by Calculated Risk on 6/18/2014 10:12:00 AM

Wednesday, June 18, 2014

AIA: Architecture Billings Index increased in May

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Three Point Jump for Architecture Billings Index

On the heels of consecutive months of decreasing demand for design services, the Architecture Billings Index (ABI) has returned to positive territory. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the May ABI score was 52.6, up sharply from a mark of 49.6 in April. This score reflects an increase in design activity (any score above 50 indicates an increase in billings). The new projects inquiry index was 63.2, up from the reading of 59.1 the previous month.

The AIA has added a new indicator measuring the trends in new design contracts at architecture firms that can provide a strong signal of the direction of future architecture billings. The score for design contracts in May was 52.5.

“Volatility continues to be the watchword in the design and construction markets, with firms in some regions of the country, and serving some sectors of the industry, reporting strong growth, while others are indicating continued weakness,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “However, overall, it appears that activity has recovered from the winter slump, and design professions should see more positive than negative numbers in the coming months.”

• Regional averages: South (58.1), Midwest (51.3), Northeast (47.6) , West (46.9) [three month average]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.6 in May, up from 49.6 in April. Anything above 50 indicates expansion in demand for architects' services. This index has indicated expansion during 17 of the last 22 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. The index has been moving sideways near the expansion / contraction line recently. However, the readings over the last year suggest some increase in CRE investment in 2014.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 6/18/2014 08:59:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 9.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 13, 2014. ...

The Refinance Index decreased 13 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. ...

...

“Interest rates increased relative to the previous week, as incoming economic data continues to suggest a pickup in the pace of growth,” said Mike Fratantoni, MBA’s Chief Economist. “Although the average rate for the week was up only a few basis points, the increase was matched by a large drop in refinance volume, and purchase application volume also declined. Some lenders continue to report that they have pre-approved borrowers who have been unable to find a property given the tight inventory in certain markets.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.36 percent from 4.34 percent, with points increasing to 0.24 from 0.16 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 15% from a year ago.

Tuesday, June 17, 2014

Wednesday: Fed Day

by Calculated Risk on 6/17/2014 07:25:00 PM

On Sunday, I posted FOMC Preview: More Tapering. It is important to note that the updated projections were submitted prior to the CPI report this morning.

It will be interesting to see if the FOMC changes this sentence from the previous statement:

Inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable.The FOMC uses the PCE price index, and PCE prices show inflation still running below the FOMC's 2% objective. But they might mention some pickup in inflation.

Other inflation mentions in the previous statement included:

The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, and it is monitoring inflation developments carefully for evidence that inflation will move back toward its objective over the medium term.And

If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings.Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Meeting Statement. The FOMC is expected to reduce monthly QE3 asset purchases from $45 billion per month to $35 billion per month at this meeting.

• Also at 2:00 PM, the FOMC projections. This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

LA area Port Traffic: Imports increasing

by Calculated Risk on 6/17/2014 05:12:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for May since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 0.4% compared to the rolling 12 months ending in April. Outbound traffic was up 0.1% compared to 12 months ending in April.

Inbound traffic has been increasing, and outbound traffic has been moving up a little recently after moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Imports were up 5% year-over-year in May, however imports were only up 1% year-over-year.

Imports were 4% below the all time high for May (set in May 2006), and it is possible that imports will be at a record high later this year.

A few comments on Housing Starts

by Calculated Risk on 6/17/2014 01:28:00 PM

There were 396 thousand total housing starts during the first five months of 2014 (not seasonally adjusted, NSA), up 6.5% from the 372 thousand during the same period of 2013. Single family starts are up 2.5%, and multi-family starts up 17%.

This was just the fourth month with starts at over a 1 million annual pace since early 2008 (Seasonally adjusted annual rate, SAAR). Starts were over 1 million in November and December of 2013 - and then starts were a little weaker in Q1 - and then were at or above 1 million in April and May.

The weak start to 2014 was due to several factors: severe weather, higher mortgage rates, higher prices and probably supply constraints in some areas.

It is also important to note that the year-over-year comparison will be easier for housing starts for the next several months. There was a huge surge in housing starts early in 2013, and then a lull - and finally more starts at the end of the year.

The bottom line is the housing recovery is ongoing and will continue.

Click on graph for larger image.

Click on graph for larger image.

This year, I expect starts to continue to increase (Q1 will probably be the weakest quarter) - and more starts combined with an easier comparison means starts will probably be up double digits year-over-year.

This graph shows the month to month comparison between 2013 (blue) and 2014 (red).

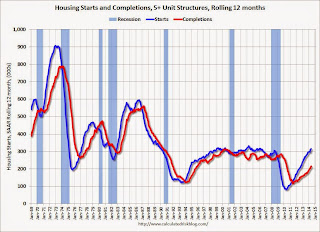

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family completions in 2014, but probably still below the 1997 through 2007 level of multi-family completions. Multi-family starts will probably move more sideways in 2014.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Starts have been moving up (but the increase has slowed recently), and completions have followed.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Key Inflation Measures Show Increase, Year-over-year still mostly below the Fed Target in May

by Calculated Risk on 6/17/2014 11:12:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.2% annualized rate) in May. The 16% trimmed-mean Consumer Price Index also increased 0.3% (3.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for May here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.4% (4.3% annualized rate) in May. The CPI less food and energy increased 0.3% (3.1% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy rose 2.0%. Core PCE is for April and increased just 1.4% year-over-year.

On a monthly basis, median CPI was at 3.2% annualized, trimmed-mean CPI was at 3.2% annualized, and core CPI increased 3.1% annualized.

There key measures of inflation have moved up over the last few months, but on a year-over-year basis these measures suggest inflation remains at or below the Fed's target of 2%.

Housing Starts at 1.001 Million Annual Rate in May

by Calculated Risk on 6/17/2014 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 1,001,000. This is 6.5 percent below the revised April estimate of 1,071,000, but is 9.4 percent above the May 2013 rate of 915,000.

Single-family housing starts in May were at a rate of 625,000; this is 5.9 percent below the revised April figure of 664,000. The May rate for units in buildings with five units or more was 366,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 991,000. This is 6.4 percent below the revised April rate of 1,059,000 and is 1.9 percent below the May 2013 estimate of 1,010,000.

Single-family authorizations in May were at a rate of 619,000; this is 3.7 percent above the revised April figure of 597,000. Authorizations of units in buildings with five units or more were at a rate of 347,000 in May.

Click on graph for larger image.

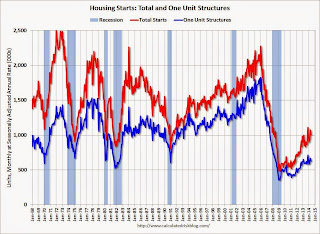

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in May (Multi-family is volatile month-to-month).

Single-family starts (blue) also decreased in May.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was Below expectations of 1.036 million starts in May. Note: Starts for March and April were revised slightly. I'll have more later.

Monday, June 16, 2014

Tuesday: Housing Starts, CPI

by Calculated Risk on 6/16/2014 07:31:00 PM

A reminder of a friendly bet I made with NDD on housing starts in 2014 (I've already "won", and NDD made a donation to the Tanta Memorial Fund - but he could still win too):

If starts or sales are up at least 20% YoY in any month in 2014, [NDD] will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.In May 2013, starts were at a 915 thousand seasonally adjusted annual rate (SAAR). For me to win again (only one win counts), starts would have to be up 20% or at 1.098 million SAAR in May (possible). For NDD to win, starts would have to fall to 815 thousand SAAR (not likely). NDD could also "win" if permits fall to 910 thousand SAAR from 1.010 million SAAR in May 2013.

Tuesday:

• At 8:30 AM, Housing Starts for May. Total housing starts were at 1.072 million (SAAR) in April. Single family starts were at 649 thousand SAAR in April. The consensus is for total housing starts to decrease to 1.036 million (SAAR) in May.

• Also at 8:30 AM, Consumer Price Index for May. The consensus is for a 0.2% increase in CPI in May and for core CPI to increase 0.2%.

Weekly Update: Housing Tracker Existing Home Inventory up 13.7% year-over-year on June 16th

by Calculated Risk on 6/16/2014 03:30:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for April). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 13.7% above the same week in 2013.

Inventory is still very low - but I expect inventory to be above the same week in 2012 very soon (prices bottomed in early 2012). This increase in inventory should slow price increases, and might lead to price declines in some areas.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess was inventory would be up 10% to 15% year-over-year at the end of 2014. Right now it looks like inventory might increase more than I expected.

Wall Street and A Dirty Little Secret

by Calculated Risk on 6/16/2014 12:26:00 PM

Josh Brown mentioned a post today at A Wealth of Common Sense: How The Unemployment Rate Affects Stock Market Performance. The author is discussing investing ...

The unemployment rate is a perfect example of the fact that the best times to invest are when things seem the worst.This reminds me of something I wrote in May 2011: Employment: A dirty little secret

[I]t really isn't much of a secret that Wall Street and corporate America like the unemployment rate to be a little high. But it is "dirty" in the sense that it is unspoken. Higher unemployment keeps wage growth down, and helps with margins and earnings - and higher unemployment also keeps the Fed on the sidelines. Yes, corporations like to see job growth, so people have enough confidence to spend (and they can have a few more customers). And they definitely don't want to see Depression era unemployment - but a slowly declining unemployment rate (even at 9%) with some job growth is considered OK.And from others, like Kash Mansori, also in 2011: Why a Bad Job Market is Good News for Some

[T]his opens up an interesting line of reasoning, one that is certainly not new but which this data reminds us of. If a bad labor market means that workers get a smaller share of the productivity they bring to their employers, then the owners of companies will have a strong preference for a weak labor market. Firms don't like recessions, of course -- it's hard to make money when your sales are falling. But companies do enjoy the way that a very slow recovery in the job market can allow them to keep wages down, and thus keep a larger share of the output of their workers for themselves.And from Paul Krugman: The Plight of the Employed

And may I suggest that employers, although they’ll never say so in public, like this situation? That is, there’s a significant upside to them from the still-weak economy. I don’t think I’d go so far as to say that there’s a deliberate effort to keep the economy weak; but corporate America certainly isn’t feeling much pain, and the plight of workers is actually a plus from their point of view.The good news is we might finally be seeing the beginning of more wage growth.