by Calculated Risk on 6/28/2014 01:11:00 PM

Saturday, June 28, 2014

Schedule for Week of June 29th

This will be a busy holiday week for economic data with several key reports including the June employment report on Thursday.

Other key reports include the ISM manufacturing index on Tuesday, June vehicle sales on Tuesday, and the May Trade Deficit and June ISM non-manufacturing index on Thursday.

Fed Chair Janet Yellen will speak on Financial Stability.

9:45 AM: Chicago Purchasing Managers Index for June. The consensus is for a decrease to 64.0, down from 65.5 in May.

10:00 AM ET: Pending Home Sales Index for May. The consensus is for a 1% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for June. This is the last of the regional Fed manufacturing surveys for June.

Early: Reis Q2 2014 Office Survey of rents and vacancy rates.

All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 16.4 million SAAR in June from 16.7 million in May (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 16.4 million SAAR in June from 16.7 million in May (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the May sales rate.

10:00 AM: Construction Spending for May. The consensus is for a 0.5% increase in construction spending.

10:00 AM: ISM Manufacturing Index for June. The consensus is for an increase to 55.6 from 55.4 in May.

10:00 AM: ISM Manufacturing Index for June. The consensus is for an increase to 55.6 from 55.4 in May.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in May at 55.4%. The employment index was at 52.8%, and the new orders index was at 56.9%.

Early: Reis Q2 2014 Apartment Survey of rents and vacancy rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in June, up from 180,000 in May.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for May. The consensus is for a 0.3% decrease in May orders.

11:00 AM: Speech by Fed Chair Janet Yellen, Financial Stability, At the Inaugural Michel Camdessus Central Banking Lecture at the International Monetary Fund, Washington, D.C.

Early: Reis Q2 2014 Mall Survey of rents and vacancy rates.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 314 thousand from 312 thousand.

8:30 AM: Employment Report for June. The consensus is for an increase of 211,000 non-farm payroll jobs added in June, down from the 217,000 non-farm payroll jobs added in May.

The consensus is for the unemployment rate to be unchanged at 6.3% in May.

This graph shows the percentage of payroll jobs lost during post WWII recessions through May. The red line is back to zero!

This graph shows the percentage of payroll jobs lost during post WWII recessions through May. The red line is back to zero!The economy has added 9.4 million private sector jobs since employment bottomed in February 2010 (8.8 million total jobs added including all the public sector layoffs).

There are 617 thousand more private sector jobs now than when the recession started in 2007, and total employment is now 98 thousand above the pre-recession peak.

8:30 AM: Trade Balance report for May from the Census Bureau.

8:30 AM: Trade Balance report for May from the Census Bureau. Both imports and exports increased in April.

The consensus is for the U.S. trade deficit to be at $45.1 billion in May from $47.2 billion in April.

10:00 AM: ISM non-Manufacturing Index for June. The consensus is for a reading of 56.2, down from 56.3 in May. Note: Above 50 indicates expansion.

All US markets are closed in observance of the Independence Day holiday.

Unofficial Problem Bank list declines to 468 Institutions, Q2 2014 Transition Matrix

by Calculated Risk on 6/28/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 27, 2014.

Changes and comments from surferdude808:

FDIC providing an update on its enforcement action activities and a deeper scrubbing of the list drove a net decline in the Unofficial Problem Bank List to 468 institutions with assets of $149.2 billion. In all, there were 21 removals and one addition this week. A year ago, the list held 749 institutions with assets of $273.3 billion. During this June, the list declined by a net 28 institutions after 26 action terminations, two failures, one merger, and one addition. The failure this week, The Freedom State Bank, Freedom, OK surprisingly was not on the list as the only action issued by FDIC that can be located is a Prompt Corrective Action order only issued less than 60 days ago.

Removals this week were The Bank of Delmarva, Seaford, DE ($425 million); Community Bank of the South, Smyrna, GA ($348 million); Mercantile Bank, Quincy, IL ($347 million); The Pueblo Bank and Trust Company, Pueblo, CO ($320 million); First Farmers & Merchants Bank, Cannon Falls, MN ($265 million); Firstier Bank, Kimball, NE ($245 million); SouthPoint Bank, Birmingham, AL ($202 million); Marine Bank & Trust Company, Vero Beach, FL ($152 million); Bank of Fairfield, Fairfield, WA ($147 million); Concord Bank, St. Louis, MO ($138 million); Town & Country Bank, Las Vegas, NV ($120 million); Freedom Bank of America, Saint Petersburg, FL ($107 million); State Bank of Park Rapids, Park Rapids, MN ($100 million); Community Pride Bank, Isanti, MN ($94 million); First Bank, West Des Moines, IA ($90 million); First Carolina Bank, Rocky Mount, NC ($89 million); Sherburne State Bank, Becker, MN ($84 million); Bank of the Prairie, Olathe, KS ($80 million); Security Bank, New Auburn, WI ($75 million); Holladay Bank & Trust, Salt Lake City, UT ($51 million); and Maple Bank, Champlin, MN ($51 million).

The sole addition this week Community 1st Bank Las Vegas, Las Vegas, NM ($146 million).

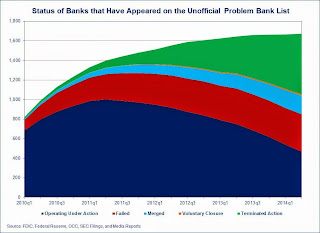

We have updated the Unofficial Problem Bank List transition matrix through the second quarter of 2014. Full details are available in the accompanying table and a graphic depicting trends in how institutions have arrived and departed the list. Since publication of the Unofficial Problem Bank List started in August 2009, a total of 1,672 institutions have appeared on the list. New entrants have slowed since late 2012, but this quarter seven institutions were added up from only three being added in the previous two quarters.

At the end of the second quarter, only 468 or 28 percent of the banks that have been on a list at some point remain. Action terminations of 619 account for around 51 percent of the 1,204 institutions removed. However, a significant number of institutions have left the list through failure. So far, 381 institutions have failed accounting for nearly 32 percent of departures. Should another institution on the list not fail, then more than 22 percent of the 1,672 institutions making an appearance would have failed. A 22 percent default rate would be more than double the rate often cited by media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 141 | (55,759,559) | |

| Unassisted Merger | 32 | (6,697,723) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 154 | (184,269,578) | |

| Asset Change | (5,411,792) | ||

| Still on List at 6/30/2014 | 58 | 13,590,663 | |

| Additions after 8/7/2009 | 478 | 135,599,760 | |

| End (6/30/2014) | 468 | 149,190,423 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 478 | 206,393,188 | |

| Unassisted Merger | 158 | 71,031,845 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 227 | 111,634,071 | |

| Total | 873 | 391,383,246 | |

| 1Institution not on 8/7/2009 or 6/30/2014 list but appeared on a weekly list. | |||

Friday, June 27, 2014

Bank Failure #12 in 2014: The Freedom State Bank, Freedom, Oklahoma

by Calculated Risk on 6/27/2014 05:30:00 PM

From the FDIC: Alva State Bank & Trust Company, Alva, Oklahoma, Assumes All of the Deposits of The Freedom State Bank, Freedom, Oklahoma

As of March 31, 2014, The Freedom State Bank had approximately $22.8 million in total assets and $20.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $5.8 million. ... The Freedom State Bank is the 12th FDIC-insured institution to fail in the nation this year, and the second in Oklahoma.There have been 12 failures so far in 2014, half the 24 failures in 2013. So it is possible there will be more failures this year than in 2013.

Lawler on Homebuilders Lennar and KB Home

by Calculated Risk on 6/27/2014 03:48:00 PM

Lennar Corporation, the second largest US home builder in 2013, reported that net home orders in the quarter ended May 31, 2014 totaled 6,183, up 8.4% from the comparable quarter of 2013. Sales per active community were down about 7.5% from a year ago. Home deliveries last quarter totaled 4,987, up 11.7% from the comparable quarter of 2013, at an average sales price of $322,000, up 13.8% from a year ago. The company’s order backlog at the end of May was 6,858, up 11.3% from last May, at an average order price of $343,000, up 13.6% from a year earlier.

Here is a comment from Lennar’s CEO in its press release.

"While the spring selling season was softer than anticipated by us and the investor community, the homebuilding recovery continued its progression at a slow and steady pace. The fundamentals of the homebuilding industry remain strong driven by high affordability levels, favorable monthly payment comparisons to rentals and overall supply shortages. Demand in most of our markets continues to outpace supply, which is constrained by limited land availability."With respect to land, the company said in its conference call that it owned or controlled bout 164,000 homesites at the end of May, up 18.3% from last May ... That lot inventory was 7.6 times Lennar’s expected level of home deliveries in 2014 – which is a lot!

In its conference call officials said that the company’s sizable land/lot position left it “well positioned” to take advantage of an increase in demand from first-time home buyers, but officials said that demand from first-time home buyers last quarter remained very weak – which officials attributed mainly to continued very tight mortgage lending standards. Officials also highlighted the company’s relatively new multifamily rental segment, which it apparently started on concerns that a higher share of householders, especially young adults/new householders, may be more likely to be renters and/or live in urban areas than has been the case in the past.

KB Home, the fifth largest US home builder in 2013, reported that net home orders in the quarter ended May 31, 2014 totaled 2,269, up 4.9% from the comparable quarter of 2013. Net orders per community last quarter were down 2.2% from a year ago. Home deliveries last quarter totaled 1,751, down 2.6% from the comparable quarter of 2013, at an average sales price of $319,700, up 10.1% from a year ago. The company’s order backlog at the end of May was 3,398, up 8.6% from last May.

In an excessively long opening remark on the company’s earnings conference call, KB Home’s CEO Jeff Mezger made two observations that raised analysts’ eyebrow: he said that (1) while mortgage credit remained tight, the company has seen evidence of easing in credit standards; and (2) the company has seen some “re-emergence” of first-time home buyers. Not surprisingly he faced questions on these observations in the Q&A session. On mortgage credit standards, Mezger pointed to “still high” but lower average credit scores on mortgage bonds issued, and to “anecdotal” reports of reduced “credit overlays” from “some lenders.” (No story here!). On the re-emergence of first-time home buyers, Mezger said that there’s been an increase in first-time home buyer purchases in some areas of Texas where job growth has been strong.

Here are net orders for the quarter ended May 31, 2014 for three large home builders. (Note: Hovnanian reported result for the quarter ended April 30, 2014, but it showed net orders for May 2014 in its earnings presentation).

| Net Home Orders, 3 Months Ending: | 5/31/2014 | 5/31/2013 | % Change |

|---|---|---|---|

| Lennar | 6,183 | 5,705 | 8.4% |

| KB Home | 2,269 | 2,162 | 4.9% |

| Hovnanian | 1,799 | 1,862 | -3.4% |

| Total | 10,251 | 9,729 | 5.4% |

Earlier this week, Census estimated that new SF home sales in the first five months of 2014 totaled 194,000 (not seasonally adjusted), up just 0.5% from the first five months of 2013.

Net, the “spring” new home buying season, while not really a “bust,” fell considerably short of “consensus” forecasts at the beginning of the year. While results varied considerably among large publicly-traded builders, overall net home orders appear to have fallen considerably short of builder expectations as well, and net order per community appear on aggregate to have declined about 6% YOY. The 13 large publicly-traded home builders I track in aggregate increased the number of lots they owned or controlled from the fall of 2011 to the fall of 2013 by about 30% -- with the bulk of the gain occurring since the middle of 2012 – and in aggregate these companies planned to increase both community counts and sales by 15-17% this year. One reason net orders have been below consensus is that many builders raised prices aggressively last year. Now that builders have substantially larger land/lot inventories – and a lot more of it is developed now compared to a year ago – it is a pretty good bet that builders’ “pricing power” has fallen sharply, and that new home prices will on average (and adjusted for mix) show little if any increase for the remainder of this year.

Chemical Activity Barometer for June Suggests "continued growth"

by Calculated Risk on 6/27/2014 02:38:00 PM

Here is a new indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Leading Economic Indicator Continues Upward Trend Despite Impacts of Global Unrest

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), continued its upward growth this month, with a 0.5 percent gain from May. Measured on a three-month moving average (3MMA), the CAB’s 0.5 percent gain beat the average first quarter monthly gains of 0.3 percent. Though the pace of growth has slowed significantly, gains in June have brought the CAB up a solid 4.3 percent over this time last year.

“Overall, we are seeing signs of continued growth in the U.S. economy, and trends in construction-related chemistry show a market which has not yet reached its full potential,” said Dr. Kevin Swift, chief economist at ACC. “However, unrest in Iraq is already affecting chemical equity prices, and the potential for an energy price shock is worrying,” he added.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

And this suggests continued growth.

Vehicle Sales Forecasts: Over 16 Million SAAR again in June

by Calculated Risk on 6/27/2014 11:45:00 AM

The automakers will report June vehicle sales on Tuesday, July 1st. Sales in May were at 16.71 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in June will be above 16 million (SAAR) again.

Note: There were only 24 selling days in June this year compared to 26 last year.

Here are a few forecasts:

From WardsAuto: Forecast Calls for Strong June Sales

A new WardsAuto forecast calls for strong U.S. light-vehicle sales in June, with competition in the midsize car segment and healthy inventories across all segments fueling growth. ... The projected 16.4 million-unit seasonally adjusted annual rate would be less than May’s 87-month-high 16.7 million SAAR ...From J.D. Power: J.D. Power and LMC Automotive Report: New-Vehicle Sales Continue Year-over-Year Growth

Total light-vehicle sales in June 2014 are expected to approach 1.4 million units, a 5 percent increase from June 2013. The pace of fleet volume growth continues to be lower than retail, with a 1 percent increase year over year, accounting for 19 percent of total sales in June. ... [16.3 million SAAR]

From TrueCar: June SAAR to Hit 16.4 Million Vehicles, According to TrueCar; 2014 New Vehicle Sales Expected to be up 1.0 Percent Year-Over-Year

Seasonally Adjusted Annualized Rate ("SAAR") of 16.4 million new vehicle sales is up 3.2 percent from June 2013 and down 1.8 percent over May 2014.Another solid month for auto sales.

Final June Consumer Sentiment increases to 82.5

by Calculated Risk on 6/27/2014 09:55:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for June increased to 82.5 from the May reading of 81.9, and was up from the preliminary June reading of 81.2.

This was above the consensus forecast of 82.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

Thursday, June 26, 2014

Zillow: Case-Shiller House Price Index expected to slow further year-over-year in May

by Calculated Risk on 6/26/2014 08:39:00 PM

The Case-Shiller house price indexes for April were released Tuesday. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Case-Shiller Indices Will Continue to Show More Marked Slowdowns

he Case-Shiller data for April 2014 came out this morning (research brief here), and based on this information and the May 2014 Zillow Home Value Index (ZHVI, released June 22), we predict that next month’s Case-Shiller data (May 2014) will show that the non-seasonally adjusted (NSA) 20-City Composite Home Price Index and the NSA 10-City Composite Home Price Index increased by 9.6 percent and 9.7 percent on a year-over-year basis, respectively. The seasonally adjusted (SA) month-over-month change from April to May will be 0.4 percent for both the 20-City Composite Index and the 10-City Composite Home Price Index (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for May will not be released until Tuesday, July 29.So the Case-Shiller index will probably show another strong year-over-year gain in May, but lower than in April (10.8% year-over-year).

| Zillow May 2014 Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | May 2013 | 169.47 | 170.00 | 156.06 | 156.52 |

| Case-Shiller (last month) | Apr 2014 | 183.28 | 186.46 | 168.71 | 171.73 |

| Zillow Forecast | YoY | 9.7% | 9.7% | 9.6% | 9.6% |

| MoM | 1.4% | 0.4% | 1.4% | 0.4% | |

| Zillow Forecasts1 | 185.9 | 186.8 | 171.1 | 172.0 | |

| Current Post Bubble Low | 146.45 | 149.86 | 134.07 | 137.14 | |

| Date of Post Bubble Low | Mar-12 | Feb-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 26.9% | 24.7% | 27.6% | 25.4% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Freddie Mac: Mortgage Serious Delinquency rate declined in May, Lowest since January 2009

by Calculated Risk on 6/26/2014 06:02:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in May to 2.10% from 2.15% in April. Freddie's rate is down from 2.85% in May 2013, and this is the lowest level since January 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for May on Monday, June 30th.

Click on graph for larger image

Click on graph for larger image

Although this indicates progress, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.75 percentage points over the last year - and at that rate of improvement, the serious delinquency rate will not be below 1% until late 2015.

Note: Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

So even though distressed sales are declining, I expect an above normal level of distressed sales for perhaps 2 more years (mostly in judicial foreclosure states).

Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group

by Calculated Risk on 6/26/2014 03:46:00 PM

As follow-up to my previous post, earlier today the Census Bureau released the population estimates by age for 2013: As the Nation Ages, Seven States Become Younger, Census Bureau Reports

The median age declined in seven states between 2012 and 2013, including five in the Great Plains, according to U.S. Census Bureau estimates released today. In contrast, the median age for the U.S. as a whole ticked up from 37.5 years to 37.6 years.I think the headline should have been something like: Baby Boomers lose Title as Largest 5-Year Cohort!

Note: This is a positive for apartments, see: The Favorable Demographics for Apartments and Apartments: Supply and Demand

The table below shows the top 11 cohorts by size for 2010, 2013 (released today), and Census Bureau projections for 2020 and 2030.

As I noted earlier, by 202 8 of the top 10 cohorts will be under 40 (the Boomers will be fading away), and by 2030 the top 11 cohorts will be the youngest 11 cohorts (the reason I included 11 cohorts).

As the graph in the previous post indicated, even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon.

There will be plenty of "gray hairs" walking around in 2020 and 2030, but the key for the economy is the population in the prime working age will be increasing again soon.

| Population: Largest 5-Year Cohorts by Year | ||||

|---|---|---|---|---|

| Largest Cohorts | 2010 | 2013 | 2020 | 2030 |

| 1 | 45 to 49 years | 20 to 24 years | 25 to 29 years | 35 to 39 years |

| 2 | 50 to 54 years | 50 to 54 years | 30 to 34 years | 40 to 44 years |

| 3 | 15 to 19 years | 25 to 29 years | 35 to 39 years | 30 to 34 years |

| 4 | 20 to 24 years | 30 to 34 years | Under 5 years | 25 to 29 years |

| 5 | 25 to 29 years | 45 to 49 years | 55 to 59 years | 5 to 9 years |

| 6 | 40 to 44 years | 55 to 59 years | 20 to 24 years | 10 to 14 years |

| 7 | 10 to 14 years | 15 to 19 years | 5 to 9 years | Under 5 years |

| 8 | 5 to 9 years | 40 to 44 years | 60 to 64 years | 15 to 19 years |

| 9 | Under 5 years | 10 to 14 years | 15 to 19 years | 20 to 24 years |

| 10 | 35 to 39 years | 5 to 9 years | 10 to 14 years | 45 to 49 years |

| 11 | 30 to 34 years | Under 5 years | 50 to 54 years | 50 to 54 years |