by Calculated Risk on 6/04/2014 08:21:00 AM

Wednesday, June 04, 2014

ADP: Private Employment increased 179,000 in May

Private sector employment increased by 179,000 jobs from April to May according to the May ADP National Employment Report®. ... he report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 210,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "Job growth moderated in May. The slowing in growth was concentrated in Professional/Business Services and companies with 50-999 employees. The job market has yet to break out from the pace of growth that has prevailed over the last three years.”

Note: ADP hasn't been very useful in directly predicting the BLS report on a monthly basis, but it might provide a hint. The BLS report for May will be released on Friday.

MBA: Mortgage Applications Decrease in Latest Survey, Mortgage Rates "lowest levels in close to a year"

by Calculated Risk on 6/04/2014 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 30, 2014. This week’s results include an adjustment for the Memorial Day holiday. ...

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. ...

...

Interest rates for most products fell to their lowest levels in close to a year.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.26 percent from 4.31 percent, with points decreasing to 0.13 from 0.15 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 73% from the levels in May 2013 (one year ago).

As expected, refinance activity is very low this year.

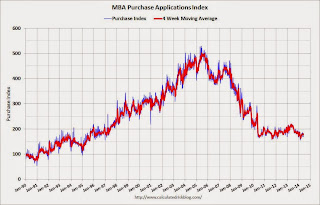

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 17% from a year ago.

Note: It appears mortgage rates will be down year-over-year in a few weeks.

Tuesday, June 03, 2014

Wednesday: ADP Employment, Trade Deficit, ISM Service, Beige Book

by Calculated Risk on 6/03/2014 06:45:00 PM

From Jon Hilsenrath at the WSJ: Fed Officials Growing Wary of Market Complacency

[M]easures of risk aversion and market volatility show an especially striking sense of investor calm. The VIX, which tracks expected stock-market fluctuations based on options trading, has gone 74 straight weeks below its long-run average—a run of steadiness not seen since 2006 and 2007."Complacency" may be a problem, but this isn't 2006 and 2007. In January 2007 I predicted a recession would start that year as a result of the housing bust (made it by one month since the recession started in December 2007!). Now - I don't see a recession any time soon.

...

New York Fed President William Dudley warned in a question-and-answer session after a speech last month that he was nervous that unusually low volatility in markets was breeding too much risk-taking.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in May, down from 220,000 in April.

• At 8:30 AM, the Trade Balance report for April from the Census Bureau. The consensus is for the U.S. trade deficit to be at $41.0 billion in April from $40.4 billion in March.

• At 10:00 AM, the ISM non-Manufacturing Index for May. The consensus is for a reading of 55.3, up from 55.2 in April. Note: Above 50 indicates expansion.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

U.S. Light Vehicle Sales increase to 16.7 million annual rate in May, Highest Rate since 2007

by Calculated Risk on 6/03/2014 02:42:00 PM

Based on an AutoData estimate, light vehicle sales were at a 16.77 million SAAR in May. That is up 9% from May 2013, and up 5% from the sales rate last month.

This is the highest sales rate since February 2007.

Note: WardsAuto is currently estimating 16.70 million SAAR (updated final), see: May 2014 Sales Thread: Late-Month Sales Send SAAR Soaring

This was above the consensus forecast of 16.1 million SAAR (seasonally adjusted annual rate).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for May (red, light vehicle sales of 16.77 million SAAR from AutoData).

Severe weather clearly impacted sales in January and February. Since then vehicle sales have been solid.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and were a key driver of the recovery.

Looking forward, the growth rate will slow for auto sales.

Vehicle Sales in May: Solid Early Reports

by Calculated Risk on 6/03/2014 12:15:00 PM

I'll post a graph of monthly vehicle sales when after all the automakers report (usually between 3 and 4 PM ET). The consensus is for light vehicle sales to increase to 16.1 million SAAR in May from just under 16.0 million in April (Seasonally Adjusted Annual Rate).

Here are a few articles that suggest sales were solid in May (there was one more selling day in May 2014 compared to May 2013).

From MarketWatch: General Motors U.S. sales jump 13% in May

GM said it sold 284,694 total vehicles in May, up from 252,894 a year earlier. ... GM called the results its best total monthly sales figure since August 2008.From MarketWatch: Chrysler's U.S. sales jump 17% in May

Chrysler, a unit of Fiat Chrysler Automobiles, sold 194,421 vehicles in May, up from 166,596 a year earlier. The company said it enjoyed its best May sales since 2007.From MarketWatch: Ford sales rise 3% in May

Ford Motor Co. reported Tuesday it sold 254,084 cars and pickup-truck in the United States in May, up 3% from a year ago. ... It was Ford's best May in 10 years

CoreLogic: House Prices up 10.5% Year-over-year in April

by Calculated Risk on 6/03/2014 09:14:00 AM

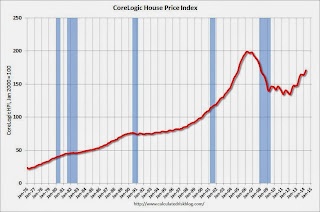

Notes: This CoreLogic House Price Index report is for April. The recent Case-Shiller index release was for March. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rise by 10.5 Percent Year Over Year in April

Home prices nationwide, including distressed sales, increased 10.5 percent in April 2014 compared to April 2013. This change represents 26 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased 2.1 percent in April 2014 compared to March 2014.

Excluding distressed sales, home prices nationally increased 8.3 percent in April 2014 compared to April 2013 and 1.1 percent month over month compared to March 2014. Distressed sales include short sales and real estate owned (REO) transactions.

“The weakness in home sales that began a few months ago is clearly signaling a slowdown in price appreciation,” said Sam Khater, deputy chief economist for CoreLogic. “The 10.5 percent increase in April, compared to a year earlier, was the slowest rate of appreciation in 14 months.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 2.1% in April, and is up 10.5% over the last year.

This index is not seasonally adjusted, so a strong month-to-month gain was expected for April.

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty six consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty six consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).I expect the year-over-year increases to continue to slow.

Monday, June 02, 2014

Tuesday: Vehicle Sales

by Calculated Risk on 6/02/2014 08:25:00 PM

From Emily Badger at the WaPo:

Census data released Monday on the characteristics of new single-family housing construction confirms that the median size of a new pad in America is bigger than it's ever been ... In 2013, the median size of a new single-family home completed in the United States was 2,384 square feet (the average, not surprisingly, was tugged even higher by the mega-mega home: 2,598 square feet). That median is above the pre-crash peak of 2,277 square feet in 2007, and it dwarfs the size of homes we were building back in 1973 (median size then: 1,525 square feet)....Looks like extra bathrooms are very popular.

What, then, do we want all of this room for? What's particularly striking in the Census Bureau's historic data on new housing characteristics is the growth of what would be luxuries for many households: fourth bedrooms, third bathrooms, three-car garages.

Tuesday:

• All day: Light vehicle sales for May. The consensus is for light vehicle sales to increase to 16.1 million SAAR in May from 16.0 million in April (Seasonally Adjusted Annual Rate).

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for April. The consensus is for a 0.5% increase in April orders.

Weekly Update: Housing Tracker Existing Home Inventory up 10.5% year-over-year on June 2nd

by Calculated Risk on 6/02/2014 06:23:00 PM

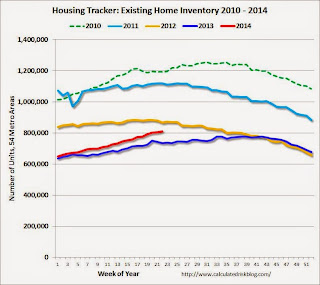

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for April). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 10.5% above the same week in 2013.

Inventory is still very low - still below the level in 2012 (yellow) when prices started increasing - but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess was inventory will be up 10% to 15% year-over-year at the end of 2014. Inventory may increase a little more than I expected!

ISM Correction: ISM Manufacturing index increased in May to 55.4

by Calculated Risk on 6/02/2014 02:16:00 PM

Note: The ISM made a seasonal adjustment error in their release this morning. The index was corrected twice, and is now reported to have increased to 55.4%, not decreased to 53.2% as was initially reported.

The ISM manufacturing index suggests faster expansion in May than in April. The PMI was at 55.4% in May, up from 54.9% in April. The employment index was at 52.8%, down from 54.7% in March, and the new orders index was at 56.9%, up from 55.1% in April.

From the Institute for Supply Management: May 2014 Manufacturing ISM® Report On Business® CORRECTION

ISM® has discovered an error in its software programming for calculating the May 2014 Manufacturing PMI® that was released at 10 a.m. ET this morning.

“We apologize for this error. We have recalculated and confirmed that the actual index indicates that the economy is accelerating,” said Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. “Our research team is analyzing our internal processes to ensure that this doesn’t happen again,” he added.

“The May PMI® registered 55.4 percent, an increase of 0.5 percentage point from April’s reading of 54.9 percent, indicating expansion in manufacturing for the 12th consecutive month. The New Orders Index registered 56.9 percent, an increase of 1.8 percentage points from the 55.1 percent reading in April, indicating growth in new orders for the 12th consecutive month. The Production Index registered 61.0 percent, 5.3 percentage points above the April reading of 55.7 percent. Employment grew for the 11th consecutive month, registering 52.8 percent, a decrease of 1.9 percentage points below April’s reading of 54.7 percent. The Supplier Deliveries Index registered 53.2 percent, 2.7 percentage points below the April reading of 55.9 percent. Comments from the panel reflect generally steady growth, but note some areas of concern regarding raw materials pricing and supply tightness and shortages.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was close to expectations of 55.5%.

Construction Spending increased 0.2% in April

by Calculated Risk on 6/02/2014 11:24:00 AM

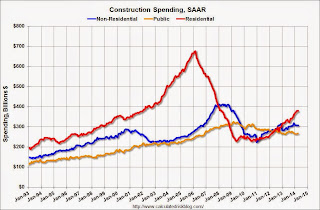

The Census Bureau reported that overall construction spending increased in April:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during April 2014 was estimated at a seasonally adjusted annual rate of $953.5 billion, 0.2 percent above the revised March estimate of $951.6 billion. The April figure is 8.6 percent above the April 2013 estimate of $878.4 billion.Private spending was mostly unchanged and public spending increased in April:

Spending on private construction was at a seasonally adjusted annual rate of $686.5 billion, nearly the same as the revised March estimate of $686.8 billion. ...

In April, the estimated seasonally adjusted annual rate of public construction spending was $267.0 billion, 0.8 percent above the revised March estimate of $264.8 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 44% below the peak in early 2006, and up 66% from the post-bubble low.

Non-residential spending is 26% below the peak in January 2008, and up about 37% from the recent low.

Public construction spending is now 18% below the peak in March 2009 and about 1% above the post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 17%. Non-residential spending is up 6% year-over-year. Public spending is up 1% year-over-year.

Looking forward, all categories of construction spending should increase in 2014. Residential spending is still very low, non-residential is starting to pickup, and public spending is probably near a bottom.

Note: Public construction spending is at the lowest level since 2006 (lowest since 2001 adjusted for inflation). Not investing more in infrastructure is probably one of the major policy failures of the last 5+ years.