by Calculated Risk on 6/02/2014 08:05:00 AM

Monday, June 02, 2014

Mortgage Monitor: "Nearly 2 million modified mortgages face interest rate resets"

Black Knight Financial Services (BKFS, formerly the LPS Data & Analytics division) released their Mortgage Monitor report for April today. According to BKFS, 5.62% of mortgages were delinquent in April, up from 5.52% in March. BKFS reports that 2.02% of mortgages were in the foreclosure process, down from 3.17% in April 2013.

This gives a total of 7.64% delinquent or in foreclosure. It breaks down as:

• 1,634,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,187,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,016,000 loans in foreclosure process.

For a total of 3,837,000 loans delinquent or in foreclosure in April. This is down from 4,699,000 in April 2013.

This graph from BKFS shows the number of modified loans that face interest rate resets by date of modification. From BKFS:

An analysis of mortgage performance data showed that, as of April, there were approximately 2 million modified mortgages facing interest rate resets. Furthermore, more than 40 percent of those loan modifications are currently underwater.There is much more in the mortgage monitor.

“We have seen a continual reduction in the number of underwater borrowers at the national level for some time now, but modified loans show a different picture,” said Kostya Gradushy, Black Knight’s manager of Loan Data and Customer Analytics. “While the national negative equity rate as of April stands at 9.4 percent of active mortgages, the share of underwater modified loans facing interest rate resets is much higher -- over 40 percent. In addition, another 18 percent of modified borrowers have 9 percent equity or less in their homes. Given that the data has shown quite clearly that equity -- or the lack thereof -- is one of the primary drivers of mortgage defaults, these resets may indeed pose an increased risk in the years ahead."

emphasis added

Sunday, June 01, 2014

Monday: ISM Manufacturing Survey, Construction Spending

by Calculated Risk on 6/01/2014 08:21:00 PM

From Jon Hilsenrath at the WSJ: Heloc Payment Jump to Take Bite Out of Consumer Spending

At issue are home-equity lines of credit, known as Helocs, which allow homeowners to tap their equity to fund home improvement, college tuitions and other expenses. Those loans typically let borrowers make interest-only payments for the first 10 years before requiring principal payments as well.Weekend:

That reckoning will come this year for an estimated 817,000 borrowers owing more than $23 billion in Helocs, more than double last year's level, according to estimates by Equifax, the credit-reporting firm, and the Office of the Comptroller of the Currency. An average of about $50 billion in loans will reset in each of the next three years.

• Schedule for Week of June 1st

Monday:

• At 10:00 AM ET, the ISM Manufacturing Index for May. The consensus is for an increase to 55.5. The ISM manufacturing index indicated expansion in April at 54.9%. The employment index was at 54.7%, and the new orders index was at 55.1%.

• Also at 10:00 AM: Construction Spending for April. The consensus is for a 0.7% increase in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down slightly and DOW futures are up slightly (fair value).

Oil prices were mixed over the last week with WTI futures at $102.97 per barrel and Brent at $109.52 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.65 per gallon (at about below the level of a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Restaurant Performance Index increases in April, Strongest since May 2013

by Calculated Risk on 6/01/2014 11:57:00 AM

From the National Restaurant Association: Restaurant Performance Index Gained 0.3 Percent in April as Sales and Customer Traffic Continued to Rise

Fueled by improving same-store sales and customer traffic and a positive outlook among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) rose for the second consecutive month. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.7 in April, up 0.3 percent from March and the strongest level since May 2013. In addition, the RPI stood above 100 for the 14th consecutive month, which signifies expansion in the index of key industry indicators.

“The recent rise in the RPI was fueled by improvements in same-store sales and customer traffic, which are back on a positive trajectory after the winter soft patch,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, restaurant operators have an optimistic outlook for business conditions in the months ahead, which is reflected by the expectations component of the RPI rising to its highest level in two years.”

...

For the second consecutive month, a majority of restaurant operators reported higher same-store sales. ... Restaurant operators reported a net gain in customer traffic levels for the second straight month, after registering declines in the previous three months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index increased to 101.7 in April, up from 101.4 in March. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month - and this is a fairly solid reading.

Saturday, May 31, 2014

Unofficial Problem Bank list declines to 496 Institutions

by Calculated Risk on 5/31/2014 05:11:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 30, 2014.

Changes and comments from surferdude808:

As expected, the FDIC provided an update on its enforcement actions through April 2014 and released industry results for 1q2014. Unexpectedly, there was a bank failure for the third consecutive week, which last occurred in October/November 2012. For the week, there were six removals and three additions that leave the Unofficial Problem Bank List at 496 institutions with assets of $154.1 billion. Asset figures were updated through 1q2014. For the first time since the list has been published, updated quarterly asset figures led to an increase in assets of $794 million. Usually, problem banks shrink their balance sheet as a tactic to increase their capital ratios. A year ago, the list held 761 institutions with assets of $277.2 billion. During May 2014, the list declined by 17 institutions after 16 action terminations, three failures, one merger and three additions.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 496.

Actions were terminated against Macon Bank, Inc., Franklin, NC ($789 million); State Bank of Countryside, Countryside, IL ($589 million); Freedom Bank, Inc., Belington, WV ($150 million); Savoy Bank, New York, NY ($103 million); and First Security Trust Bank, Inc., Florence, KY ($82 million).

Slavie Federal Savings Bank, Bel Air, MD ($140 million) was the ninth institution to fail this year. Also, Slavie Federal was the ninth institution to fail in Maryland since the on-set of the Great Recession.

Added this week were GSL Savings Bank, Guttenberg, NJ ($100 million); Grant County Deposit Bank, Williamstown, KY ($79 million); and Columbus Junction State Bank, Columbus Junction, IA ($56 million). The last time three institutions were added during a week was back on October 4, 2013. The FDIC also issued a Prompt Correction Action order against State Bank of Herscher, Herscher, IL ($149 million) and Highland Community Bank, Chicago, IL ($64 million).

The FDIC told us there are now officially 411 problem institutions with assets of $126 billion. The spread between the official and unofficial count narrowed to 85 from 99 last quarter and assets to $28 billion from $29 billion. Next week will likely be quiet nor do we think there will be a failure for a fourth consecutive week.

Schedule for Week of June 1st

by Calculated Risk on 5/31/2014 08:47:00 AM

This will be a busy week for economic data with several key reports including the May employment report on Friday.

Other key reports include the ISM manufacturing index on Monday, May vehicle sales on Tuesday, and the April Trade Deficit and May ISM non-manufacturing index on Wednesday.

The Fed's Q1 Flow of Funds report will be released Thursday.

Note: The ECB will probably ease monetary policy on Thursday.

10:00 AM ET: ISM Manufacturing Index for May. The consensus is for an increase to 55.5 from 54.9 in April.

10:00 AM ET: ISM Manufacturing Index for May. The consensus is for an increase to 55.5 from 54.9 in April.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in April at 54.9%. The employment index was at 54.7%, and the new orders index was at 55.1%.

10:00 AM: Construction Spending for April. The consensus is for a 0.7% increase in construction spending.

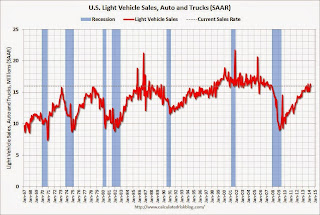

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be increase to 16.1 million SAAR in May from 16.0 million in April (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be increase to 16.1 million SAAR in May from 16.0 million in April (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for April. The consensus is for a 0.5% increase in April orders.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in May, down from 220,000 in April.

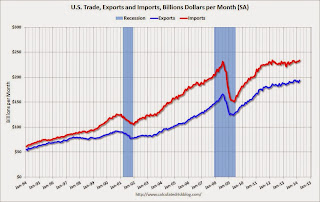

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. Imports increased and exports decreased in February.

The consensus is for the U.S. trade deficit to be at $41.0 billion in April from $40.4 billion in March.

10:00 AM: ISM non-Manufacturing Index for May. The consensus is for a reading of 55.3, up from 55.2 in April. Note: Above 50 indicates expansion.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 300 thousand.

Early: The ECB meets in Frankfurt. From Nomura:

We expect the ECB to deliver a package of measures on 5 June to ease monetary policy. We expect a 10bp cut to all key interest rates, taking the refi rate down to 0.15%, the deposit rate negative for the first time to -0.10% and the marginal lending facility rate down to 0.65%. We also expect an extension of the forward guidance on liquidity provisions, with the fixed-rate full-allotment procedure extended by a further 12 months to at least the end of June 2016. We also expect the ECB to launch a targeted LTRO programme in June (60% probability), to address credit weakness and risks to the recovery from this channel.Early: Trulia Price Rent Monitors for May. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

12:00 PM: Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM: Employment Report for May. The consensus is for an increase of 213,000 non-farm payroll jobs in May, down from the 288,000 non-farm payroll jobs added in April.

The consensus is for the unemployment rate to increase to 6.4% in May.

This graph shows the percentage of payroll jobs lost during post WWII recessions through April.

This graph shows the percentage of payroll jobs lost during post WWII recessions through April.The economy has added 9.2 million private sector jobs since employment bottomed in February 2010 (8.6 million total jobs added including all the public sector layoffs).

There are 406 thousand more private sector jobs now than when the recession started in 2007, but total employment is still 113 thousand below the pre-recession peak.

3:00 PM: Consumer Credit for April from the Federal Reserve. The consensus is for credit to increase $15.5 billion.

Friday, May 30, 2014

Bank Failure #9 in 2014: Slavie Federal Savings Bank, Bel Air, Maryland

by Calculated Risk on 5/30/2014 06:13:00 PM

From the FDIC: Bay Bank, FSB, Lutherville, Maryland, Assumes All of the Deposits of Slavie Federal Savings Bank, Bel Air, Maryland

As of March 31, 2014, Slavie Federal Savings Bank had approximately $140.1 million in total assets and $111.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $6.6 million. ... Slavie Federal Savings Bank is the ninth FDIC-insured institution to fail in the nation this year, and the first in Maryland.Bank failures three weeks in a row ...

Fannie Mae and Freddie Mac: Mortgage Serious Delinquency rate declined in April

by Calculated Risk on 5/30/2014 04:13:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in April to 2.13% from 2.19% in March. The serious delinquency rate is down from 2.93% in April 2013, and this is the lowest level since November 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier Freddie Mac reported that the Single-Family serious delinquency rate declined in April to 2.15% from 2.20% in March. Freddie's rate is down from 2.91% in April 2013, and is at the lowest level since February 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Both Fannie Mae and Freddie Mac serious delinquency rates have fallen about 0.8 percentage points over the last year, and at that pace the serious delinquency rates will probably be below 2% in a few months - and will be under 1% in late 2015.

Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be back to normal in late 2015 or 2016.

Lawler on Toll Brothers: Net Signed Contracts “Flat” vs. Year Ago; Prices Up But Gains Slow; Demand over Past Year “Relatively Flat”

by Calculated Risk on 5/30/2014 02:37:00 PM

From economist Tom Lawler:

Toll Brothers, the self-described “nation’s leading builder of luxury homes” which was recently honored as BUILDER Magazine’s “builder of the year,” reported that net signed contracts on homes in the quarter ended April 30, 2014 totaled 1,749, down 0.2% from the comparable quarter of 2013. Net signed contracts per community last quarter were down 8.3% from the comparable quarter of 2013. The average price on net signed contracts last quarter was $729,000, up 7.5% from a year ago. Home deliveries totaled 1,218 last quarter, up 36.2% from the comparable quarter of 2013, at an average sales price of $706,000, up 22.4% from the comparable quarter of 2013. The outsized gain in the average sales price for closed homes partly reflected big increases in contract prices last year, but also reflected product “mix” changes, including a sharp increase in the share of homes closed in the expensive West region. The company’s order backlog as of the end of April was 4,324, up 18.3% from last April, at an average order price of $742,000, up 7.1% from a year ago.

The company said that it owned or controlled 50,358 lots at the end of April, up 11.5% from last April, and up 40.1% from April 2011.

In Toll’s press release, the company’s CEO said that “(d)emand over the past year has been solid, although relatively flat, compared to the strong growth we initially experienced beginning in 2011, coming off the bottom of this housing cycle.” He also expressed optimism going forward. Here is another quote from the press release.

“We note that last cycle's recovery, in the early 1990's, began with a period of rapid acceleration, followed by leveling, before further upward momentum. We believe that we are in a similar leveling period in the early stages of the housing recovery with significant pent-up demand building."

Toll does give limited (and not very useful) guidance in its press release, and Toll said that it expects to deliver between 5,100 and 5,850 in the fiscal year ending 10/31/2014. Given deliveries in the first half of the fiscal year, that guidance implies a range of deliveries from May 1 through October 31 of between 2,954 and 3,704. Toll’s guidance on the average sales price on deliveries for the year was between $690,000 and $720,000. Using the midpoint of these ranges as the “best guidance,” that would imply deliveries from May 1, 2014 through October 2014 of 3,329, up 30.8% from the comparable period of 2013, at an average sales price of 705,000, up 3.5% from the comparable period of 2013, and little changed from the average sales price in the first half of FY 2014.

Toll’s earnings beat consensus, but net orders per community were disappointing.

Headline for Next Friday: "U.S. Employment at All Time High"

by Calculated Risk on 5/30/2014 12:22:00 PM

Just a quick note, total nonfarm U.S. employment is currently 113 thousand below the pre-recession peak. With the release of the May employment report next Friday, total employment will probably be at an all time high.

Note: The consensus is for an increase of 217 thousand non-farm payroll jobs added in May.

I guess I'm going to have to retire the following graph until the next recession ... (once call the "THE SCARIEST JOBS CHART EVER").

Click on graph for larger image.

The graph shows the percentage of payroll jobs lost during post WWII recessions through April.

Of course this doesn't include growth of the labor force, but this will be a significant milestone as the economy recovers from the housing bust and severe financial crisis.

Final May Consumer Sentiment at 81.9, Chicago PMI increases to 65.5

by Calculated Risk on 5/30/2014 09:55:00 AM

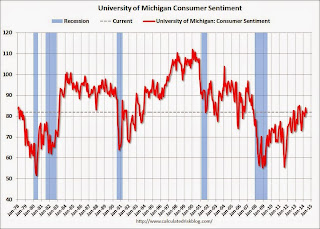

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for May decreased to 81.9 from the April reading of 84.1, and was up slightly from the preliminary May reading of 81.8.

This was below the consensus forecast of 82.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

Still waiting for sentiment to back at post-recession highs!

Chicago PMI May 2014: Chicago Business Barometer Up 2.5 to 65.5 in May

The Chicago Business Barometer increased to 65.5 in May from 63.0 in April, the highest since October, as demand strengthened and the economy continued to recover from a weather related slowdown in Q1. ...This was above the consensus estimate of 61.0.

Commenting on the MNI Chicago Report, Philip Uglow, Chief Economist at MNI Indicators said, “It looks pretty clear now that the slowdown in Q1 was due to the poor weather, with activity now back to or exceeding the level seen in Q4. The rise in the Barometer to a seven month high in May suggests we’ll see a significant bounceback in GDP growth this quarter following the contraction in Q1.”

emphasis added