by Calculated Risk on 7/25/2014 11:10:00 AM

Friday, July 25, 2014

Hotels: Record High Occupancy Rate for Week Ending July 19th

From HotelNewsNow.com: STR: US hotel results for week ending 19 July

In year-over-year measurements, the industry’s occupancy rate rose 2.9 percent to 77.1 percent. Average daily rate increased 4.1 percent to finish the week at US$117.57. Revenue per available room for the week was up 7.1 percent to finish at US$90.68.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

emphasis added

This is the highest occupancy rate for any week since at least January 2000. The previous high was 77.0% in late July 2000.

And from HotelNewNow.com: June US hotel occupancy best of this century

Just how good is the current state of demand? Take a bite of this juicy nugget: June occupancy of 71.7% is the highest of any June this century.The following graph shows the seasonal pattern for the hotel occupancy rate for the last 15 years using the four week average.

The above factoid was culled by Jan Freitag, senior VP of global development for STR and our resident hotel data aficionado. Jan’s also a master of context, explaining this milestone another way: The average occupancy for U.S. hotels is now higher than the previous peak recorded in June 2007 (71.1%).

To understand how we got here, you need look no further than economics 101. For much of the past few years, the relationship between supply and demand has been, well, just great.

As of June, demand growth (12-month moving average) was up 3.2%, according to STR data. Supply growth? Only 0.8%.

In other words, supply growth still has had no impact, as Freitag points out.

...

June ADR (12-month moving average) was $112, up 3.9%. The result is revenue per available room of $71, which represents growth of 6.4%.

Both those ADR and RevPAR numbers represent all-time highs for the U.S. hotel industry.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is at the same level as in 2000.

Right now it looks like 2014 will be the best year since 2000 for hotels. A very strong year ...

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Chemical Activity Barometer "retains strong year-over-year growth; shows short-term tightening"

by Calculated Risk on 7/25/2014 09:38:00 AM

Here is a new indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: U.S. Economic Expansion Being Tempered By Uncertainty in Energy Markets, Shows Leading Economic Indicator

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC) posted a 0.4 percent increase over June, as measured on a three-month moving average (3MMA). The pace of growth was consistent with earlier growth logged in the second quarter. Year over year growth now stands at a 4.4 percent increase. ...

During July production-related indicators were up, as were product/selling prices, and inventories. After rebounding sharply in May, chemical equity prices have weakened in response to the growing unrest in the Middle East and Ukraine.

Unlike earlier readings, trends in construction-related chemistries suggest a lackluster market for this sector, which includes plastic resins as well as adhesives and sealants, construction chemicals, paint additives, and other performance chemistries. Pigments are faring better, as are plastic resins used in consumer product applications. Continued strength in electronic chemicals is encouraging, as the semiconductor industry’s early place in the supply chain makes it a bellwether of the industrial cycle. Gains in oilfield chemicals suggest that the boom in unconventional oil and gas will continue to progress, contributing to the overall growth of the U.S. economy.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

And this suggests continued growth.

Thursday, July 24, 2014

Lawler: Various Builder Results: Horton Home Orders, Market Share Jumps on Increased Sales Incentives; Orders “Lackluster” at Other Builders

by Calculated Risk on 7/24/2014 09:25:00 PM

CR Note: The comments on D.R. Horton are very interesting (more incentives, no price increases). Also see table at bottom for summary stats.

From housing economist Tom Lawler:

D.R. Horton reported that net home orders in the quarter ended June 30, 2014 totaled 8,551, up 25.3% from the comparable quarter of 2013. Sales per community were up almost 13% YOY. Horton’s acquisition of Crown Communities added 290 to last quarter’s orders. DHI’s average net order price last quarter was $281,336, up 5.0% from a year ago. Home deliveries last quarter totaled 7,676, up 18.8% from the comparable quarter of 2013, at an average sales price of $272,316, up 7.9% from a year ago. The acquisition of Crown Communities added 254 to last quarter’s deliveries. DHI’s order backlog at the end was 11,365, up 14.7% from last June, at an average order price of $286,194, up 9.8% from a year ago.

In the company’s conference call Horton’s CEO characterized the overall demand for new homes last quarter as “relatively stable” compared to a year ago, but that Horton’s previous aggressive acquisition of land/lots, combined with more aggressive use of sales incentives to move inventory, enabled the company to boost its market share to its highest level ever. Another official said that the company increased sales incentives in MANY of its communities in order to meet its aggressive sales goals. The official noted that sales incentives were much lower than normal in 2013 and early 2014, but that last quarter (and currently) sales incentives were “back to normal.” Another official noted that home price appreciation had slowed appreciably.

...

PulteGroup reported that net home orders in the quarter ended June 30, 2014 totaled 4,778, down 2.2% from the comparable quarter of 2013. Sales per active community were up about 6% YOY, reflected the 6% YOY drop in community count. Pulte’s average net order price last quarter was $333,698, up 7.1% from a year ago. Home deliveries last quarter totaled 3,798, down 8.5% from the comparable quarter of 2013, at an average sales price of $328,000, up 11.6% from a year ago. The company’s order backlog at the end of June was 8,179, down 4.4% from last June, at an average order price of $338,689, up 6.8% from a year ago.

Meritage Homes reported that net home orders in the quarter ended June 30, 2014 totaled 1,647, up 0.6% from the comparable quarter of 2013. Net orders per community were down about 8.2% YOY. Meritage’s average net order price last quarter was $375,000, up 7.1% from a year ago. Home deliveries last quarter totaled 1,368, up 3.6% from the comparable quarter of 2013, at an average sales price of $368,000, up 11.5% from a year ago. The company’s order backlog at the end of June was 2,548, up 11.6% from last June, at an average order price of $373,000, up 5.7% from a year ago. Meritage owned or controlled about 25,800 lots at the end of June, up 14.2% from last June and up 44.5% from two years ago.

M/I Homes reported that net home orders in the quarter ended June 30, 2014 totaled 1,016, down 5.8% from the comparable quarter of 2013. Sales per community were down 14.4% YOY. Home deliveries last quarter totaled 894, up 13.5% from the comparable quarter of 2013, at an average sales price of $306,000, up 8.9% from a year ago. The company’s order backlog at the end of June was 1,647, down 1.7% from last June, at an average order price of $332,000, up 13.3% from a year ago. In its press release the company attributed the disappointed pace of new orders “primarily to delays in opening new communities and (to) lower traffic levels. Orders were especially weak in the Mid-Atlantic region, where orders were down 15.6% YOY. M/I owned or controlled 20,991 lots at the end of June, 22.3% from last June and up 98.1% from two years ago.

Here are some summary stats from large publicly-traded builders who have reported results for last quarter.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 06/14 | 06/13 | % Chg | 06/14 | 06/13 | % Chg | 06/14 | 06/13 | % Chg |

| D.R. Horton | 8,551 | 6,822 | 25.3% | 7,676 | 6,464 | 18.8% | $272,316 | $252,290 | 7.9% |

| PulteGroup | 4,778 | 4,885 | -2.2% | 3,798 | 4,152 | -8.5% | $328,000 | $294,000 | 11.6% |

| NVR | 3,415 | 3,278 | 4.2% | 2,943 | 2,878 | 2.3% | $368,200 | $344,700 | 6.8% |

| Meritage Homes | 1,647 | 1,637 | 0.6% | 1,368 | 1,321 | 3.6% | $368,000 | $330,000 | 11.5% |

| M/I Homes | 1,016 | 1,078 | -5.8% | 894 | 788 | 13.5% | $306,000 | $281,000 | 8.9% |

| Total | 19,407 | 17,700 | 9.6% | 16,679 | 15,603 | 6.9% | $311,568 | $288,463 | 8.0% |

NMHC Survey: Apartment Market Conditions Tighter in Q2 2014

by Calculated Risk on 7/24/2014 03:45:00 PM

From the National Multi Housing Council (NMHC): Apartment Markets Continue Expansion in July NMHC Quarterly Survey

Apartment markets continued to expand in the second quarter of 2014, as growth accelerated in all four indexes in the National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. The market tightness (68), sales volume (56), equity financing (58) and debt financing (68) indexes all improved from the first quarter this year and marked the second quarter in a row with all above the breakeven level of 50.

“Despite concerns in some quarters about the pace of new development, most markets appear to be absorbing new supply with no downward pressure on rents or vacancies,” said NMHC Senior Vice President of Research and Chief Economist Mark Obrinsky. “The improvement in market tightness was particularly noteworthy. Four years into the apartment industry recovery and expansion, the increase in demand continues to outstrip the pickup in new supply.”

The survey also asked about urban vs. suburban development. Four in ten (43 percent) reported an increased share of urban development relative to suburban in the last six months, compared to one quarter (27 percent) reporting an increased share of suburban development. Of the suburban development taking place, more than half (54 percent) reported more town center-style developments, with 39 percent reporting no appreciable change and 7 percent reporting more garden-style developments. [These results exclude “Don’t know/not applicable.”]

“Early in the recovery, apartment development was concentrated in downtown areas of large cities. While such areas continue to attract investment, new construction is expanding more broadly into suburbs as well. But developers are bringing urban style to suburban locations, with a heavier emphasis on ‘town center’ communities than we’ve seen in the past,” said Obrinsky.

...

The Market Tightness Index rose from 56 to 68. The percentage of respondents who saw looser conditions continued to decline, down from 20 percent to 15 percent. While this improvement is partly seasonal, the index is higher than the average for the July quarter since the survey began 15 years ago.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter. This indicates tighter market conditions.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. The apartment market is still solid right now.

Comments on the New Home Sales report

by Calculated Risk on 7/24/2014 12:31:00 PM

The new home sales report for June - combined with the downward revisions for previous months - was very weak.

The Census Bureau reported that new home sales this year, through June, were 225,000, Not seasonally adjusted (NSA). That is down 4.3% from 235,000 during the first half of 2013 (NSA).

Maybe sales will move sideways for a little longer, but remember early 2013 was a difficult comparison period. Annual sales in 2013 were up 16.3% from 2012, but sales in the first four months of 2013 were up 26% from the same period in 2012!

Click on graph for larger image.

Click on graph for larger image.

This graph shows new home sales for 2013 and 2014 by month (Seasonally Adjusted Annual Rate).

The comparisons to last year will be a little easier in Q3, and I still expect to see year-over-year growth later this year.

And here is another update to the "distressing gap" graph that I first started posting several years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through June 2014. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through June 2014. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to decline or move sideways (distressed sales will slowly decline and be partially offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Kansas City Fed: Regional Manufacturing "Activity Edged Higher" in July

by Calculated Risk on 7/24/2014 11:00:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Edged Higher

The Federal Reserve Bank of Kansas City released the July Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity edged higher, and producers’ optimism for future activity increased.The last regional Fed manufacturing survey for July will be released on Monday, July 28th (the Dallas Fed). All of the regional surveys so far have indicated stronger growth in July than in June and - in general - the strongest growth in several years.

“Factories in our region reported slightly faster growth in July,” said Wilkerson. “In addition, future hiring and capital spending plans were the highest in six months.”

The month-over-month composite index was 9 in July, up from 6 in June but slightly lower than 10 in May. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. ... The production index climbed from 2 to 11, and the shipments, new orders [to 12], and employment indexes [from 1 to 8] also rose considerably.

emphasis added

New Home Sales decrease to 406,000 Annual Rate in June

by Calculated Risk on 7/24/2014 10:00:00 AM

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 406 thousand.

May sales were revised down from 504 thousand to 442 thousand, and April sales were revised down from 425 thousand to 408 thousand.

Sales of new single-family houses in June 2014 were at a seasonally adjusted annual rate of 406,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 8.1 percent below the revised May rate of 442,000 and is 11.5 percent below the June 2013 estimate of 459,000.

Click on graph for larger image.

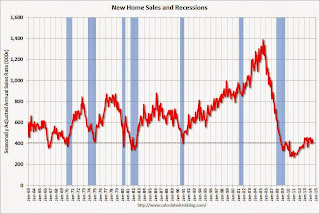

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are still close to the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply increased in June to 5.8 months from 5.2 months in May.

The months of supply increased in June to 5.8 months from 5.2 months in May. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of June was 197,000. This represents a supply of 5.8 months at the current sales rate."

On inventory, according to the Census Bureau:

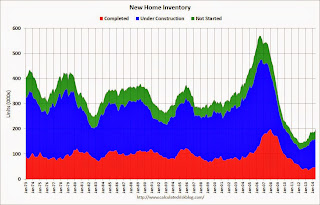

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

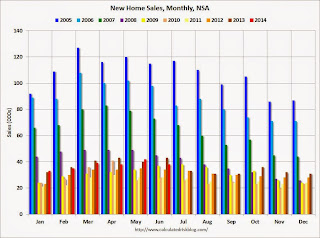

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In June 2014 (red column), 38 thousand new homes were sold (NSA). Last year 43 thousand homes were also sold in June. The high for June was 115 thousand in 2005, and the low for June was 28 thousand in 2010 and 2011.

This was well below expectations of 475,000 sales in June, and sales were down 11.5% year-over-year.

I'll have more later today .

Weekly Initial Unemployment Claims decrease to 284,000, 4-Week Average Lowest since May 2007

by Calculated Risk on 7/24/2014 08:30:00 AM

The DOL reports:

In the week ending July 19, the advance figure for seasonally adjusted initial claims was 284,000, a decrease of 19,000 from the previous week's revised level. This is the lowest level for initial claims since February 18, 2006 when they were 283,000. The previous week's level was revised up by 1,000 from 302,000 to 303,000. The 4-week moving average was 302,000, a decrease of 7,250 from the previous week's revised average. This is the lowest level for this average since May 19, 2007 when it was 302,000. The previous week's average was revised up by 250 from 309,000 to 309,250.The previous week was revised up to 303,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 302,000.

This was lower than the consensus forecast of 310,000. The 4-week average is now at normal levels for an expansion.

Wednesday, July 23, 2014

Thursday: New Home Sales, Unemployment Claims and More

by Calculated Risk on 7/23/2014 08:16:00 PM

The scams never end, and this one was really disgusting (ripping off people in financial trouble) ... from the LA Times: Authorities crack down on mortgage-relief scams nationwide

Federal and state officials filed lawsuits accusing dozens of companies of ripping off struggling homeowners by falsely promising help in avoiding foreclosures or lowering mortgage payments while collecting millions of dollars in illegal upfront fees.Thursday:

...

The Consumer Financial Protection Bureau said three suits it filed against eight companies and their owners involved scams that cost homeowners more than $25 million in illegal upfront fees for services such as renegotiating mortgages or preventing foreclosures.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 302 thousand.

• At 10:00 AM, New Home Sales for June from the Census Bureau. The consensus is for a decrease in sales to 475 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 504 thousand in May.

• At 11:00 AM, the Kansas City Fed manufacturing survey for July.

• During the day, the NMHC Quarterly Survey of Apartment Conditions.

Inflation: Another "False Alarm"?

by Calculated Risk on 7/23/2014 06:00:00 PM

From Gavyn Davies at the Financial Times: Another false alarm on US inflation?

There have been a few false alarms about a possible upsurge in inflation in the US in the past few years, even as core inflation on most measures has remained extremely subdued. ... Another such scare has been brewing recently.From Ron Insana at CNBC: Inflation is about to fall—and fall hard

...

It now seems probable that part of the recent jump in core inflation was just a random fluctuation in the data. ... But the main reason for the lack of concern is that wage pressures in the economy have remained stable, on virtually all the relevant measures. ... there has been yet another false alarm on US inflation.

I will make a bet with this country's leading inflationistas, who continue to warn that inflation is about to surge, that they are dead wrong. ...My view is inflation is not a concern this year.

Agricultural commodity prices, excluding meats, have crashed. Corn, wheat and soybean prices have plummeted on expectations of bumper crops around the world — particularly in the United States. ...

...

Likewise, despite geopolitical hot spots around the world, energy prices have also dropped from recent highs. While oil remains stubbornly above $100 a barrel, both at home and abroad. Were it not for recent events in Ukraine and the Middle East, oil prices may have continued their recent dip below that century mark. ...

With respect to raging wage inflation, that argument is also a non-starter. Wages are rising at a 2 percent to 2.5 percent annual rate, hardly the stuff of wage-price spirals....

For years, and on all counts, inflation hawks have been, let's say, premature in calling for a rapid acceleration in inflation.