by Calculated Risk on 7/16/2014 05:56:00 PM

Wednesday, July 16, 2014

DataQuick on California Bay Area: June Home Sales up 0.2% Year-over-year

From DataQuick: Bay Area Home Sales Up Slightly; Price Increases Slow

A total of 7,915 new and resale houses and condos sold in the nine-county Bay Area last month. That was up 0.2 percent from 7,898 in May and up 0.2 percent from 7,897 in June last year, according to DataQuick ....A few key year-over-year trends: 1) declining distressed sales, 2) generally declining investor buying, 3) flat or declining total sales, but 4) some increase in non-distressed sales. Though total sales were up 0.2% year-over-year, the percent of non-distressed sales was up about 9%. There were 7,915 total sales this year in June, and only 7.5% were distressed. In June 2013, there were 7,897 total sales, and 15.2% were distressed.

June’s year-over-year increase in sales was the Bay Area’s first since last September, when sales rose 3.6 percent from a year earlier. Since 1988, when DataQuick’s statistics begin, June sales have ranged from a low of 7,118 in 1993 to a high of 15,735 in 2004. Last month’s sales were 20.2 percent below the June average of 9,916 sales since 1988. Bay Area sales haven’t been above average for any particular month in more than eight years.

...

Last month foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 3.1 percent of all resales. That was unchanged from the month before, and down from 5.7 percent a year earlier. Foreclosure resales in the Bay Area peaked at 52.0 percent in February 2009, while the monthly average over the past 17 years is 9.8 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 4.4 percent of Bay Area resales last month. That was down from an estimated 4.6 percent in May and down from 9.5 percent a year earlier.

Last month absentee buyers – mostly investors – purchased 20.8 percent of all Bay Area homes. That was up slightly from May’s revised 19.3 percent and down from 21.8 percent in June last year.

emphasis added

Fed's Beige Book: Residential construction activity "generally increased"

by Calculated Risk on 7/16/2014 02:07:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Kansas City and based on information collected before July 7, 2014. "

All twelve Federal Reserve Districts indicated that economic activity continued to expand since the previous report. The pace of economic growth was characterized as moderate in New York, Chicago, Minneapolis, Dallas, and San Francisco, while the remaining Districts reported modest expansion. Compared to the previous reporting period, Boston and Richmond noted a slightly slower pace of growth. Most Districts were optimistic about the outlook for growth.And on real estate:

Residential real estate activity continued to vary by Federal Reserve District, reflecting generally low inventories and mixed levels of demand. ...Somewhat positive comments on both residential and non-residential real estate.

Residential construction activity generally increased across the Districts, with only St. Louis and Minneapolis reporting a decline in overall activity. ...

Commercial construction activity strengthened across most Districts. Cleveland and Atlanta reported increased commercial construction activity compared to a year ago, and Philadelphia, Chicago, St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco noted gains since the previous survey period. Boston and Richmond saw mixed commercial construction activity across their Districts since the previous report. Dallas indicated strong overall commercial real estate construction activity, and commercial real estate construction increased in the Minneapolis District compared with the previous report. Boston, New York, Richmond, Chicago, Kansas City, and Dallas reported tight commercial vacancy rates. Industrial real estate construction and leasing activity was strong in the Philadelphia and Chicago Districts.

emphasis added

DataQuick on SoCal: June Home Sales down 4% Year-over-year, Non-Distressed sales up Year-over-year

by Calculated Risk on 7/16/2014 12:22:00 PM

From DataQuick: Southland Home Sales Down from Last Year Again; Price Gains Throttle Back

Southern California homes sold at the slowest pace for a June in three years as investor purchases fell again and other would-be buyers continued to struggle with inventory and affordability constraints. ...Both distressed sales and investor buying is declining - and this has been dragging down overall sales. Even though total sales are still down year-over-year, the percent of non-distressed sales is up slightly year-over-year. There were 20,654 total sales this year in June, and 11.3% were distressed. In June 2013, there were 21,608 total sales, and 23.5% were distressed.

A total of 20,654 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 5.6 percent from 19,556 sales in May, and down 4.4 percent from 21,608 sales in June last year, according to DataQuick ...

On average, sales have increased 6.4 percent between May and June since 1988, when DataQuick’s statistics begin. Sales have fallen on a year-over-year basis for nine consecutive months. Sales during the month of June have ranged from a low of 18,032 in June 2008 to a high of 40,156 in June 2005. Last month was 23.7 percent below the June average of 27,069 sales. Sales haven’t been above the long-term average for more than eight years.

...

“Many of the market indicators we track continue to ease toward normalcy ... For example, the use of larger, so-called jumbo loans is up significantly this year, as is the use of adjustable-rate mortgages. Distressed property sales are way down and, related to that, investor and cash purchases are trending lower, toward more normal levels.” [said Andrew LePage, a DataQuick analyst].

Foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 5.3 percent of the Southland resale market last month. That was up slightly from a revised 5.0 percent the prior month and down from 9.0 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 6.0 percent of Southland resales last month. That was down from a revised 6.4 percent the prior month and down from 14.5 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 23.6 percent of the Southland homes sold last month. That was the lowest share since December 2010 ...

emphasis added

NAHB: Builder Confidence increased to 53 in July, Highest in Six Months

by Calculated Risk on 7/16/2014 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 53 in July, up from 49 in June. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Surpasses Key Benchmark in July

Builder confidence in the market for newly-built single-family homes reached an important milestone in July, rising four points to a reading of 53 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today. Any reading over 50 indicates that more builders view sales conditions as good than poor.

...

“An improving job market goes hand-in-hand with a rise in builder confidence,” said NAHB Chief Economist David Crowe. “As employment increases and those with jobs feel more secure about their own economic situation, they are more likely to feel comfortable about buying a home.”

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three HMI components posted gains in July. The index gauging current sales conditions increased four points to 57, while the index measuring expectations for future sales rose six points to 64 and the index gauging traffic of prospective buyers increased three points to 39.

The HMI three-month moving average was up in all four regions, with the Northeast and Midwest posting a one-point and two-point gain to 35 and 48, respectively. The West registered a five-point gain to 52 while the South rose two points to 51.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was the first reading above 50 since January.

Fed: Industrial Production increased 0.2% in June

by Calculated Risk on 7/16/2014 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.2 percent in June and advanced at an annual rate of 5.5 percent for the second quarter of 2014. In June, manufacturing output edged up 0.1 percent for its fifth consecutive monthly gain, while the production at mines moved up 0.8 percent and the output of utilities declined 0.3 percent. For the second quarter as a whole, manufacturing production rose at an annual rate of 6.7 percent, while mining output increased at an annual rate of 18.8 percent because of gains in the extraction of oil and gas; by contrast, the output of utilities fell at an annual rate of 21.4 percent following a weather-related increase of 15.6 percent in the first quarter. At 103.9 percent of its 2007 average, total industrial production in June was 4.3 percent above its level of a year earlier. The capacity utilization rate for total industry was unchanged in June at 79.1 percent, a rate that is 1.0 percentage point below its long-run (1972–2013) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.1% is 1.0 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.2% in June to 103.9. This is 24.1% above the recession low, and 3.1% above the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were below expectations.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 7/16/2014 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 11, 2014. The previous week’s results included an adjustment for the July 4th holiday. ...

The Refinance Index decreased 0.1 percent from the previous week. The seasonally adjusted Purchase Index decreased 8 percent from one week earlier to the lowest level since February 2014. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.33 percent from 4.32 percent, with points increasing to 0.20 from 0.16 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

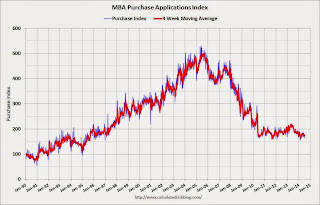

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 17% from a year ago.

Tuesday, July 15, 2014

Wednesday: Yellen, Industrial Production, PPI, Beige Book, Homebuilder Survey

by Calculated Risk on 7/15/2014 09:28:00 PM

For enjoyment, some thoughts from Paul Krugman on Life Without Cars.

I've been thinking about "IT-mediated car services" combined with self-driving cars. I agree with Krugman's points, but what does this mean for real estate and housing? How about no home garages? (I dislike big ugly home garages at the front of homes - so 20th Century!). And no garages or parking lots at work or restaurants (wasted space). Sure - there will still be garages to park the self-driving cars at night, but they could be located in undesirable areas. Fun to think about ...

Tuesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Producer Price Index for June from the BLS. The consensus is for a 0.3% increase in prices.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for June. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 79.2%.

• At 10:00 AM, the July NAHB homebuilder survey. The consensus is for a reading of 50, up from 49 in June. Any number above 50 indicates that more builders view sales conditions as good than poor.

• Also at 10:00 AM, Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the House Financial Services Committee

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Earlier: Empire State Manufacturing Survey at 4 Year High in July

by Calculated Risk on 7/15/2014 12:38:00 PM

From the NY Fed: Empire State Manufacturing Survey

Business conditions improved significantly for a third consecutive month for New York manufacturers, according to the July 2014 survey. The general business conditions index advanced six points to 25.6, a four-year high. ...A solid report.

Labor market conditions continued to improve. The index for number of employees climbed six points to 17.0, a level which indicated a solid increase in employment levels. The average workweek index retreated seven points to 2.3, and pointed to a slight increase in hours worked.

emphasis added

Yellen: Semiannual Monetary Policy Report to the Congress

by Calculated Risk on 7/15/2014 10:02:00 AM

Federal Reserve Chair Janet Yellen testimony "Semiannual Monetary Policy Report to the Congress" Before the Senate Banking, Housing, and Urban Affairs Committee, Washington, D.C. (starts at 10 AM ET):

In sum, since the February Monetary Policy Report, further important progress has been made in restoring the economy to health and in strengthening the financial system. Yet too many Americans remain unemployed, inflation remains below our longer-run objective, and not all of the necessary financial reform initiatives have been completed. The Federal Reserve remains committed to employing all of its resources and tools to achieve its macroeconomic objectives and to foster a stronger and more resilient financial system.Here is the C-Span Link

emphasis added

Here is the Bloomberg TV link.

Retail Sales increased 0.2% in June

by Calculated Risk on 7/15/2014 08:43:00 AM

On a monthly basis, retail sales increased 0.2% from May to June (seasonally adjusted), and sales were up 4.3% from June 2013. Sales in May were revised up from a 0.3% increase to a 0.5% increase. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for June, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $439.9 billion, an increase of 0.2 percent from the previous month, and 4.3 percent above June 2013. ... The April to May 2014 percent change was revised from +0.3 percent to +0.5 percent.

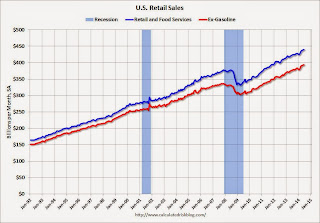

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos were up 0.4%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.6% on a YoY basis (4.3% for all retail sales).

Retail sales ex-gasoline increased by 4.6% on a YoY basis (4.3% for all retail sales).The increase in June was well below consensus expectations of a 0.6% increase - however sales in April and May were revised up (so total sales in June were actually above expectations, but the increase was below expectations due to the upward revisions to prior months).