by Calculated Risk on 7/23/2014 01:41:00 PM

Wednesday, July 23, 2014

Housing Inventory: NAR and Housing Tracker

I've been using weekly inventory numbers from Housing Tracker ("DeptofNumbers") to track changes in listed inventory and it might be useful to compared the Housing Tracker numbers to the Realtor (NAR) numbers for inventory.

According to Housing Tracker for (54 metro areas), inventory is up 15.0% compared to the same week last year.

However the NAR reported yesterday that inventory in June was only up 6.5% year-over-year. Some of the difference could be because of coverage (Housing Tracker is only for the largest 54 metro areas), and some of the difference could be because of timing and methodology.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the NAR estimate of existing home inventory through June (left axis) and the HousingTracker data for the 54 metro areas through July.

In general - over time - Housing Tracker and the NAR reports of inventory move together.

Both reports suggest inventory is increasing, and that overall inventory is still fairly low.

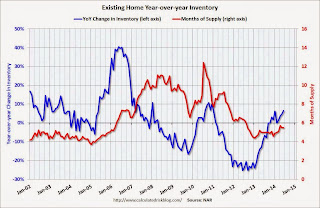

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

This year-over-year increase in inventory is a significant story. This increase should slow house price increases (maybe even lead to price declines in some areas).

This year-over-year increase in inventory is a significant story. This increase should slow house price increases (maybe even lead to price declines in some areas).

Note: I use the NAR data as the "standard", but I think the Housing Tracker data is useful (since it is reported weekly without a significant lag). My guess is the NAR will continue to report increases in inventory, and that inventory will be up 10% to 15% year-over-year at the end of 2014 based on the NAR report (maybe even more).

AIA: Architecture Billings Index increased in June

by Calculated Risk on 7/23/2014 10:35:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Momentum Increasing for Architecture Billings Index

The Architecture Billings Index (ABI) is signaling improving conditions for the overall design and construction industry. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the June ABI score was 53.5, up from a mark of 52.6 in May. This score reflects an increase in design activity (any score above 50 indicates an increase in billings). The new projects inquiry index was 66.4, up noticeably from the reading of 63.2 the previous month and its highest level in a calendar year.

The AIA has added a new indicator measuring the trends in new design contracts at architecture firms that can provide a strong signal of the direction of future architecture billings. The score for design contracts in June was 55.7 – the highest mark since that indicator starting being measured in October 2010.

“The recent surge in both design contracts and general inquiries for new projects by prospective clients is indicative of a sustainable strengthening across the construction marketplace,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “With the first positive reading since last summer in billings at institutional firms, it appears that design activity for all major segments of the building industry is growing. The challenge now for architecture firms seems to be finding the right balance for staffing needs to meet increasing demand.”

• Regional averages: Midwest (56.3), South (53.9), Northeast 51.1) , West (48.7) [three month average]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.5 in June, up from 52.6 in May. Anything above 50 indicates expansion in demand for architects' services. This index has indicated expansion during 18 of the last 23 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the readings over the last year suggest some increase in CRE investment this year and in 2015.

Black Knight: Mortgage Loans in Foreclosure Process Lowest since May 2008

by Calculated Risk on 7/23/2014 09:16:00 AM

According to Black Knight's First Look report for June, the percent of loans delinquent increased slightly in June compared to May, and declined by 15.0% year-over-year.

Also the percent of loans in the foreclosure process declined further in June and were down 36% over the last year. Foreclosure inventory was at the lowest level since May 2008.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 5.70% in June, up seasonally from 5.62% in May. The normal rate for delinquencies is around 4.5% to 5%. The increase in delinquencies was in the 'less than 90 days' bucket.

The percent of loans in the foreclosure process declined to 1.88% in June from 1.91% in May.

The number of delinquent properties, but not in foreclosure, is down 445,000 properties year-over-year, and the number of properties in the foreclosure process is down 507,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for June in early August.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| June 2014 | May 2014 | June 2013 | |

| Delinquent | 5.70% | 5.62% | 6.68% |

| In Foreclosure | 1.88% | 1.91% | 2.93% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,728,000 | 1,670,000 | 1,983,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,155,000 | 1,169,000 | 1,345,000 |

| Number of properties in foreclosure pre-sale inventory: | 951,000 | 966,000 | 1,458,000 |

| Total Properties | 3,834,000 | 3,805,000 | 4,785,000 |

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 7/23/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 18, 2014. ...

The Refinance Index increased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 0.3 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 4.33 percent, with points increasing to 0.23 from 0.20 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 74% from the levels in May 2013.

As expected, refinance activity is very low this year.

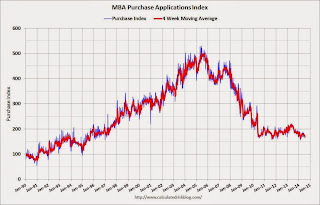

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 15% from a year ago.

Tuesday, July 22, 2014

Wednesday: Architecture Billings Index, Mortgage Applications

by Calculated Risk on 7/22/2014 09:48:00 PM

Earlier today, the Richmond Fed manufacturing survey for July was released: Manufacturing Sector Activity Expanded; Shipments Grew Mildly, Hiring Picked Up

Overall, manufacturing conditions strengthened. The composite index for manufacturing moved up to a reading of 7 following last month's reading of 4. The index for shipments gained one point, ending at 3. New orders grew at the same pace as a month ago, with that index finishing at a reading of 5. ...This is the 3rd regional survey released for July (NY and Philly were released last week) and all three surveys were strong this month.

Manufacturing employment strengthened this month, with the index gaining nine points to finish at 13. The average workweek grew at a slower pace this month; moving that gauge down two points to end at 3. Average wages advanced compared to a month ago, ending at 16.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

First Look at 2015 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 7/22/2014 05:09:00 PM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 2.0 percent over the last 12 months to an index level of 234.702 (1982-84=100). For the month, the index rose 0.2 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

Since the highest Q3 average was last year (Q3 2013), at 230.327, we only have to compare to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 2.0% year-over-year in June, and although this is very early - we need the data for July, August and September - my current guess is COLA will be higher than the previous two years, and will probably be a little over 2% this year.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2013 yet, but wages probably increased again in 2013. If wages increased the same as last year, then the contribution base next year will be increased to around $120,500 from the current $117,000.

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).

A Few Comments on Existing Home Sales

by Calculated Risk on 7/22/2014 02:37:00 PM

The most important number in the NAR report each month is inventory. This morning the NAR reported that inventory was up 6.5% year-over-year in June. This is a smaller increase than other sources suggest (Housing Tracker shows inventory up 15% year-over-year in July), and it is important to note that the NAR inventory data is "noisy" and difficult to forecast based on other data.

The headline NAR inventory number is not seasonally adjusted, even though there is a clear seasonal pattern. Trulia chief economist Jed Kolko has sent me the seasonally adjusted inventory. NOTE: The NAR does provide a seasonally adjusted months-of-supply, although that is in the supplemental data.

Click on graph for larger image.

Click on graph for larger image.

This shows that inventory bottomed in January 2013 (on a seasonally adjusted basis), and inventory is now up about 10.9% from the bottom. On a seasonally adjusted basis, inventory was up 1.8% in June compared to May.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, many "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were down 2.3% from June 2013, but normal equity sales were probably up from June 2013, and distressed sales down sharply. The NAR reported that 11% of sales were distressed in May (from a survey that is far from perfect):

Distressed homes – foreclosures and short sales – accounted for 11 percent of June sales, down from 15 percent in June 2013. Eight percent of June sales were foreclosures and 3 percent were short sales.Last year in June the NAR reported that 15% of sales were distressed sales.

A rough estimate: Sales in June 2013 were reported at 5.16 million SAAR with 15% distressed. That gives 774 thousand distressed (annual rate), and 4.39 million equity / non-distressed. In June 2014, sales were 5.04 million SAAR, with 11% distressed. That gives 554 thousand distressed - a decline of 28% from June 2013 - and 4.49 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up slightly (even with less investor buying).

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in June (red column) were slightly above the level of sales in June 2013, and above sales for 2008 through 2012.

Overall this report was a solid report.

Earlier:

• Existing Home Sales in June: 5.04 million SAAR, Inventory up 6.5% Year-over-year

Key Measures Show Inflation mostly at or below Fed's Target in June

by Calculated Risk on 7/22/2014 11:48:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.0% annualized rate) in June. The 16% trimmed-mean Consumer Price Index also increased 0.1% (1.8% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for June here. Motor fuel was up sharply in June.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.3% (3.1% annualized rate) in June. The CPI less food and energy increased 0.1% (1.6% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy rose 1.9%. Core PCE is for May and increased just 1.5% year-over-year.

On a monthly basis, median CPI was at 2.0% annualized, trimmed-mean CPI was at 1.8% annualized, and core CPI increased 1.6% annualized.

There key measures of inflation have moved up over the last few months, but on a year-over-year basis these measures suggest inflation remains at or below the Fed's target of 2%.

Existing Home Sales in June: 5.04 million SAAR, Inventory up 6.5% Year-over-year

by Calculated Risk on 7/22/2014 10:14:00 AM

The NAR reports: Existing-Home Sales Up in June, Unsold Inventory Shows Continued Progress

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, climbed 2.6 percent to a seasonally adjusted annual rate of 5.04 million in June from an upwardly-revised 4.91 million in May. Sales are at the highest pace since October 2013 (5.13 million), but remain 2.3 percent below the 5.16 million-unit level a year ago. ...

Total housing inventory at the end of June rose 2.2 percent to 2.30 million existing homes available for sale, which represents a 5.5-month supply at the current sales pace, unchanged from May. Unsold inventory is 6.5 percent higher than a year ago, when there were 2.16 million existing homes available for sale.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June (5.04 million SAAR) were 2.6% higher than last month, but were 2.3% below the June 2013 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.30 million in June from 2.25 million in May. Headline inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.30 million in June from 2.25 million in May. Headline inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 6.5% year-over-year in June compared to June 2013.

Inventory increased 6.5% year-over-year in June compared to June 2013. Months of supply was at 5.5 months in June.

This was above expectations of sales of 4.99 million. For existing home sales, the key number is inventory - and inventory is still low, but up solidly year-over-year. I'll have more later ...

CPI increases 0.3% in June, Core CPI 0.1%

by Calculated Risk on 7/22/2014 08:35:00 AM

From the Bureau of Labor Statistics (BLS): Consumer Price Index - June 2014

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.1 percent before seasonal adjustment.On a year-over-year basis, CPI is up 2.1 percent, and core CPI is up also up 1.9 percent. This was close to the consensus forecast of a 0.3% increase for CPI, and a 0.2% increase in core CPI.

In contrast to the broad-based increase last month, the June seasonally adjusted increase in the all items index was primarily driven by the gasoline index. It rose 3.3 percent and accounted for two-thirds of the all items increase.

...

The index for all items less food and energy also decelerated in June, increasing 0.1 percent after a 0.3 percent increase in May.

emphasis added

Note: CPI-W (used for cost of living adjustment, COLA) is up 2.0% year-over-year in June. The COLA is calculated using the average Q3 data (July, August, and September).

I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.