by Calculated Risk on 6/10/2014 07:18:00 PM

Tuesday, June 10, 2014

Update: Will Mortgage Rates be down year-over-year in late June?

It is fun to try to guess future headlines, and it looks like we might see "Mortgage Rates down year-over-year" in a couple of weeks.

I use the weekly Freddie Mac Primary Mortgage Market Survey® (PMMS®) to track mortgage rates. The PMMS series started in 1971, so there is a fairly long historical series.

For daily rates, the Mortgage News Daily has a series that tracks the PMMS very well, and is usually updated daily around 3 PM ET. The MND data is based on actual lender rate sheets, and is mostly "the average no-point, no-origination rate for top-tier borrowers with flawless scenarios". (this tracks the Freddie Mac series).

MND reports that average 30 Year fixed mortgage rates increased today to 4.25% from 4.23% yesterday.

One year ago rates were at 4.05% and rising. If the current rate holds, mortgage rates will be down year-over-year in less than 2 weeks.

Here is a table from Mortgage News Daily:

Click on graph for larger image.

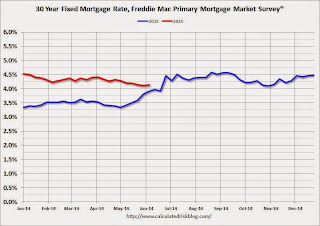

Click on graph for larger image.Here is a graph of 30 year fixed mortgage rates - according to the Freddie Mac PMMS® - for 2013 (blue) and 2014 (red).

Mortgage rates jumped to 4.46% in late June 2013, and it is possible that rates will be lower in late June 2014 (currently 4.25% according to Mortgage News Daily).

Las Vegas Real Estate in May: Year-over-year Non-contingent Inventory Doubles, Distressed Sales and Cash Buying down sharply

by Calculated Risk on 6/10/2014 01:12:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada home prices rebound in May, GLVAR reports

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in May was 3,450, up from 3,215 in April, but down from 3,884 one year ago.There are several key trends that we've been following:

GLVAR said 40.2 percent of all existing local homes sold in May were purchased with cash. That’s down from 41.4 percent in April, well short of the February 2013 peak of 59.5 percent and suggesting that investors are accounting for a smaller percentage of local buyers.

...

In May, 7.9 percent of all existing local home sales were short sales, down substantially from 12.4 in April. Another 9.1 percent of all May sales were bank-owned properties, down from 11.4 in April.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in May was 13,637. That’s down 1.4 percent from 13,833 in April and down 1.3 percent from one year ago.

By the end of May, GLVAR reported 6,615 single-family homes listed without any sort of offer. That’s up 3.0 percent from 6,420 such homes listed in April, and a 100.6 percent jump from one year ago. For condos and townhomes, the 2,258 properties listed without offers in May represented a 0.3 percent decrease from 2,264 such properties listed in April, but a 76.8 percent jump from one year ago.

emphasis added

1) Overall sales were down about 11% year-over-year.

2) Conventional (equity, not distressed) sales were up 27% year-over-year. In May 2013, only 57.9% of all sales were conventional equity. This year, in May 2014, 83.0% were equity sales.

3) The percent of cash sales has declined year-over-year from 57.9% in May 2013 to 40.2% in May 2014. (investor buying appears to be declining).

4) Non-contingent inventory is up 100.6% year-over-year (double)!

Inventory has clearly bottomed in Las Vegas (A major theme for housing last year). And fewer distressed sales and more inventory (a major theme for 2014) suggests price increases will slow.

FNC: Residential Property Values increased 8.4% year-over-year in April

by Calculated Risk on 6/10/2014 12:31:00 PM

In addition to Case-Shiller, CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their April index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.6% from March to April (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.6% and 0.7% in April. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

The year-over-year change slowed in April, with the 100-MSA composite up 8.4% compared to April 2013. The index is still down 21.7% from the peak in 2006.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the year-over-year change based on the FNC index (four composites) through April 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

This might be the beginning of a slowdown in prices increases in the FNC index.

The April Case-Shiller index will be released on Tuesday, June 24th, and I expect Case-Shiller to show a slowdown in price increases.

BLS: Jobs Openings increase sharply to 4.5 million in April

by Calculated Risk on 6/10/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 4.5 million job openings on the last business day of April, up from 4.2 million in March, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) increased over the 12 months ending in April for total nonfarm and total private and was little changed for government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for April, the most recent employment report was for May.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in April to 4.455 million from 4.166 million in March.

The number of job openings (yellow) are up 17% year-over-year compared to April 2013.

Quits are up 11% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

It is a good sign that job openings are over 4 million for the third consecutive month, and that quits are increasing.

NFIB: Small Business Optimism Index increases in May, Highest since 2007

by Calculated Risk on 6/10/2014 08:33:00 AM

From the National Federation of Independent Business (NFIB): Small Business Sentiment: Improves a Bit But Is No Sign Of A Surge

NFIB Optimism Index rose 1.4 points in May to 96.6, the highest reading since September 2007. ...In another good sign, the percent of firms reporting "poor sales" as the single most important problem has fallen to 12, down from 16 last year - and "taxes" are the top problem at 25 (taxes are usually reported as the top problem during good times).

Labor Markets. NFIB owners increased employment by an average of 0.11 workers per firm in May (seasonally adjusted), the eighth positive month in a row and the best string of gains since 2006.

emphasis added

Click on graph for larger image.

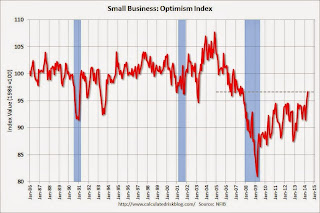

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 96.6 in May from 95.2 in April.

Monday, June 09, 2014

Tuesday: Job Openings, Small Business Optimism

by Calculated Risk on 6/09/2014 08:58:00 PM

From Fannie Mae: Spring-Summer Buying and Selling Season Sputters Despite Drop in Mortgage Rates

"Consumers’ lukewarm income expectations and reticence about the economy seem to be holding back housing demand," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "This year’s spring and summer home buying season has gotten off to a slow start, even as mortgage rates have trended lower over the past two months. Our National Housing Survey data show that economic conditions continue to be the top concern among consumers who think it’s a bad time to buy or sell a home. While recent housing activity suggests that the worst of the housing slump may be behind us, this caution among consumers supports our expectation that the rebound in home sales will likely be too modest to pull sales for all of 2014 ahead of last year."As a reminder: a decline in existing home sales this year is not "bad news". With fewer distressed sales and less investor buying, it is no surprise that existing home sales are down. I expect housing starts and new home sales (the key for GDP and employment growth) to increase this year and also in 2015.

Tuesday:

• At 7:30 AM ET, NFIB Small Business Optimism Index for May.

• At 10:00 AM, Job Openings and Labor Turnover Survey for April from the BLS. In March, the number of job openings (yellow) were up 3.5% year-over-year compared to March 2013, and Quits were up sharply year-over-year.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for April. The consensus is for a 0.5% increase in inventories.

Weekly Update: Housing Tracker Existing Home Inventory up 10.9% year-over-year on June 9th

by Calculated Risk on 6/09/2014 04:27:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for April). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 10.9% above the same week in 2013.

Inventory is still very low - but I expect inventory to be above the same week in 2012 in July (prices bottomed in early 2012). This increase in inventory should slow price increases, and might lead to price declines in some areas.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess was inventory would be up 10% to 15% year-over-year at the end of 2014. Right now it looks like inventory might increase a little more than I expected.

Lawler on Hovnanian: Home Sales Soft without “Big Deals”

by Calculated Risk on 6/09/2014 03:24:00 PM

From housing economist Tom Lawler:

Hovnanian Enterprises, the 7th largest US home builder in 2013, reported that net home orders, including unconsolidated joint ventures, totaled 1,907 in the quarter ending April 30, 2014, down 2.2% from the comparable quarter of 2013. Sales per community were down 8.5% from a year ago. The average net order price last quarter was $368,668, up 3.3% from a year ago. Home deliveries last quarter including JVs) totaled 1,331 last quarter, down 6.5% from the comparable quarter of 2013, at an average sales price of $354,405, up 4.3% from a year ago. The company’s order backlog at the end of April was 3,032, up 7.3% from last April, at an average order price of $374,584, up 3.4% from a year ago.

Here is an excerpt from the company’s press release.

"We launched our national sales campaign, Big Deal Days, in March and were encouraged by the 728 net contracts signed during the month of March 2014, the highest level of monthly net contracts since April 2008. In addition, the 3.6 net contracts per active selling community in March was the highest level of monthly net contracts per community since September 2007," stated Ara K. Hovnanian, Chairman of the Board, President and Chief Executive Officer. "However, our sales pace during April and May was choppy and the total monthly sales pace per active selling community in both months fell short of last year's levels."Hovnanian’s “Big Deal Days” campaign, which offered “the biggest savings of the year” on a selection of “quick move-in” homes, ended at the end of March.

In the company’s conference call presentation Hovnanian broke out net orders by month, and included net orders for May. Net orders for April and May combined were down 12.4% from net orders in April and May of 2013.

Hovnanian owned or controlled 37,787 lots (including JVs) at the end of April, up 25.8% from last April.

Phoenix Real Estate in May: Sales down 21%, Cash Sales down 40%, Inventory up 47%

by Calculated Risk on 6/09/2014 02:01:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in May were down 21% year-over-year and at the lowest for May since 2008.

2) Cash Sales (frequently investors) were down 40%, so investor buying appears to be declining. Non-cash sales were down about 9% year-over-year.

3) Active inventory is now increasing rapidly and is up 47% year-over-year - and at the highest level for May since 2011.

Inventory has clearly bottomed in Phoenix (A major theme for housing in 2013). And more inventory (a theme this year) - and less investor buying - suggests price increases should slow sharply in 2014.

According to Case-Shiller, Phoenix house prices bottomed in August 2011 (mostly flat for all of 2011), and then increased 23% in 2012, and another 15% in 2013. Those large increases were probably due to investor buying, low inventory and some bounce back from the steep price declines in 2007 through 2010. Now, with more inventory, price increases should flatten out in 2014.

We only have Case-Shiller through March, but the Zillow index shows Phoenix prices down slightly year-to-date through April.

| May Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Inventory | YoY Change Inventory | |

| May-08 | 5,6371 | --- | 1,062 | 18.8% | 54,1611 | --- |

| May-09 | 9,284 | 64.7% | 3,592 | 38.7% | 39,902 | -26.3% |

| May-10 | 9,067 | -2.3% | 3,341 | 36.8% | 41,326 | 3.6% |

| May-11 | 9,8112 | 8.2% | 4,523 | 46.1% | 31,661 | -23.4% |

| May-12 | 8,445 | 13.5% | 3,907 | 46.3% | 20,162 | -36.3% |

| May-13 | 9,440 | 11.8% | 3,669 | 38.9% | 19,734 | -2.1% |

| May-14 | 7,442 | -21.2% | 2,193 | 29.5% | 29,091 | 47.4% |

| 1 May 2008 does not include manufactured homes, ~100 more 2 Error corrected for 2011 sales and percent cash sales. | ||||||

Update: 41-Year-Olds and the Labor Force Participation Rate

by Calculated Risk on 6/09/2014 11:00:00 AM

To make a few simple points on the Labor Force Participation Rate, yesterday I posted 41-Year-Olds and the Labor Force Participation Rate . In the previous post I only used men for each age group to simplify.

By request here is a look at the participation rate of women in the prime working age groups over time.

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the trends for each prime working age women 5-year age group.

Note: This is a rolling 12 month average to remove noise (data is NSA), and the scale doesn't start at zero to show the change.

For women, the participation rate increased significantly until the late 90s, and then started declining slowly. This is a more complicated story than for men, and that is why I used prime working age men only yesterday to show the gradual downward decline in participation that has been happening for decades (and is not just recent economic weakness).

The second graph shows the same data for women but with the full scale (0% to 100%). The upward participation until the late 80s is very clear, and the decline since then has been gradual.

The second graph shows the same data for women but with the full scale (0% to 100%). The upward participation until the late 80s is very clear, and the decline since then has been gradual.

The third graph is a repeat of the full scale graph for prime working age men. The participation rate has been trending down for decades.

To repeat: The bottom line is that the participation rate was declining for prime working age workers before the recession, there are several reasons for this decline (not just recent "economic weakness") and many estimates of "missing workers" are probably way too high.

To repeat: The bottom line is that the participation rate was declining for prime working age workers before the recession, there are several reasons for this decline (not just recent "economic weakness") and many estimates of "missing workers" are probably way too high.