by Calculated Risk on 7/18/2014 01:52:00 PM

Friday, July 18, 2014

The Recovery for U.S. Heavy Truck Sales

Just a quick graph ... heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April 2009 on a seasonally adjusted annual rate (SAAR) from a peak of 555 thousand in February 2006.

Sales were above 382 thousand (SAAR) in June (after increasing to over 400 thousand SAAR in April for the first time since 2007).

Click on graph for larger image.

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is current estimated sales rate.

The recovery for heavy truck has slowed, but as construction for both residential and commercial picks up, heavy truck sales will probably increase further.

BLS: No State with Unemployment Rate at or above 8% in June, First Time since mid-2008

by Calculated Risk on 7/18/2014 10:45:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in June. Twenty-two states and the District of Columbia had unemployment rate decreases from May, 14 states had increases, and 14 states had no change, the U.S. Bureau of Labor Statistics reported today. Forty-nine states and the District of Columbia had unemployment rate decreases from a year earlier and one state had an increase.

...

Mississippi and Rhode Island had the highest unemployment rates among the states in June, 7.9 percent each. North Dakota again had the lowest jobless rate, 2.7 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. Rhode Island and Mississippi had the highest unemployment rates in June at 7.9%.

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).For the first time since mid-2008, no state has an unemployment rate at or above 8% (light blue), although 9 states are still at or above 7% (dark blue).

Preliminary July Consumer Sentiment decreases to 81.3

by Calculated Risk on 7/18/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for July was at 81.3, down from 82.5 in June.

This was below the consensus forecast of 83.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011.

Thursday, July 17, 2014

DataQuick: "California Foreclosure Starts Lowest Since 2005"

by Calculated Risk on 7/17/2014 08:12:00 PM

From DataQuick: California Foreclosure Starts Lowest Since 2005

A total of 17,524 Notices of Default (NoDs) were recorded at county recorders offices during the April-through-June period. That was down 8.8 percent from 19,215 in the prior quarter, and down 31.9 percent from 25,747 in second-quarter 2013, according to DataQuick, which is owned by Irvine-based CoreLogic, a leading global property information, analytics and data-enabled services provider.

Last quarter's NoD tally was the lowest since fourth-quarter 2005, when 15,337 NoDs were recorded. NoD filings peaked in first-quarter 2009 at 135,431. DataQuick's NoD statistics go back to 1992.

"It looks like the mortgage servicers doing the foreclosure paperwork are systematically working through a backlog. While their pile is getting smaller, they're working at a steady pace. With one exception, the number of NoDs we've seen filed each quarter over the last year-and-a-half hasn't changed much, and probably just reflects staffing and workload logistics," said John Karevoll, DataQuick analyst.

In first quarter 2013 California saw 18,568 NoDs filed. In last year's second quarter the number was 25,747. In third quarter 2013 it was 20,314. Fourth quarter was 18,120. In first quarter 2014 the tally was 19,215, and last quarter it was 17,524.

"The relatively high NoD tally in second quarter last year reflected a one-time bump because of deferred activity and policy change. Otherwise the quarterly flow of NoDs since early last year has been remarkably flat, and probably doesn't reflect any meaningful changes in trends. The overall trend is that homeowner distress continues to decline because of a stronger economy and rising home prices," Karevoll said.

Most of the loans going into default are still from the 2005-2007 period.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of Notices of Default (NoD) filed in California each year. 2014 is in red (Q1 plus Q2 times 2).

Last year was the lowest year for foreclosure starts since 2005, and 2013 was also below the levels in 1997 through 2000 when prices were rising following the much smaller late '80s housing bubble / early '90s bust in California.

Overall foreclosure starts are close to a normal level in California (foreclosure starts were over 50,000 in 2004 and 2005 when prices were rising quickly).

Note: Foreclosures are still higher than normal in states with a judicial foreclosure process.

LA area Port Traffic: Imports increasing

by Calculated Risk on 7/17/2014 06:06:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for June since LA area ports handle about 40% of the nation's container port traffic. Note: This is for the month before the recent trucker strike.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 1.0% compared to the rolling 12 months ending in May. Outbound traffic was up 0.5% compared to 12 months ending in May.

Inbound traffic has been increasing, and outbound traffic has been moving up a little recently after moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Imports were up 13% year-over-year in June, exports were up 7% year-over-year.

Imports were 4% below the all time high for June (set in June 2007), and it is possible that imports will be at a record high later this year.

A few comments on June Housing Starts

by Calculated Risk on 7/17/2014 01:32:00 PM

This was a weak report for housing starts in June.

There were 479 thousand total housing starts during the first half of 2014 (not seasonally adjusted, NSA), up 6.0% from the 452 thousand during the same period of 2013. Single family starts are up 1%, and multi-family starts up 18%. The key weakness is in single family starts.

The weak growth so far in 2014 is due to several factors: severe weather early in the year, higher mortgage rates (although rates are now down year-over-year), higher prices and probably supply constraints in some areas. And some judicial foreclosure states are still working through a backlog of distressed homes that depress new construction.

Starts were up 7.5% year-over-year in June, but the year-over-year comparison for housing starts is easier now than in Q1 (see first graph). There was a huge surge in housing starts early in 2013, and then a lull - and finally more starts at the end of the year.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month to month comparison between 2013 (blue) and 2014 (red).

Starts in Q1 averaged 925 thousand SAAR, and starts in Q2 averaged 980 thousand SAAR (up 6% from Q1).

This year, I expect starts to increase (Q1 will probably be the weakest quarter, and Q2 the second weakest).

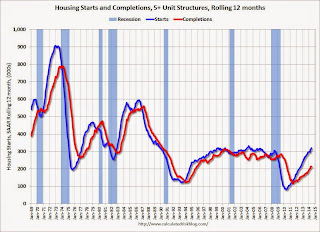

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family completions in 2014 and 2015. Multi-family starts will probably move more sideways soon.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Single family starts had been moving up, but recently starts have been moving sideways on a rolling 12 months basis.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Philly Fed Manufacturing Survey highest since March 2011

by Calculated Risk on 7/17/2014 10:11:00 AM

From the Philly Fed: July Manufacturing Survey

The diffusion index of current general activity increased from a reading of 17.8 in June to 23.9 this month. The index has remained positive for five consecutive months and is at its highest reading since March 2011. The current new orders [at 34.2] and shipments indexes increased notably this month, increasing 17 points and 19 points, respectively.This was above the consensus forecast of a reading of 15.5 for July.

...

The current indicators for labor market conditions also suggest improved conditions this month. The employment index remained positive, and, although it increased less than 1 point [to 12.2], it has improved for four consecutive months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through July. The ISM and total Fed surveys are through June.

The average of the Empire State and Philly Fed surveys is at the highest level since 2004, and this suggests stronger expansion in the ISM report for July.

Weekly Initial Unemployment Claims decrease to 302,000, 4-Week Average Lowest since June 2007

by Calculated Risk on 7/17/2014 09:31:00 AM

The DOL reports:

In the week ending July 12, the advance figure for seasonally adjusted initial claims was 302,000, a decrease of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 304,000 to 305,000. The 4-week moving average was 309,000, a decrease of 3,000 from the previous week's revised average. This is the lowest level for this average since June 2, 2007 when it was 307,500. The previous week's average was revised up by 500 from 311,500 to 312,000.The previous week was revised up to 305,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 309,000.

This was lower than the consensus forecast of 310,000. The 4-week average is now at normal levels for an expansion.

Housing Starts decline to 893 thousand Annual Rate in June

by Calculated Risk on 7/17/2014 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in June were at a seasonally adjusted annual rate of 893,000. This is 9.3 percent below the revised May estimate of 985,000, but is 7.5 percent above the June 2013 rate of 831,000.

Single-family housing starts in June were at a rate of 575,000; this is 9.0 percent below the revised May figure of 632,000. The June rate for units in buildings with five units or more was 305,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 963,000. This is 4.2 percent below the revised May rate of 1,005,000, but is 2.7 percent above the June 2013 estimate of 938,000.

Single-family authorizations in June were at a rate of 631,000; this is 2.6 percent above the revised May figure of 615,000. Authorizations of units in buildings with five units or more were at a rate of 301,000 in June.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in June (Multi-family is volatile month-to-month).

Single-family starts (blue) also decreased in June.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was well below expectations of 1.020 million starts in June. Note: Starts for April and May were revised slightly lower. I'll have more later.

Wednesday, July 16, 2014

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 7/16/2014 08:59:00 PM

A reminder of a friendly bet I made with NDD on housing starts in 2014 (I've already "won", and NDD made a donation to the Tanta Memorial Fund - but he could still win too):

If starts or sales are up at least 20% YoY in any month in 2014, [NDD] will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.In June 2013, starts were at a 831 thousand seasonally adjusted annual rate (SAAR). For me to win again (only one win counts), starts would have to be up 20% or at 997.2 thousand SAAR in June (very possible). For NDD to win, starts would have to fall to 731 thousand SAAR (not likely). NDD could also "win" if permits fall to 838 thousand SAAR from 938 thousand SAAR in June 2013.

Thursday:

• At 8:30 AM ET, Housing Starts for June. Total housing starts were at 1.001 million (SAAR) in May. Single family starts were at 625 thousand SAAR in May. The consensus is for total housing starts to increase to 1.020 million (SAAR) in June.

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 304 thousand.

• At 10:00 AM, the Philly Fed manufacturing survey for July. The consensus is for a reading of 15.5, down from 17.8 last month (above zero indicates expansion).