by Calculated Risk on 7/01/2014 09:02:00 AM

Tuesday, July 01, 2014

CoreLogic: House Prices up 8.8% Year-over-year in May

Notes: This CoreLogic House Price Index report is for May. The recent Case-Shiller index release was for April. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rose by 8.8 Percent Year Over Year in May

Home prices nationwide, including distressed sales, increased 8.8 percent in May 2014 compared to May 2013. This change represents 27 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased 1.4 percent in May 2014 compared to April 2014.

...

Excluding distressed sales, home prices nationally increased 8.1 percent in May 2014 compared to May 2013 and 1.2 percent month over month compared to April 2014. ... Distressed sales include short sales and real estate owned (REO) transactions.

"The pace of home price appreciation is cooling off quickly as the weather warms up,” said Mark Fleming, chief economist for CoreLogic. “May's 8.8 percent year-over-year growth rate is down almost three percentage points from just three months ago. The influences of modestly rising inventory and less-than-expected demand are causing price growth to moderate toward our forecasted expectations.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.4% in May, and is up 8.8% over the last year.

This index is not seasonally adjusted, so a strong month-to-month gain was expected for May.

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty seven consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty seven consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).However this was the smallest year-over-year gain since late 2012, and I expect the year-over-year increases to continue to slow.

Reis: Office Vacancy Rate unchanged in Q2 at 16.8%

by Calculated Risk on 7/01/2014 08:31:00 AM

Reis released their Q2 2014 Office Vacancy survey this morning. Reis reported that the office vacancy rate was unchanged in Q2 compared to Q1 at 16.8%. This is down slightly from 17.0% in Q2 2013, and down from the cycle peak of 17.6%.

From Reis Senior Economist Ryan Severino:

The national vacancy rate was unchanged during the first quarter at 16.8%. This reflects the pattern in vacancy rate movement that we have seen since the market began recovering during the first quarter of 2011. Quarters of slightly declining vacancy have often been followed by quarters with no change in the vacancy rate. During that interval we have not had a quarter with a vacancy compression greater than 10 basis points. Over the last twelve months, the vacancy rate is down just 20 basis points, on par with last quarter, indicating that in aggregate we are not yet seeing an acceleration in the recovery in the office market. National vacancies remain elevated at 430 basis points above the sector's cyclical low of 12.5% recorded during the third quarter of 2007. Although job growth is accelerating, it is likely that newly created office jobs are taking up under‐utilized space and not yet creating much demand for the leasing of new or additional space.On absorption and new construction:

emphasis added

Net absorption increased by 2.759 million square feet during the second quarter. This is the lowest quarterly figure since the fourth quarter of 2010, the last time net absorption was negative in the US. Last quarter, net absorption was the highest quarterly figure since before the recession so that is a stark reversal in only one quarter. Net absorption averaged roughly 8.2 million square feet over the last four quarters so this represents a significant change from recent performance in the market.On rents:

Construction increased by 3.884 million square feet during the second quarter. This is the lowest quarterly figure since the first quarter of 2013. Although the national vacancy rate did not change, new supply outpaced net absorption during the quarter.

Asking and effective rents both grew by 0.7%, respectively, during the second quarter. These figures are essentially the same as last quarter. Asking and effective rents have now risen for fifteen consecutive quarters. However, we continue to see slow but ongoing acceleration in rent growth over time. Asking rent growth was 1.6% during 2011, 1.8% during 2012, and 2.1% in 2013, and 2.2% over the prior 12 months during the first quarter. During the second quarter, the 12‐month change in asking rent increased to 2.5%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was unchanged at 16.8% in Q2, and was down from 17.0% in Q2 2013. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010, and Q1 2011.

Office vacancy data courtesy of Reis.

Monday, June 30, 2014

Tuesday: ISM Mfg Survey, Vehicle Sales, Construction Spending

by Calculated Risk on 6/30/2014 08:18:00 PM

From the National Restaurant Association: Restaurant Performance Index Rose to Its

Highest Level in More Than Two Years

Driven by stronger sales and traffic levels and an increasingly optimistic outlook among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) rose to its highest level in more than two years. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 102.1 in May, the third consecutive monthly gain and strongest reading since March 2012. In addition, the RPI stood above 100 for the 15th consecutive month, which signifies expansion in the index of key industry indicators.

...

“Positive sales results fueled the May increase in the RPI, as nearly two-thirds of restaurant operators said their same-store sales rose above year-ago levels,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, restaurant operators are increasingly optimistic about continued sales gains in the months ahead, a sentiment that is also showing up in their capital expenditure plans.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index increased to 102.1 in May, up from 101.7 in April. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month - and this is a solid reading.

Tuesday:

• Early: Reis Q2 2014 Office Survey of rents and vacancy rates.

• All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 16.4 million SAAR in June from 16.7 million in May (Seasonally Adjusted Annual Rate).

• At 10:00 AM ET, the ISM Manufacturing Index for June. The consensus is for an increase to 55.6 from 55.4 in May. In May the employment index was at 52.8%, and the new orders index was at 56.9%.

• At 10:00 AM, Construction Spending for May. The consensus is for a 0.5% increase in construction spending.

Weekly Update: Housing Tracker Existing Home Inventory up 14.0% YoY on June 30th, Above June 30, 2012 Level

by Calculated Risk on 6/30/2014 05:12:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data released was for May). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 14.0% above the same week in 2013. (Note: There are differences in how the data is collected between Housing Tracker and the NAR).

Also inventory is now above the same week in 2012. This increase in inventory should slow price increases, and might lead to price declines in some areas.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess was inventory would be up 10% to 15% year-over-year at the end of 2014 based on the NAR report. Right now it looks like inventory might increase more than I expected.

Fannie Mae: Mortgage Serious Delinquency rate declined in May, Lowest since October 2008

by Calculated Risk on 6/30/2014 04:28:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in May to 2.08% from 2.13% in April. The serious delinquency rate is down from 2.83% in May 2013, and this is the lowest level since October 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Last week, Freddie Mac reported that the Single-Family serious delinquency rate declined in May to 2.10% from 2.15% in April. Freddie's rate is down from 2.85% in May 2013, and is at the lowest level since January 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The Fannie Mae serious delinquency rate has fallen 0.75 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in late 2015.

Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be back to normal in late 2015 or 2016.

Schedule Update: Reis Office, Aparment and Mall Surveys to be released this week

by Calculated Risk on 6/30/2014 01:55:00 PM

Just an update to the weekly schedule ... adding the quarterly Reis surveys of rents and vacancy rates for offices, apartments and malls.

Early: Reis Q2 2014 Office Survey of rents and vacancy rates.

Early: Reis Q2 2014 Apartment Survey of rents and vacancy rates.

Early: Reis Q2 2014 Mall Survey of rents and vacancy rates.

Dallas Fed: Manufacturing Activty Increases "Picks Up Pace" in June

by Calculated Risk on 6/30/2014 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Picks Up Pace

Texas factory activity increased again in June, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 11 to 15.5, indicating output grew at a faster pace than in May.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Other measures of current manufacturing activity also reflected growth in June. The new orders index rose from 3.8 to 6.5 but remained below the levels seen earlier in the year. The capacity utilization index held steady at 9.2. The shipments index came in at 10.3, similar to its May level, with nearly a third of manufacturers noting an increase in volumes.

Perceptions of broader business conditions were more optimistic this month. The general business activity index rose from 8 to 11.4. ...

Labor market indicators reflected stronger employment growth and longer workweeks. The June employment index rebounded to 13.1 after dipping to 2.9 in May.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through June), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through May (right axis).

All of the regional surveys showed expansion in June, and it seems likely the ISM index will be at about the same level as in May, or increase slightly in June. The ISM index for June will be released tomorrow, Tuesday, July 1st.

NAR: Pending Home Sales Index increased 6.1% in May, down 5.2% year-over-year

by Calculated Risk on 6/30/2014 10:00:00 AM

From the NAR: Pending Home Sales Surge in May

Pending home sales rose sharply in May, with lower mortgage rates and increased inventory accelerating the market, according to the National Association of Realtors®. All four regions of the country saw increases in pending sales, with the Northeast and West experiencing the largest gains.Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 6.1 percent to 103.9 in May from 97.9 in April, but still remains 5.2 percent below May 2013 (109.6).

...

The PHSI in the Northeast jumped 8.8 percent to 86.3 in May, and is now 0.2 percent above a year ago. In the Midwest the index rose 6.3 percent to 105.4 in May, but is still 6.6 percent below May 2013.

Pending home sales in the South advanced 4.4 percent to an index of 117.0 in May, and is 2.9 percent below a year ago. The index in the West rose 7.6 percent in May to 95.4, but remains 11.1 percent below May 2013.

Sunday, June 29, 2014

Monday: Chicago PMI, Pending Home Sales

by Calculated Risk on 6/29/2014 09:00:00 PM

Monday:

• At 9:45 AM ET, the Chicago Purchasing Managers Index for June. The consensus is for a decrease to 64.0, down from 65.5 in May.

• At 10:00 AM, the Pending Home Sales Index for May. The consensus is for a 1% increase in the index.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for June. This is the last of the regional Fed manufacturing surveys for June.

Weekend:

• Demographics: Prime and Near-Prime Population and Labor Force

• Schedule for Week of June 29th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down slightly and DOW futures are down 11 (fair value).

Oil prices moved down slightly over the last week with WTI futures at $105.45 per barrel and Brent at $113.10 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.68 per gallon, up about 20 cents from a year ago. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Demographics: Prime and Near-Prime Population and Labor Force

by Calculated Risk on 6/29/2014 12:33:00 PM

Earlier this week, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group and The Future is still Bright!

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Here are a couple more graphs making this point. The first shows prime and near-prime working age population in the U.S. since 1948 (this is population, not labor force).

Click on graph for larger image.

Click on graph for larger image.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The near-prime group has been growing - especially the 55 to 64 age group.

The good news is the prime working age group will start growing again by 2020, and this should boost economic activity.

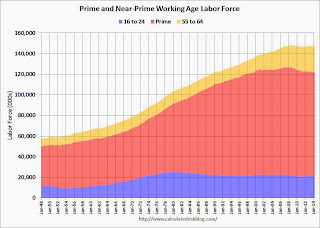

The second graph shows prime and near-prime working age labor force in the U.S. since 1948 (this is labor force - the first graph was population).

The second graph shows prime and near-prime working age labor force in the U.S. since 1948 (this is labor force - the first graph was population).

The prime working age labor force grew even quicker than the population in the '70s and '80s due the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased).

As Bruegel notes, the working age population in the US is expected to grow over the next few decades - so the US has much better demographics than Europe, China or Japan (not included).

The key points are:

1) A slowdown in the US was expected this decade just based on demographics (the housing bust, financial crisis were piled on top of weak demographics).

2) The prime working age population in the US will start growing again soon.