by Calculated Risk on 6/12/2014 04:03:00 PM

Thursday, June 12, 2014

DataQuick on California Bay Area: May Home Sales down 7.5% Year-over-year, Non-Distressed sales up slightly Year-over-year

From DataQuick: Bay Area Home Sales Constrained by Supply; Prices Continue to Rise

A total of 7,898 new and resale houses and condos sold in the nine-county Bay Area last month. That was up 4.5 percent from 7,555 in April and down 7.5 percent from 8,541 in May last year, according to San Diego-based DataQuick.A few key year-over-year trends: 1) declining distressed sales, 2) generally declining investor buying, 3) declining total sales, but 4) some increase in non-distressed sales. Though total sales were down 7.5% year-over-year, the percent of non-distressed sales was up 3%. There were 7,898 total sales this year in May, and 7.8% were distressed. In May 2013, there were 8,541 total sales, and 16.9% were distressed.

Bay Area sales almost always increase from April to May. On average they have risen about 7.2 percent between those two months since 1988, when DataQuick’s statistics begin. ...

Last month foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 3.1 percent of all resales, down from a revised 3.6 percent the month before, and down from 6.5 percent a year ago. Foreclosure resales peaked at 52.0 percent in February 2009. The monthly average for foreclosure resales over the past 17 years is 9.8 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 4.7 percent of Bay Area resales last month. That was up from an estimated 4.2 percent in April and down from 10.4 percent a year earlier.

Last month absentee buyers – mostly investors – purchased 20.5 percent of all Bay Area homes. That was up a hair from April’s revised 20.4 percent and down from 22.4 percent for May a year ago.

emphasis added

Hotels: Occupancy Rate up 3.1%, RevPAR up 7.4% in Latest Survey

by Calculated Risk on 6/12/2014 01:04:00 PM

From HotelNewsNow.com: SSTR: US hotel results for week ending 7 June

In year-over-year measurements, the industry’s occupancy increased 3.1 percent to 69.1 percent. Average daily rate increased 4.2 percent to finish the week at US$114.00. Revenue per available room for the week was up 7.4 percent to finish at US$78.81.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

emphasis added

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is at the highest level since 2000.

The following graph shows the seasonal pattern for the hotel occupancy rate for the last 15 years using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014 and black is for 2009 - the worst year since the Great Depression for hotels. Note: 2001 was briefly worse than 2009 in September.

Year 2000 was the best year for hotel occupancy until late in the year when 2005 had the highest occupancy rate (due to hurricane Katrina).

Right now it looks like 2014 will be the best year since 2000 for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Retail Sales increased 0.3% in May

by Calculated Risk on 6/12/2014 08:45:00 AM

On a monthly basis, retail sales increased 0.3% from April to May (seasonally adjusted), and sales were up 4.3% from May 2013. Sales in April were revised up sharply from a 0.1% increase to a 0.5% increase. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for May, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $437.6 billion, an increase of 0.3 percent from the previous month, and 4.3 percent above May 2013. ... The March 2014 to April 2014 percent change was revised from +0.1 percent to +0.5 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos were up 0.1%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.6% on a YoY basis (4.3% for all retail sales).

Retail sales ex-gasoline increased by 4.6% on a YoY basis (4.3% for all retail sales).The increase in May was well below consensus expectations of a 0.6% increase - however sales in April were revised up sharply (sales in May were up 0.7% from the initial April release level).

Weekly Initial Unemployment Claims increase to 317,000

by Calculated Risk on 6/12/2014 08:30:00 AM

The DOL reports:

In the week ending June 7, the advance figure for seasonally adjusted initial claims was 317,000, an increase of 4,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 312,000 to 313,000. The 4-week moving average was 315,250, an increase of 4,750 from the previous week's revised average. The previous week's average was revised up by 250 from 310,250 to 310,500.The previous week was revised up from 312,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 315,250.

This was above the consensus forecast of 309,000. The 4-week average is now at normal levels for an expansion.

Wednesday, June 11, 2014

Thursday: Retail Sales, Unemployment Claims

by Calculated Risk on 6/11/2014 07:24:00 PM

Thursday:

• At 8:30 AM ET, Retail sales for May will be released. The consensus is for retail sales to increase 0.6% in May, and to increase 0.4% ex-autos.

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 309 thousand from 312 thousand.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for April. The consensus is for a 0.4% increase in inventories.

Also here is a price index for commercial real estate that I follow. From CoStar: Property Price Gains In April Strongest At High End Of Market

•HIGH-END CRE PROPERTIES ENJOY BIGGEST PRICING GAINS IN APRIL: Bolstered by continued demand for large, core properties, the value-weighted U.S. Composite Index advanced by 2% in April 2014, while the equal-weighted U.S. Composite Index, which is more heavily influenced by smaller, second-tier properties, declined by 0.8% for the same month. In particular, average sale prices for core multifamily and office properties in major markets have soared well above their 2006–07 average as investors continued to aggressively pursue those types of properties. This investment activity is reflected in the value-weighted U.S. Composite Index, which has recovered to within 2.2% of its prior peak level in September of 2007, while the equal-weighted U.S. Composite Index sits 21.9% below its prior peak.

...

DISTRESS SALES CONTINUE TO DISSIPATE: As market fundamentals and liquidity have improved, the distress percentage of total observed sale pair counts declined to just 10.6% through the first four months of 2014, down from 16.6% for the same timeframe in 2013 and down 32% from the bottom of the market in 2010.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Equal and Value Weighted indexes through April. The value-weighted index is almost back to the pre-recession peak.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

DataQuick on SoCal: May Home Sales down 15% Year-over-year, Non-Distressed sales up Year-over-year

by Calculated Risk on 6/11/2014 03:05:00 PM

From DataQuick: Southland Home Sales Slow; Median Price Rises Again but at Slower Pace

Southern California home sales lost momentum in May, falling from both April and a year earlier as investor demand fell and buyers continued to face inventory, affordability and credit constraints. ...Both distressed sales and investor buying is declining - and this has been dragging down overall sales. Even though total sales are still down year-over-year, the percent of non-distressed sales is up slightly year-over-year. There were 19,556 total sales this year, and 11.6% were distressed. In May 2013, there were 23,034 total sales, and 26.6% were distressed.

A total of 19,556 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 2.3 percent from 20,008 sales in April, and down 15.1 percent from 23,034 sales in May last year, according to San Diego-based DataQuick.

On average, sales have increased 5.8 percent between April and May since 1988, when DataQuick’s statistics begin. Sales have fallen on a year-over-year basis for eight consecutive months. May sales have ranged from a low of 16,917 in May 2008 to a high of 35,557 in May 2005. Last month’s sales were 23.0 percent below the May average of 25,393 sales.

...

“We expected rising prices to unlock more inventory this spring and that's happened. But the supply of homes for sale still falls short of demand in many markets, contributing to a rise in prices and a below-average sales pace. The drop in affordability has also hampered activity, helping to explain how sales could be lower now even though today’s inventory is higher than a year ago. The recent dip in mortgage rates will help fuel demand, adding pressure to home prices. But the sort of price spikes we saw this time last year – annual gains of 20 percent or more – are less likely today given affordability constraints, higher inventory and the drop-off in investor purchases,” said Andrew LePage, a DataQuick analyst.

Foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 5.0 percent of the Southland resale market in May. That was down from a revised 5.8 percent the prior month and down from 10.9 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 6.6 percent of Southland resales last month. That was up slightly from a revised 6.2 percent the prior month and down from 15.7 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 25.0 percent of the Southland homes sold last month, which is the lowest share since September 2011, when 24.6 percent of homes sold to absentee buyers. Last month’s figure was down from 26.7 percent in April and down from 29.5 percent a year earlier. The peak was 32.4 percent in January 2013, while the monthly average since 2000, when the absentee data begin, is about 19 percent.

emphasis added

Treasury: Budget Deficit declined in May 2014 compared to May 2013

by Calculated Risk on 6/11/2014 02:00:00 PM

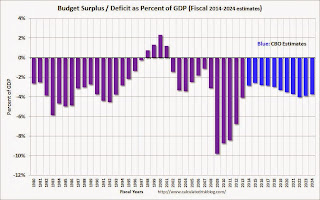

The Treasury released the May Monthly Treasury Statement today. The Treasury reported a $130 billion deficit in May 2014, down from $138 billion in May 2013. For fiscal year 2014 through May, the deficit was $436 billion compared to $626 billion for the same period in fiscal 2013.

In April, the Congressional Budget Office (CBO) released their new Updated Budget Projections: 2014 to 2024. The projected budget deficits were reduced for each of the next ten years, and the projected deficit for 2014 was revised down from 3.0% to 2.8%. Based on the Treasury release today, I expect the deficit for fiscal 2014 to be lower than the current CBO projection.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

The deficit should decline further next year.

The decline in the deficit, as a percent of GDP, from almost 10% to under 3% in 2014 is the fastest decline in the deficit since the demobilization following WWII (not shown on graph).

Will Congress "Pay the Bills" in 2015?

by Calculated Risk on 6/11/2014 11:19:00 AM

I wrote several posts about the "debt ceiling" debate in 2011 and again in 2013. Unfortunately "debt ceiling" sounds virtuous, but it isn't - it is actually a question of "paying the bills". And I've always argued that Congress would "pay the bills". So even though the debate in 2011 clearly scared many Americans and impacted the economy, I was confident that Congress would eventually do its job.

These political stunts always happen in off election years with the hope that most voters will forget about the nonsense by the next election. So there is a risk in 2015 - and right now I'm a little more concerned than in previous years. Most of the commentary concerning the upset of Congressman Eric Cantor has focused on immigration reform, but his opponent has also argued that the government should not pay the bills (default on payments to the American companies and people).

This is an economic risk for next year (and a political risk for the GOP). As Republican Senator Mitch McConnell noted in 2011, if the debt ceiling isn't raised the "Republican brand" would become toxic and synonymous with fiscal irresponsibility.

Back in 2013 I promised to start criticizing Congress earlier in the process since 2011 was ridiculous and reckless (2013 was also dumb). I think there is a general ignorance of how the budget works, and what it means to be fiscally responsible. I'll write more about these topics and start earlier this time!

Note: There are certain politicians who think it is OK to not pay the bills as long as the U.S. makes interest and principal payments on the debt. That is crazy talk. There is a name for people who don't pay their bills: deadbeats. If politicians don't pay their personal bills, they are deadbeats. But if they stop the government from paying the bills, we are all deadbeats. And there will be serious economic consequences for not paying the bills on time. The consequences will build over time, but after several months, not "paying the bills" in 2015 would ripple through the entire economy.

MBA:"Strong Growth in Mortgage Application Volume Following Memorial Day Holiday"

by Calculated Risk on 6/11/2014 07:00:00 AM

From the MBA: Strong Growth in Mortgage Application Volume Following Memorial Day Holiday

Mortgage applications increased 10.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 6, 2014. The previous week’s results included an adjustment for the Memorial Day holiday. ...

The Refinance Index increased 11 percent from the previous week. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.34 percent from 4.26 percent, with points increasing to 0.16 from 0.13 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 71% from the levels in May 2013.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 13% from a year ago.

Tuesday, June 10, 2014

Update: Will Mortgage Rates be down year-over-year in late June?

by Calculated Risk on 6/10/2014 07:18:00 PM

It is fun to try to guess future headlines, and it looks like we might see "Mortgage Rates down year-over-year" in a couple of weeks.

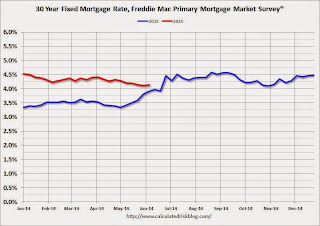

I use the weekly Freddie Mac Primary Mortgage Market Survey® (PMMS®) to track mortgage rates. The PMMS series started in 1971, so there is a fairly long historical series.

For daily rates, the Mortgage News Daily has a series that tracks the PMMS very well, and is usually updated daily around 3 PM ET. The MND data is based on actual lender rate sheets, and is mostly "the average no-point, no-origination rate for top-tier borrowers with flawless scenarios". (this tracks the Freddie Mac series).

MND reports that average 30 Year fixed mortgage rates increased today to 4.25% from 4.23% yesterday.

One year ago rates were at 4.05% and rising. If the current rate holds, mortgage rates will be down year-over-year in less than 2 weeks.

Here is a table from Mortgage News Daily:

Click on graph for larger image.

Click on graph for larger image.Here is a graph of 30 year fixed mortgage rates - according to the Freddie Mac PMMS® - for 2013 (blue) and 2014 (red).

Mortgage rates jumped to 4.46% in late June 2013, and it is possible that rates will be lower in late June 2014 (currently 4.25% according to Mortgage News Daily).