by Calculated Risk on 7/11/2014 02:55:00 PM

Friday, July 11, 2014

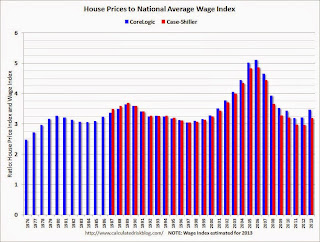

House Prices to National Average Wage Index

One of the metrics we'd like to follow is a ratio of house prices to incomes. Unfortunately most income data is released with a significantly lag, and there is always a question on what income data to use (the average total income is skewed by the income of a few people).

And for key measures of house prices - like Case-Shiller and CoreLogic - we have indexes, not actually prices.

But we can construct a ratio of the house price indexes to some measure of income.

For this graph I decided to look at house prices and the National Average Wage Index from Social Security.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the ratio of house price indexes divided by the National Average Wage Index (the Wage index is first divided by 1000).

This uses the annual average CoreLogic index since 1976, and also the National Case-Shiller index since 1987.

As of 2013, house prices were just above the historical ratio. Prices have increased further in 2014, but it appears house prices relative to incomes is still below the 1989 peak.

Going forward, I think it would be a positive if wages outpaced, or at least kept pace with house prices increases for a few years.

Notes: The national wage index for 2013 is estimated using the same increase as in 2012.

Update: Framing Lumber Prices

by Calculated Risk on 7/11/2014 12:11:00 PM

Here is another graph on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs. Then prices declined over 25% from the highs by mid-year 2013.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand), however prices haven't fallen as sharply either.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through last week (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up about 15% from a year ago, and CME futures are up about 11% year-over-year.

New Tool from Atlanta Fed: GDPNow

by Calculated Risk on 7/11/2014 08:57:00 AM

The Atlanta Fed has introduced a nowcast of GDP called GDPNow. The model mimics the BEA's methods to estimate GDP and is updated five to six times a month as data is released. The model tends to converge to the BEA estimate just before the BEA advance estimate for GDP is released each quarter.

Here is a discussion of the model: Introducing the Atlanta Fed's GDPNow Forecasting Model

We will update the nowcast five to six times each month following the releases of certain key economic indicators listed in the frequently asked questions. Look for the next GDPNow update on July 15, with the release of the retail trade and business inventory reports.Here is the current Q2 nowcast:

If you want to dig deeper, the GDPNow page includes downloadable charts and tables as well as numerical details including the model's nowcasts for GDP, its subcomponents, and how the subcomponent nowcasts are built up from both the underlying source data and the model parameters. This working paper supplies the model's technical documentation. We hope economy watchers find GDPNow to be a useful addition to their information sets.

The GDPNow model forecast for real GDP growth (SAAR) in 2014: Q2 was 2.6 percent on July 10, unchanged from its July 3 value.Ouch. Not much of a rebound from Q1.

Note: The first estimate of Q2 GDP will be released on July 30th and will include the annual revision (maybe Q1 will be revised up).

Thursday, July 10, 2014

Hotels: Occupancy Rate up 4.4%, RevPAR up 9.0% in Latest Survey

by Calculated Risk on 7/10/2014 08:40:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 5 July

In year-over-year measurements, the industry’s occupancy rate increased 4.4 percent to 66.0 percent. Average daily rate increased 4.5 percent to finish the week at US$112.40. Revenue per available room for the week was up 9.0 percent to finish at US$74.14.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

emphasis added

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is at the same level as in 2000.

The following graph shows the seasonal pattern for the hotel occupancy rate for the last 15 years using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014 and black is for 2009 - the worst year since the Great Depression for hotels. Note: 2001 was briefly worse than 2009 in September.

Right now it looks like 2014 will be the best year since 2000 for hotels. A very strong year ...

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Fed Vice Chairman Stanley Fischer: Financial Sector Reform: How Far Are We?

by Calculated Risk on 7/10/2014 04:48:00 PM

A speech from Fed Vice Chairman Stanley Fischer Financial Sector Reform: How Far Are We? Here is his conclusion:

The United States is making significant progress in strengthening the financial system and reducing the probability of future financial crises. In particular

• By raising capital and liquidity ratios for SIFIs, and through the active use of stress tests, regulators and supervisors have strengthened bank holding companies and thus reduced the probability of future bank failures.

• Work on the use of the resolution mechanisms set out in the Dodd-Frank Act, based on the principle of a single point of entry, holds out the promise of making it possible to resolve banks in difficulty at no direct cost to the taxpayer--and in any event at a lower cost than was hitherto possible. However, work in this area is less advanced than the work on raising capital and liquidity ratios.

• Although the BCBS and the FSB reached impressively rapid agreement on needed changes in regulation and supervision, progress in agreeing on the resolution of G-SIFIs and some other aspects of international coordination has been slow.

• Regulators almost everywhere need to do more research on the effectiveness of microprudential and other tools that could be used to deal with macroprudential problems.

• It will be important to ensure that coordination among different regulators of the financial system is effective and, in particular, will be effective in the event of a crisis.

• A great deal of progress has been made in dealing with the TBTF problem. While we must continue to work toward ending TBTF or the need for government financial intervention in crises, we should never allow ourselves the complacency to believe that we have put an end to TBTF.

• We should recognize that despite some imperfections, the Dodd-Frank Act is a major achievement.

• At the same time, we need always be aware that the next crisis--and there will be one--will not be identical to the last one, and that we need to be vigilant in both trying to foresee it and seeking to prevent it.

And if, despite all our efforts, a crisis happens, we need to be willing and prepared to deal with it.

emphasis added

Sacramento Housing in June: Total Sales down 4% Year-over-year, Equity Sales up 13%, Active Inventory increases 91%

by Calculated Risk on 7/10/2014 01:49:00 PM

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a long time, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In June 2014, 13.3% of all resales (single family homes) were distressed sales. This was down from 14.7% last month, and down from 26.5% in June 2013. This is the post-bubble low.

The percentage of REOs was at 7.2%, and the percentage of short sales was 6.1%.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales over the last 2+ years (blue).

Active Listing Inventory for single family homes increased 91.0% year-over-year in June.

Cash buyers accounted for 19.8% of all sales, down from 29.9% in June 2013, and down from 20.5% last month (frequently investors). This has been trending down, and it appears investors are becoming much less of a factor in Sacramento.

Total sales were down 3.7% from June 2013, but conventional equity sales were up 13.5% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

Summary: Distressed sales down sharply (at post bubble low), Cash buyers down significantly, normal equity sales up 13.5% year-over-year, inventory up significantly (price increases should slow). If I was "wishcasting", this is what I'd like to see!

As I've noted before, we are seeing a similar pattern in other distressed areas.

FNC: Residential Property Values increased 8.2% year-over-year in May

by Calculated Risk on 7/10/2014 11:44:00 AM

In addition to Case-Shiller, CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their May index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 1.0% from April to May (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 1.1% and 1.3% in May. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

The year-over-year change slowed in May, with the 100-MSA composite up 8.2% compared to May 2013. The index is still down 20.9% from the peak in 2006.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the year-over-year change based on the FNC index (four composites) through May 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

This might be the beginning of a slowdown in prices increases in the FNC index.

The May Case-Shiller index will be released on Tuesday, July 29th, and I expect Case-Shiller to show a further slowdown in price increases.

Trulia: Asking House Prices up 8.1% year-over-year in June

by Calculated Risk on 7/10/2014 10:07:00 AM

From Trulia chief economist Jed Kolko: Despite Home Price Slowdown, Wages Can’t Keep Up With Prices

In June 2014, prices were up 8.1% year-over-year and 2.6% quarter-over-quarter, compared with 9.5% and 3.1%, respectively, in June 2013. ... But despite this national slowdown in price gains, price increases continue to be widespread, with 97 of 100 metros posting year-over-year price gains – the most since the recovery began. Furthermore, asking prices in June rose at their highest month-over-month rate (1.2%) in sixteen months.Asking prices had been slowing down, although there was a slight increase in year-over-year prices in June ... in November 2013, year-over-year asking prices were up 12.2%, in December, the year-over-year increase slowed slightly to 11.9%. In January 11.4%, in February 10.4%, in March 10.0%, April 9.0%, May 8.0%, but now 8.1% in June.

The price slowdown has been particularly sharp in the boom-and-bust markets of California and the Southwest, where the recession was severe, the recovery was dramatic, and the slowdown is now most pronounced. In Phoenix, Las Vegas, Sacramento, and Orange County, price gains have skidded to a stop or gone into reverse in the past quarter after posting gains of more than 20% year-over-year in June 2013. Although these four housing markets all still have average or above-average year-over-year price increases in June 2014, their slowdowns or reversals in the most recent quarter foreshadow a continued deceleration in year-over-year gains ...

...

Rental Affordability Worsens as Rents Rise 5.5% Year-over-Year

Rent increases outpaced wage increases in all of the 25 largest Rents rose more than 10% year-over-year in Miami, Oakland, San Francisco, San Diego, and Denver. Among these five markets with the largest rent increases, all but Denver are among the nation’s least affordable rental markets.

emphasis added

Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases, but probably at a slower rate, over the next few months on a seasonally adjusted basis.

Weekly Initial Unemployment Claims decrease to 304,000

by Calculated Risk on 7/10/2014 08:34:00 AM

The DOL reports:

In the week ending July 5, the advance figure for seasonally adjusted initial claims was 304,000, a decrease of 11,000 from the previous week's unrevised level of 315,000. The 4-week moving average was 311,500, a decrease of 3,500 from the previous week's unrevised average of 315,000.The previous week was unrevised at 315,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 311,400.

This was lower than the consensus forecast of 316,000. The 4-week average is now at normal levels for an expansion.

Wednesday, July 09, 2014

Thursday: Unemployment Claims

by Calculated Risk on 7/09/2014 08:17:00 PM

Here is an updated housing and mortgage forecast from Goldman Sachs economist Hui Shan: Housing at half time: activity picks up while prices slow down

There are clear signs of house price growth deceleration. Across various indices, year over year appreciation rate has declined from double digits to high single digits. ... We update our bottom-up house price forecast model. At the national level, we expect house price growth to fall from 9.0% during the past year to 4.7% in the coming year and 3.0% in the year thereafter.CR Note: I also expect house price increases to slow, and for activity to pickup going forward. At the end of 2013, mortgage rates were around 4.62%, so Goldman is forecasting rates will down year-over-year (rates are currently down about 45 bps compared to a year ago according to Mortgage News Daily).

...

We now expect mortgage rate to rise to 4.5% by year-end.

...

the underlying housing recovery continues. ... Although we see housing activity improving further in the second half of 2014, we expect the pace of the recovery to be moderate.

emphasis added

Thursday:

• Early: Trulia Price Rent Monitors for June. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 316 thousand from 315 thousand.

• At 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories report for May. The consensus is for a 0.6% increase in inventories.

• At 4:30 PM, Speech by Fed Vice Chairman Stanley Fischer, Financial Sector Reform, At the Martin Feldstein Lecture, hosted by the National Bureau of Economic Research, Cambridge, Massachusetts