5% | 19.5% | 19.4% |

| Orlando | 9.1% | 21.2% | 23.7% | 20.5% | 32.9% | 41.8% | 42.4% | 54.8% |

| California * | 5.5% | 16.1% | 6.7% | 13.5% | 12.2% | 29.6% | ||

| Bay Area CA* | 3.8% | 11.8% | 3.6% | 8.4% | 7.4% | 20.2% | 22.9% | 28.3% |

| So. California* | 5.4% | 16.6% | 5.9% | 12.4% | 11.3% | 29.0% | 26.7% | 34.4% |

| Florida SF | 6.9% | 14.8% | 21.1% | 16.2% | 28.0% | 31.0% | 43.4% | 47.9% |

| Florida C/TH | 4.5% | 10.2% | 15.6% | 12.0% | 20.1% | 22.3% | 70.9% | 73.8% |

| Miami MSA SF | 10.5% | 18.5% | 16.5% | 10.8% | 27.0% | 29.3% | 44.4% | 47.1% |

| Miami MSA C/TH | 5.6% | 12.8% | 17.5% | 12.0% | 23.1% | 24.7% | 73.4% | 78.9% |

| Sarasota | 3.8% | 9.5% | 12.8% | 12.5% | 16.6% | 22.0% | ||

| Northeast Florida | 38.1% | 39.5% | ||||||

| Hampton Roads | 24.4% | 27.8% | ||||||

| Toledo | 33.4% | 40.8% | ||||||

| Des Moines | 17.1% | 19.6% | ||||||

| Peoria | 21.2% | 24.4% | ||||||

| Tucson | 30.5% | 33.5% | ||||||

| Omaha | 22.3% | 17.4% | ||||||

| Pensacola | 35.6% | 34.5% | ||||||

| Georgia*** | 34.3% | NA | ||||||

| Houston | 6.1% | 10.4% | ||||||

| Memphis* | 16.6% | 24.7% | ||||||

| Birmingham AL | 16.8% | 24.1% | ||||||

| Springfield IL** | 13.2% | 14.4% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Hotels: Occupancy Rate up 4.6%, RevPAR up 9.6% in Latest Survey

by Calculated Risk on 5/22/2014 04:09:00 PM

From HotelNewsNow.com: STR: US results for week ending 17 May

In year-over-year measurements, the industry’s occupancy increased 4.6 percent to 69.7 percent. Average daily rate increased 4.8 percent to finish the week at US$116.30. Revenue per available room for the week was up 9.6 percent to finish at US$81.10.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

emphasis added

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is at the highest level since 2000.

The following graph shows the seasonal pattern for the hotel occupancy rate for the last 15 years using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014 and black is for 2009 - the worst year since the Great Depression for hotels. Note: 2001 was briefly worse than 2009 in September.

Year 2000 was the best year for hotel occupancy until late in the year when 2005 had the highest occupancy rate (due to hurricane Katrina).

Right now it looks like 2014 will be the best year since 2000 for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

"Employment Scars of the Housing Bust"

by Calculated Risk on 5/22/2014 03:03:00 PM

More insight from Atif Mian and Amir Sufi at House of Debt: Employment Scars of the Housing Bust

One way to see the scars of the housing bust is to look at the unemployment rate today in counties that saw the biggest decline in house prices. As we argue in the book, such an approach actually significantly underestimates the impact of the house price-driven spending collapse. This is because even people living in areas that were not hit by housing lost their jobs when people living in areas where house prices crashed stopped buying goods. But even with this under-estimation ... [t]he unemployment rate in counties hit hardest by the housing crash is more than 3% higher in 2013 relative to 2006. The rise in the unemployment rate is twice as high as the rise in counties with the smallest decline in house prices. The housing crash has led to a large and persistent increase in unemployment.This reminds me ... way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire in California. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.And the Inland Empire was crushed. Note: The Inland Empire unemployment rate in March 2007 was 5.3%. The rate peaked at 15.0% in 2010, and was at 9.4% in March 2014.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

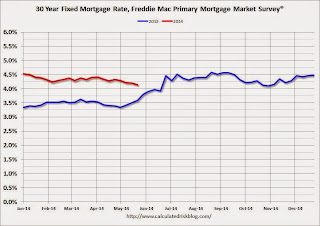

Freddie Mac: "Fixed Mortgage Rates Near Seven Month Low"

by Calculated Risk on 5/22/2014 12:04:00 PM

It is looking more likely that we will see a headline sometime in June: "Mortgage Rates down year-over-year"!

From Freddie Mac: Fixed Mortgage Rates Near Seven Month Low Heading Into Memorial Day Weekend

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing showing average fixed mortgage rates moving lower for the fourth consecutive week with fixed mortgage rates hitting new lows for this year.

30-year fixed-rate mortgage (FRM) averaged 4.14 percent with an average 0.6 point for the week ending May 22, 2014, down from last week when it averaged 4.20 percent. A year ago at this time, the 30-year FRM averaged 3.59 percent.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of 30 year fixed mortgage rates - according to the PMMS® - for 2013 (blue) and 2014 (red).

Mortgage rates jumped to 4.46% in late June 2013, and it is possible that rates will be lower in late June 2014 (currently 4.14%).

Note: The lowest rate in the PMMS® since June 2013 was 4.10% last October.