by Calculated Risk on 6/23/2014 12:05:00 PM

Monday, June 23, 2014

Comments on Existing Home Sales

The two key numbers in the existing home sales report right now are: 1) inventory, and 2) the percent of distressed sales.

The most important number in the report each month is inventory. This morning the NAR reported that inventory was up 6.0% year-over-year in May. This is a smaller increase than other sources suggest, and it is important to note that the NAR inventory data is "noisy" (and difficult to forecast based on other data). A few other points:

• The headline NAR inventory number is NOT seasonally adjusted (and there is a clear seasonal pattern).

• Inventory is still very low, and with the low level of inventory, there is still upward pressure on prices.

• I expect inventory to increase in 2014, and I expect the year-over-year increase to be in the 10% to 15% range by the end of 2014 (maybe even higher).

Click on graph for larger image.

Click on graph for larger image.

The NAR does not seasonally adjust inventory, even though there is a clear seasonal pattern. Trulia chief economist Jed Kolko sent me the seasonally adjusted inventory.

This shows that inventory bottomed in January 2013 (on a seasonally adjusted basis), and inventory is now up about 9.4% from the bottom. On a seasonally adjusted basis, inventory was up slightly in May compared to April.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, many "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were down 5.0% from May 2013, but normal equity sales were probably up from May 2013, and distressed sales down sharply. The NAR reported that 11% of sales were distressed in May (from a survey that is far from perfect):

Distressed homes – foreclosures and short sales – accounted for 11 percent of May sales, down from 18 percent in May 2013. Eight percent of May sales were foreclosures and three percent were short sales.Last year the NAR reported that 18% of sales were distressed sales.

A rough estimate: Sales in May 2013 were reported at 5.15 million SAAR with 18% distressed. That gives 927 thousand distressed (annual rate), and 4.22 million equity / non-distressed. In May 2014, sales were 4.89 million SAAR, with 11% distressed. That gives 538 thousand distressed - a decline of 42% from May 2013 - and 4.35 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up slightly (even with less investor buying).

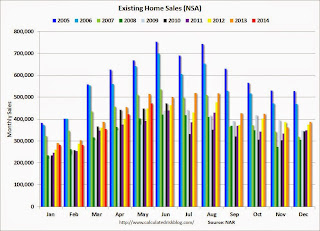

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in May (red column) were below the level of sales in May 2013, and above sales for 2008 through 2012.

Overall this report was a solid report.

Earlier:

• Existing Home Sales in May: 4.89 million SAAR, Inventory up 6.0% Year-over-year

Existing Home Sales in May: 4.89 million SAAR, Inventory up 6.0% Year-over-year

by Calculated Risk on 6/23/2014 10:00:00 AM

The NAR reports: Existing-Home Sales Heat Up in May, Inventory Levels Continue to Improve

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 4.9 percent to a seasonally adjusted annual rate of 4.89 million in May from an upwardly-revised 4.66 million in April, but remain 5.0 percent below the 5.15 million-unit level in May 2013. ...

Total housing inventory at the end of May climbed 2.2 percent to 2.28 million existing homes available for sale, which represents a 5.6-month supply at the current sales pace, down slightly from 5.7 months in April. Unsold inventory is 6.0 percent higher than a year ago, when there were 2.15 million existing homes available for sale.

Click on graph for larger image.

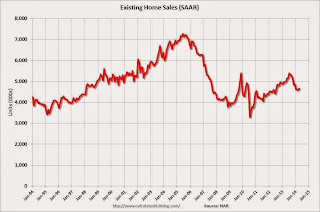

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in May (4.89 million SAAR) were 4.9% higher than last month, but were 5.0% below the May 2013 rate.

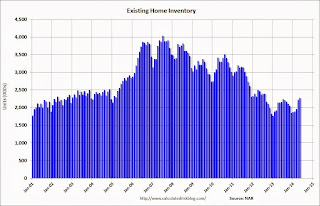

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.28 million in May from 2.23 million in April. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.28 million in May from 2.23 million in April. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 6.0% year-over-year in May compared to May 2013.

Inventory increased 6.0% year-over-year in May compared to May 2013. Months of supply was at 5.6 months in May.

This was above expectations of sales of 4.75 million. For existing home sales, the key number is inventory - and inventory is still low, but up solidly year-over-year. I'll have more later ...

Chicago Fed: "Economic growth picked up in May"

by Calculated Risk on 6/23/2014 08:30:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth picked up in May

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.21 in May from –0.15 in April. Three of the four broad categories of indicators that make up the index made positive contributions to the index in May, and three of the four categories increased from April.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to +0.18 in May from +0.31 in April, marking its third consecutive reading above zero. May’s CFNAI-MA3 suggests that growth in national economic activity was somewhat above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was somewhat above the historical trend in May (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, June 22, 2014

Monday: Existing Home Sales

by Calculated Risk on 6/22/2014 08:51:00 PM

This is a funny sentence from the WSJ on inflation: Inflation Is Back on Wall Street Agenda

For years, critics have warned that the Federal Reserve’s easy-money policies would produce massive inflation. So far, they have been wrong."So far"? Come on - those predicting "massive inflation" were dead wrong. Period.

Update: And an excellent overview from Tim Duy: Inflation Hysteria

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for May. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for sales of 4.75 million on seasonally adjusted annual rate (SAAR) basis. Sales in April were at a 4.65 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.81 million SAAR.

Weekend:

• Schedule for Week of June 22nd

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are unchanged and DOW futures are up slightly (fair value).

Oil prices were mixed over the last week with WTI futures at $107.13 per barrel and Brent at $115.01 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.68 per gallon, up about a dime from a year ago. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

"3 reasons Iraq conflict isn't driving up gas prices (yet)"

by Calculated Risk on 6/22/2014 12:49:00 PM

Kathleen Pender points out three reasons gasoline prices haven't risen sharply yet: 1) Geography in Iraq, 2) seasonal factors, and 3) domestic production. From the San Francisco Chronicle: 3 reasons Iraq conflict isn't driving up gas prices (yet)

The fighting is mainly in the northern part of Iraq. Its main oil production and export facilities are in the south, where Shiites dominate. ... Most experts do not expect the Sunni rebels to invade the south, which accounts for about 90 percent of Iraq's oil production and exports.And a couple of articles on oil from Jim Hamilton: Iraq, oil markets, and the U.S. economy and Gasoline price calculator

...

Prices typically fall in June, when refineries are revved up and ready to go but families still have kids in school. They go up again in July and August, when vacationers take to the roads. ... This June, prices have been mostly steady, which amounts to a stealth increase.

...

U.S. production has gone from about 5.5 million barrels a day to almost 8.5 million in the past three years, and could hit 10 million within a few years ... reduced reliance on Mideast oil is blunting the impact of the Iraq conflict.

Saturday, June 21, 2014

Schedule for Week of June 22nd

by Calculated Risk on 6/21/2014 01:11:00 PM

There are several key reports this week: New and Existing home sales for May, Case-Shiller house prices for April, the 3rd estimate of Q1 GDP, and the May Personal Income and Outlays.

For manufacturing, the June Richmond and Kansas City Fed surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for May. This is a composite index of other data.

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for sales of 4.75 million on seasonally adjusted annual rate (SAAR) basis. Sales in April were at a 4.65 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.81 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

9:00 AM: FHFA House Price Index for April. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.5% increase.

9:00 AM: S&P/Case-Shiller House Price Index for April. Although this is the April report, it is really a 3 month average of February, March and April.

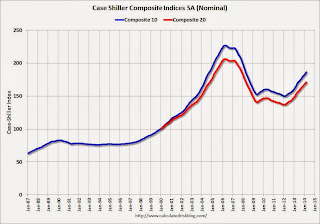

9:00 AM: S&P/Case-Shiller House Price Index for April. Although this is the April report, it is really a 3 month average of February, March and April. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through March 2014 (the Composite 20 was started in January 2000).

The consensus is for a 11.4% year-over-year increase in the Composite 20 index (NSA) for April. The Zillow forecast is for the Composite 20 to increase 11.8% year-over-year, and for prices to increase 1.2% month-to-month seasonally adjusted.

10:00 AM: New Home Sales for May from the Census Bureau.

10:00 AM: New Home Sales for May from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the April sales rate.

The consensus is for an in increase in sales to 441 thousand Seasonally Adjusted Annual Rate (SAAR) in May from 433 thousand in April.

10:00 AM: Conference Board's consumer confidence index for June. The consensus is for the index to increase to 83.7 from 83.0.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for June. The consensus is for a reading of 7, unchanged from 7 in May.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for May from the Census Bureau. The consensus is for a 0.4% increase in durable goods orders.

8:30 AM: Q1 GDP (third estimate). This is the third estimate of Q1 GDP from the BEA. The consensus is that real GDP decreased 1.8% annualized in Q1, revised down from the second estimate of a 1.0% decrease.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 313 thousand from 312 thousand.

8:30 AM: Personal Income and Outlays for May. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

11:00 AM: the Kansas City Fed manufacturing survey for May.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for June). The consensus is for a reading of 82.0, up from the preliminary reading of 81.2, and up from the May reading of 81.9.

Unofficial Problem Bank list declines to 488 Institutions

by Calculated Risk on 6/21/2014 08:19:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 20, 2014.

Changes and comments from surferdude808:

A couple bank failures and an update from the OCC on its enforcement action activities contributed to several changes to the Unofficial Problem Bank List. In all, there were six removals that push the list count down to 488 institutions with assets of $152.6 billion. In comparison, there were 751 institutions with assets of $273 billion on the list a year ago.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 494.

The OCC terminated actions against Eagle National Bank, Upper Darby, PA ($190 million); The First National Bank and Trust Company of Broken Arrow, Broken Arrow, OK ($189 million); Lee County Bank & Trust, National Association, Fort Madison, IA ($148 million); and First National Bank Northwest Florida, Panama City, FL ($108 million).

The failure plagued states of Florida and Illinois experienced a failure each this Friday. The River Valley Bancorp, Inc., Davenport, IA, saw its two banking subsidiaries that each operate under the name Valley Bank fail. The larger Valley Bank with assets of $456 million was located in Moline, Illinois, while its smaller sister with $82 million of assets was located in Fort Lauderdale, Florida. Since the on-set of the Great Recession, there have been 71 failures in Florida and 59 in Georgia. Both states only trail Georgia which has an astonishing 87 failures but none so far this year.

Next week we anticipate the FDIC will release an update on its enforcement action activities. With it being the last Friday of the quarter, we will provide an update on transition matrix.

Friday, June 20, 2014

Bank Failures #10 & 11 in 2014: Two Valley Banks

by Calculated Risk on 6/20/2014 06:35:00 PM

From the FDIC: Great Southern Bank, Reeds Spring, Missouri, Assumes All of the Deposits of Valley Bank, Moline, Illinois

As of March 31, 2014, Valley Bank had approximately $456.4 million in total assets and $360.0 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $51.4 million. ... Valley Bank is the 10th FDIC-insured institution to fail in the nation this year, and the third in Illinois.From the FDIC: Landmark Bank, National Association, Fort Lauderdale, Florida, Assumes All of the Deposits of Valley Bank, Fort Lauderdale, Florida

As of March 31, 2014, Valley Bank had approximately $81.8 million in total assets and $66.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $7.7 million. ... Valley Bank is the 11th FDIC-insured institution to fail in the nation this year, and the first in Florida.A two for Friday!

Mortgage News Daily: Mortgage Rates Down Year-over-year on June 20th

by Calculated Risk on 6/20/2014 03:48:00 PM

I use the weekly Freddie Mac Primary Mortgage Market Survey® (PMMS®) to track mortgage rates. The PMMS series started in 1971, so there is a fairly long historical series.

For daily rates, the Mortgage News Daily has a series that tracks the PMMS very well, and is usually updated daily around 3 PM ET. The MND data is based on actual lender rate sheets, and is mostly "the average no-point, no-origination rate for top-tier borrowers with flawless scenarios". (this tracks the Freddie Mac series).

MND reports that average 30 Year fixed mortgage rates decreased today to 4.18% from 4.20% yesterday.

One year ago, on June 20, 2013, rates were at 4.29% and rising. So rates are down year-over-year!

The spread will be even larger next week. Here is a table from Mortgage News Daily:

Fed: Q1 Household Debt Service Ratio at Record Low

by Calculated Risk on 6/20/2014 12:58:00 PM

The Fed's Household Debt Service ratio through Q1 2014 was released this morning: Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio decreased in Q1, and is at a record low. Note: The financial obligation ratio (FOR) is also near a record low (not shown)

Also the DSR for mortgages (blue) are near the low for the last 30 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

This data suggests household cash flow is in much better shape than a few years ago.