by Calculated Risk on 7/21/2014 08:01:00 PM

Monday, July 21, 2014

Tuesday: CPI, Existing Home Sales, Richmond Fed Mfg Survey

Here is a followup on an earlier article concerning short sale fraud, from E. Scott Reckard at the LA Times: Former BofA short-sales employee gets prison term for taking bribes

A former Bank of America mortgage employee was sentenced to 30 months in prison for pocketing $1.2 million in payoffs to approve sales of distressed properties for far less than their actual value.Short sale fraud was widespread, especially in the 2009 through 2012 period. Fraud has always been a key problem with short sales (the agent represents the "seller" who has no equity in the home - and this creates an obvious agency problem with unscrupulous agents).

...

Plea agreements filed by three other defendants at the time of Lauricella's arrest indicated that the manipulation of Southland home sales for illicit profit was widespread.

"It's part of a large, ongoing investigation," Katzenstein said. "There are a large number of related cases."

There are many types of short sales fraud (money under the table to either seller or agent, agents not actually marketing property, etc.), and unfortunately most of the fraud will never be prosecuted - but we can still hope some more of them will be caught.

Tuesday:

• At 8:30 AM ET, the Consumer Price Index for June. The consensus is for a 0.3% increase in CPI in June and for core CPI to increase 0.2%.

• At 9:00 AM, the FHFA House Price Index for May. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.3% increase.

• At 10:00 AM, Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 4.99 million on seasonally adjusted annual rate (SAAR) basis. Sales in May were at a 4.89 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.96 million SAAR.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for July. The consensus is for a reading of 5.5, up from 3 in June.

Lawler: NVR: Net Home Orders Up Slightly in Q2, Little Changed YTD; Sales Per Community Down; Prices Flat on Quarter

by Calculated Risk on 7/21/2014 04:30:00 PM

From housing economist Tom Lawler:

NVR, Inc. the fourth largest US home builder with a heavy concentration in the Mid-Atlantic region, reported that net home orders in the quarter ended June 30, 2014 totaled 3,415, up 4.2% from the comparable quarter of 2013. Net orders per active community were down 4.7% YOY. NVR’s average net order price last quarter was $368,000, up 1.9% from a year ago, but virtually unchanged from the previous quarter.

For the first two quarters of 2014 NVR’s net home orders were down 0.7% from the first half of 2013, while net orders per active community were down 9.5%. Home settlements last quarter totaled 2,943, up 2.3% from the comparable quarter of 2013, at an average sales price of $368,200, up 6.8% from a year ago and up 1.9% from the previous quarter. Home settlements in the first half of 2014 were virtually unchanged from the first half of 2013.

The company’s order backlog at the end of June was 6,513, down 1.3% from last June, at an average order price of $374,100, up 4.3% from last June but virtually unchanged from the previous quarter. NVR controlled (owned or optioned) 67,500 lots at the end of June, up 10.3% from a year earlier and up 22.7% from two years earlier.

Tanta: What Is "Subprime"?

by Calculated Risk on 7/21/2014 01:42:00 PM

CR Note: If you want to understand subprime lending, I strongly suggest the following post from my former co-blogger Doris "Tanta" Dungey. This was written in 2007, but the concepts are forever. Read it all.

What Is "Subprime"?

For other Tanta posts, see: The Compleat UberNerd and Compendium of Tanta's Posts

Weekly Update: Housing Tracker Existing Home Inventory up 15.0% YoY on July 21st

by Calculated Risk on 7/21/2014 11:05:00 AM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data released was for May and indicated inventory was up 6.0% year-over-year). Existing home sales for June will be released tomorrow.

Fortunately Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data, for 54 metro areas, for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays.

Inventory in 2014 (Red) is now 15.0% above the same week in 2013. (Note: There are differences in how the data is collected between Housing Tracker and the NAR).

Inventory is also about 2.7% above the same week in 2012. According to several of the house price indexes, house prices bottomed in early 2012, and low inventories were a key reason for the subsequent price increases. Now that inventory is back above 2012 levels, I expect house price increases to slow (and possibly decline in some areas).

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess was inventory would be up 10% to 15% year-over-year at the end of 2014 based on the NAR report. Right now it looks like inventory might increase more than I expected.

Chicago Fed: "Index shows economic growth decelerated slightly in June"

by Calculated Risk on 7/21/2014 08:39:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth decelerated slightly in June

Led by slower growth in production-related indicators, the Chicago Fed National Activity Index (CFNAI) edged down to +0.12 in June from +0.16 in May. Two of the four broad categories of indicators that make up the index made nonpositive contributions to the index in June, but two of the four categories increased from May.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to +0.13 in June from +0.28 in May, marking its fourth consecutive reading above zero. June’s CFNAI-MA3 suggests that growth in national economic activity was somewhat above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was somewhat above the historical trend in June (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, July 20, 2014

Sunday Night Futures

by Calculated Risk on 7/20/2014 09:39:00 PM

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for June. This is a composite index of other data.

Weekend:

• Schedule for Week of July 20th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down slightly and DOW futures are down 7 (fair value).

Oil prices moved up over the last week with WTI futures at $102.93 per barrel and Brent at $107.16 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.57 per gallon (down about a dime from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

CoStar: Commercial Real Estate prices increased more than 11% year-over-year in May

by Calculated Risk on 7/20/2014 11:49:00 AM

Here is a price index for commercial real estate that I follow.

From CoStar: Value-Weighted U.S. Composite Price Index Approaches Prerecession Peak Levels

COMMERCIAL REAL ESTATE PRICES POST DOUBLE-DIGIT ANNUAL GAINS IN MAY: The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—increased by 0.9% and 1.2%, respectively, in the month of May 2014, and 11.4% and 11.7% respectively, year over year, reflecting a broad improvement in market fundamentals seen across all property types. The value-weighted U.S. Composite Index, which is heavily influenced by core property transactions, has now risen within 1% of its prerecession peak level reached in 2007, while its equal-weighted counterpart, which is more influenced by smaller non-core property sales, has recovered to within 20% of its 2007 high water mark.

...

DISTRESS LEVELS CONTINUE TO DISSIPATE: The percentage of commercial transactions involving distressed assets has declined to 10.5% in May 2014 from over 17% one year earlier. In the multifamily and industrial sectors, the distress share of total sales fell into the single digits, while it remains comparatively high at 11% in the retail sector and 17% in the office sector, suggesting there is more room for pricing appreciation. The share of distress trades in late-recovery markets such as Chicago, Atlanta, and Detroit remain near 20%, while in the early-recovery, coastal markets of Los Angeles, San Francisco and San Jose, distress levels are nearly non-existent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value weighted index is almost back to the pre-recession peak, however the equal weighted index is about 20% below the pre-recession peak.

The second graph shows the percent of distressed "pairs".

The second graph shows the percent of distressed "pairs".The distressed share is down from over 30% at the peak, to 10.5% in May.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Saturday, July 19, 2014

Schedule for Week of July 20th

by Calculated Risk on 7/19/2014 01:11:00 PM

The key reports this week are New and Existing home sales for June.

For manufacturing, the July Richmond and Kansas City Fed surveys will be released.

For prices, CPI will be released on Tuesday.

8:30 AM ET: Chicago Fed National Activity Index for June. This is a composite index of other data.

8:30 AM: Consumer Price Index for June. The consensus is for a 0.3% increase in CPI in June and for core CPI to increase 0.2%.

9:00 AM: FHFA House Price Index for May. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.3% increase.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 4.99 million on seasonally adjusted annual rate (SAAR) basis. Sales in May were at a 4.89 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.96 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for July. The consensus is for a reading of 5.5, up from 3 in June.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 302 thousand.

10:00 AM: New Home Sales for June from the Census Bureau.

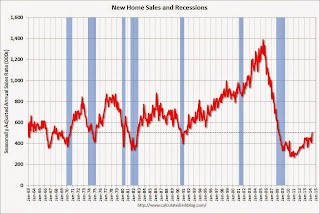

10:00 AM: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the May sales rate.

The consensus is for a decrease in sales to 475 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 504 thousand in May.

11:00 AM: the Kansas City Fed manufacturing survey for July.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 0.2% increase in durable goods orders.

Unofficial Problem Bank list declines to 463 Institutions

by Calculated Risk on 7/19/2014 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 18, 2014.

Changes and comments from surferdude808:

Surprisingly there were few changes to the Unofficial Problem Bank List this week given that the OCC released an update of its enforcement action activity this Friday. There were two removals this week that push the list count down to 463 institutions with assets of $147.4 billion. A year ago, the list held 734 institutions with assets of $267.2 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 463.

Removals this week include the OCC terminating an action against Commerce National Bank & Trust, Winter Park, FL ($77 billion). The other removal was the failed Eastside Commercial Bank, Conyers, GA ($169 million), which was the 13th failure this year. This is the first failure in Georgia since Sunrise Bank failed more than a year ago on May 10, 2013. Still, there have now been an astonishing 88 failures of Georgia-based institutions with aggregate assets of $33.4 billion since the on-set of the Great Recession. So 17.5 percent of the 503 institutions that have failed in this crisis were headquartered in Georgia.

Next week we anticipate the FDIC will provide an update on its enforcement action activity.

Friday, July 18, 2014

Bank Failure #13 in 2014: Eastside Commercial Bank, Conyers, Georgia

by Calculated Risk on 7/18/2014 05:17:00 PM

From the FDIC: Community & Southern Bank, Atlanta, Georgia, Assumes All of the Deposits of Eastside Commercial Bank, Conyers, Georgia

As of March 31, 2014, Eastside Commercial Bank had approximately $169.0 million in total assets and $161.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $33.9 million. ... Eastside Commercial Bank is the 13th FDIC-insured institution to fail in the nation this year, and the first in Georgia.There hasn't been a failure in Georgia since May 2013, but this is the 88th failure in Georgia since the crisis started - the most of any state.