by Calculated Risk on 7/09/2014 04:49:00 PM

Wednesday, July 09, 2014

Phoenix Real Estate in June: Sales down 11%, Cash Sales down Sharply, Inventory up 43%

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in June were down 11% year-over-year and at the lowest for June since 2008.

2) Cash Sales (frequently investors) were down about 40%, so investor buying appears to be declining. Non-cash sales were up about 6% year-over-year.

3) Active inventory is now increasing rapidly and is up 43% year-over-year - and at the highest level for June since 2011.

Inventory has clearly bottomed in Phoenix (A major theme for housing in 2013). And more inventory (a theme this year) - and less investor buying - suggests price increases should slow sharply in 2014.

According to Case-Shiller, Phoenix house prices bottomed in August 2011 (mostly flat for all of 2011), and then increased 23% in 2012, and another 15% in 2013. Those large increases were probably due to investor buying, low inventory and some bounce back from the steep price declines in 2007 through 2010. Now, with more inventory, price increases should flatten out in 2014.

We only have Case-Shiller through April, but the Zillow index shows Phoenix prices up slightly year-to-date through May.

| June Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| June 2008 | 5,748 | --- | 1,093 | 19.0% | 53,8262 | --- |

| June 2009 | 9,325 | 62.2% | 3,443 | 36.9% | 38,358 | ---2 |

| June 2010 | 9,278 | -0.5% | 3,498 | 37.7% | 41,869 | 9.2% |

| June 2011 | 11,134 | 20.0% | 5,001 | 44.9% | 29,203 | -30.3% |

| June 2012 | 9,133 | -18.0% | 4,272 | 46.8% | 19,857 | -32.0% |

| June 2013 | 8,150 | -10.8% | 3,055 | 37.5% | 19,541 | -1.6% |

| June 2014 | 7,239 | -11.2% | 1,854 | 25.6% | 27,954 | 43.1% |

| 1 June 2008 does not include manufactured homes, ~100 more 2 June 2008 Inventory includes pending | ||||||

FOMC Minutes: QE3 Expected to End in October

by Calculated Risk on 7/09/2014 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee, June 17-18, 2014. Excerpt:

Some committee members had been asked by members of the public whether, if tapering in the pace of purchases continues as expected, the final reduction would come in a single $15 billion per month reduction or in a $10 billion reduction followed by a $5 billion reduction. Most participants viewed this as a technical issue with no substantive macroeconomic consequences and no consequences for the eventual decision about the timing of the first increase in the federal funds rate--a decision that will depend on the Committee's evolving assessments of actual and expected progress toward its objectives. In light of these considerations, participants generally agreed that if incoming information continued to support its expectation of improvement in labor market conditions and a return of inflation toward its longer-run objective, it would be appropriate to complete asset purchases with a $15 billion reduction in the pace of purchases in order to avoid having the small, remaining level of purchases receive undue focus among investors. If the economy progresses about as the Committee expects, warranting reductions in the pace of purchases at each upcoming meeting, this final reduction would occur following the October meeting.And more on Monetary Policy Normalization:

emphasis added

Meeting participants continued their discussion of issues associated with the eventual normalization of the stance and conduct of monetary policy. The Committee's consideration of this topic was undertaken as part of prudent planning and did not imply that normalization would necessarily begin sometime soon. A staff presentation included some possible strategies for implementing and communicating monetary policy during a period when the Federal Reserve will have a very large balance sheet. In addition, the presentation outlined design features of a potential ON RRP facility and discussed options for the Committee's policy of rolling over maturing Treasury securities at auction and reinvesting principal payments on all agency debt and agency mortgage-backed securities (MBS) in agency MBS.

Most participants agreed that adjustments in the rate of interest on excess reserves (IOER) should play a central role during the normalization process. It was generally agreed that an ON RRP facility with an interest rate set below the IOER rate could play a useful supporting role by helping to firm the floor under money market interest rates. One participant thought that the ON RRP rate would be the more effective policy tool during normalization in light of the wider variety of counterparties eligible to participate in ON RRP operations. The appropriate size of the spread between the IOER and ON RRP rates was discussed, with many participants judging that a relatively wide spread--perhaps near or above the current level of 20 basis points--would support trading in the federal funds market and provide adequate control over market interest rates. Several participants noted that the spread might be adjusted during the normalization process. A couple of participants suggested that adequate control of short-term rates might be accomplished with a very wide spread or even without an ON RRP facility. A few participants commented that the Committee should also be prepared to use its other policy tools, including term deposits and term reverse repurchase agreements, if necessary. Most participants thought that the federal funds rate should continue to play a role in the Committee's operating framework and communications during normalization, with many of them indicating a preference for continuing to announce a target range. However, a few participants thought that, given the degree of uncertainty about the effects of the Committee's tools on market rates, it might be preferable to focus on an administered rate in communicating the stance of policy during the normalization period. In addition, participants examined possibilities for changing the calculation of the effective federal funds rate in order to obtain a more robust measure of overnight bank funding rates and to apply lessons from international efforts to develop improved standards for benchmark interest rates.

While generally agreeing that an ON RRP facility could play an important role in the policy normalization process, participants discussed several potential unintended consequences of using such a facility and design features that could help to mitigate these consequences. Most participants expressed concerns that in times of financial stress, the facility's counterparties could shift investments toward the facility and away from financial and nonfinancial corporations, possibly causing disruptions in funding that could magnify the stress. In addition, a number of participants noted that a relatively large ON RRP facility had the potential to expand the Federal Reserve's role in financial intermediation and reshape the financial industry in ways that were difficult to anticipate. Participants discussed design features that could address these concerns, including constraints on usage either in the aggregate or by counterparty and a relatively wide spread between the ON RRP rate and the IOER rate that would help limit the facility's size. Several participants emphasized that, although the ON RRP rate would be useful in controlling short-term interest rates during normalization, they did not anticipate that such a facility would be a permanent part of the Committee's longer-run operating framework. Finally, a number of participants expressed concern about conducting monetary policy operations with nontraditional counterparties.

Participants also discussed the appropriate time for making a change to the Committee's policy of rolling over maturing Treasury securities at auction and reinvesting principal payments on all agency debt and agency MBS in agency MBS. It was noted that, in the staff's models, making a change to the Committee's reinvestment policy prior to the liftoff of the federal funds rate, at the time of liftoff, or sometime thereafter would be expected to have only limited implications for macroeconomic outcomes, the Committee's statutory objectives, or remittances to the Treasury. Many participants agreed that ending reinvestments at or after the time of liftoff would be best, with most of these participants preferring to end them after liftoff. These participants thought that an earlier change to the reinvestment policy would involve risks to the economic outlook if it was seen as suggesting that the Committee was likely to tighten policy more rapidly than currently anticipated or if it had unexpectedly large effects in MBS markets; moreover, an early change could add complexity to the Committee's communications at a time when it would be clearer to signal changes in policy through interest rates alone. However, some participants favored ending reinvestments prior to the first firming in policy interest rates, as stated in the Committee's exit strategy principles announced in June 2011. Those participants thought that such an approach would avoid weakening the credibility of the Committee's communications regarding normalization, would act to modestly reduce the size of the Federal Reserve's balance sheet, or would help prepare the public for the eventual rise in short-term interest rates. Regardless of whether they preferred to introduce a change to the Committee's reinvestment policy before or after the initial tightening in short-term interest rates, a number of participants thought that it might be best to follow a graduated approach with respect to winding down reinvestments or to manage reinvestments in a manner that would smooth the decline in the balance sheet. Some stressed that the details should depend on financial and economic conditions.

Overall, participants generally expressed a preference for a simple and clear approach to normalization that would facilitate communication to the public and enhance the credibility of monetary policy. It was observed that it would be useful for the Committee to develop and communicate its plans to the public later this year, well before the first steps in normalizing policy become appropriate. Most participants indicated that they expected to learn more about the effects of the Committee's various policy tools as normalization proceeds, and many favored maintaining flexibility about the evolution of the normalization process as well as the Committee's longer-run operating framework. Participants requested additional analysis from the staff on issues related to normalization and agreed that it would be helpful to continue to review these issues at upcoming meetings.

Goldman Sachs: Funding for Highway Construction Appears Likely

by Calculated Risk on 7/09/2014 10:35:00 AM

A few comments from Goldman Sachs economist Alec Phillips:

The House and Senate both appear to be finally moving forward with plans to provide additional funding for the nearly exhausted highway trust fund and to extend the program through at least year end, though there are still several areas of disagreement that need to be worked out. Resolution of the issue by later this month should provide greater certainty to state governments that might otherwise pull back on new construction in the absence of a legislative fix.First a few words from Ronald Reagan from November 1982 when he proposed raising the gasoline tax:

The legislation that is beginning to move through Congress is notable in two other respects. First, it makes no changes to international corporate tax rules (i.e., corporate inversions), seemingly taking the prospect for congressional intervention off the table until after the election. Second, the House plan would lower the minimum contribution that defined benefit pension plan sponsors must make for the next few years, reducing DB pension plans' demand for financial assets but increasing their tax liabilities.

... Our expectation is that without a viable long-term funding mechanism a multi-year renewal of the program will be difficult. The gasoline tax that has traditionally funded most federal transportation spending has not been raised since 1993 and receipts have not kept up with the increased spending out of the fund. Unless a solution can be found--either a gasoline tax increase or a new long-term funding source--Congress may simply adopt a series of short-term renewals.

This special holiday weekend is a time when we all give thanks for the many things our land is blessed with. It's also a fitting time for us to think about ways in which we can preserve those blessings for future generations.A few key points:

One of our great material blessings is the outstanding network of roads and highways that spreads across this vast continent. ... Lately, driving isn't as much fun as it used to be. Time and wear have taken their toll on America's roads and highways. ...

We simply cannot allow this magnificent system to deteriorate beyond repair. The time has come to preserve what past Americans spent so much time and effort to create, and that means a nationwide conservation effort in the best sense of the word. America can't afford throwaway roads or disposable transit systems. The bridges and highways we fail to repair today will have to be rebuilt tomorrow at many times the cost.

emphasis added

• This is just a short term fix until after the election, but I expect it will happen.

• Historically both parties supported infrastructure spending and raising user fees to support the spending (see Reagan's comments).

• The gasoline tax hasn't been increased since August 1993 (it is a fixed amount of 18.4 cents per gallon). If the tax was indexed to inflation, it would be 30 cents per gallon now (and the Highway Trust Fund would be in good shape).

• And on budget accounting: Although building a bridge is obviously an investment, the Federal Government does not have a capital account. These investments are just expensed (a company would depreciate the expenditure over a number of years).

• Although downside risks have diminished this year, I expect Congress to be a significant downside risk in 2015 (with more dumb and damaging actions like in 2011 and 2013).

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 7/09/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 4, 2014. This week’s result included an adjustment for the July 4th holiday. ...

The Refinance Index increased 0.4 percent from the previous week. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.32 percent from 4.28 percent, with points increasing to 0.16 from 0.14 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

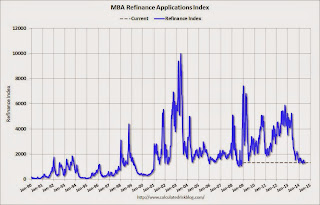

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 10% from a year ago.

Note: Mortgage rates were around 4.75% this time last year, and are down about 50 bps year-over-year.

Tuesday, July 08, 2014

Wednesday: FOMC Minutes

by Calculated Risk on 7/08/2014 09:00:00 PM

This never gets old: Years ago, whenever there was a market sell-off, my friend Tak Hallus (Stephen Robinett) would shout at his TV tuned to CNBC "Bring out the bears!".

That was because CNBC would usually interview "bears" whenever there was a sell-off, and interview "bulls" whenever the market rallied.

Today was no exception Marc Faber: The asset bubble has begun to burst

All in all, Faber is looking for a 30 percent drop in the S&P 500.Here is Faber on April 10th: 2014 crash will be worse than 1987's: Marc Faber

"This year, for sure—maybe from a higher diving board—the S&P will drop 20 percent," Faber said, adding: "I think, rather, 30 percent"And Faber from August 8, 2013:

Faber expect to see stocks end the year "maybe 20 percent [lower], maybe more!"And from October 24, 2012:

"I believe globally we are faced with slowing economies and disappointing corporate profits, and I will not be surprised to see the Dow Jones, the S&P, the major indices, down from the recent highs by say, 20 percent," Faber said...Since the market is up 40% since his 2012 prediction, shouldn't he be expecting something like a 50%+ decline now?

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, the FOMC Minutes for the Meeting of June 17-18, 2014.

Kolko: "Basement-Dwelling Millennials Are For Real"

by Calculated Risk on 7/08/2014 06:02:00 PM

Using data from other sources than the CPS, Trulia chief economist Jed Kolko writes: Basement-Dwelling Millennials Are For Real

[T]he Current Population Survey’s (CPS) Annual Social and Economic Supplement (ASEC) counts college students who are living in dorms as living with their parents, and college enrollment has indeed gone up. But it does not follow that basement-dwelling millennials are a myth. The ASEC and other Census data show that after adjusting for college enrollment and for dormitory living, millennials were more likely to live with parents in 2012 and 2013 than at any other time for which data are available.An interesting discussion!

P.S. Great to be back online. SC Edison performed some electrical upgrades on my block on Monday, and one of the "upgrades" was to sever my cable connection. Oh well ...

Las Vegas Real Estate in June: YoY Non-contingent Inventory up 86%, Distressed Sales and Cash Buying down YoY

by Calculated Risk on 7/08/2014 05:06:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports rising local home prices, fewer cash buyers

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in May was 3,274, up from 3,450 in May, but down from 3,642 one year ago..There are several key trends that we've been following:

GLVAR said 34.7 percent of all existing local homes sold in June were purchased with cash. That’s down from 40.2 percent in May and well short of the February 2013 peak of 59.5 percent, suggesting that investors are accounting for a smaller percentage of local buyers.

...

In June, 10.8 percent of all existing local home sales were short sales. That’s up from 7.9 percent in May. Another 10.1 percent of all June sales were bank-owned properties, up from 9.1 percent in May.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in June was 13,838. That’s up 1.5 percent from 13,637 in May and up 0.6 percent from one year ago.

By the end of June, GLVAR reported 7,126 single-family homes listed without any sort of offer. That’s up 7.7 percent from 6,615 such homes listed in May, and an 86.2 percent jump from one year ago. For condos and townhomes, the 2,333 properties listed without offers in June represented a 3.3 percent increase from 2,258 such properties listed in May and a 59.4 percent jump from one year ago.

emphasis added

1) Overall sales were down about 10% year-over-year.

2) Conventional (equity, not distressed) sales were up 19% year-over-year. In June 2013, only 60.0% of all sales were conventional equity. This year, in June 2014, 79.1% were equity sales.

3) The percent of cash sales has declined year-over-year from 55.3% in June 2013 to 34.7% in June 2014. (investor buying appears to be declining).

4) Non-contingent inventory is up 86% year-over-year.

Inventory has clearly bottomed in Las Vegas (A major theme for housing last year). And fewer distressed sales and more inventory (a major theme for 2014) suggests price increases will slow.

BLS: Jobs Openings increase to 4.6 million in May

by Calculated Risk on 7/08/2014 10:11:00 AM

Note: I have limited internet access until later today.

From the BLS: Job Openings and Labor Turnover Summary

There were 4.6 million job openings on the last business day of May, little changed from 4.5 million in April, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) increased over the 12 months ending in May for total nonfarm and total private and was little changed for government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent employment report was for June.

Click on graph for larger image.

Click on graph for larger image.Note: graph is from last month (power outage - limited internet access and cannot upload graphs)

Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in May to 4.635 million from 4.464 million in April.

The number of job openings (yellow) are up 19% year-over-year compared to May 2013.

Quits are up 15%year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

It is a good sign that job openings are over 4 million for the fourth consecutive month, and that quits are increasing.

NFIB; Small business optimism declines in June

by Calculated Risk on 7/08/2014 08:46:00 AM

From NFIB: SMALL BUSINESS OPTIMISM CAN’T BE SUSTAINED

" After a promising 3 month run, June’s Optimism Index fell 1.6 points to 95.0. While job components improved ..."

"NFIB owners increased employment by an average of 0.05 workers per firm in June (seasonally adjusted), the ninth positive month in a row and the best string of gains since 2006."

Monday, July 07, 2014

Tuesday: Job Openings, Small Business Survey

by Calculated Risk on 7/07/2014 09:01:00 PM

Special Note: Due to a power outage and internet interruption (thanks SCE), posting may be light or non-existent until Tuesday afternoon. I'm also unable to respond to most emails. I'll be back online soon!

Tuesday:

• At 7:30 AM ET, the NFIB Small Business Optimism Index for June.

• At 10:00 AM, Job Openings and Labor Turnover Survey for May from the BLS. In April, Job Openings were up 17% year-over-year and quits were up 11% year-over-year.

• At 3:00 PM, Consumer Credit for May from the Federal Reserve. The consensus is for credit to increase $17.5 billion.